I find these products absolutely fascinating. 'Scuse me while I geek out about spreads and trading for a moment. (thread) https://twitter.com/MurphyCinthia/status/1341405146400616448

One of the biggest hesitations I heard from advisors/investors about NTA ETFs was: How would these things trade?

Turns out… Not great.

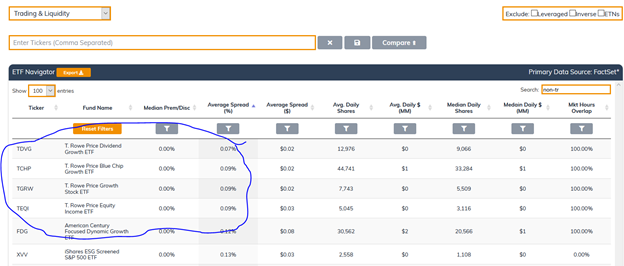

But look: One firm has avg spreads below 10 bps -- @TRowePrice (please forgive my apparent inability to draw circles)

Turns out… Not great.

But look: One firm has avg spreads below 10 bps -- @TRowePrice (please forgive my apparent inability to draw circles)

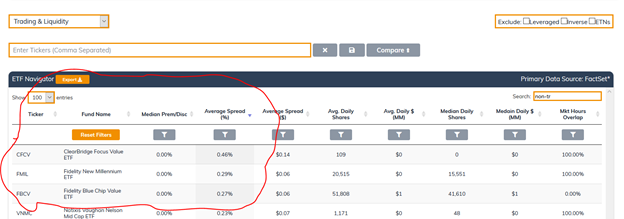

Meanwhile, ClearBridge and Fidelity's products have MUCH higher spreads (again, sorry for the "circle," my four year old would be so disappointed in me):

Why such a big difference? It's not the particular NTA model, I don't think. Both T. Rowe & Fidelity use a "proxy basket" model, where trading is hidden via a portfolio that's different than the actual holdings, but which trades very similar to the holdings.

Meanwhile, ClearBridge uses the ActiveShares model: An AP Rep. acts go-between to facilitate creation/redemption.

American Century also uses this model, and its spreads are MUCH lower: between 0.12%-0.15%

American Century also uses this model, and its spreads are MUCH lower: between 0.12%-0.15%

Are the varying spreads linked to AUM of product? Issuer? Strategy? (Value NTA ETFs seem to have higher spreads than growth NTA ETFs.)

Probably some smart journalist or analyst somewhere could answer this question better than I could...

Probably some smart journalist or analyst somewhere could answer this question better than I could...

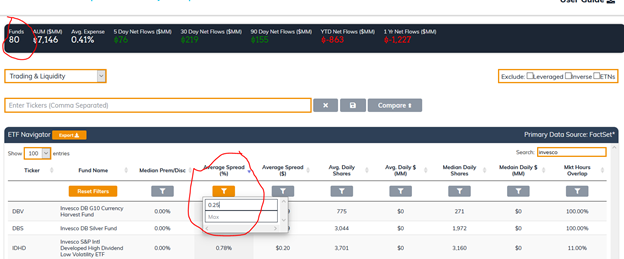

But I do wonder how Invesco's NTA ETFs will fare. Can they keep spreads low?

80 ETFs in Invesco's current line-up have spreads higher than 0.25%. That's about 36% of the suite. Not Big Three liquidity... but not bad?

Low spreads are HARD for new ETFs -- NTA or not.

80 ETFs in Invesco's current line-up have spreads higher than 0.25%. That's about 36% of the suite. Not Big Three liquidity... but not bad?

Low spreads are HARD for new ETFs -- NTA or not.

Anyway, I don't have any big grand conclusion here, just more questions. Thoughts from the peanut gallery? (/thread)

Read on Twitter

Read on Twitter