#Millwall 2019/20 financial results covered a season when they improved their position in the Championship from 21st to 8th. Manager Neil Harris left in October 2019, replaced by Gary Rowett. COVID-19 had a substantial impact on the club’s operations. Some thoughts follow.

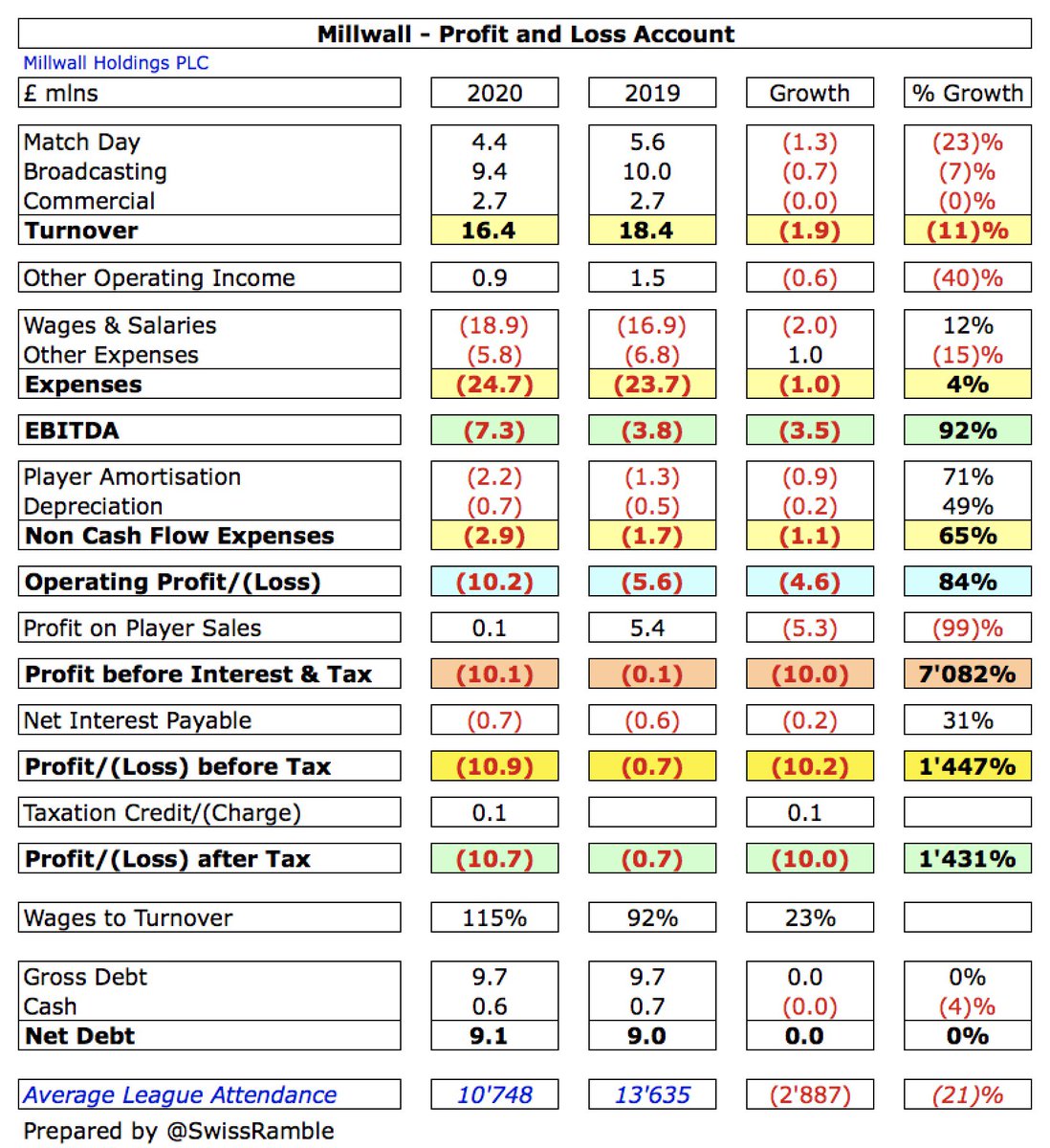

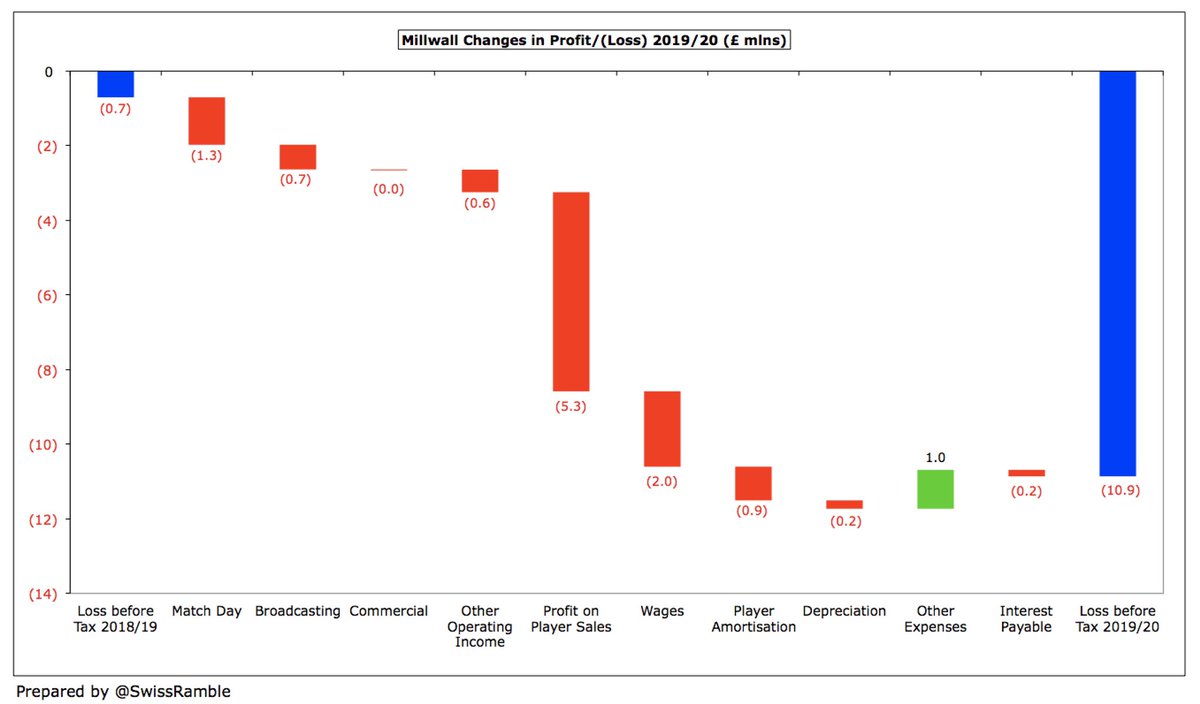

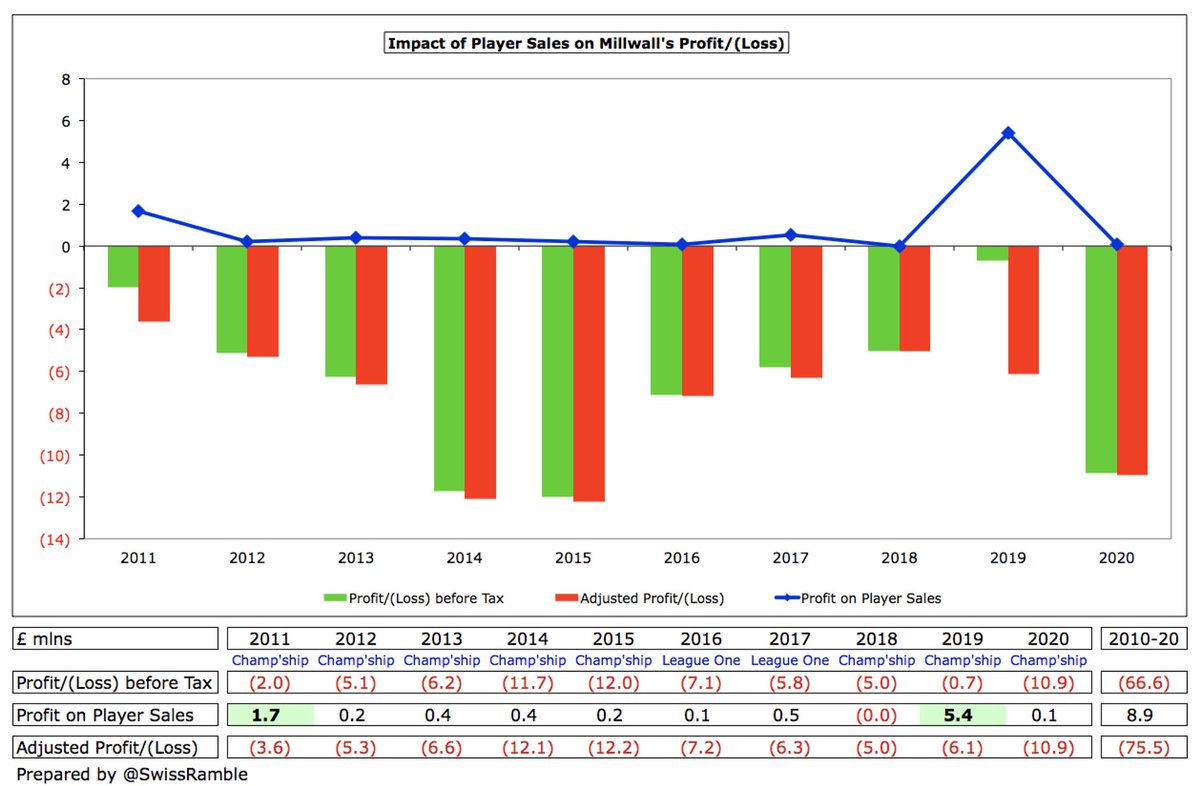

#Millwall pre-tax loss widened from £0.7m to £10.9m, largely due to profit on player sales dropping £5.3m to £0.1m, though COVID and a run to FA Cup quarter-final prior year meant revenue fell £2.0m (11%) from £18.4m to £16.4m, while expenses rose £2.3m (9%).

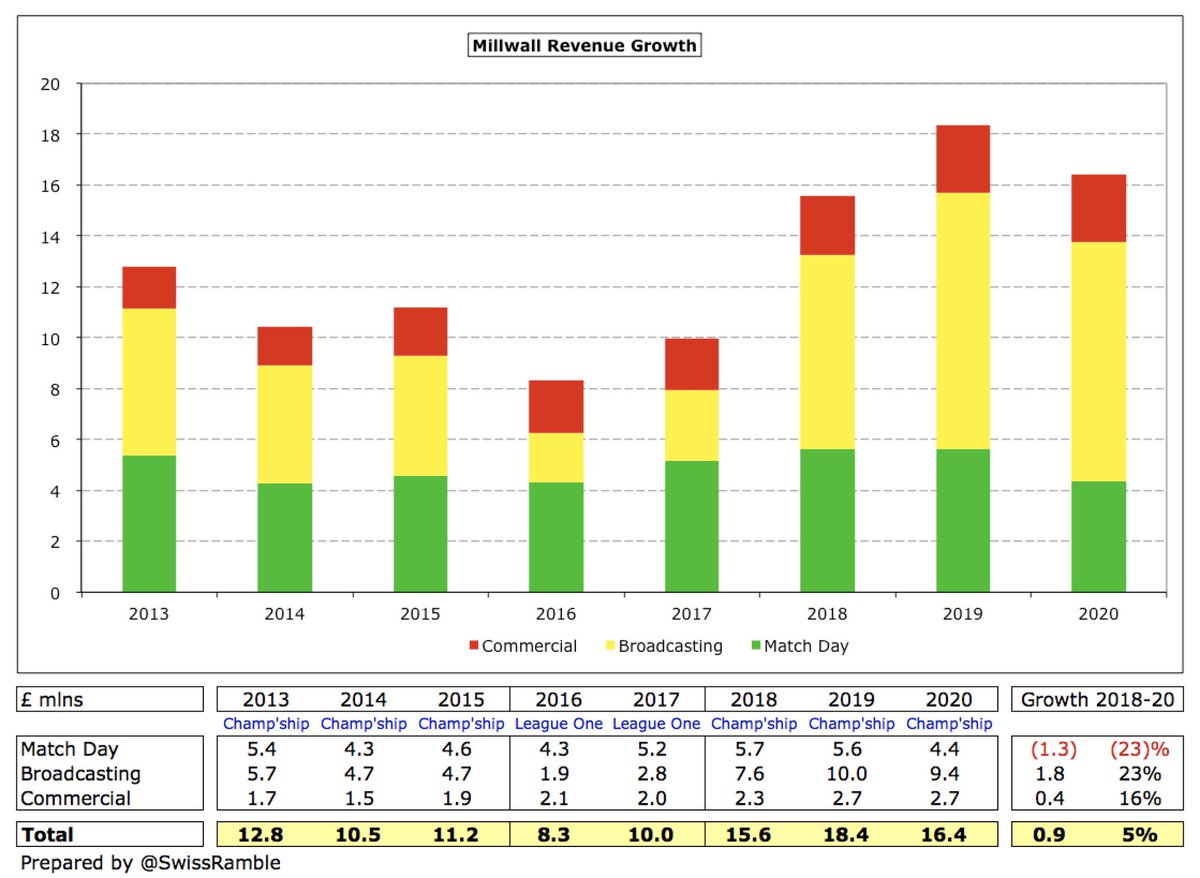

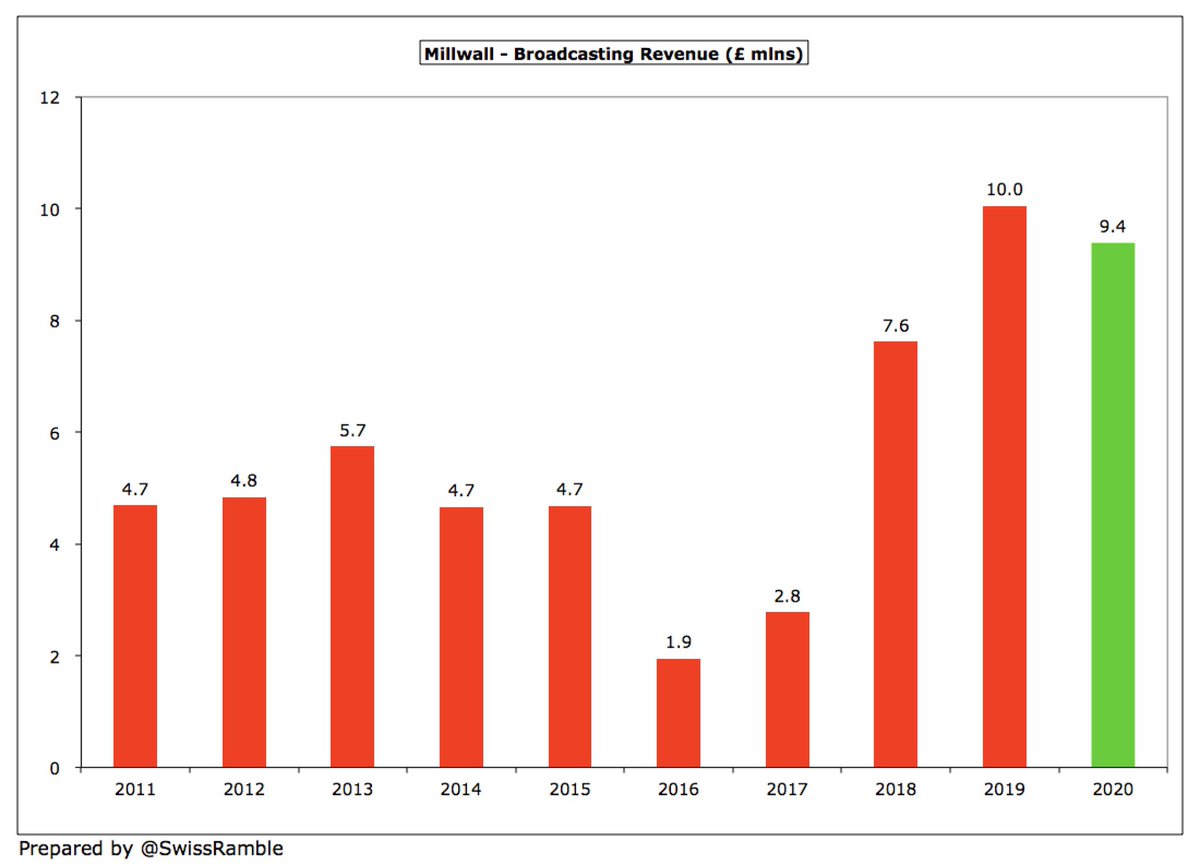

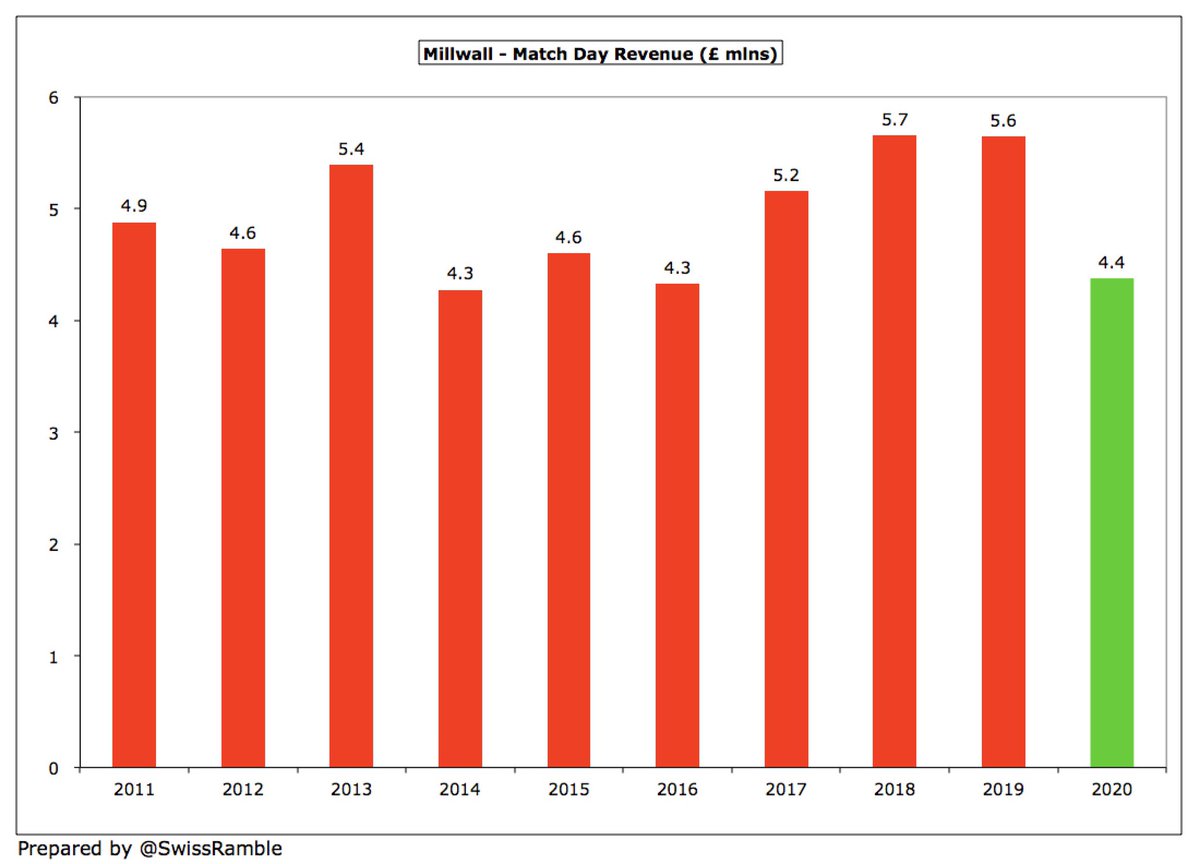

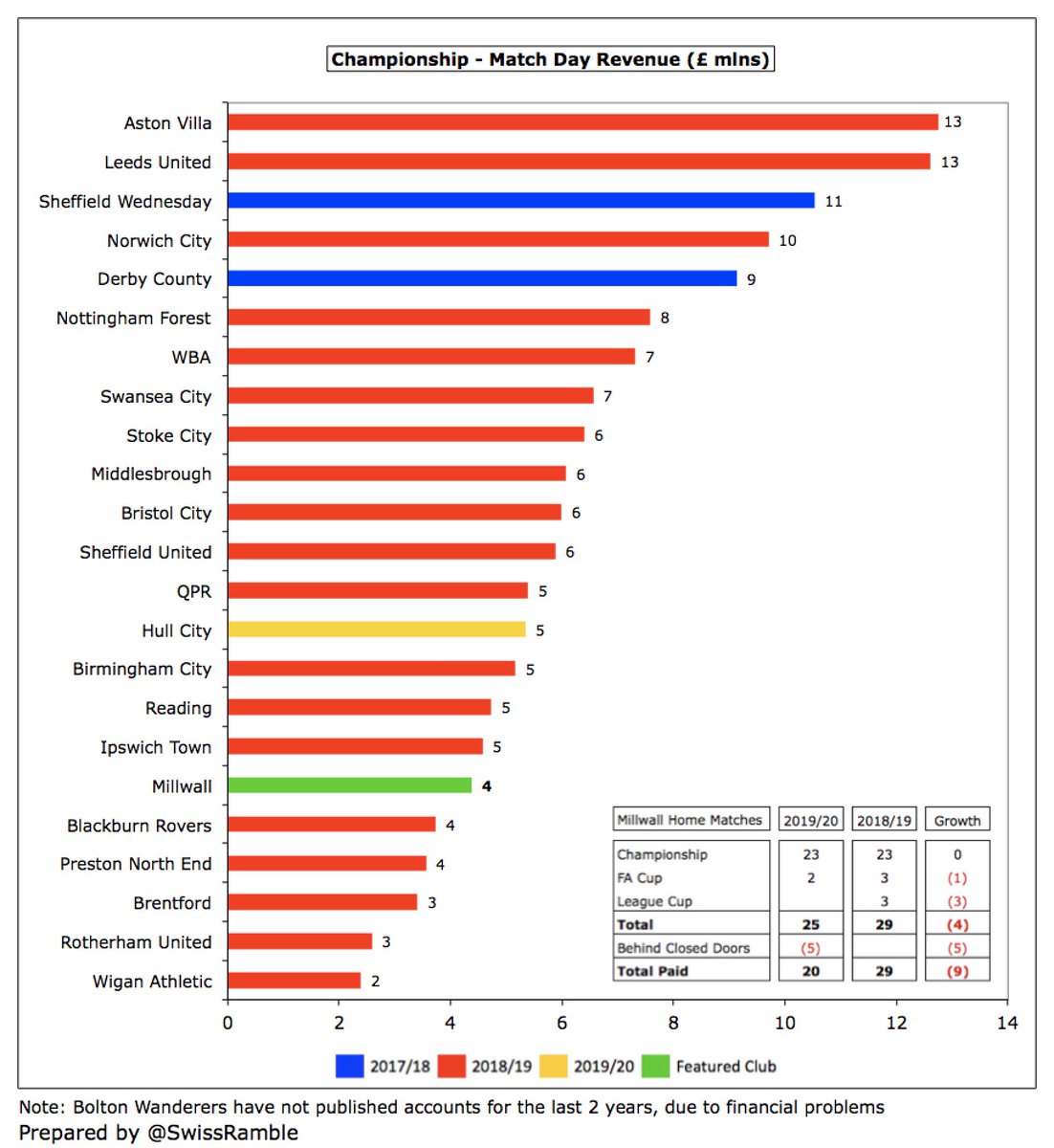

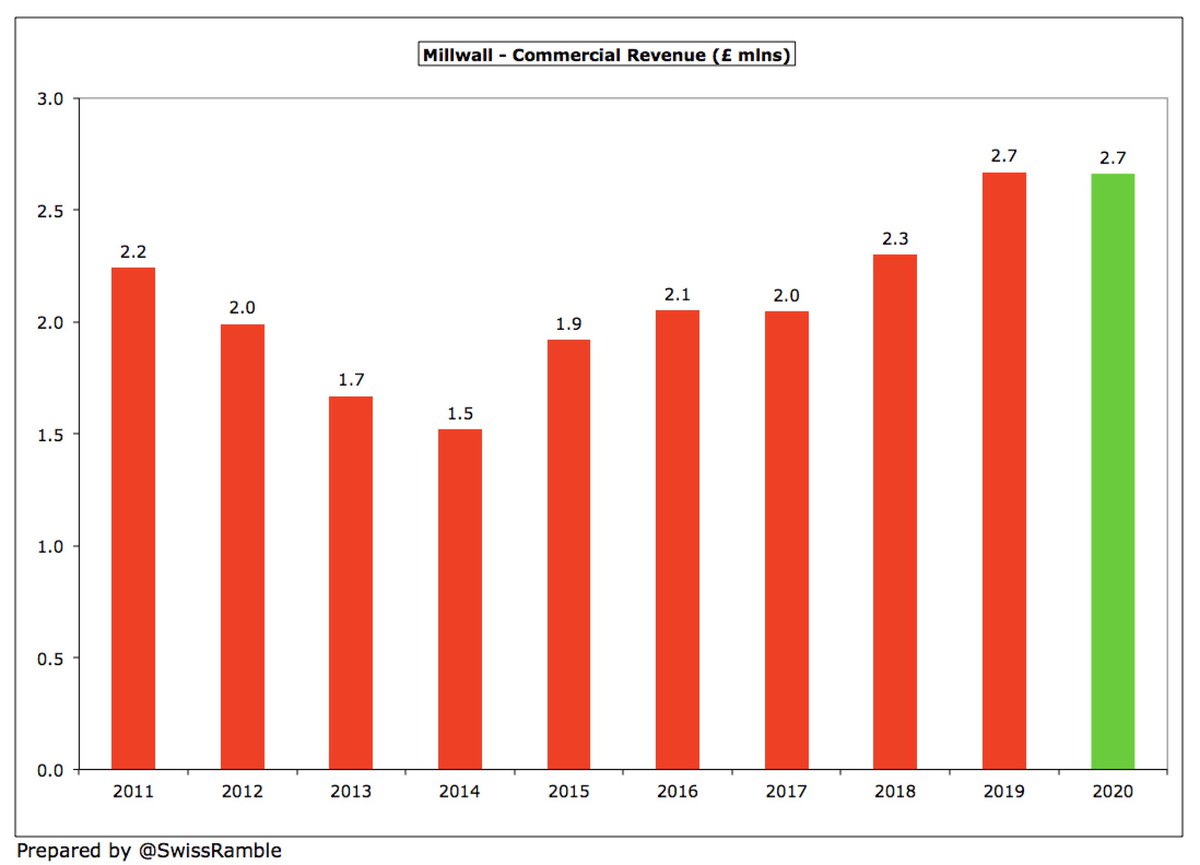

#Millwall revenue decrease was largely driven by match day falling £1.3m (23%) to £4.4m, as 5 games were played behind closed doors, while broadcasting decreased £0.7m (7%) to £9.4m. Commercial income held steady at £2.7m.

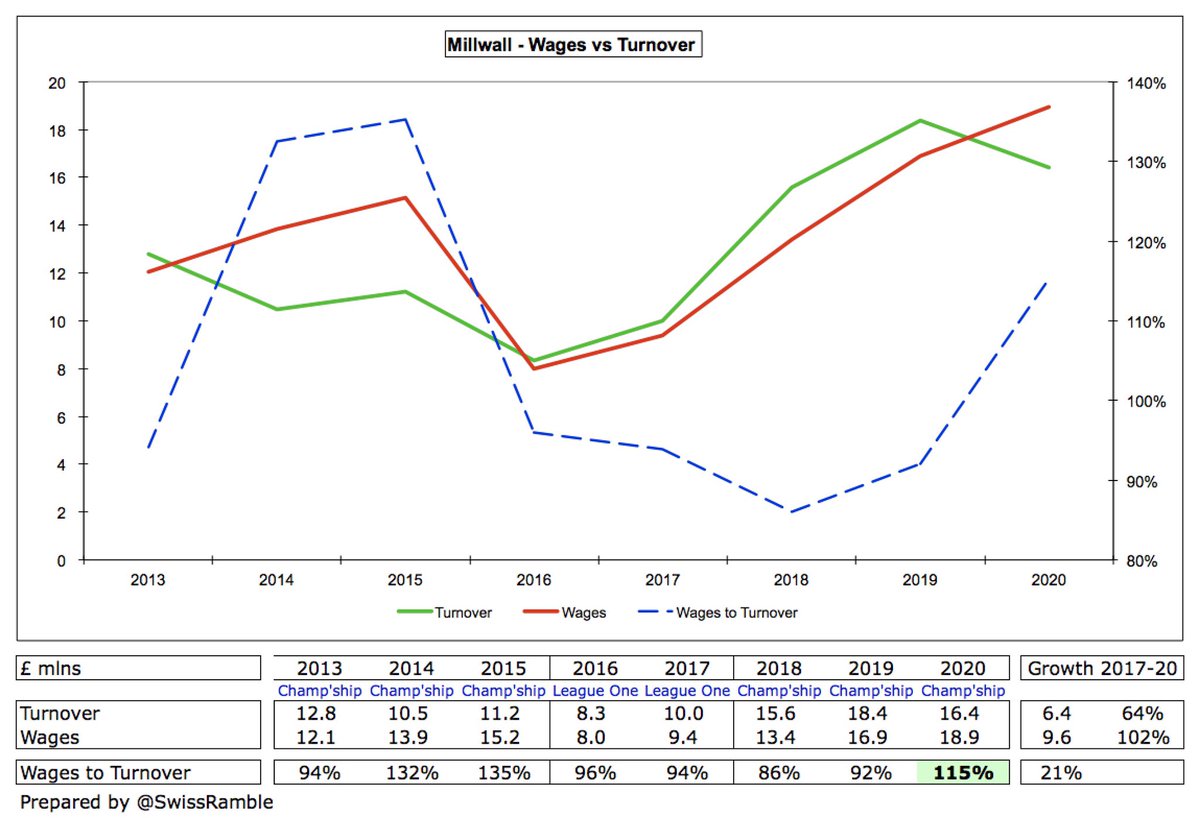

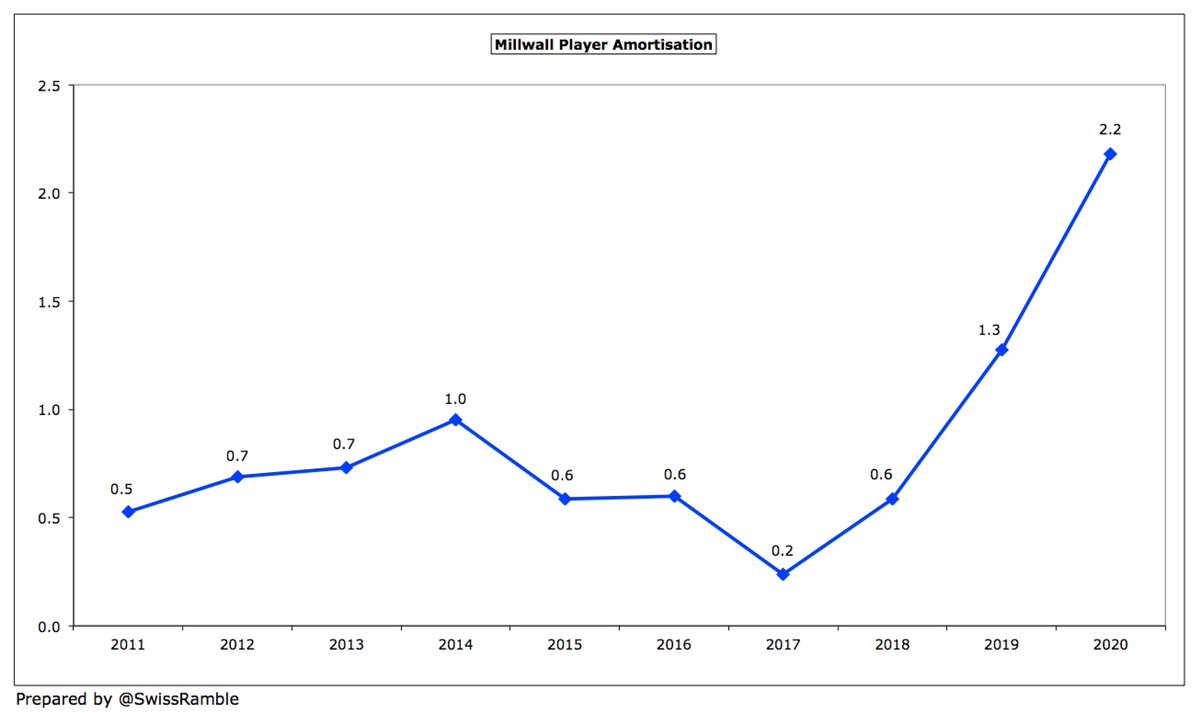

#Millwall wage bill rose £2.0m (12%) from £16.9m to £18.9m, while player amortisation increased £0.9m (71%) to £2.2m and depreciation was up £0.2m (49%) to £0.7m. The reduction in activities due to the pandemic meant other expenses fell £1.0m (15%) to £5.8m.

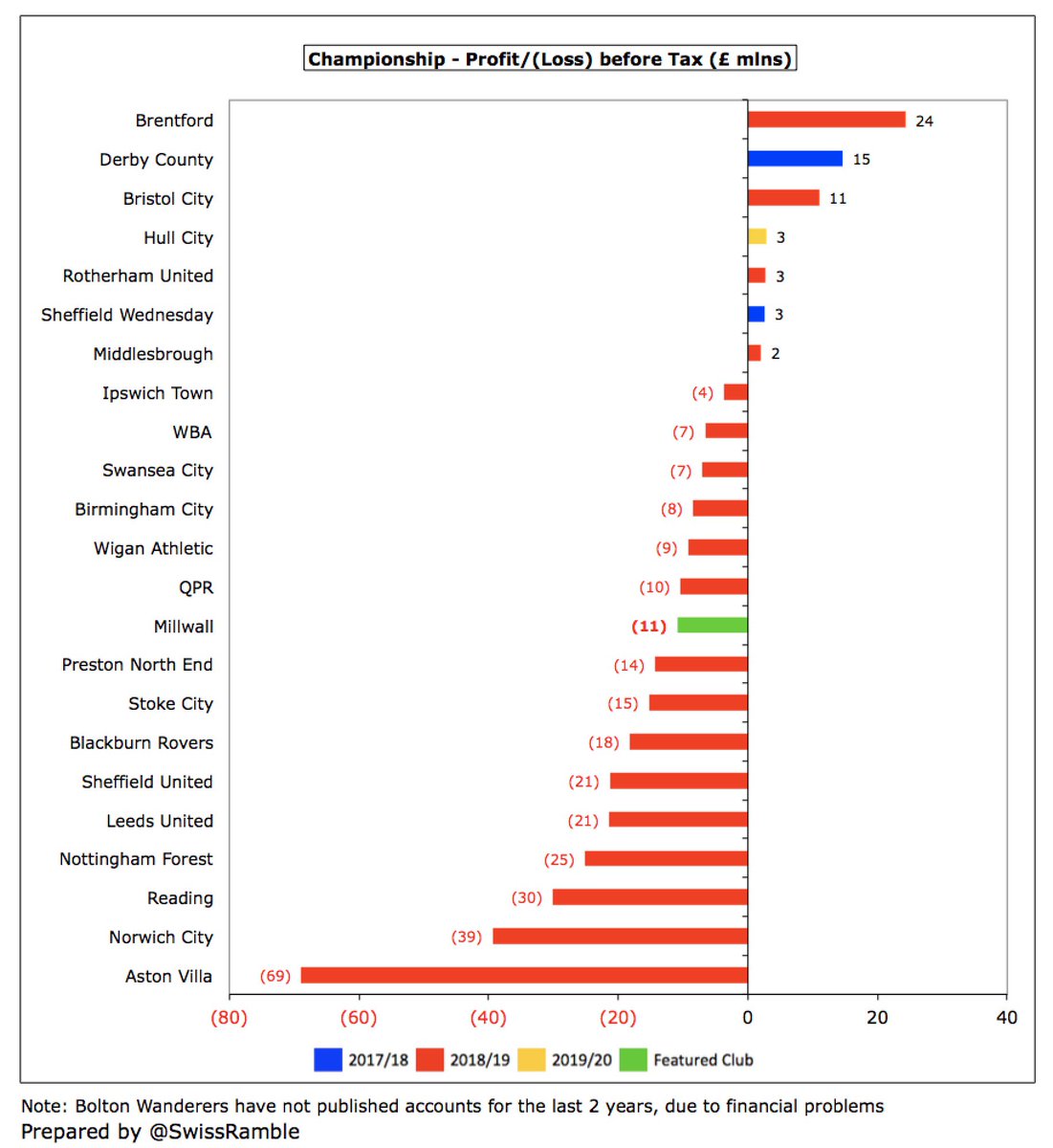

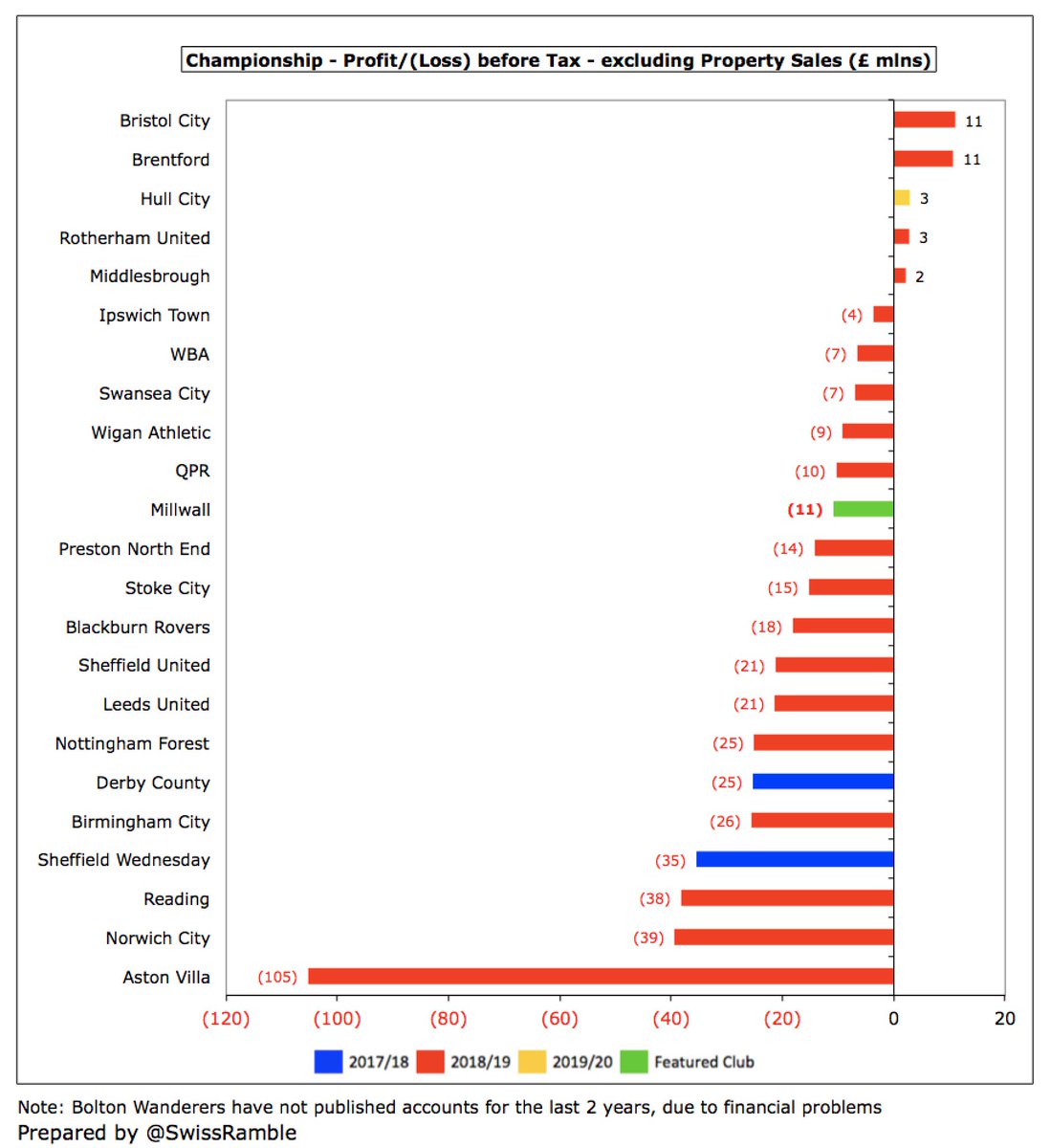

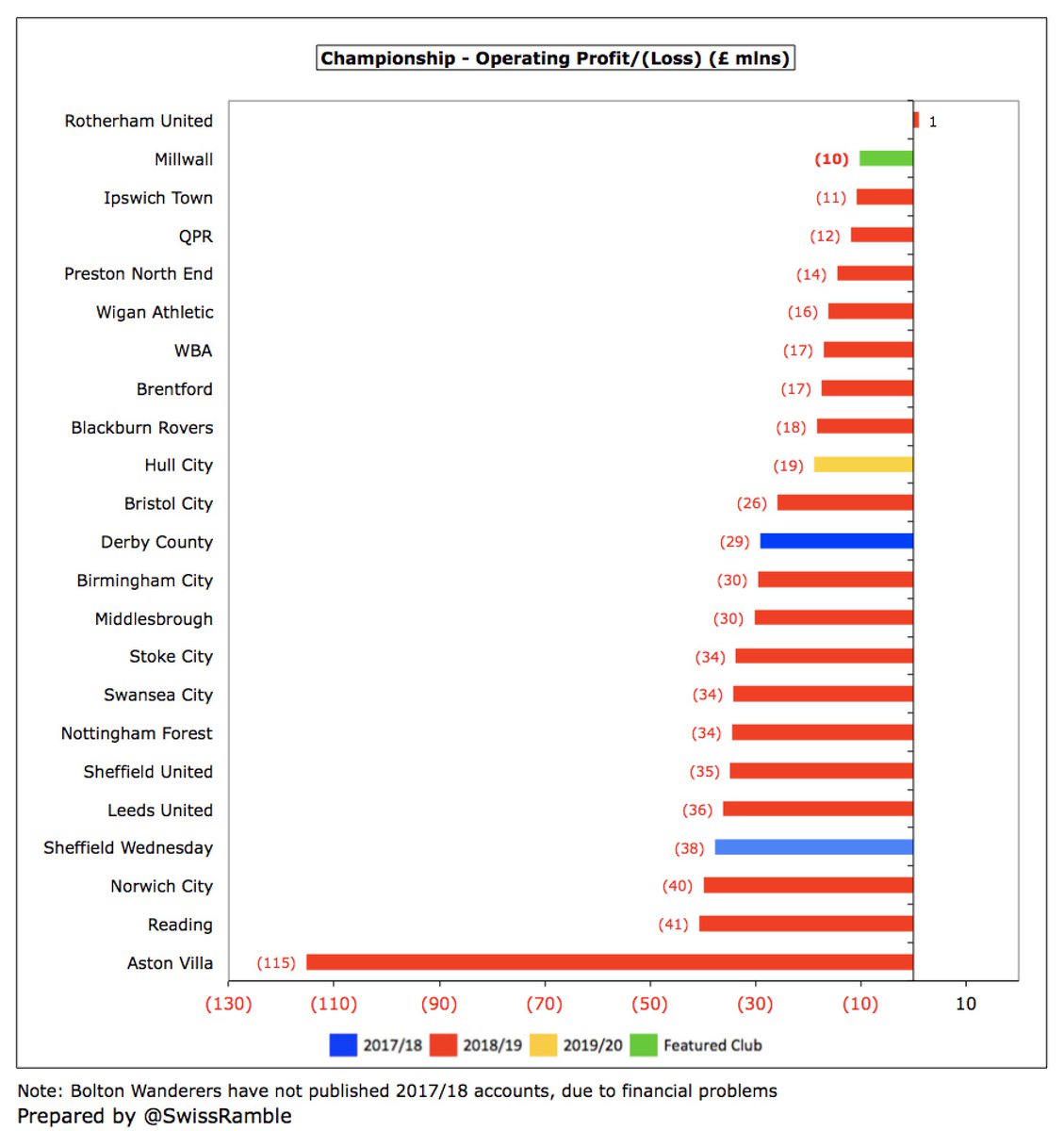

Despite the deterioration, #Millwall loss of £10.9m is still only mid-table in the Championship. This result is likely to look better when other clubs publish their COVID-impacted 2019/20 accounts. In fact, before the pandemic, no fewer than 6 clubs posted losses above £20m.

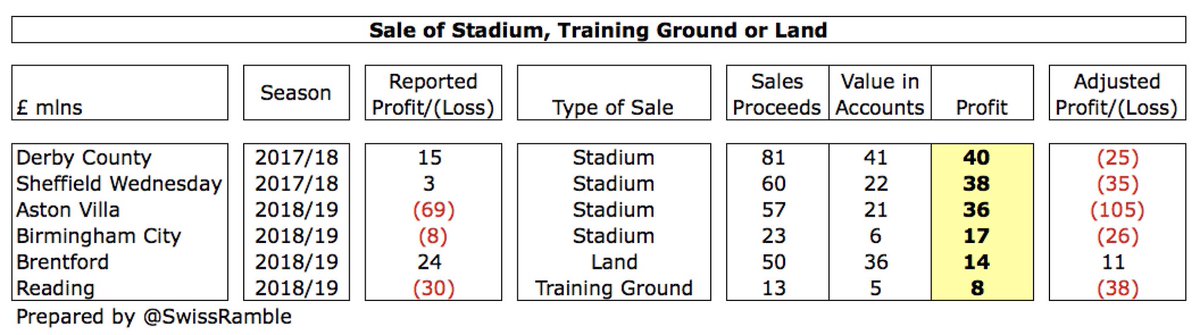

It is also worth noting that some clubs’ figures were boosted by once-off accounting profits from the sale of stadiums, training grounds and land, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so their underlying figures were even worse than reported.

Excluding these property sales, only 5 Championship clubs were profitable in 2018/19 with £11m highest profits at Bristol City and Brentford. On this basis, #Millwall £11m loss was actually 11th best in the division – not bad for a team that finished just outside the play-offs.

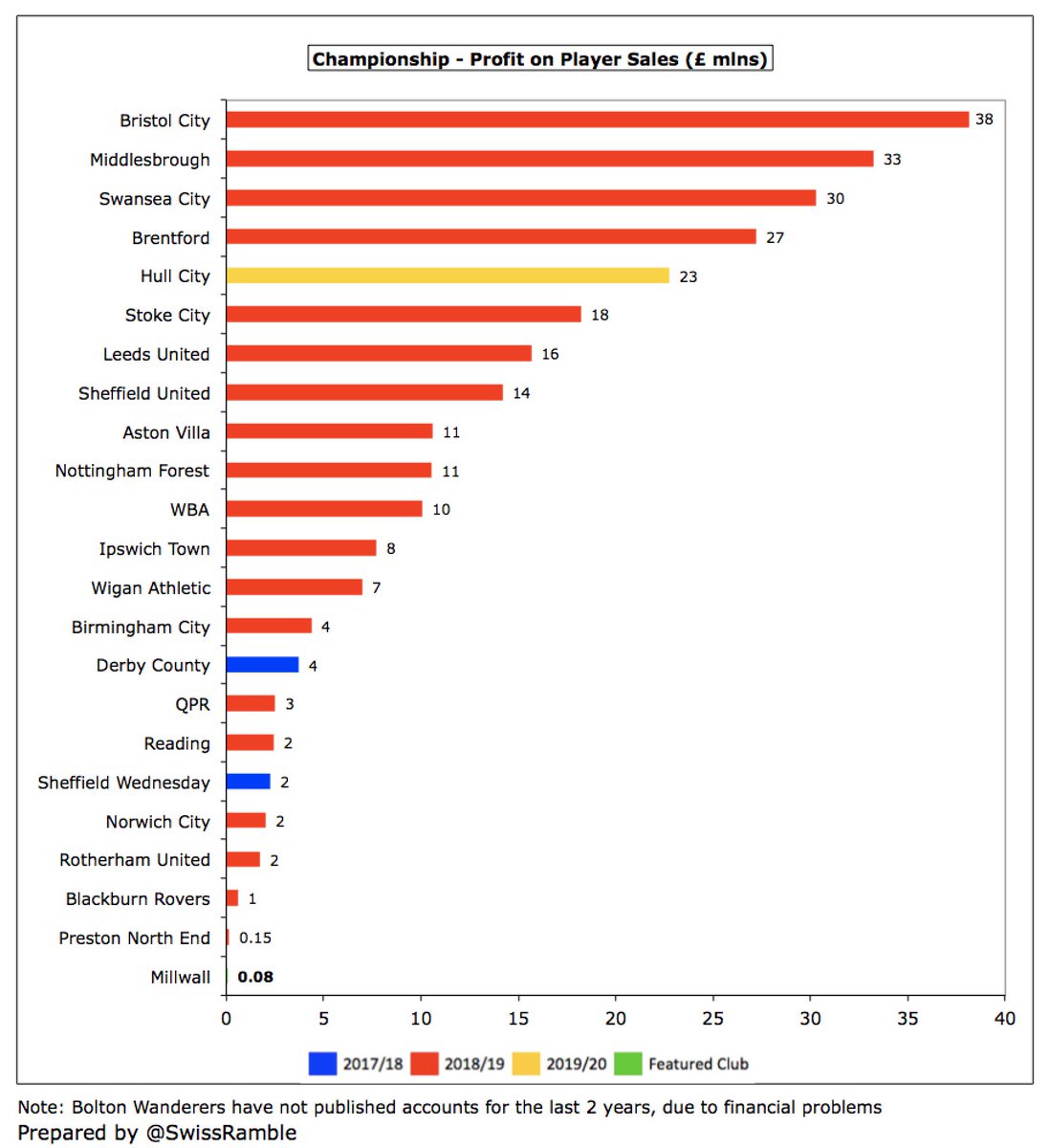

Furthermore, #Millwall bottom line received almost no benefit from player sales (just £76k profit), a steep decline compared to prior season £5.4m, which included the lucrative move of George Saville to #Boro. Miles behind Bristol City’s amazing £38m profit from this activity.

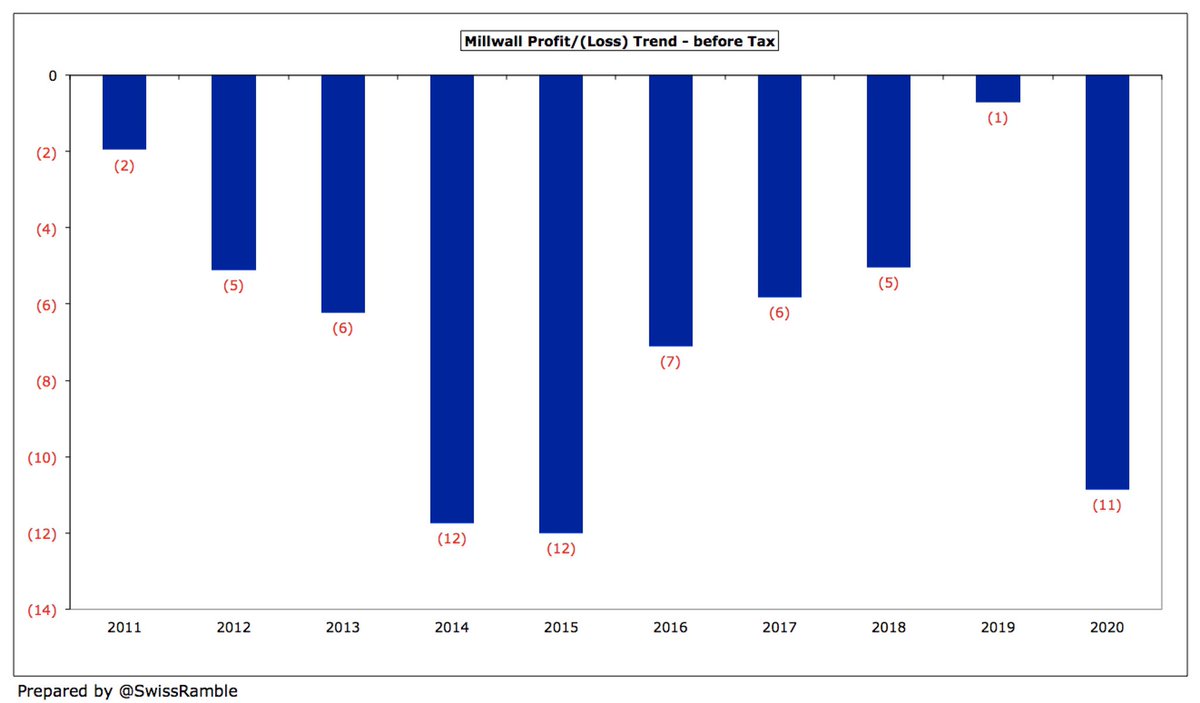

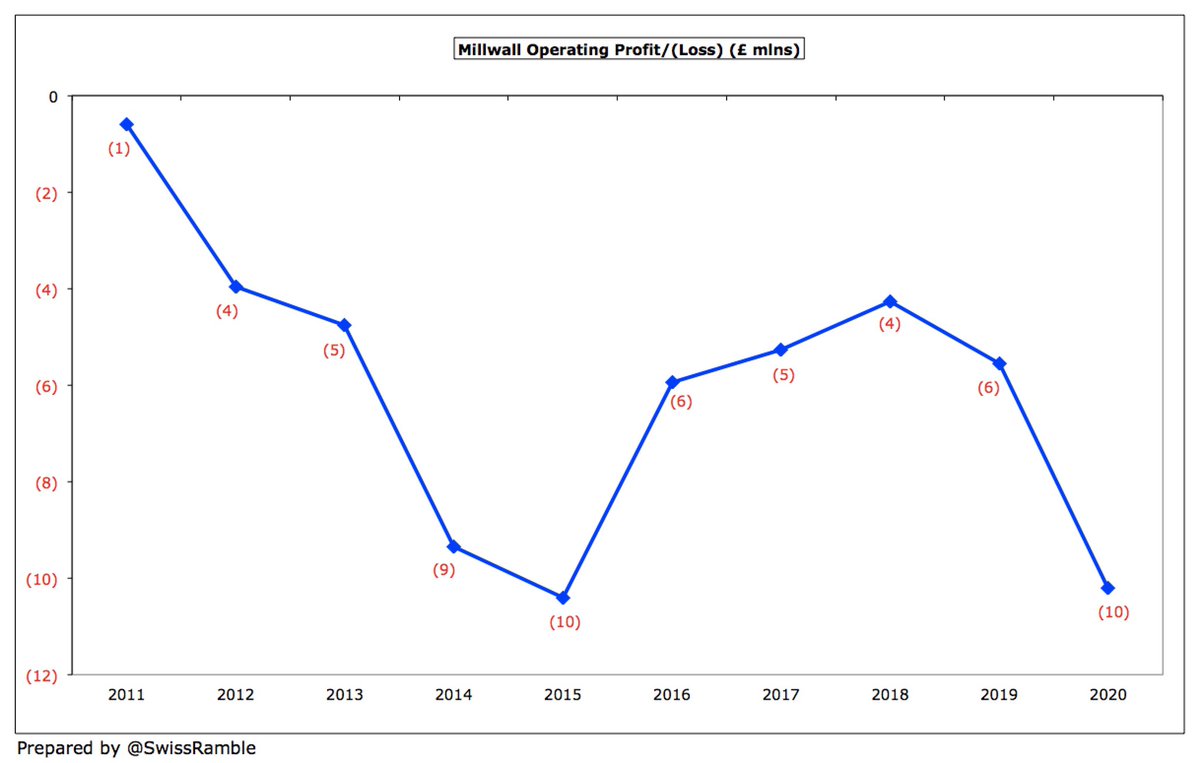

#Millwall have lost £67m in the last 10 years. Their losses had been falling – from £12m in 2015 to just £1m in 2019. However, this season’s figure was adversely affected by lower player sales, higher wages and no cup run (worth £2.2m in 2018/19).

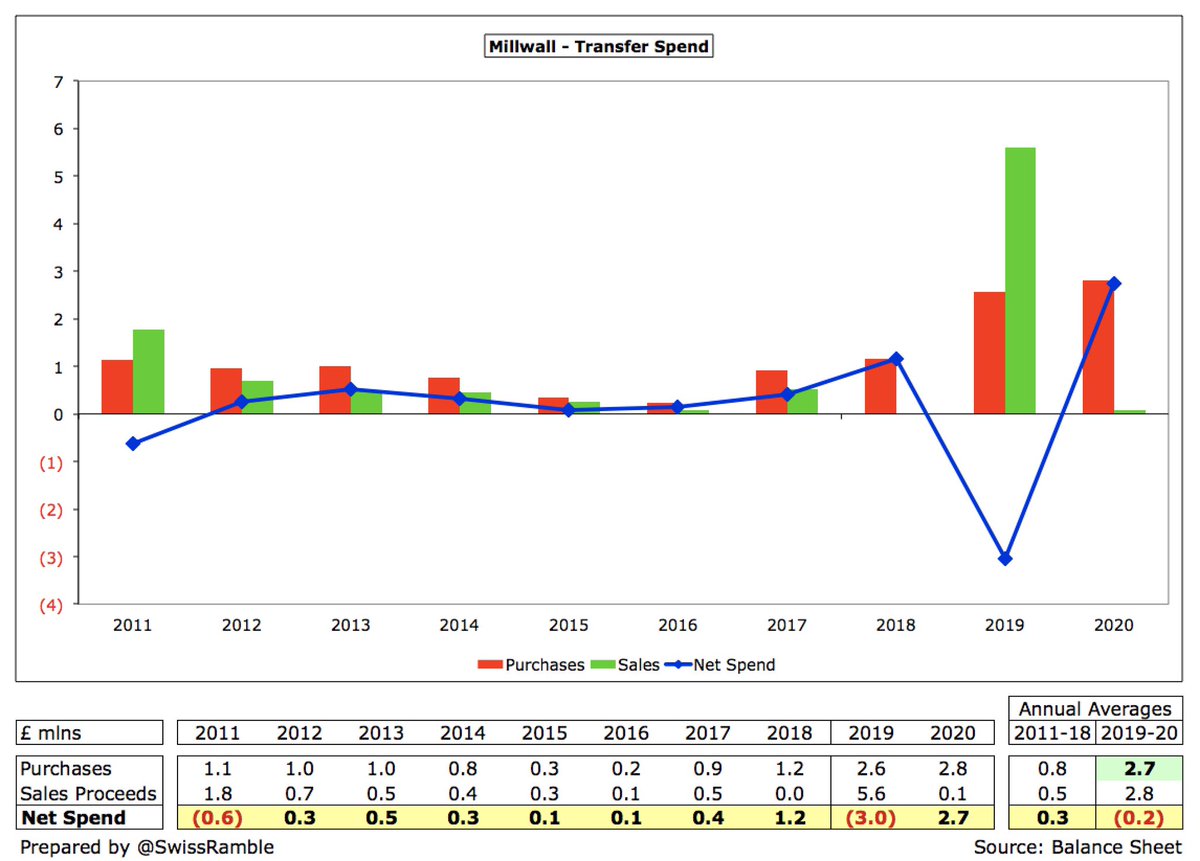

#Millwall have rarely made big money from player sales. In fact, they have only twice in the last 10 years generated a profit above £0.5m from this activity: Saville to #Boro in 2019 (£5.4m) and Steve Morison to #NCFC in 2011 (£1.7m).

#Millwall operating loss (excluding player sales and interest payable) widened from £5.6m to £10.2m, as revenue fell, but expenses increased. This is the club’s worst financial performance since 2015.

However, #Millwall £10m operating loss was still the second best performance in the Championship, a division where most clubs operate at a significant loss, due to very high wages to turnover ratios, as they compete for promotion to the “promised land” of the Premier League.

Despite the revenue fall in 2019/20 from £18.4m to £16.4m, #Millwall revenue has still grown by £0.8m (5%) from the £15.6m in the first season back in the Championship in 2017/18, mainly due to TV money. However, will fall further this season, due to ongoing COVID restrictions.

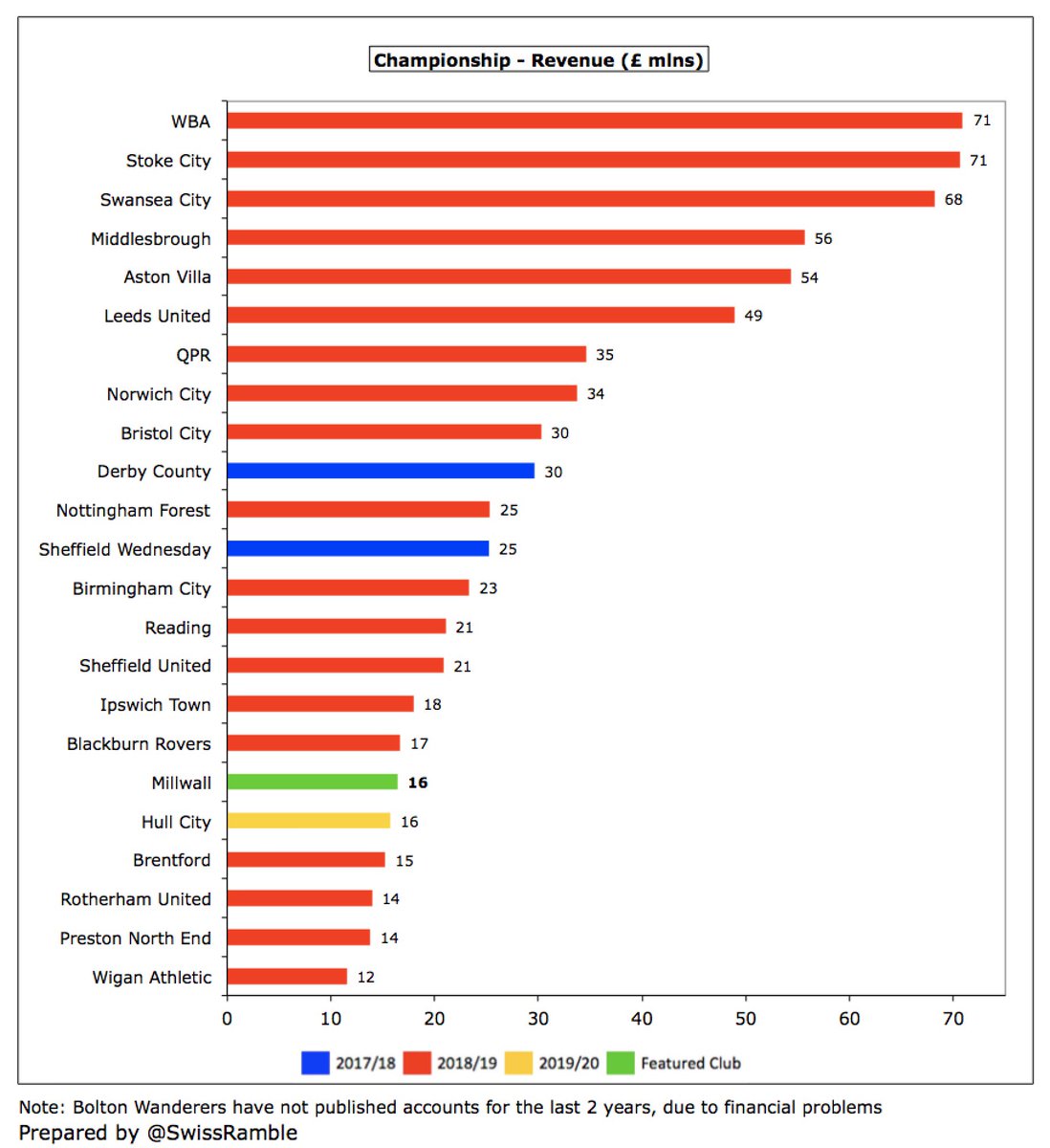

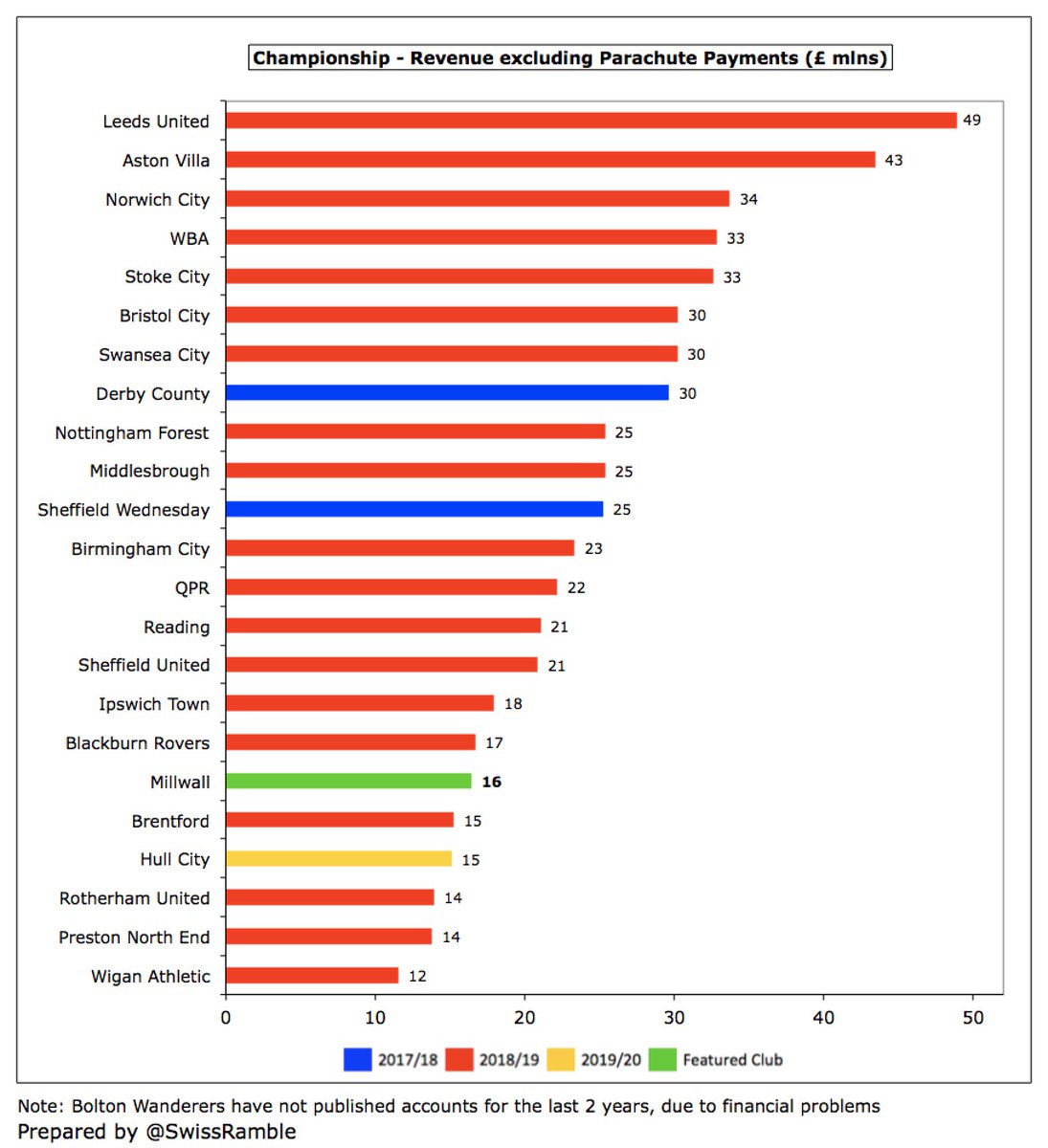

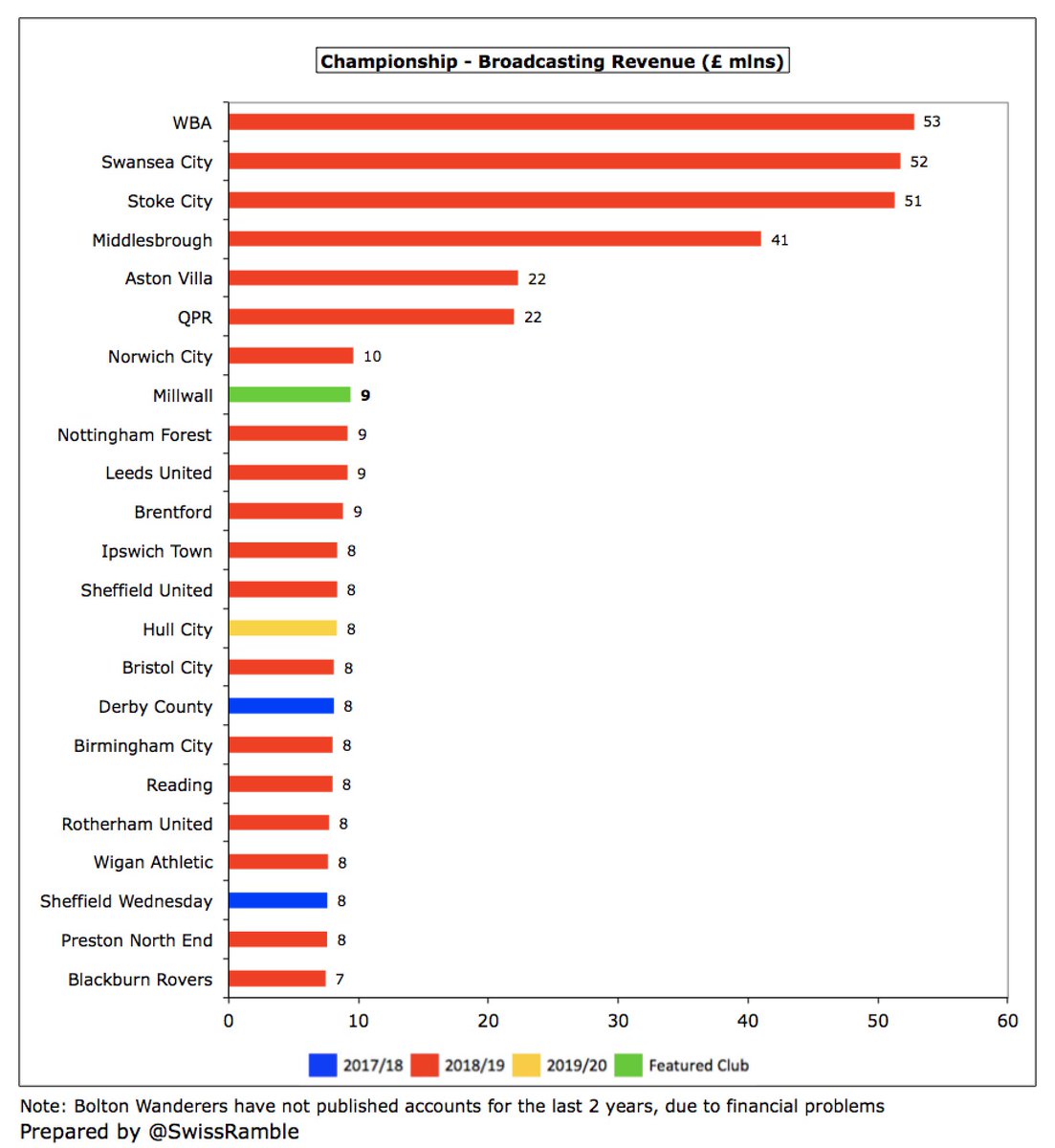

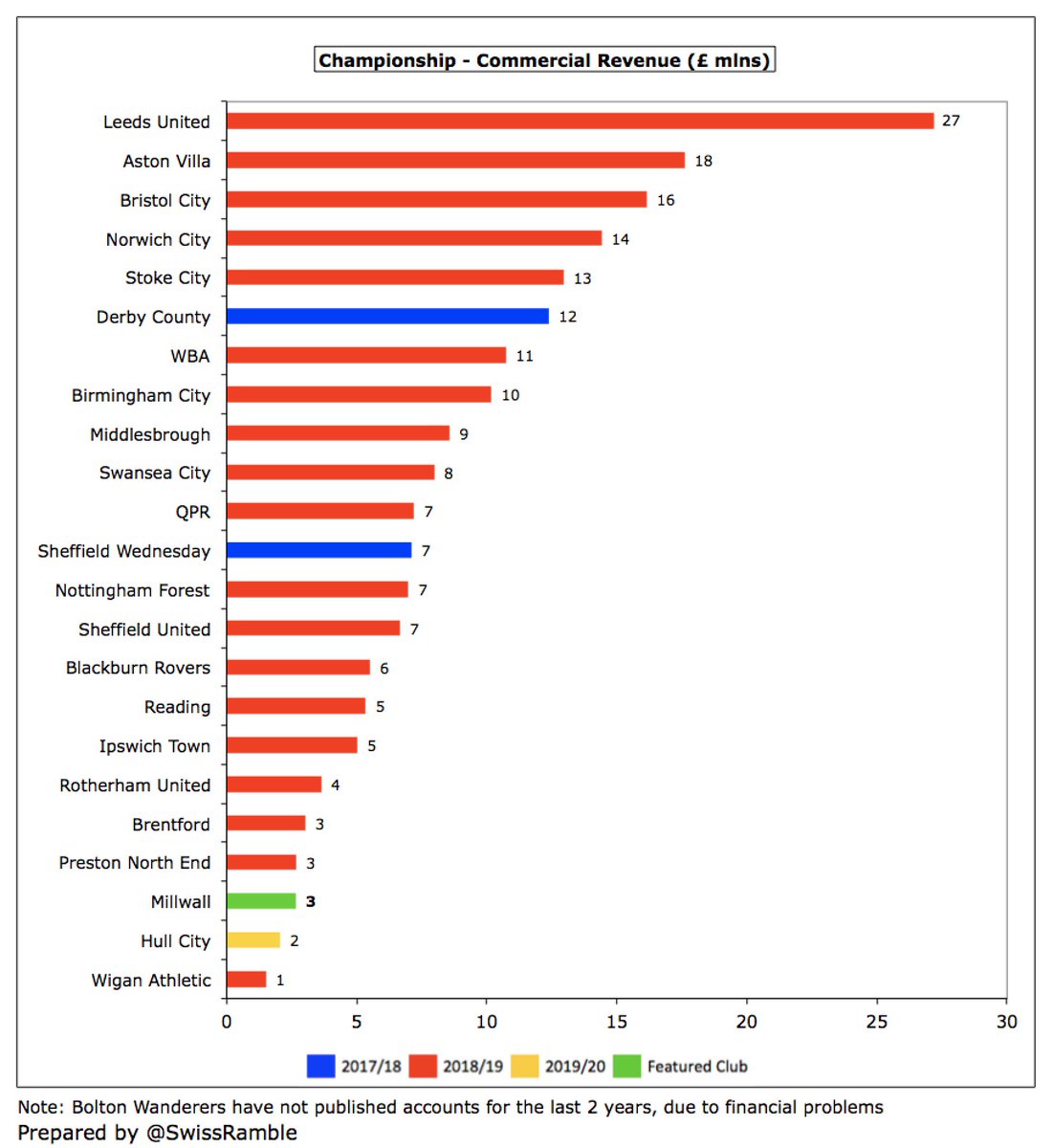

Even after the growth, #Millwall £16m revenue is still one of the smallest in the Championship, though it was just above Hull City, the only other club ton have published 2019/20 accounts to date. Less than a quarter of WBA £71m, Stoke City £71m and Swansea City £68m.

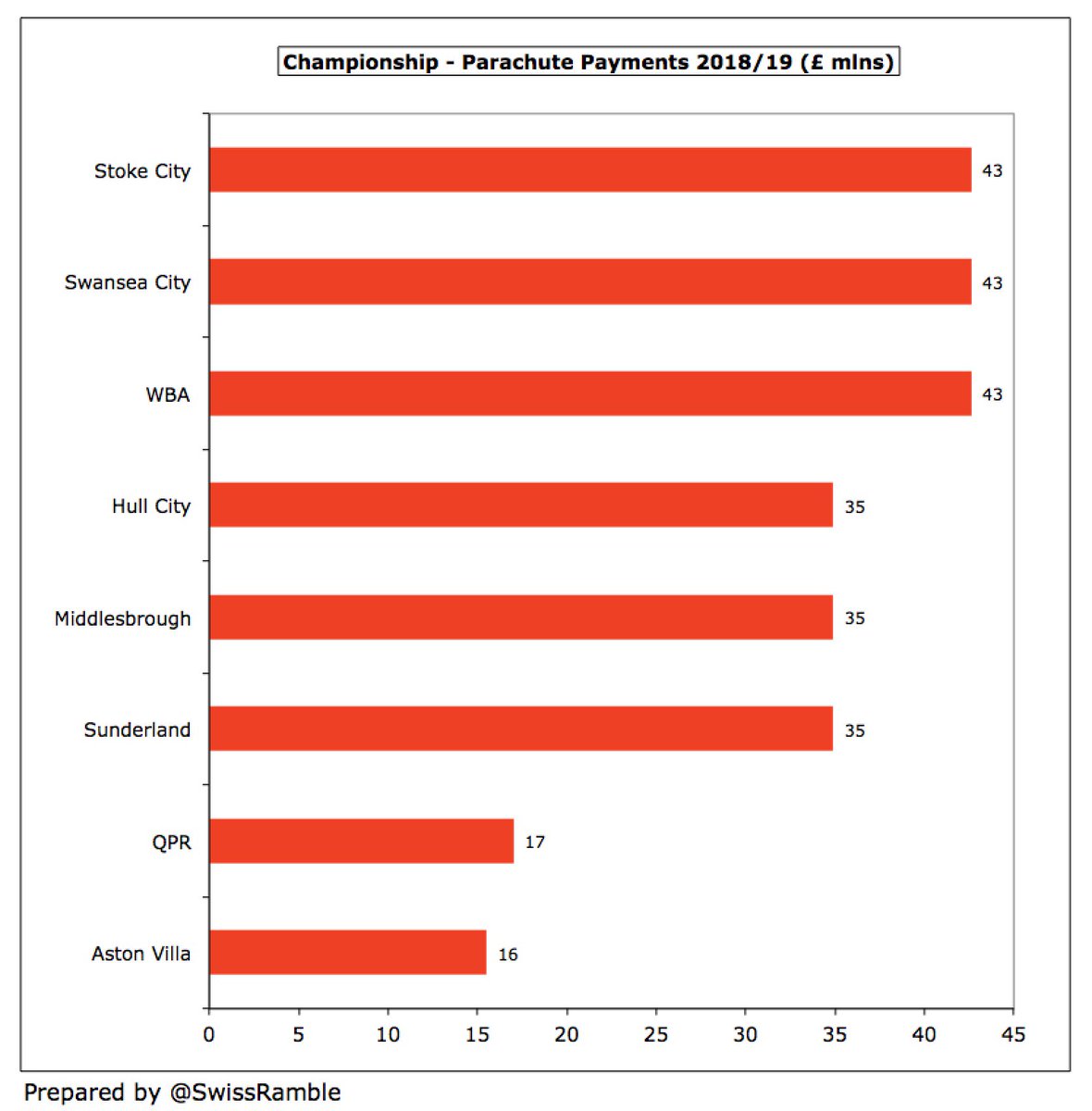

As #Millwall chief executive Steve Kavanagh said, “The quality and wealth of many of the clubs playing in the Championship continued to rise, with an increasing number of clubs in receipt of parachute payments from the Premier League”, led by Stoke, Swansea & WBA, all with £43m.

If parachute payments were excluded, #Millwall £16m would still be firmly in the bottom half of the Championship, though the gap to #LUFC £49m and #AVFC £43m (figures from 2018/19 season) would be “only” around £27m.

#Millwall broadcasting income fell by £0.6m (7%) to £9.4m, due to COVID impact and FA Cup money in previous year. Boosted by 5 games shown live on Sky. Most Championship clubs earn £8-9m from TV, but there is a big gap to clubs with parachute payments.

#Millwall match day income fell £1.2m (23%) from £5.6m to £4.4m, largely due to playing 5 home games behind closed doors because of the pandemic, though also no FA Cup run. This was firmly in the bottom half of the Championship.

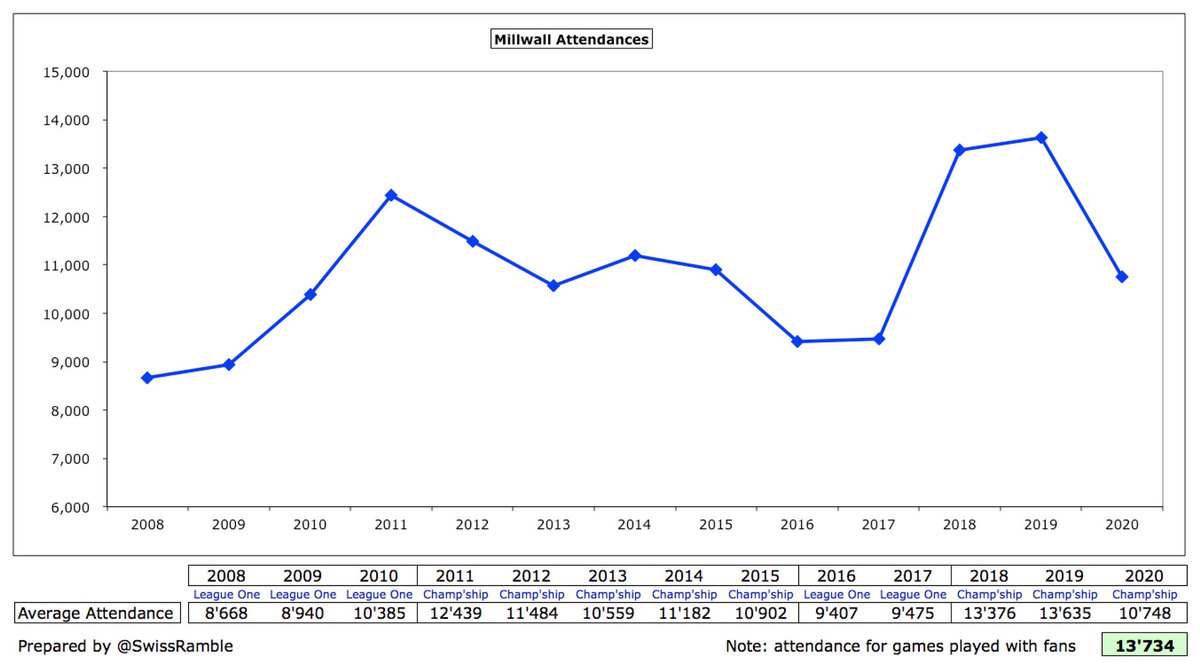

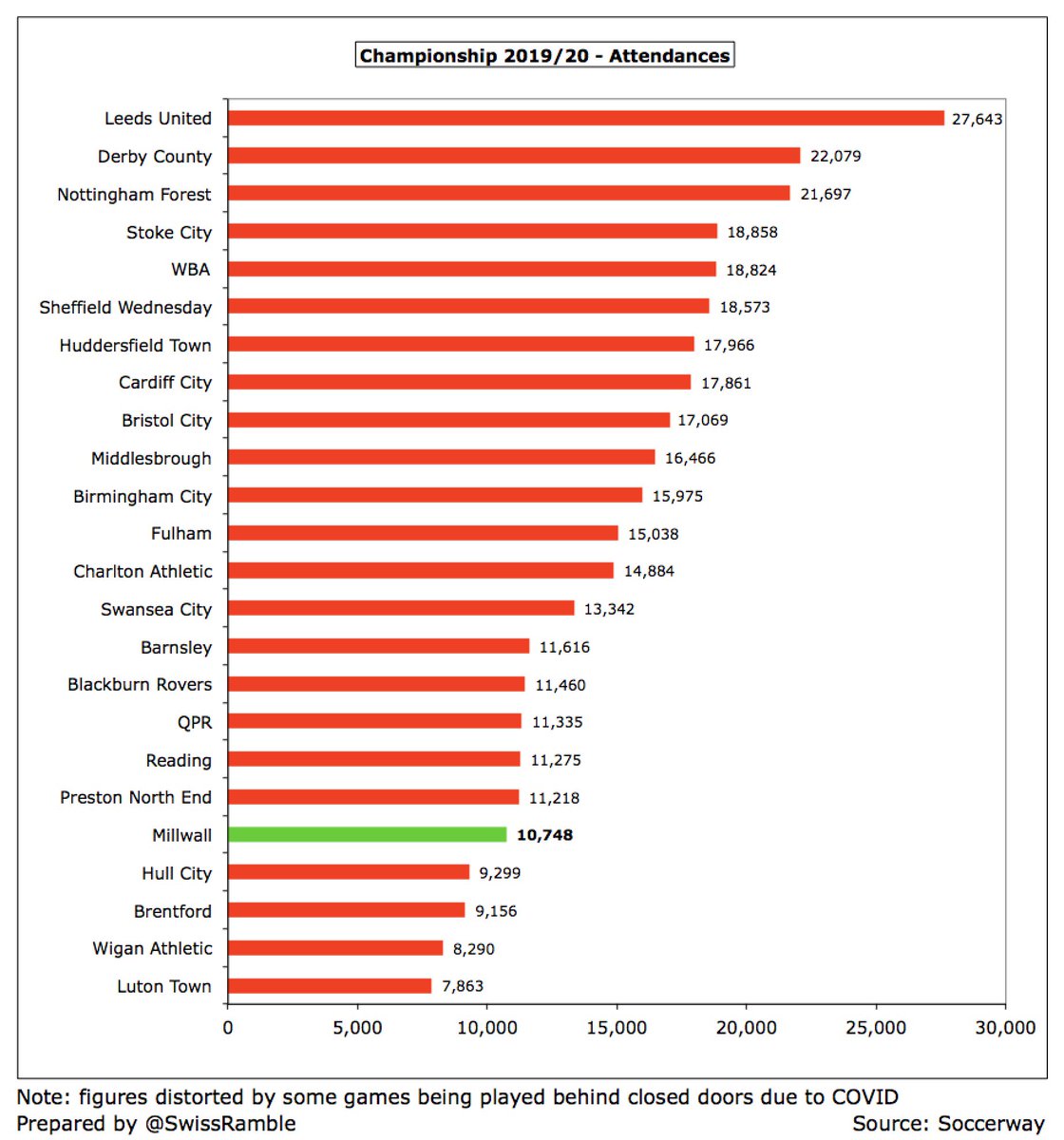

#Millwall attendance fell from 13,635 to 10,748, due to 5 games behind closed doors. For games played with fans, attendance rose slightly to 13,734. Whichever way you look at it, this is one of the lowest in the Championship, only above Hull City, Brentford, Wigan and Luton Town.

Despite the challenges of the pandemic, #Millwall commercial income of £2.7m remained the same. However, this is still one of the lowest in the Championship, miles below the likes of Leeds United £27m, Aston Villa £18m and Bristol City £16m.

#Millwall had a couple of new shirt sponsors in 2019/20: front – Huski Chocolate five-year agreement is “the biggest in the club’s history”; back – The Energy Check for 3 years. The kit supplier has been Macron from 2018.

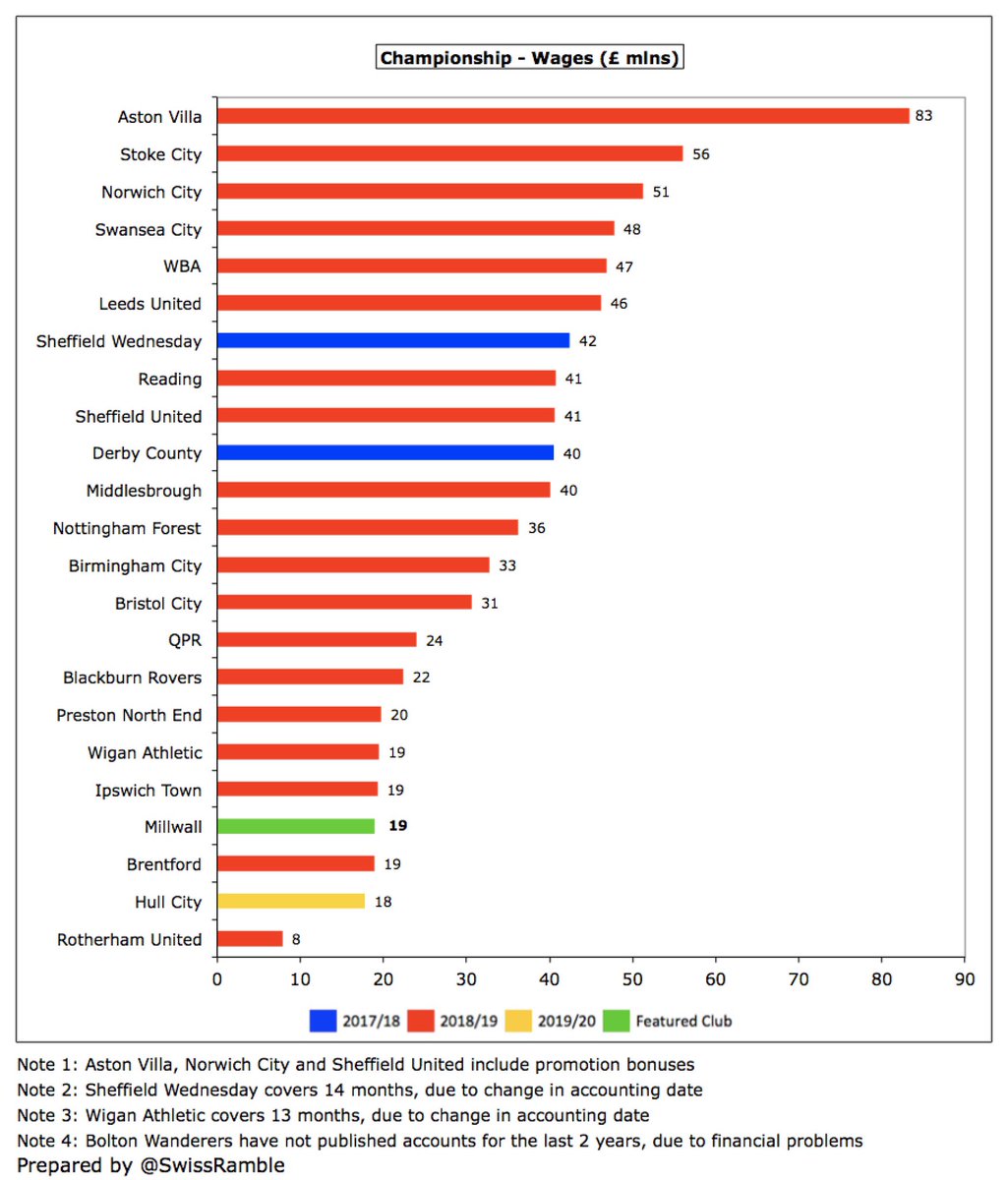

#Millwall wage bill rose by £2.0m (12%) from £16.9m to £18.9m, reflecting investment into the playing squad plus the change in manager during the season. Wages have now more than doubled since promotion from £9.4m in League One in 2017.

However, despite the investment, #Millwall £18.9m wage bill “continues not to match the level of salary costs of many clubs in the league” (Kavanagh again). In particular, it is much lower than clubs benefiting from parachute payments, e.g. #AVFC £83m and Stoke City £56m.

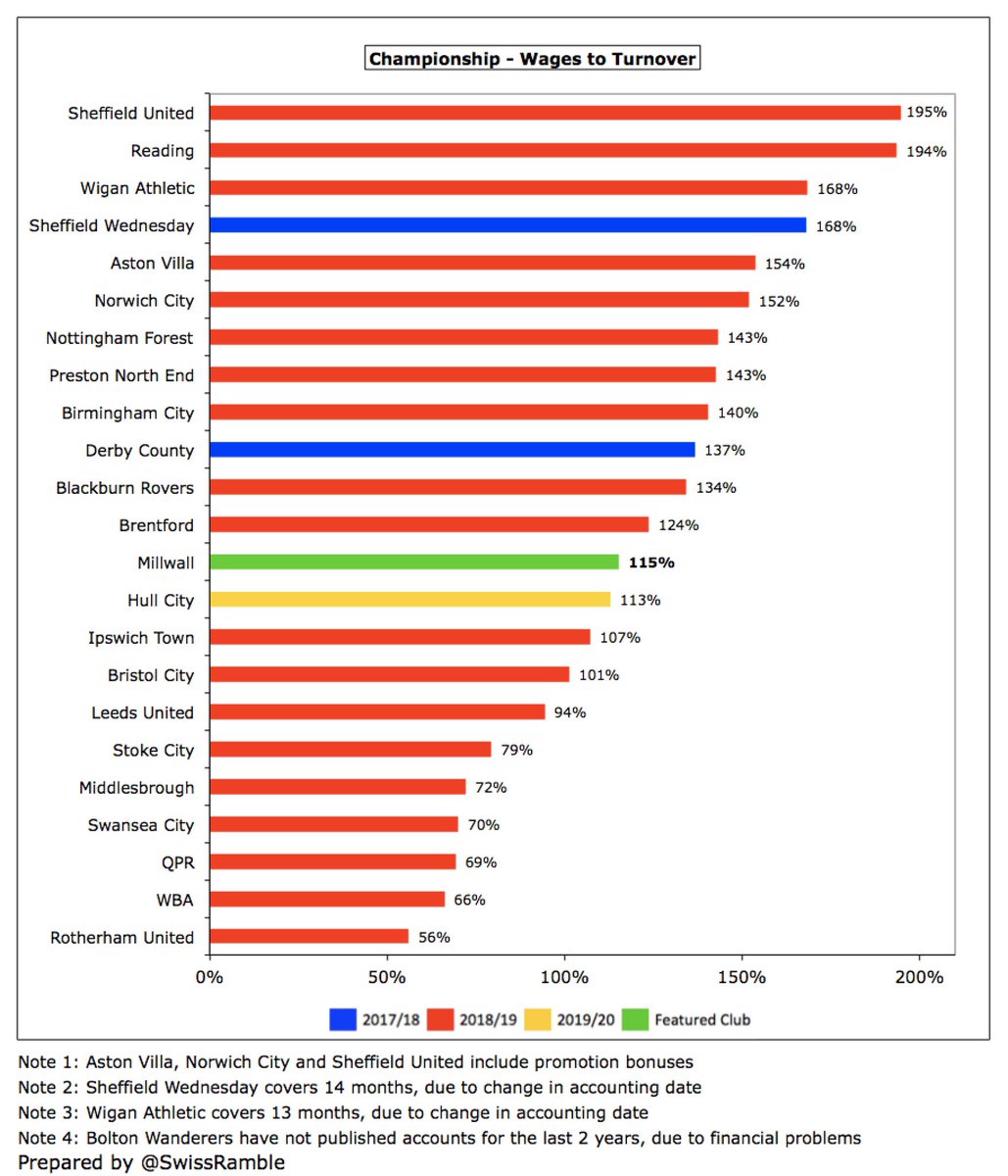

#Millwall wages to turnover ratio increased from 92% to 115%, which is not great, but this is pretty much the norm in this ultra-competitive division, where 16 clubs are above 100%, much worse than UEFA’s recommended 70% upper limit.

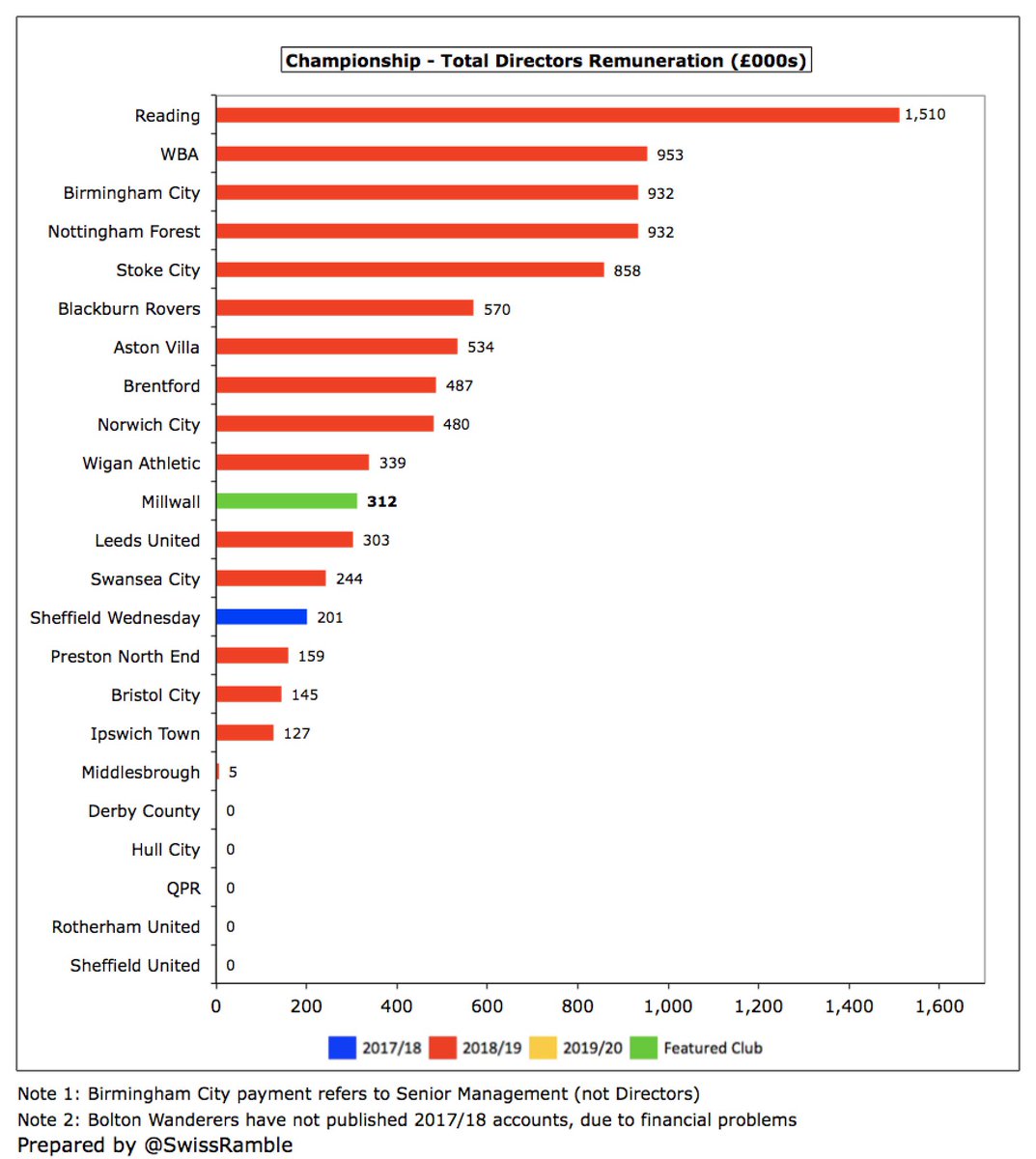

#Millwall directors’ remuneration was unchanged at £312k, but this was still significantly lower than the likes of Reading £1.5m, WBA £953k, Birmingham City £932k and Nottingham Forest £932k.

#Millwall player amortisation, the charge to writing-off transfer fees over a player’s contract, rose £0.9m (71%) from £1.3m to £2.2m. However, this is still very low, highlighting the club philosophy of giving home grown players from the academy opportunities in the first team.

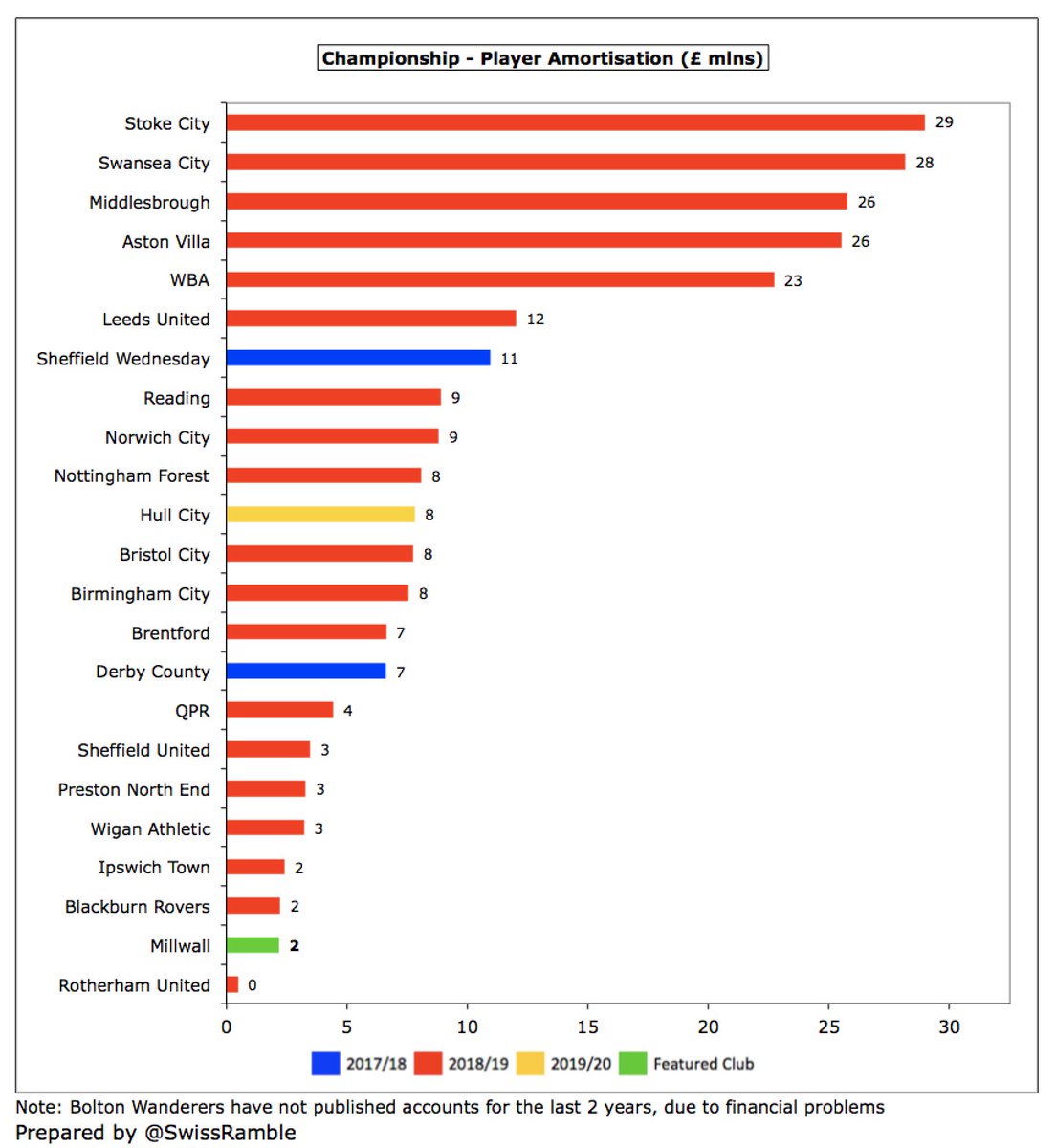

To further emphasise #Millwall’s conservative approach in the transfer market, their £2.2m player amortisation is the second lowest in the Championship, only ahead of Rotherham United, and a lot lower than big-spending Stoke City £29m and Swansea City £28m.

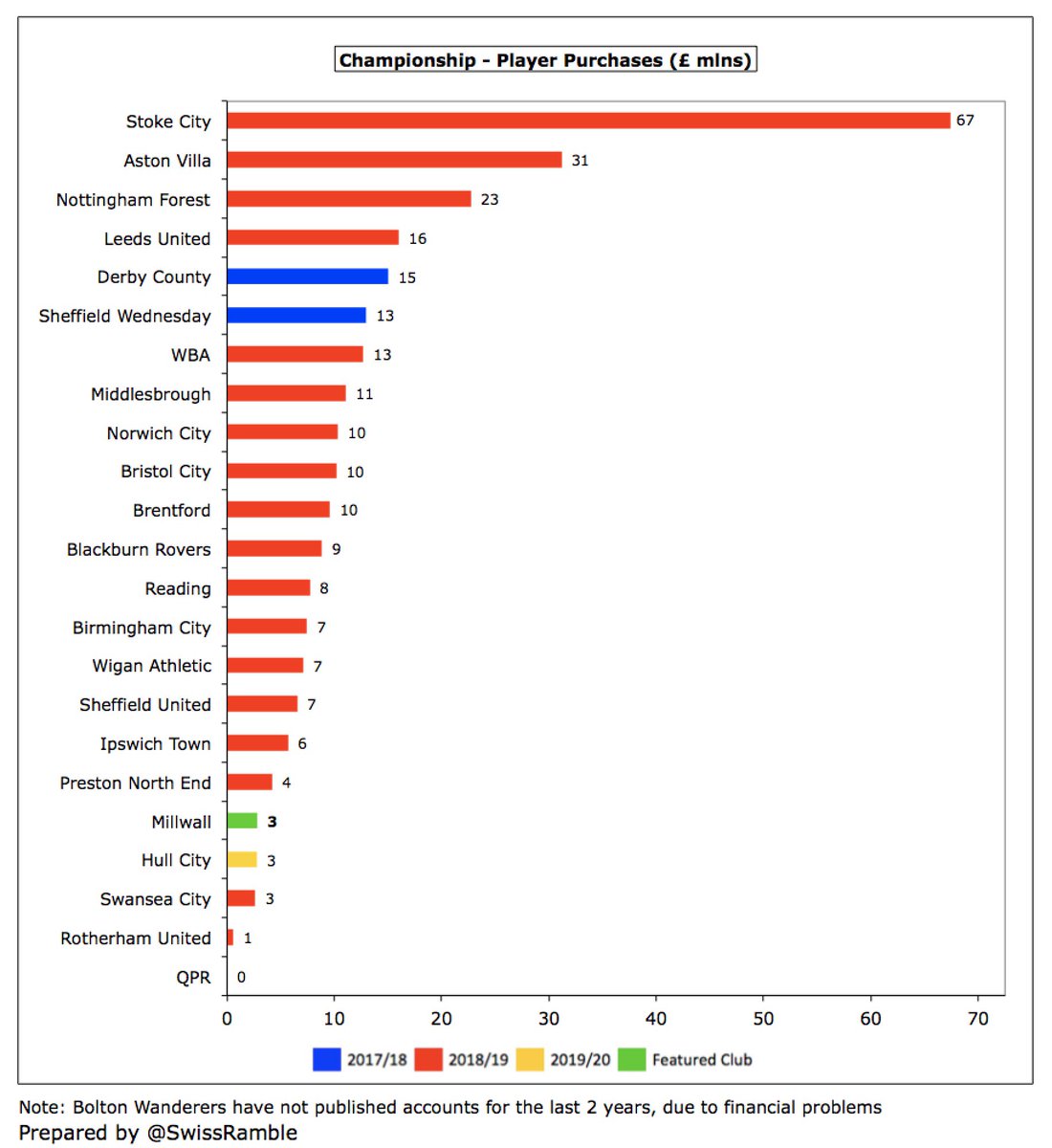

#Millwall player purchases of £2.8m was slightly higher than prior years £2.6m. This investment has increased 4 years in a row, but this was still miles below Stoke City £67m, #AVFC £31m and #NFFC £23m. Included Connor Mahoney from #AFCB and Jón Daði Böðvarsson from Reading.

#Millwall’s player trading objective in most seasons seems to be to balance the books. Even though they increased gross spend in last 2 seasons, this was matched by higher sales, so have still ended up essentially break-even. Number of senior players low compared to other clubs.

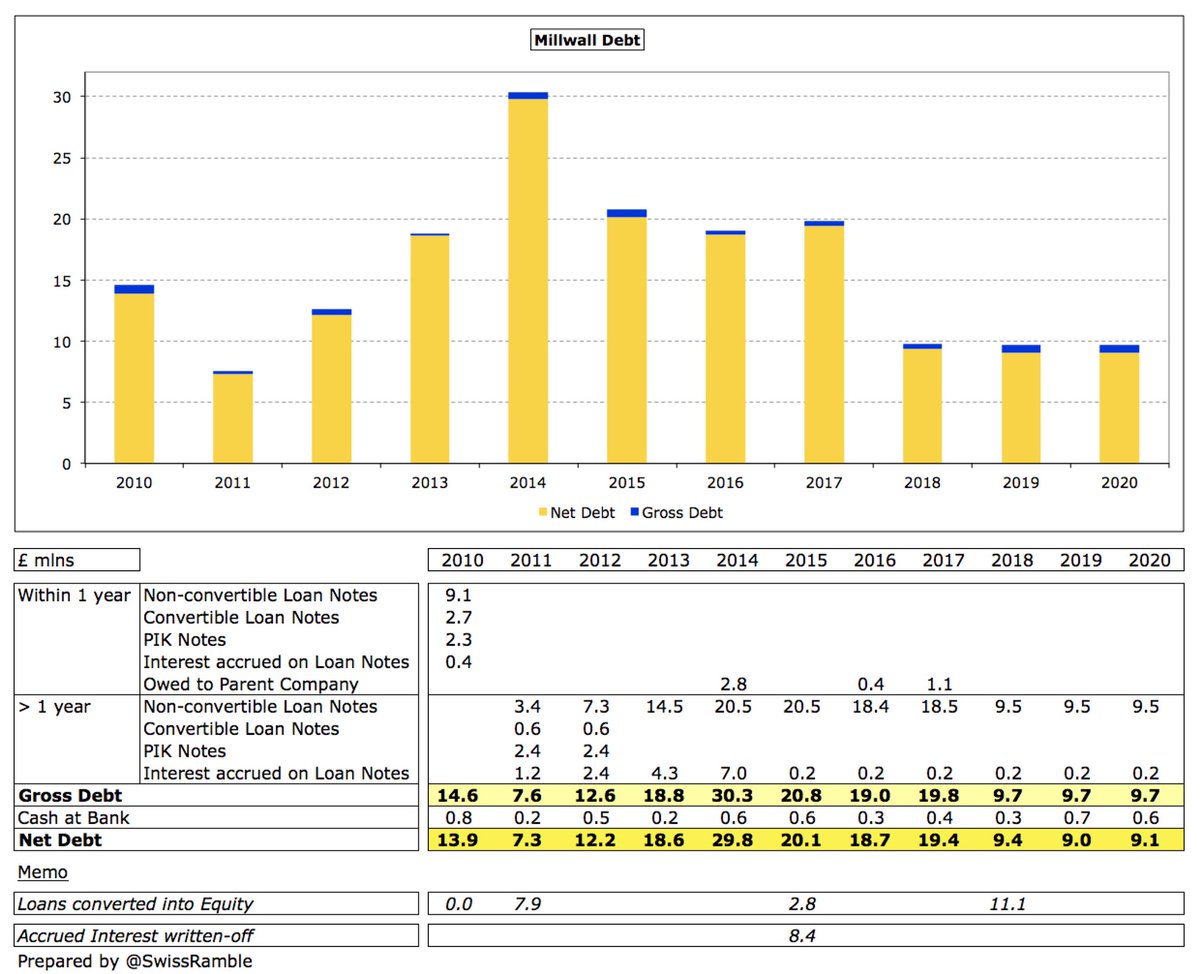

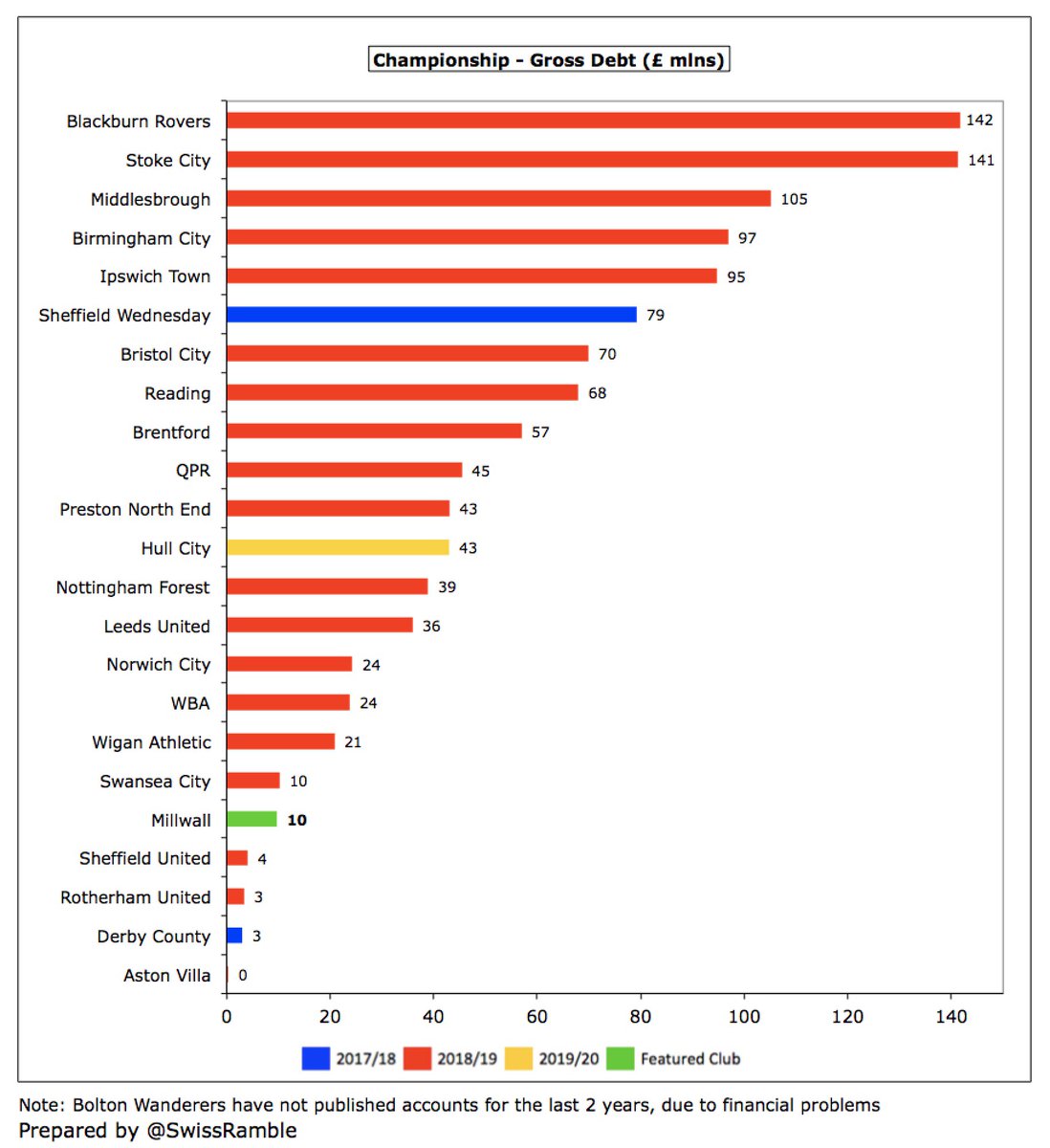

#Millwall gross debt was unchanged at £9.7m of loan notes, where repayment has been extended again to July 2022. This would be around £30m higher without the owners Chestnut Hill Ventures (CHV) effectively writing-off debt by waiving interest and converting loans into equity.

#Millwall £10m gross debt is very small compared to many other clubs in the Championship who have much larger debts, e.g. #BRFC £142m and Stoke City £141m. The debt at these clubs is normally not an issue – so long as the owners continue to provide support.

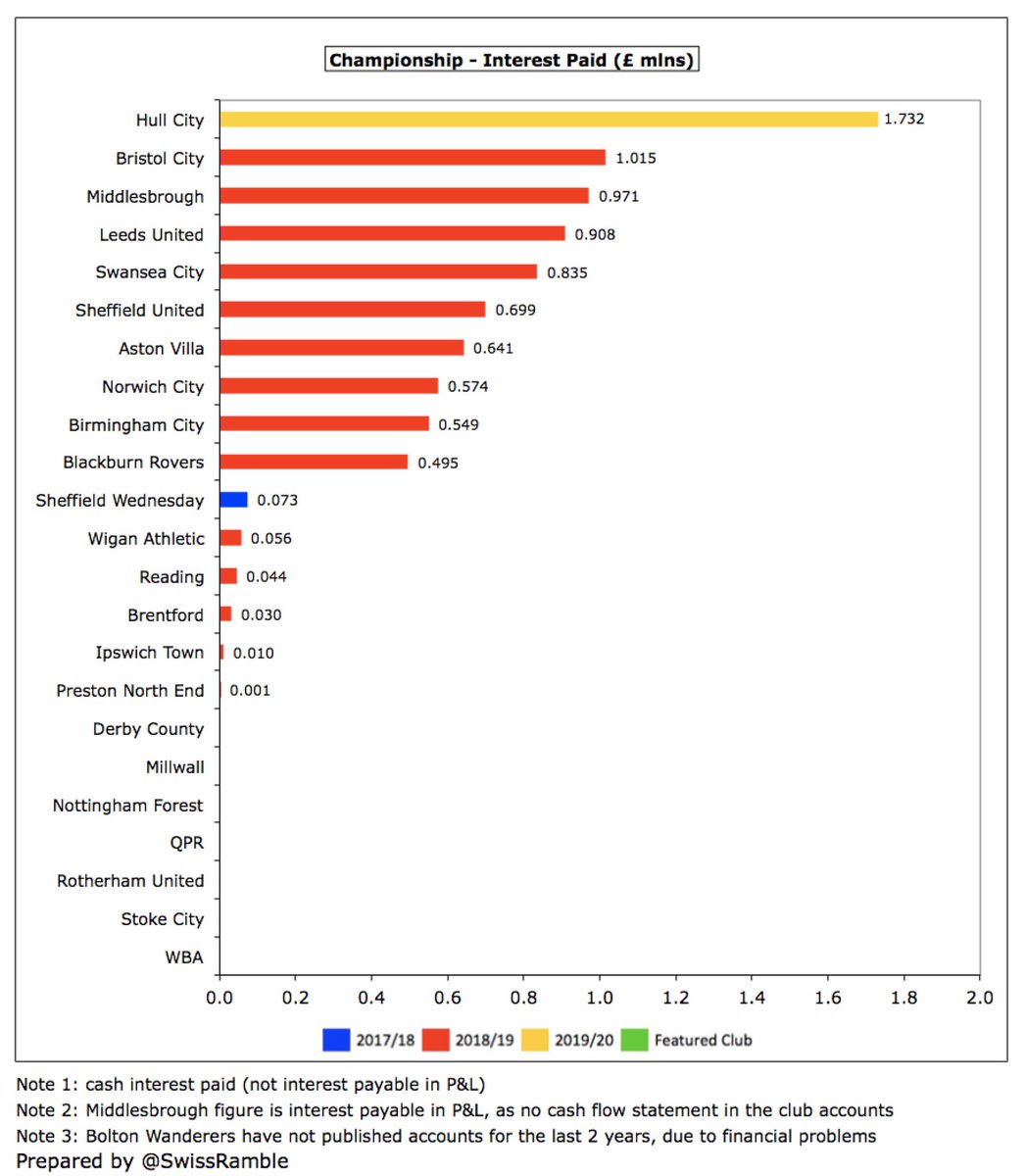

Although debt is high in the Championship, most of it is provided by owners who charge little or no interest. #Millwall chairman John Berylson’s company CHV charges 12% per annum on the loan notes, but interest payments have been frequently suspended (latest to June 2021).

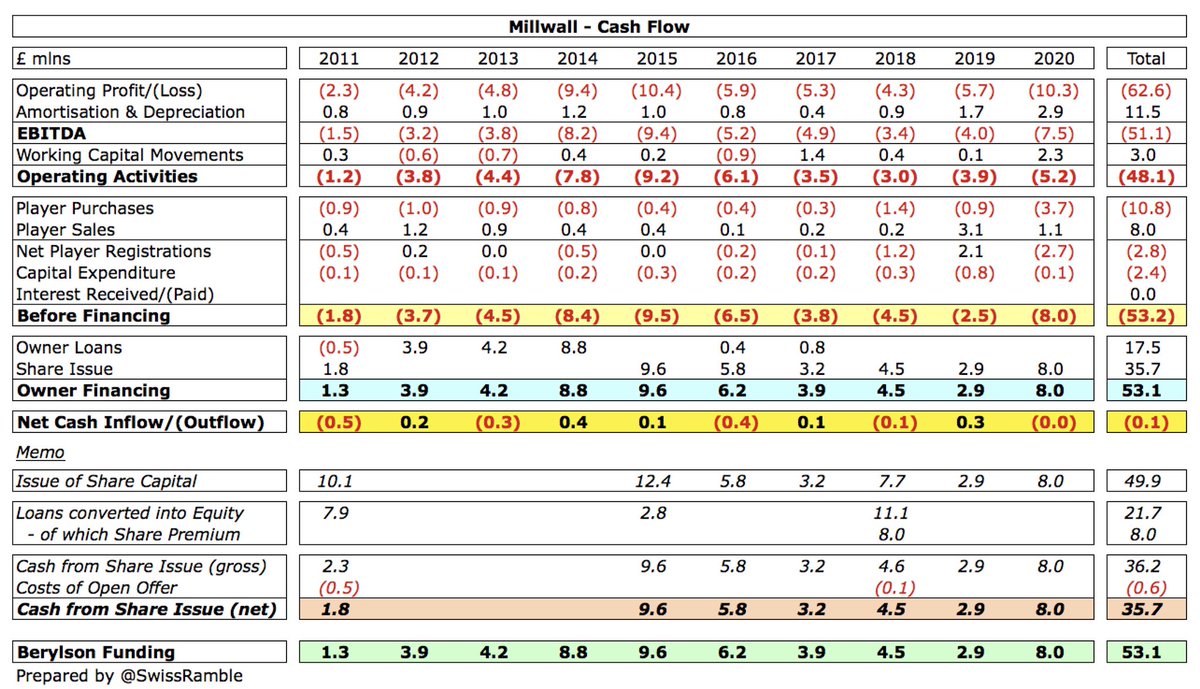

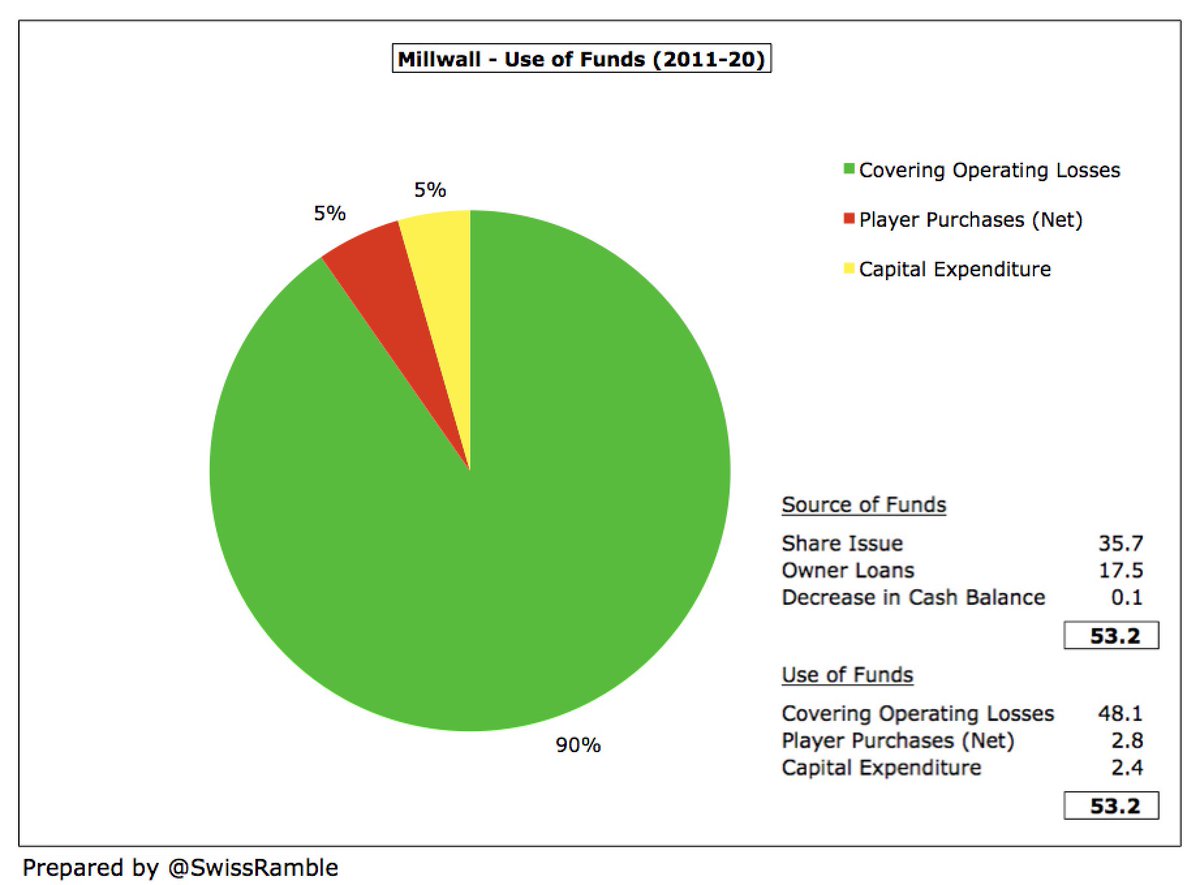

#Millwall cash flow statement reveals the extent of the support of Berylson and other directors with £53m of funding provided in the last 10 years through £36m of share capital and £17m of loans, including £8m of shares in 2019/20 that covered the net cash outflow.

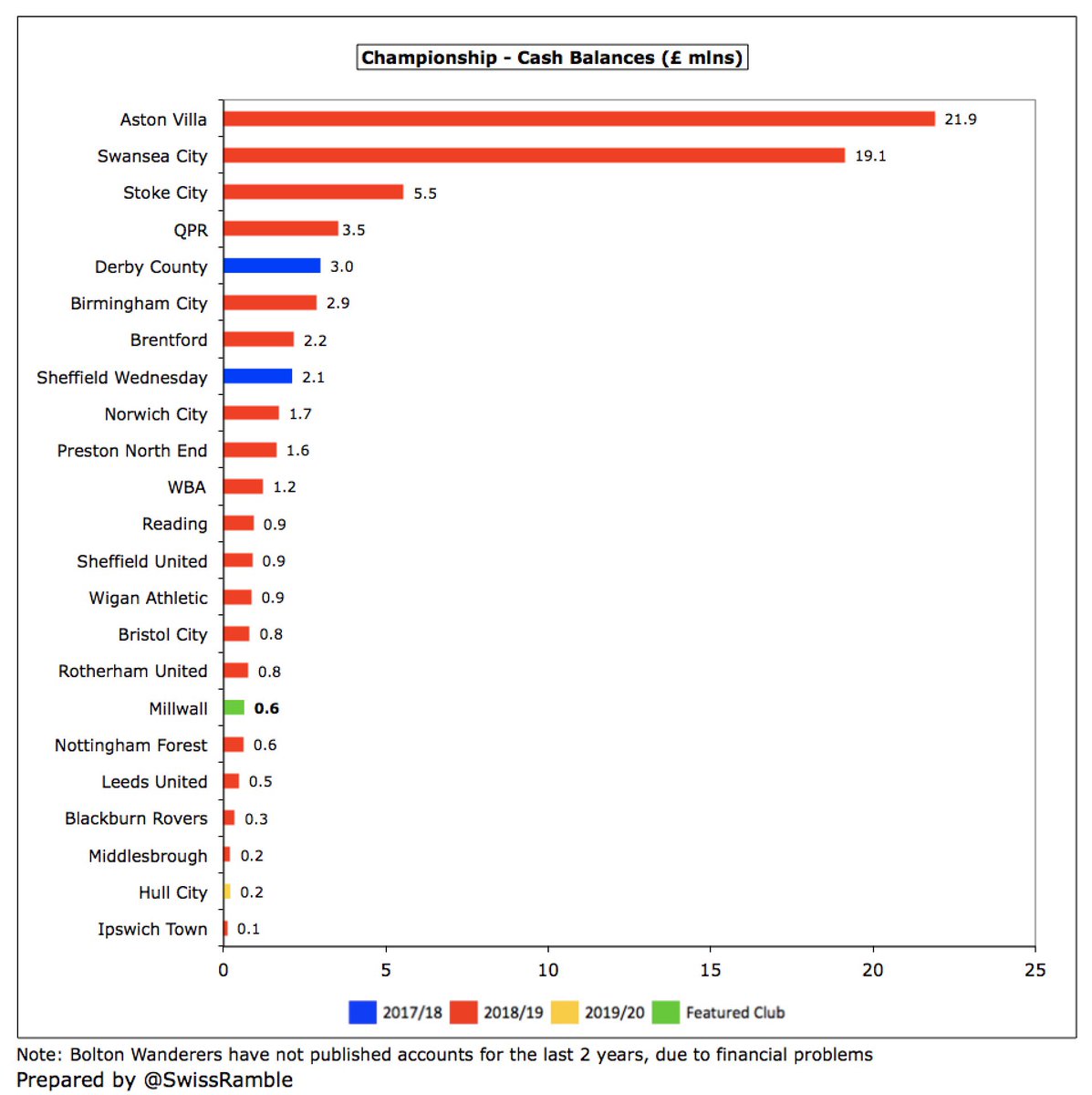

As a result, #Millwall cash balance was unchanged at £0.6m, one of the lowest in the Championship. In fairness, 15 clubs in this division had less than £2m cash in the bank, so this was not exceptional (though not a great buffer in the current climate).

The owners’ £53m funding since 2011 has been almost entirely used to cover the club’s losses of £48m over this period. In contrast, very little money has been spent on infrastructure investment (£2.4m) and player purchases – less than £3m (net of sales).

#Millwall’s best opportunity to generate more revenue is by developing the land adjoining the stadium. They have a regeneration plan to create affordable housing, student accommodation, retail and office space, a hotel and conference centre plus a stadium expansion.

The good news for the club is that an agreement has finally been reached with Lewisham council, with the threat of Compulsory Purchase Orders being removed, so that it now looks like #Millwall’s scheme to transform the area around the stadium can go ahead.

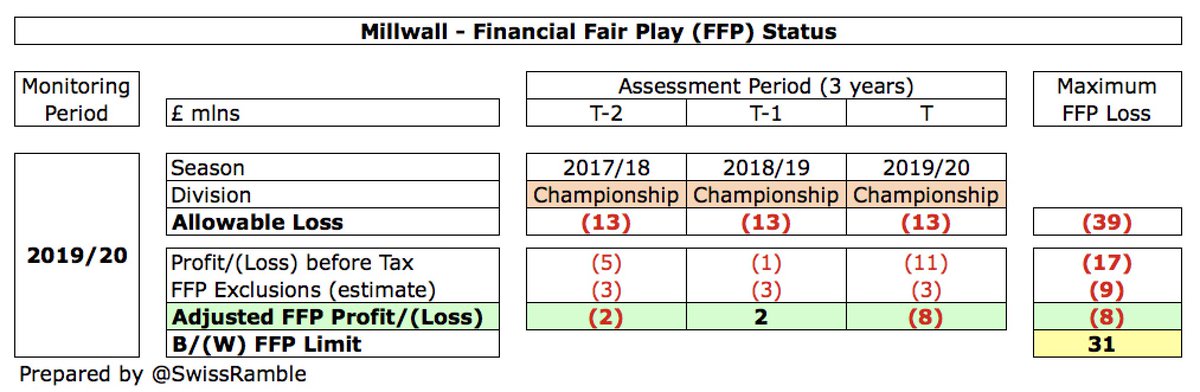

Under FFP #Millwall are allowed to incur £39m losses over the 3-year monitoring period, though they can make deductions for academy, community and infrastructure. The club is “well within this limit”, even after the larger loss for the 2019/20 season.

#Millwall have punched above their weight in the Championship, though Berylson will have to continue funding to cover the operating losses. Kavanagh noted, “Although the club is in a stronger position versus some of its peers, it is not immune to (COVID) financial challenges.”

Read on Twitter

Read on Twitter