$SALT Scorpio Bulkers Ltd.

Looks like shareholders have a pretty good oppression claim here.

Let's see what these guys are up to...

Looks like shareholders have a pretty good oppression claim here.

Let's see what these guys are up to...

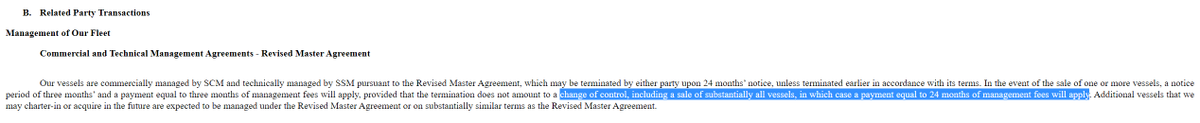

Figure 1 (2 April 2020): Form 20-F provides for "change of control fees" for termination of vessel management contract with related party. 3 months' fees unless resulting from a "change of control", stipulated to include the sale of all vessels.

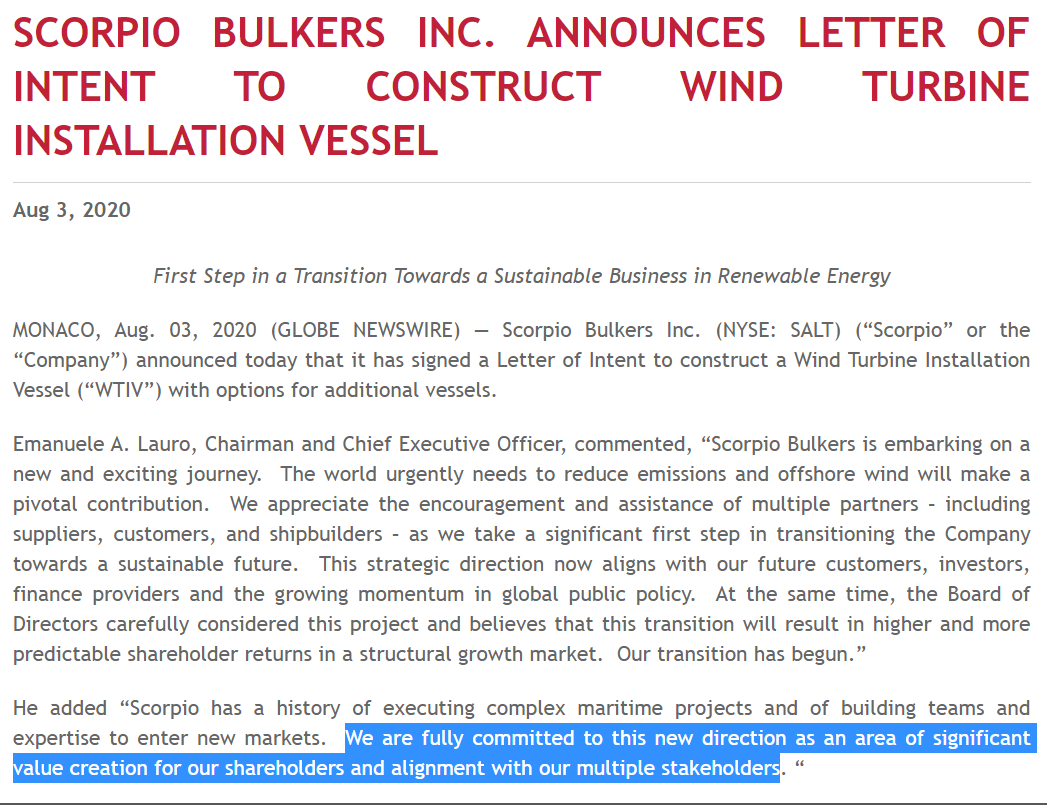

Figure 2 (3 August 2020): $SALT announces an exit from the dry bulk sector for a new venture, to enter the business of operating offshore windmill installation vessels.

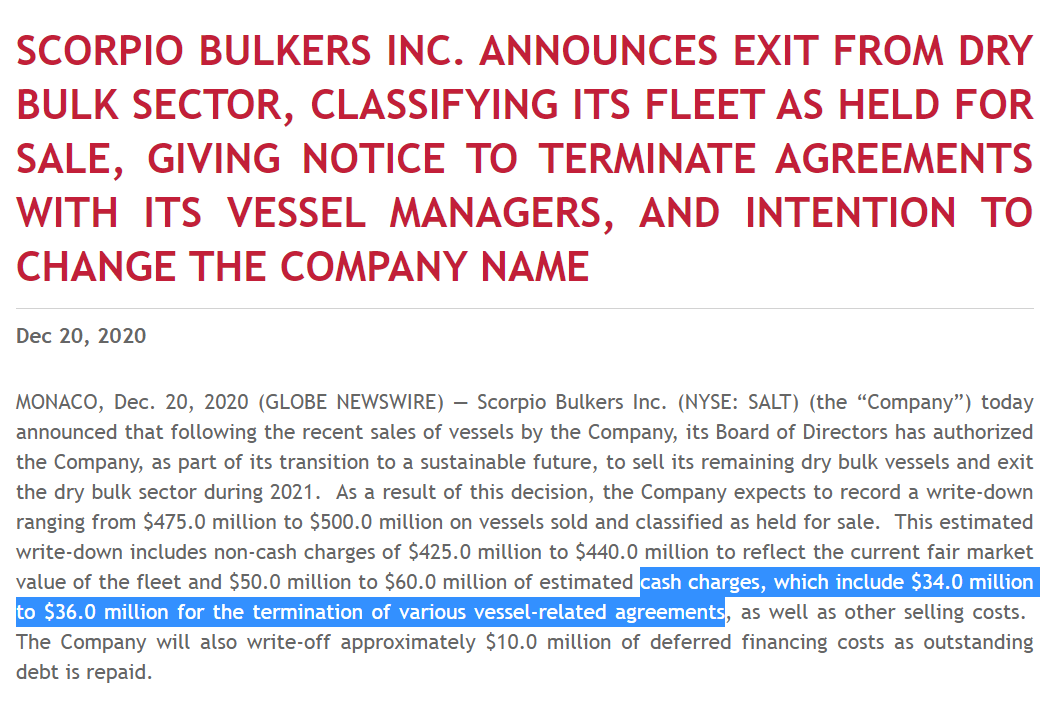

Figure 3 (20 December 2020): Following the sale of its last bulker, $SALT announces, along with a whopping $425-440 million writedown on ships divested, a $34-36 million cash termination payment to a related party, presumably linked to the 24 month period cited in the 20-F.

The only thing is, it is not a "change of control" at all, because the existing management remains in place. After $SALT corporate executives chose to sell all bulk carriers managed by numerous related parties which they control, at a huge loss, ...

...wind installation vessels will likely be purchased, and run by the same people, with similar lucrative management services agreements.

The change of control is triggered by initiation of contract termination by either party, each of which is controlled by the same people.

The change of control is triggered by initiation of contract termination by either party, each of which is controlled by the same people.

In fact, even before this transaction, management fees were high. In 2019, the only year of its 8 year history in which they recorded a profit, general and administrative expenses summed to 18% of revenue. These change of control fees amounted to more than a year's G&A.

Figure 4 (21 December 2020): The stock falls 9% on the news, now down 99% from IPO.

Figure 5 (21 December 2020): Management companies announce the purchase of shares. (They tend not to report sales.)

Figure 5 (21 December 2020): Management companies announce the purchase of shares. (They tend not to report sales.)

The company is incorporated in the Marshall Islands, and headquartered in Monaco. So the likelihood of enforcing a judgement is slim to none. And slim is out of town. The defence would be that it is all disclosed in advance. It behoves investors to read the docs.

The MO of these shipping companies is generally to raise money on promotion and high dividends—which are really a return of capital—oppress shareholders with exorbitant fees, depress the share price, and buy back with a creeping tender, along with stock option and share grants.

They can point to their high insider equity ownership as evidence of "alignment of interest" and believing in the economics of the business, but it is merely a mechanism of control, and a smoke screen.

Eventually they gobble most of the equity, and do an MBO at a discount, as e.g. in the case of Dryships, or a recap at a discount to NAV, as e.g. in the case of $ESEA.

If you ever invest—or trade—in shipping, you should carefully track all disclosure (or lack thereof) pertaining to related party dealing. If any transaction tilted in management's favour, it will not be the last time.

This applies to all industries, but shipping is notorious for oppression of the minority through grossly excessive management fees and related party transactions.

Read on Twitter

Read on Twitter