$RUNE kek - I personally have a bag sitting as my hedge against picking the winning chains.

Oh you thought this was about 2 chains? No.

There will be other blockchains, DeFi has found a home on Ethereum but we will need more solutions then just the replacement of finance.

Oh you thought this was about 2 chains? No.

There will be other blockchains, DeFi has found a home on Ethereum but we will need more solutions then just the replacement of finance.

$RUNE allows me to sleep at night, not having to wonder about what use cases might pop up elsewhere on other blockchain islands of happiness. $RUNE fills the space between these chains and allows the seamless flow of liquidity - across chains....natively.

There are going to be many reasons where you want to swap one blockchain native asset for the other and $RUNE will be that medium.

OK then so doesn’t that mean if $RUNE wins the cross chain liquidity war? What happens to wrapping services……….ded right?

OK then so doesn’t that mean if $RUNE wins the cross chain liquidity war? What happens to wrapping services……….ded right?

Well the thing about native assets is that they aren't really composable off their chain. So if any other blockchains assets e.g $BTC are going to earn yield and play in the new financial space we are creating, guess what - it’s going to need to be wrapped onto Ethereum.

So what do we have out there in ways of wrapped asset protocols.

wBTC (Bitgo) Custodial risk, also largest marketcap

renBTC (DeFi) - yet to release code and move to decentralised model

hBTC - Huobi centralised exchange

tBTC - $KEEP DeFi solution, high security - large pledge

wBTC (Bitgo) Custodial risk, also largest marketcap

renBTC (DeFi) - yet to release code and move to decentralised model

hBTC - Huobi centralised exchange

tBTC - $KEEP DeFi solution, high security - large pledge

These are just the top projects.

All the current options for tokenizing cross chain assets onto Ethereum have their own pros and cons.

Some are not going anywhere like centralization risk, and others still need time to evolve passed a private key risk.

All the current options for tokenizing cross chain assets onto Ethereum have their own pros and cons.

Some are not going anywhere like centralization risk, and others still need time to evolve passed a private key risk.

Enter @BoringDAO_Defi into the chat……. $BOR is a project I have been keeping my eye on for a while, with solutions to bring security to centralization risk and the ability to create a simplistic and streamline “Tunnel” between Ethereum and other native assets managed by a DAO.

The DAO allows the tunnel to onboard new assets via a voting mechanism and pledging assets to support. The pledging process works so that assets are back 1:1 in a multisig smart contract and wrapped onto $ETH as oTokens.

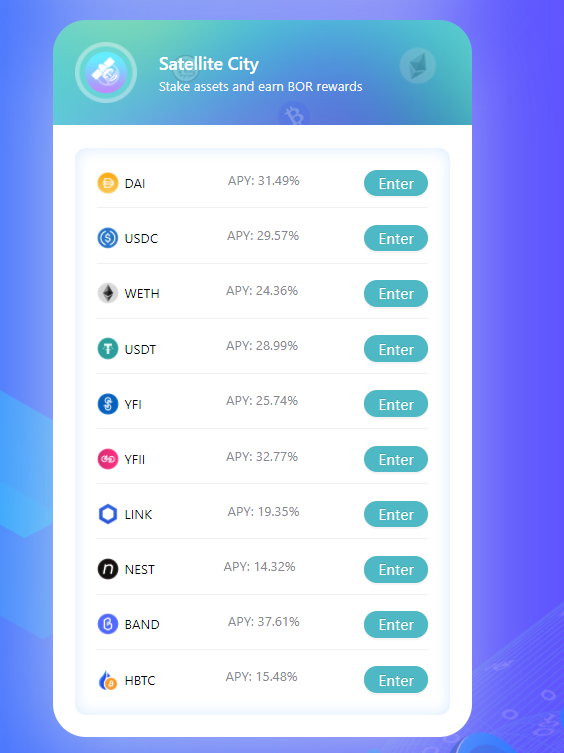

The additional security and collateralization comes from $BOR and other assets being pledge to the protocol via the Satellite City where you can earn $BOR rewards. Single sided LPs are not common today, so no IL here.

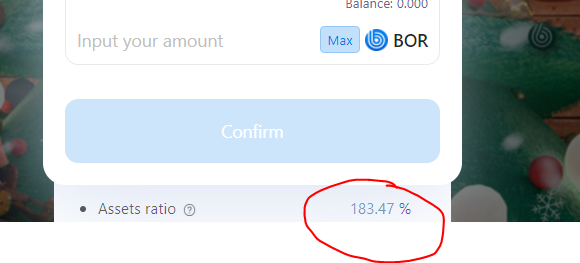

This means that the collateralization ratio is anywhere from 100% to 200% backing each oToken on Ethereum which gives the user confidence that the value is well and truly backed. Currently it stands at 183.47% collateralization for $oBTC

The team are very fast paced and are continuing to develop their product into a simple, streamlined option for other native assets to interact with DeFi - even if they are a Maxi........

So, I wanted to be apart of that.

Today I have accepted an advisory and business development role within the @BoringDAO_Defi to give a better experience to new users in #DeFi and help make it a safe and secure place to transact.

Today I have accepted an advisory and business development role within the @BoringDAO_Defi to give a better experience to new users in #DeFi and help make it a safe and secure place to transact.

The roadmap is impressive as well, and has had a lot of time and effort put into the planning of this protocol. I am very excited to help them realize the potential the protocol has. @Enki_BoringDAO @SamMingX @krypto_henry Look forward to working together in the new year.

Read on Twitter

Read on Twitter