Motilal Oswal Wealth Creation study Live on - https://www.motilaloswalwcs.com/live/login.aspx

Will share notes in this thread:

(1)

Will share notes in this thread:

(1)

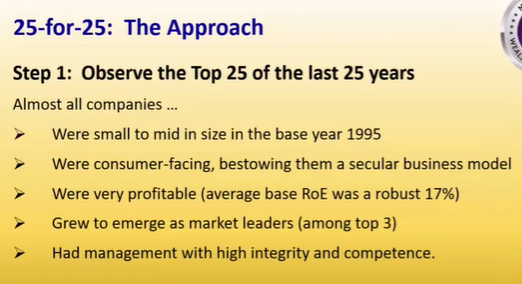

This year the team has done study for last 25 years.

Mr. Agarwal says that he is also surprised to see the results on an expanded time frame-

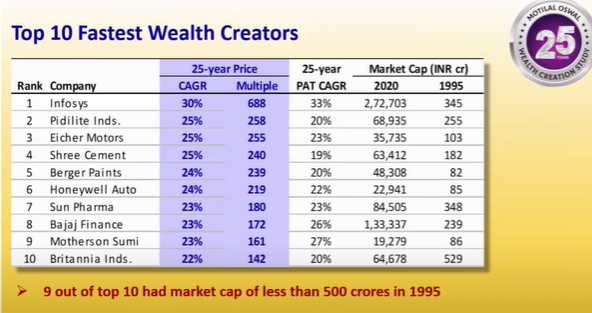

Top ten Fastest wealth Creators over 25 years:

Mr. Agarwal says that he is also surprised to see the results on an expanded time frame-

Top ten Fastest wealth Creators over 25 years:

(4)

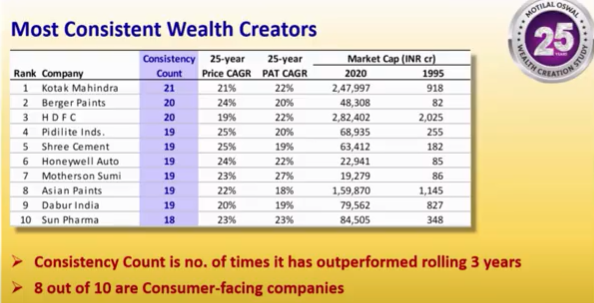

Consistent wealth Creators -

these companies have started small and have grown over the years -

8 out of 10 is consumer facing companies. Regulation around B2C is far better in B2B.

Consistent wealth Creators -

these companies have started small and have grown over the years -

8 out of 10 is consumer facing companies. Regulation around B2C is far better in B2B.

(6)

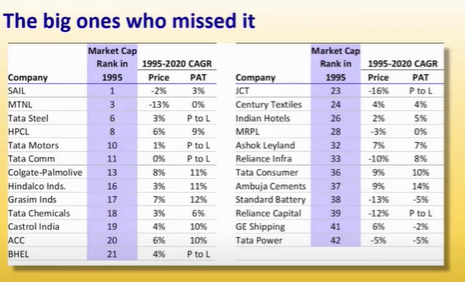

Who missed the list?

SAIL had the highest market cap in 1995 with 14000 Cr, but over the period have lost the way:

Who missed the list?

SAIL had the highest market cap in 1995 with 14000 Cr, but over the period have lost the way:

(7)

Wealth Creation by sector-

Not surprisingly Consumer & Retail has created the maximum wealth.

IT - since it started listing in 1995, so only few companies got included.

If we include the other companies after 1995, then IT will be second biggest sector

Wealth Creation by sector-

Not surprisingly Consumer & Retail has created the maximum wealth.

IT - since it started listing in 1995, so only few companies got included.

If we include the other companies after 1995, then IT will be second biggest sector

(16)

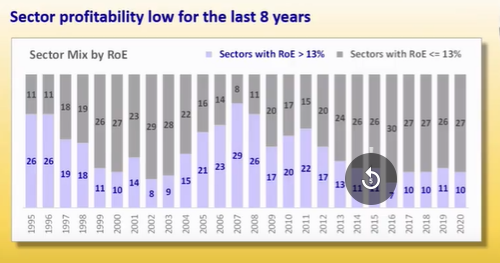

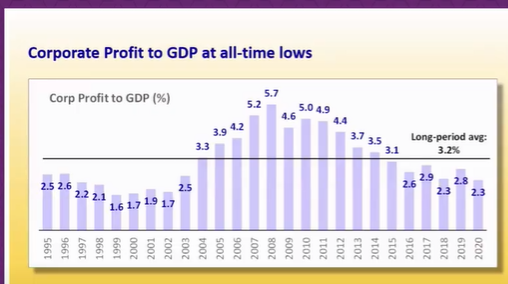

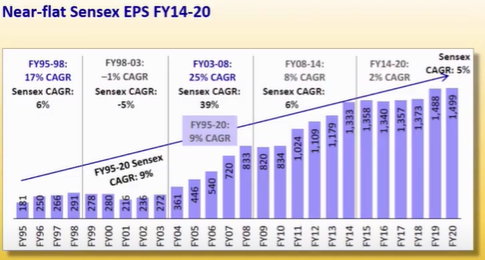

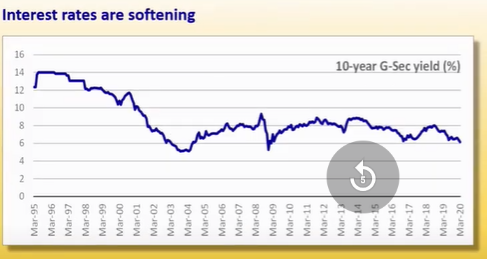

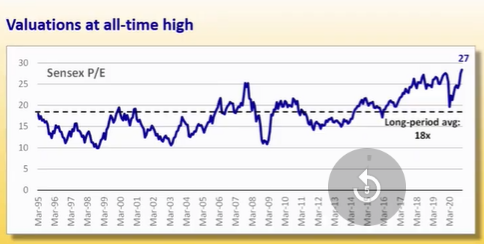

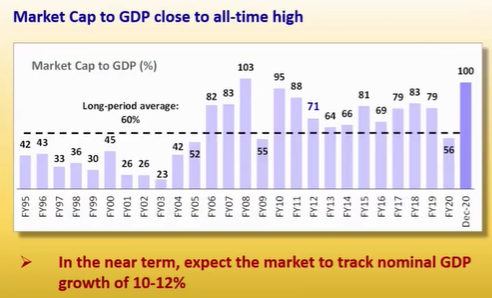

Valuations hit average in march but back to all time high due to low interest rates and liquidity

Valuations hit average in march but back to all time high due to low interest rates and liquidity

25

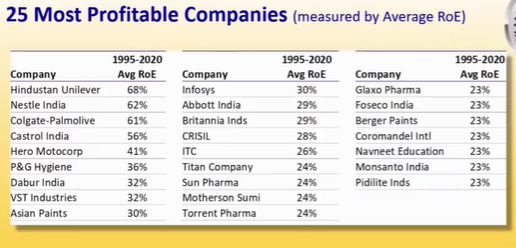

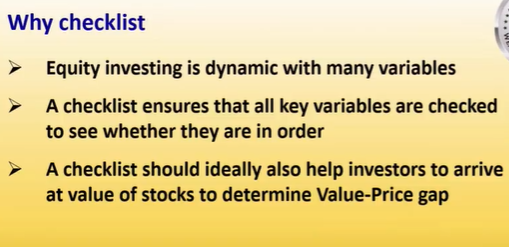

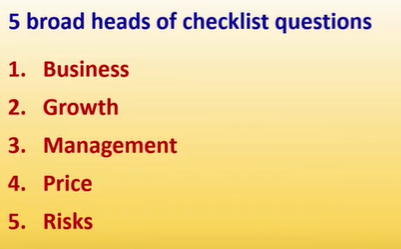

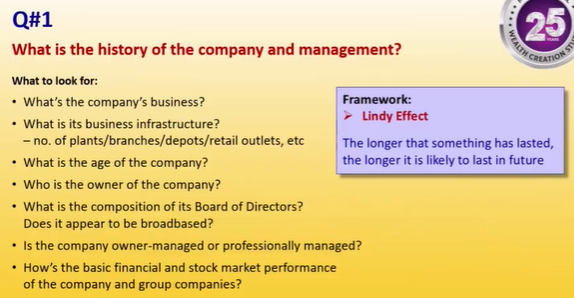

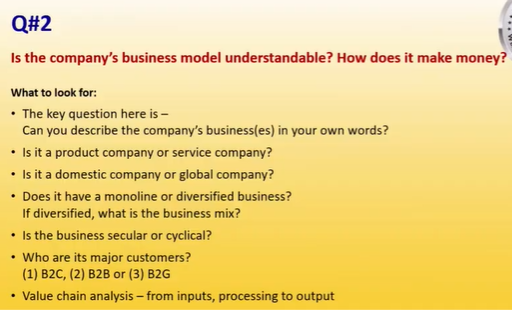

Every business is simple from the perspective of Business owner and may be complex from the view of investor

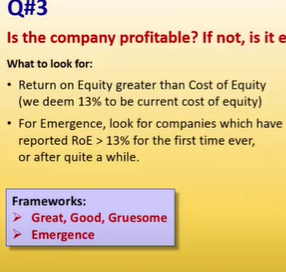

Great, good, gruesome and Emergence business

Every business is simple from the perspective of Business owner and may be complex from the view of investor

Great, good, gruesome and Emergence business

Read on Twitter

Read on Twitter