I have updated my top 10 reasons investors should buy $TSLA:

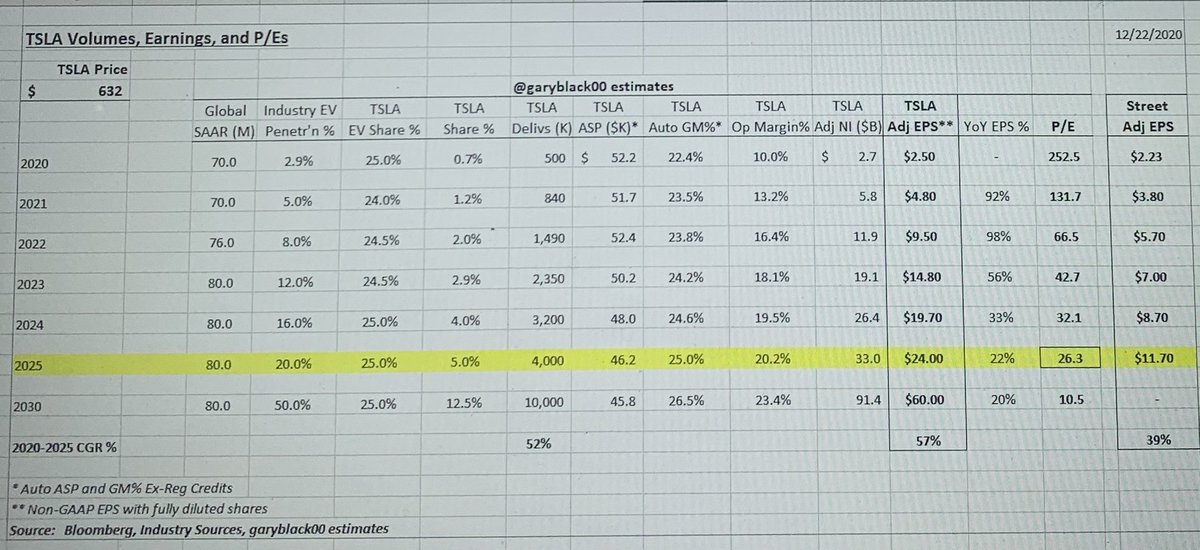

1/ Huge EV runway ahead, with global EV penetration now 3% likely to go to 20% by 2025 (6x increase = +46% CGR).

2/ TSLA’s EV share continues to grow - not fall - as TAM expands, even as ICE competitors launch...

1/ Huge EV runway ahead, with global EV penetration now 3% likely to go to 20% by 2025 (6x increase = +46% CGR).

2/ TSLA’s EV share continues to grow - not fall - as TAM expands, even as ICE competitors launch...

their own EVs. New EVs take from ICE vehicles, not other EVs. This is biggest research flaw in short thesis.

3/ $TSLA has several positive Jan catalysts to propel it higher: 4Q vols (181K vs 172K Street, 1/4), FSD MRR (1/15), MIC Y production (1/15), CyTruck update (1/15).

3/ $TSLA has several positive Jan catalysts to propel it higher: 4Q vols (181K vs 172K Street, 1/4), FSD MRR (1/15), MIC Y production (1/15), CyTruck update (1/15).

4/ FY’21 vol guide of 840K+ will beat Street ests of 777K (1/27), driven by 1M installed capacity today, and spark new round of 2021 $TSLA EPS & PT increases.

5/ Biden’s 1/21 inaugural address will feature clean energy plan, incl restoration of $7.5K credit on all EVs incl TSLA.

5/ Biden’s 1/21 inaugural address will feature clean energy plan, incl restoration of $7.5K credit on all EVs incl TSLA.

6/ $TSLA TAM in Europe and China will double with introduction of Model Y CUV (2021/1Q). In the US, Model Y has become $TSLA ‘s best selling model in less than a year, with 15-20% cannibalization of M3 and X. The same will happen as TSLA doubles TAM in Europe and China.

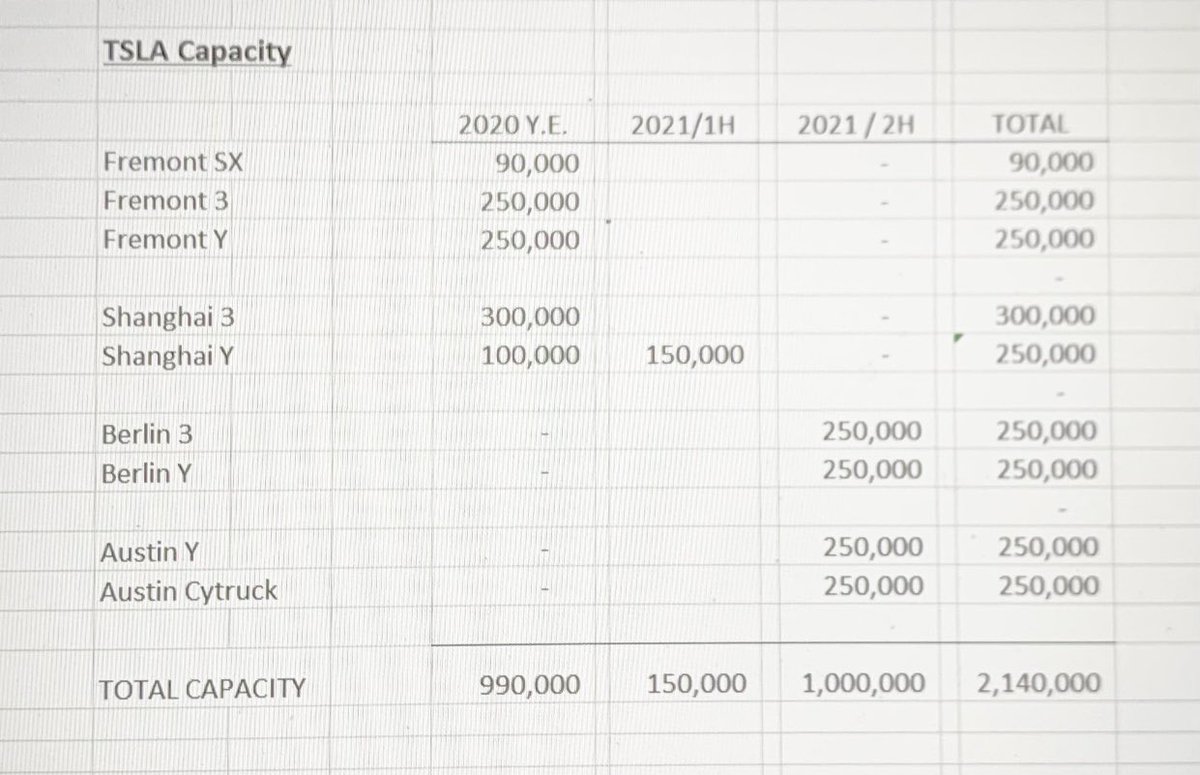

7/ Berlin and Austin factories will come on stream in 2021/2H. With ongoing Shanghai Y expansion, this will double $TSLA production capacity from 1.0M today to 2.1M by 2021 YE. @elonmusk has always said production capacity limits deliveries, not demand. Upside 2021 vol guide 1M.

8/ $TSLA Cybertruck, Semi, and Roadster will all launch in 2021-22. Cybertruck alone could add 250-300K delivs each in FY’22 & FY’23, given a reported 750K in pre-orders that will likely prove very sticky, given CyTrck’s uniqueness. Every 250K CyTruck delivs worth $2/sh incr EPS.

9/ With S&P inclusion, $8T in active mgr assets will have to make a conscious decision to hold or not hold $TSLA at 1.69% bm weight, or risk underperformance (85% mgrs underperformed S&P past 5 yrs). At 1.69% weight, that equals 210 shares (27% float). This is huge Jan catalyst.

Read on Twitter

Read on Twitter