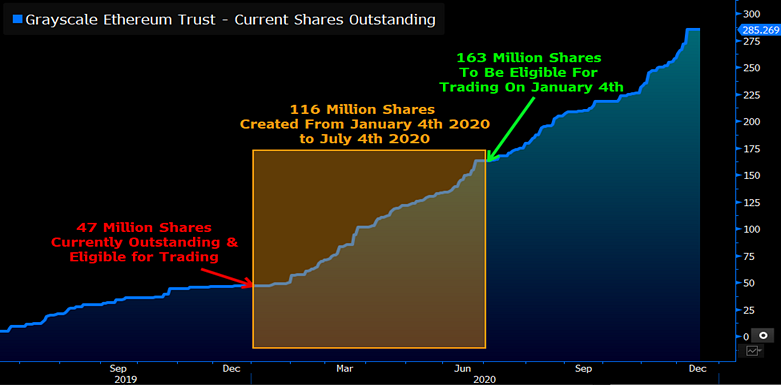

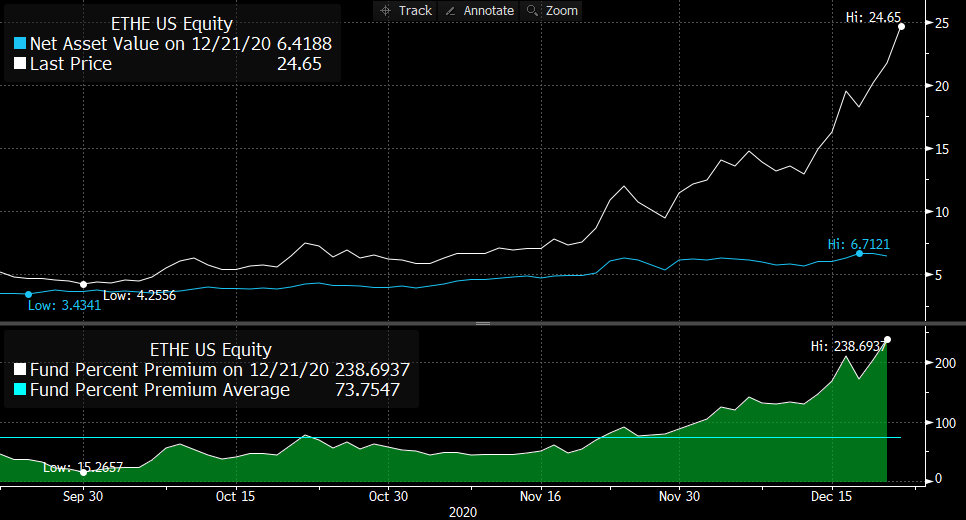

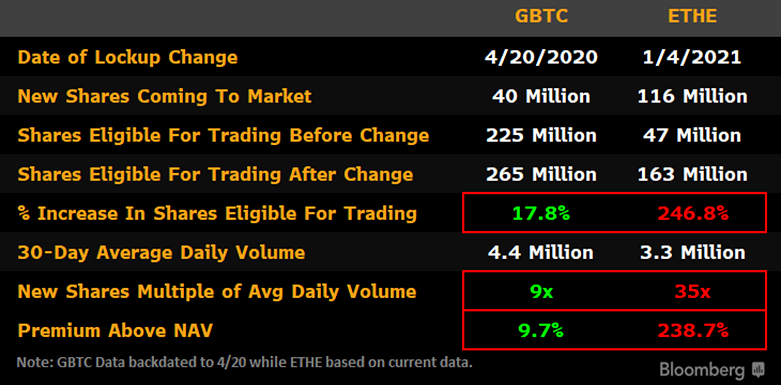

Soo Grayscale's $ETHE is facing a tidal wave of new shares (116 million) as it transitions from a 12 to 6 month lockup on Jan 4th. There's currently about 47 mln shares trading OTC but that's going to more than triple to 163 mln. Yesterday's 239% premium is in trouble post Jan 4.

Those 116 million shares are worth $2.85 billion at current prices but only $744 million at the current NAV. In the days and weeks following January 4th, holders eligible to sell are likely to rush to try to cash out at the open market 239% premium price.

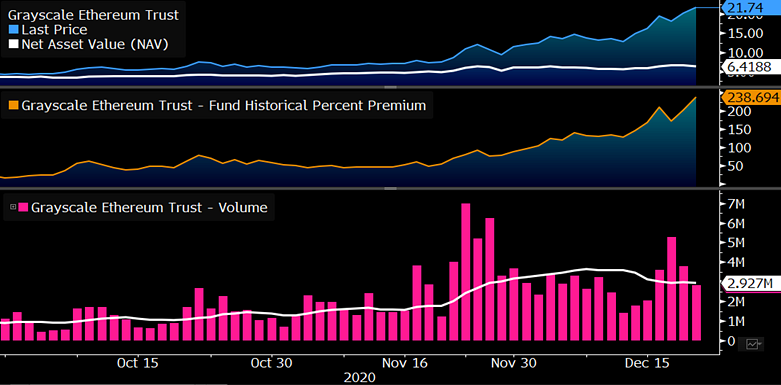

Those 116 million million shares are set to blow away the average daily volume. I mean its traded an average about about 3.3 million shares with a peak of about 7 million.

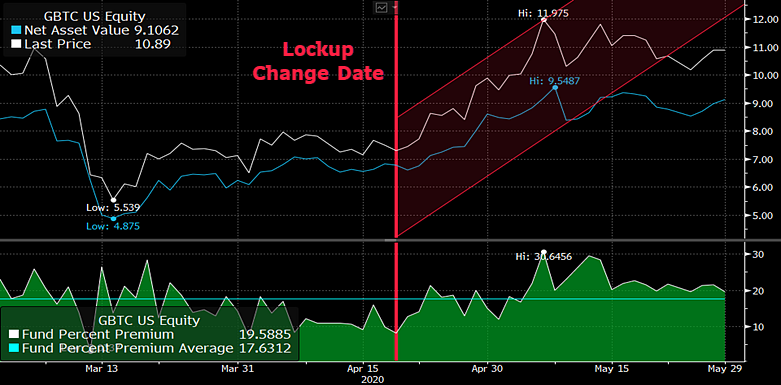

Now, $GBTC went through this process on 4/20 (haha) and its premium actually went up afterwards. But it was a completely different scenario. That was in the middle of a 44% bitcoin rally after every asset in the world hit all time lows. Plus $GBTC was simply a more mature product

When you look at the relevancy of the shares coming to market as a % of current shares and as a portion of the current trading volume it's eye popping. Not to mention $GBTC's premium was under 10%. The value of selling $ETHE at 238% is in a different universe from $GBTC's 10%.

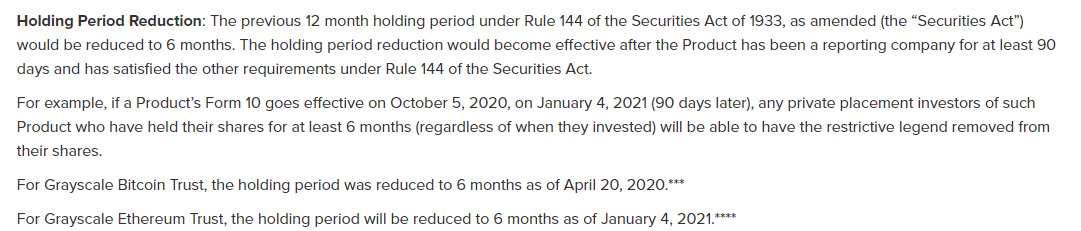

The reason 116mln shares are hitting OTC is because $ETHE has become an form10 SEC reporting company. Prior to this there was a 12 month lockup/'seasoning' period to sell shares. Its changing to 6. All shares older than 6 but younger than 12 months become trade eligible on jan 4.

This is fantastic for accredited investors that can get into the fund and sell their shares on the open market at premiums after taking the risk of 12 or 6 month lockups. SEC is 'protecting' retail investors by not allowing an ETF. But then this is happening across the street.

IMO by failing to allow a crypto ETF in the U.S., the SEC has left retail investors exposed to significant risks via wide mispricing in less-efficient vehicles, while giving an advantage to accredited investors such as wealthy individuals, hedge funds, PE firms & Family Offices.

Here's a quote form @HesterPeirce's dissent when the SEC denied a bitcoin ETF.

https://www.sec.gov/news/public-statement/peirce-dissent-34-83723

https://www.sec.gov/news/public-statement/peirce-dissent-34-83723

The problem here is that $ETHE can move completely independently from Ethereum. In a worst case (unlikely) scenario:

If $ETHE's price theoretically fell to meet its NAV (0% premium). $ETHE shares would see a ~70% loss irrespective of the underlying value of ethereum.

If $ETHE's price theoretically fell to meet its NAV (0% premium). $ETHE shares would see a ~70% loss irrespective of the underlying value of ethereum.

I've gotten a lot of feedback here and i would add a couple things.

1. I specifically say in my piece:

"Absent the kind of frenzied increase in demand for cryptocurrency assets that occurred in December 2017, Grayscale Ethereum Trust's premium is likely to feel a gravity pull"

1. I specifically say in my piece:

"Absent the kind of frenzied increase in demand for cryptocurrency assets that occurred in December 2017, Grayscale Ethereum Trust's premium is likely to feel a gravity pull"

2. I specifically talk about AFTER January 4th. Entirely plausible the premium continues to balloon into January. Would argue an increasing premium is the likely path of least resistance until these shares hit the market... but who knows?

Almost forgot. All of this and more available on the terminal at:

https://blinks.bloomberg.com/news/stories/QLR9PXDWRGGG

https://blinks.bloomberg.com/news/stories/QLR9PXDWRGGG

Read on Twitter

Read on Twitter