Cord-CUTTING

Cord-CUTTING

$MGNI is making inroads into the Connected TV advertising space

$MGNI is making inroads into the Connected TV advertising space Only 40% of advertisers have spent on CTV ads until NOW

Only 40% of advertisers have spent on CTV ads until NOWCan $MGNI profitably grow in this NEW sector?

Here is an EASY thread

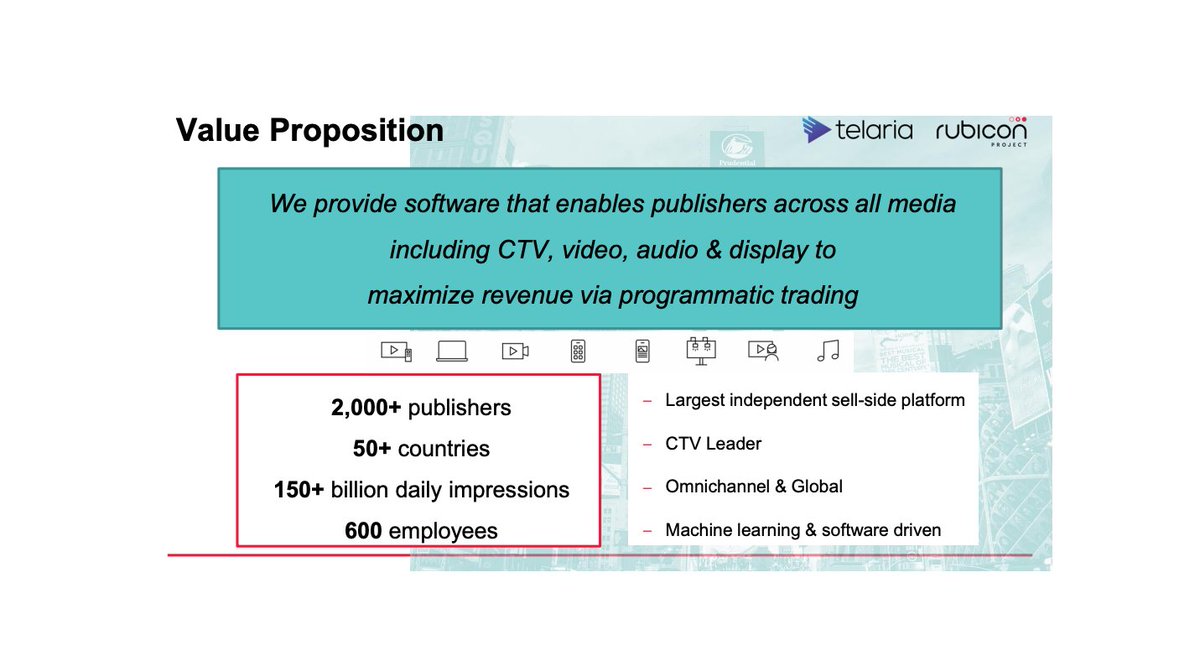

$MGNI Magnite is an US based online advertising technology firm  The company was formed following a merger of the Rubicon Project and Telaria

The company was formed following a merger of the Rubicon Project and Telaria

The merger turned Magnite into one of the world’s largest independent omni-channel sell-side platform

The merger turned Magnite into one of the world’s largest independent omni-channel sell-side platform

The company was formed following a merger of the Rubicon Project and Telaria

The company was formed following a merger of the Rubicon Project and Telaria The merger turned Magnite into one of the world’s largest independent omni-channel sell-side platform

The merger turned Magnite into one of the world’s largest independent omni-channel sell-side platform

Ok, this isn’t clear. Let’s dive into the world of Advertising Technology

You are working for Nike’s marketing department and need to get Nike’s ads online

You are working for Nike’s marketing department and need to get Nike’s ads online

You go on Google Adwords, create an account and start bidding for your adds to get published on sports websites

You go on Google Adwords, create an account and start bidding for your adds to get published on sports websites

You are working for Nike’s marketing department and need to get Nike’s ads online

You are working for Nike’s marketing department and need to get Nike’s ads online You go on Google Adwords, create an account and start bidding for your adds to get published on sports websites

You go on Google Adwords, create an account and start bidding for your adds to get published on sports websites

You then visit Facebook, Bings Ads and other websites were you could display your ads

You then visit Facebook, Bings Ads and other websites were you could display your ads You start buying ads, bidding & managing all of these

You start buying ads, bidding & managing all of these Well, you’re soon overwhelmed as you have to manage plenty of different platforms, place bids and monitor your ads’ effectiveness

Well, you’re soon overwhelmed as you have to manage plenty of different platforms, place bids and monitor your ads’ effectiveness

So this is not great! Here comes Demand-Side-Platforms (DSP):

A DSP is software used by advertisers to buy advertising inventory from publishers

A DSP is software used by advertisers to buy advertising inventory from publishers

Advertising inventory is the space available from publishers for ads (eg: a box on a website meant to be filled with an ad)

Advertising inventory is the space available from publishers for ads (eg: a box on a website meant to be filled with an ad)

A DSP is software used by advertisers to buy advertising inventory from publishers

A DSP is software used by advertisers to buy advertising inventory from publishers Advertising inventory is the space available from publishers for ads (eg: a box on a website meant to be filled with an ad)

Advertising inventory is the space available from publishers for ads (eg: a box on a website meant to be filled with an ad)

A DSP allows for the management of advertising across many real-time bidding networks, as opposed to just one, like Google Ads

A DSP allows for the management of advertising across many real-time bidding networks, as opposed to just one, like Google Ads Using a set of algorithms, a DSP ensures that an advertiser’s ads are displayed to the most relevant viewers

Using a set of algorithms, a DSP ensures that an advertiser’s ads are displayed to the most relevant viewers

These algorithms use the viewer’s browsing history, time of day, IP address and many other elements into account

These algorithms use the viewer’s browsing history, time of day, IP address and many other elements into accountSo, problem solved! Instead of crawling through advertising platforms

You log into to your favourite DSP, set your criteria and bidding budget and off you go

You log into to your favourite DSP, set your criteria and bidding budget and off you go

But we are still missing a piece of the total equation!

Advertisers use a Demand Side Platform to have their ads displayed

Advertisers use a Demand Side Platform to have their ads displayed

But how do websites / publishers make sure that their DSPs know about their advertising inventory?

But how do websites / publishers make sure that their DSPs know about their advertising inventory?

Advertisers use a Demand Side Platform to have their ads displayed

Advertisers use a Demand Side Platform to have their ads displayed But how do websites / publishers make sure that their DSPs know about their advertising inventory?

But how do websites / publishers make sure that their DSPs know about their advertising inventory?

In other words, how to publishers make sure they sell their advertising inventory?

In other words, how to publishers make sure they sell their advertising inventory? Here come SUPPLY Side Platforms (SSP)

Here come SUPPLY Side Platforms (SSP)

SSP platforms work in the same way as DSP, the difference is that publishers rather than advertisers use these

A SSP send its available ad impressions to potential buyers

A SSP send its available ad impressions to potential buyers

The goal of the SSP is to send as much ad impressions AND get the best price as possible

The goal of the SSP is to send as much ad impressions AND get the best price as possible

A SSP send its available ad impressions to potential buyers

A SSP send its available ad impressions to potential buyers The goal of the SSP is to send as much ad impressions AND get the best price as possible

The goal of the SSP is to send as much ad impressions AND get the best price as possible

The SSP evaluates the requirements matching the right bids with the right publisher and send its “offer” (request) to the ad exchange

The SSP evaluates the requirements matching the right bids with the right publisher and send its “offer” (request) to the ad exchange The winning bid from the DSP-side (advertisers) get its ads displayed on the publisher’s media

The winning bid from the DSP-side (advertisers) get its ads displayed on the publisher’s media

This falls under Programmatic Advertising

It is the process of buying and selling ads with software and publishing those ads on the right website using algorithms

It is the process of buying and selling ads with software and publishing those ads on the right website using algorithms

Most online advertising now is done programmatically through real-time bidding and direct deals

Most online advertising now is done programmatically through real-time bidding and direct deals

It is the process of buying and selling ads with software and publishing those ads on the right website using algorithms

It is the process of buying and selling ads with software and publishing those ads on the right website using algorithms Most online advertising now is done programmatically through real-time bidding and direct deals

Most online advertising now is done programmatically through real-time bidding and direct deals

Here is the full review:

https://instapage.com/blog/demand-side-platform https://publift.com/what-is-supply-side-platform/

https://instapage.com/blog/demand-side-platform https://publift.com/what-is-supply-side-platform/

And where does MGNI fits in? $MGNI is an independent Supply Side Platform

It thus competes with other SSPs but also with advertising giants such as Google, Facebook and even Amazon

Given their daily page views, these giants have a lot of advertising inventory to sell

Given their daily page views, these giants have a lot of advertising inventory to sell

It thus competes with other SSPs but also with advertising giants such as Google, Facebook and even Amazon

Given their daily page views, these giants have a lot of advertising inventory to sell

Given their daily page views, these giants have a lot of advertising inventory to sell

$MGNI could face difficulties if these giants start preferring publishers and advertisers they have a stake into

$MGNI could face difficulties if these giants start preferring publishers and advertisers they have a stake into Or if Google for example starts using its server advantages to outbid $MGNI in open-market transactions

Or if Google for example starts using its server advantages to outbid $MGNI in open-market transactions

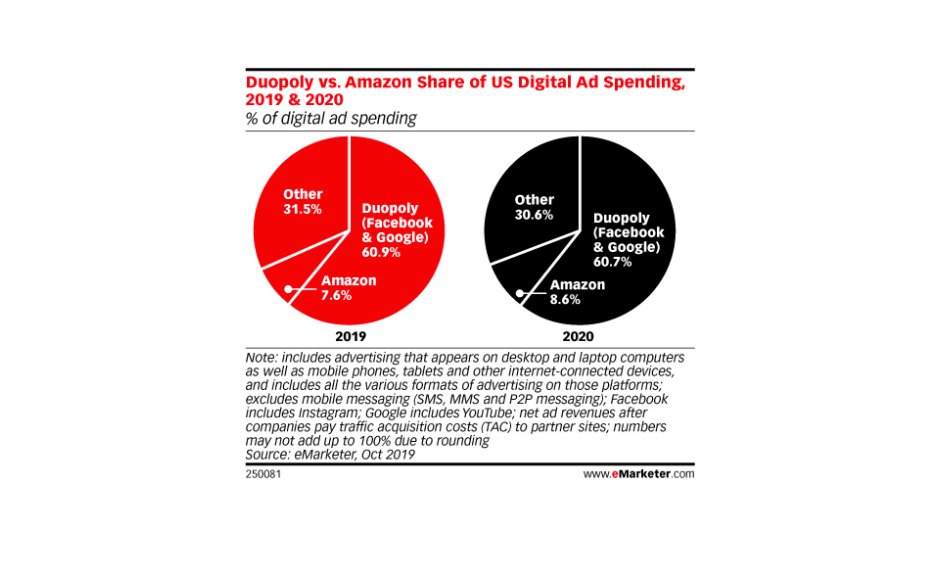

But how are these giants’ sales evolving? Here is from eMarketer

The Facebook - Google Duopoly’s share of US digital advertising is decreasing from 60.9% in 2019 to 60.7%

The Facebook - Google Duopoly’s share of US digital advertising is decreasing from 60.9% in 2019 to 60.7%

The Facebook - Google Duopoly’s share of US digital advertising is decreasing from 60.9% in 2019 to 60.7%

The Facebook - Google Duopoly’s share of US digital advertising is decreasing from 60.9% in 2019 to 60.7%

On the other hand, smaller publishers are consolidating:

“To better compete with them, smaller publishers are also consolidating and partnering up in other ways to allow advertisers to buy audiences at scale.”

“To better compete with them, smaller publishers are also consolidating and partnering up in other ways to allow advertisers to buy audiences at scale.”

“Notable recent acquisitions include Vox Media’s purchase of New York Media and Vice’s purchase of Refinery29”

from https://www.emarketer.com/content/facebook-google-duopoly-won-t-crack-this-year

from https://www.emarketer.com/content/facebook-google-duopoly-won-t-crack-this-year

Competition is also coming social media players as $PINS $SNAP $TWTR

“Strong reports from smaller advertising players shows there is still an appetite from marketers to diversify their ad spend across platforms. New advertising offerings could also be luring in businesses.”

“Strong reports from smaller advertising players shows there is still an appetite from marketers to diversify their ad spend across platforms. New advertising offerings could also be luring in businesses.”

“Amazon and Twitter executives both told analysts on their earnings calls that new and improved product offerings overall are giving advertisers more of a reason to advertise with them.”

By Lauren Feiner for CNBC https://www.cnbc.com/2019/08/02/facebook-and-googles-ad-dominance-is-showing-more-cracks.html

By Lauren Feiner for CNBC https://www.cnbc.com/2019/08/02/facebook-and-googles-ad-dominance-is-showing-more-cracks.html

This is good and bad news at the same time

Large publishers such as Google and Facebook are loosing ground

Large publishers such as Google and Facebook are loosing ground

Smaller publishers are gaining share and consolidating on their turn

Smaller publishers are gaining share and consolidating on their turn

Demand for the Rubicon Project’s product is growing but reflects the weakness listed above

Demand for the Rubicon Project’s product is growing but reflects the weakness listed above

Large publishers such as Google and Facebook are loosing ground

Large publishers such as Google and Facebook are loosing ground Smaller publishers are gaining share and consolidating on their turn

Smaller publishers are gaining share and consolidating on their turn Demand for the Rubicon Project’s product is growing but reflects the weakness listed above

Demand for the Rubicon Project’s product is growing but reflects the weakness listed above

Here is the Rubicon Project’s sales growth over the last quarters

· 27% in Q3 2019

· 17% in Q4 2019

· 12% in Q1 2020

· 12% in Q2 2020 (for the whole Magnite Group)

· 12% in Q3 2020 (for the whole Magnite Group)

· 27% in Q3 2019

· 17% in Q4 2019

· 12% in Q1 2020

· 12% in Q2 2020 (for the whole Magnite Group)

· 12% in Q3 2020 (for the whole Magnite Group)

But what is the pitch for $MGNI

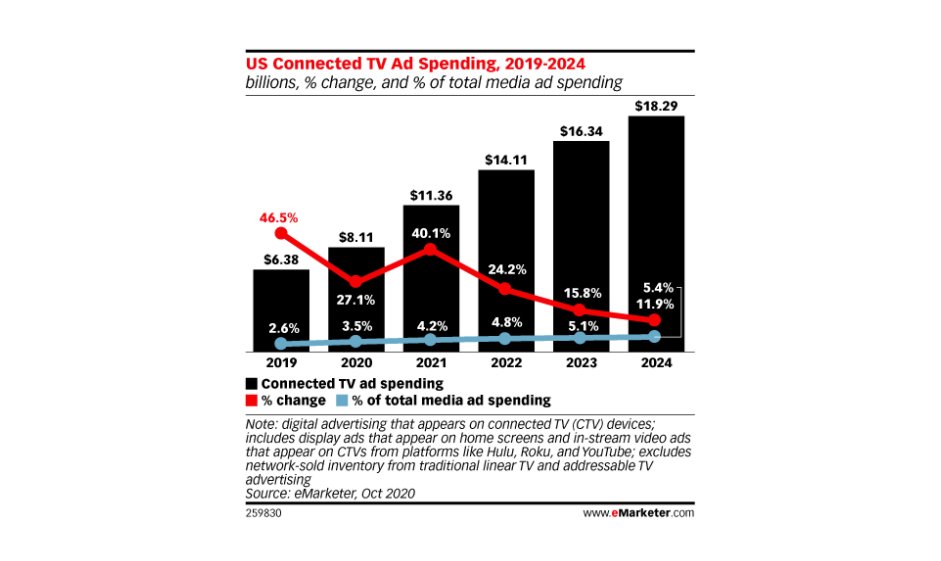

There is one thing showing tremendous growth each quarter: Connected TV (CTV)

“CTV revenue grew 51% year over year in Q3 2020 to $11.1 million on a pro forma basis” - $MGNI Q3 ’20 Report

$MGNI expects strong CTV growth in Q4 2020

$MGNI expects strong CTV growth in Q4 2020

There is one thing showing tremendous growth each quarter: Connected TV (CTV)

“CTV revenue grew 51% year over year in Q3 2020 to $11.1 million on a pro forma basis” - $MGNI Q3 ’20 Report

$MGNI expects strong CTV growth in Q4 2020

$MGNI expects strong CTV growth in Q4 2020

The $MGNI story is all about serving ads to CTV

According to eMarketer, the CTV ad spend is set to rise from $ 6.4B in 2019 to $ 18.3B in 2024

According to eMarketer, the CTV ad spend is set to rise from $ 6.4B in 2019 to $ 18.3B in 2024

With revenues from YouTube, Hulu and Roku representing around 50% of all CTV ad sales

With revenues from YouTube, Hulu and Roku representing around 50% of all CTV ad sales

https://www.emarketer.com/content/us-connected-tv-advertising-2020

According to eMarketer, the CTV ad spend is set to rise from $ 6.4B in 2019 to $ 18.3B in 2024

According to eMarketer, the CTV ad spend is set to rise from $ 6.4B in 2019 to $ 18.3B in 2024 With revenues from YouTube, Hulu and Roku representing around 50% of all CTV ad sales

With revenues from YouTube, Hulu and Roku representing around 50% of all CTV ad saleshttps://www.emarketer.com/content/us-connected-tv-advertising-2020

On top of this, eMarketer found out that this channel was still little used by advertisers

“We found that while CTV/OTT spend has increased, there is a significant opportunity for advertisers to include these channels in their marketing mix.”

“We found that while CTV/OTT spend has increased, there is a significant opportunity for advertisers to include these channels in their marketing mix.”

“Fewer than 40% of advertisers have spent on CTV/OTT channels in the past year, significantly lagging behind social media, display, and non-CTV/OTT video.”

from https://www.emarketer.com/content/ott-ctv-advertising-will-breakout-star-of-2021-sponsored-content

from https://www.emarketer.com/content/ott-ctv-advertising-will-breakout-star-of-2021-sponsored-content

This explains the rationale behind the Telaria and Rubicon Project merger

Use the Rubicon Project experience with ad exchanges

Use the Rubicon Project experience with ad exchanges

And Telaria’s expertise in CTV ads

And Telaria’s expertise in CTV ads

Use the Rubicon Project experience with ad exchanges

Use the Rubicon Project experience with ad exchanges And Telaria’s expertise in CTV ads

And Telaria’s expertise in CTV ads

Financials Check

Financials Check

Sales grew 12% YoY in Q3 ’20 to $ 61m with 74% of sales coming from the USA

Sales grew 12% YoY in Q3 ’20 to $ 61m with 74% of sales coming from the USA CTV sales grew 51% YoY to $ 11.1m

CTV sales grew 51% YoY to $ 11.1m Net income stood at $ 10.5m down from $ 6.2m a year earlier

Net income stood at $ 10.5m down from $ 6.2m a year earlier Cash & equivalents stood at $ 103.8m down from $ 107.5m a year earlier

Cash & equivalents stood at $ 103.8m down from $ 107.5m a year earlier

THE BOTTOM LINE

THE BOTTOM LINE

In a pre-Covid world, the Rubicon Project was growing at above 25% year over year but saw its growth slow down following the pandemic

In a pre-Covid world, the Rubicon Project was growing at above 25% year over year but saw its growth slow down following the pandemic The merger with Telaria provides an interesting growth allay as connected TVs are becoming omnipresent

The merger with Telaria provides an interesting growth allay as connected TVs are becoming omnipresent

The CTV advertising market is still little penetrated as fewer than 40% of advertisers pushed their adds to CTV

The CTV advertising market is still little penetrated as fewer than 40% of advertisers pushed their adds to CTV As a merged entity, $MGNI has a real chance to become the leading ind. supply side platform for CTV, a market that is set to triple over the 2019 - 2024 period

As a merged entity, $MGNI has a real chance to become the leading ind. supply side platform for CTV, a market that is set to triple over the 2019 - 2024 period

When looking at the mobile and desktop ads - which accounts for more than 80% of $MGNI ’s sales - the current digital advertising landscape (non-CTV) is lead by Facebook and Google and these dictate their prices and rules

When looking at the mobile and desktop ads - which accounts for more than 80% of $MGNI ’s sales - the current digital advertising landscape (non-CTV) is lead by Facebook and Google and these dictate their prices and rules

Smaller publishers that provide advertising inventory are growing and consolidating in order to increase their bargaining power and prices

Smaller publishers that provide advertising inventory are growing and consolidating in order to increase their bargaining power and prices The risks exists that some players such as Disney (through Hulu With Live TV) and YouTube TV form a duopoly, decreasing $MGNI appeal

The risks exists that some players such as Disney (through Hulu With Live TV) and YouTube TV form a duopoly, decreasing $MGNI appeal

We stay on the sidelines for now and will review $MGNI at the next earnings

We stay on the sidelines for now and will review $MGNI at the next earnings

$RKT is on our watchlist

$RKT is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ eMarketer

✑ CNBC

✑ Instapage

✑ Clearcode

✑ Statista

✑ Forbes

Sources

✑ Investor presentation

✑ Company website

✑ eMarketer

✑ CNBC

✑ Instapage

✑ Clearcode

✑ Statista

✑ Forbes

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter