been looking in detail into $fubo & their financials & unless im a complete idiot being an investor in this stock at these levels is madness. Dont want to appear all knowing so please correct me if wrong (especially after My Tesla post) as dont want to Lways appear negative...

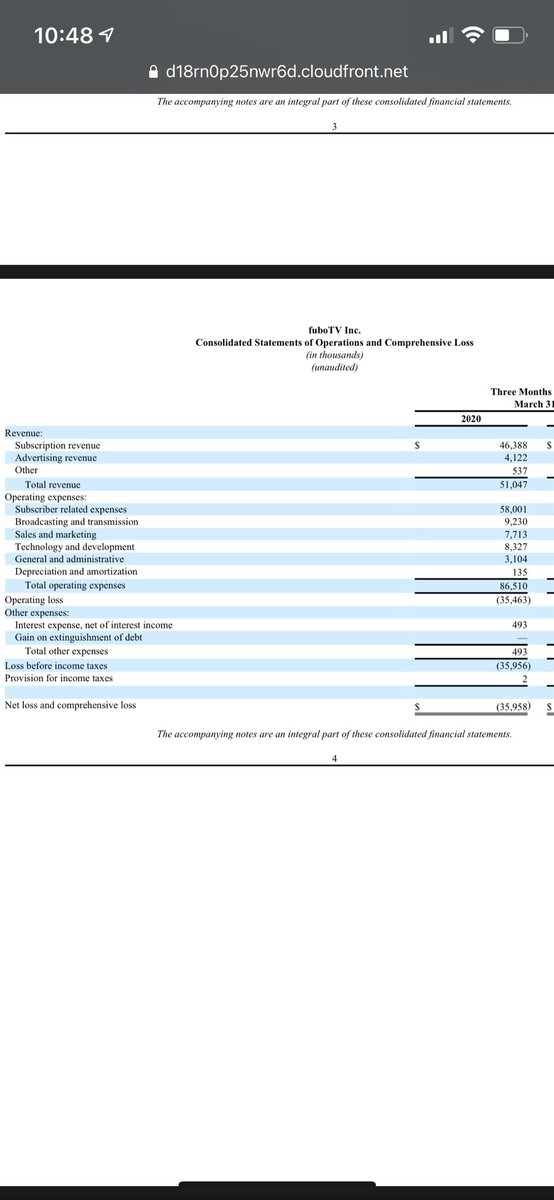

1) as far as I can see $fubo loses money on every subscriber & thats before any additional costs such as SG&A, r&d, broadcasting transmission are even added in. This company has a negative gross margin. Best comparison is their subscriber revs r like $roku hardware revs but worse

2) Ad revs make up 12% of $fubo’s revs so again in comparison to $roku which has 65% of revs as advertising with 60%+ margins and hardware revs at least contributing positive margins to gain users for their ad revs $fubo is completely backwards & again has negative gross margins

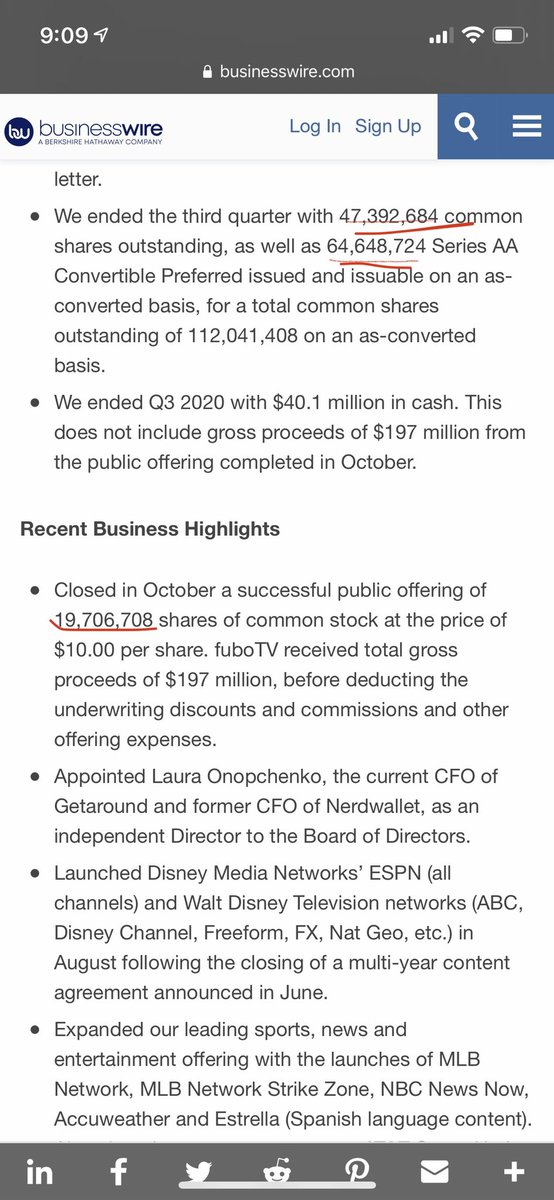

3) $fubo mrkt cap on every platform is listed @ 3.5B however that’s not accurate. The latest filing shows outstanding share count is not 65M as shown on brokerage sites but 132M + 4.6M warrants at 4.65/share!This company is over 2x as expensive as ppl think @ 8B+ mrkt cap already

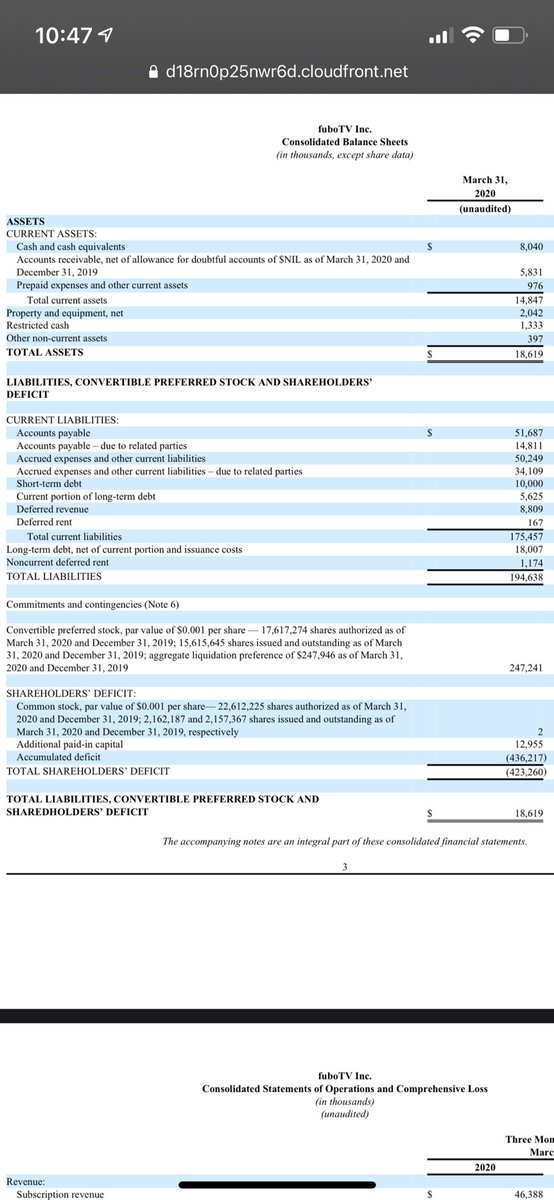

4) $fubo balance sheet is a mess. Prior to facebank acquiring them in april the company had $18.5M in total assets with 8M cash & 195M in liabilities with a shareholder DEFICIT of 425M... in fact with their losses from operations if they didnt raise funds theyd have gone under

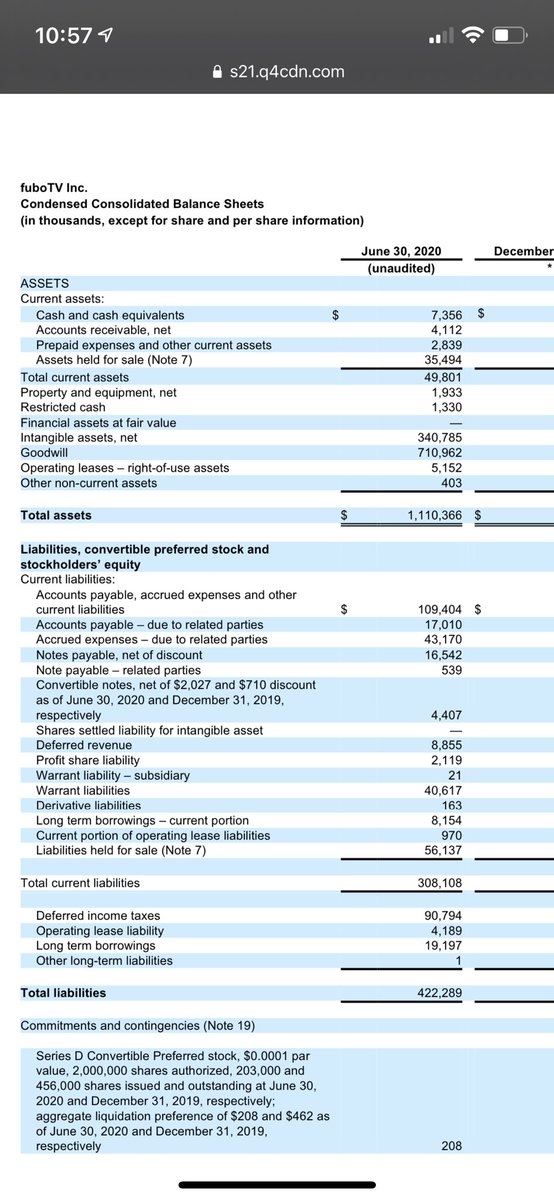

5) after $fubo was acquired their balance sheet swelled with 340M of intangible assets & a whopping $711M of goodwill. So where did this come from? Well facebank was a public company who did the technology behind celebrity holographic likeness (tupac at coachella)

6) the facebank acquisition was a reverse merger that valued facebank at 200M & $fubo at 700M valuation & as part of it has facebank issue 100M of debt as an enticer to get fubo to agree to a deal since they immediately needed funding & was used to bring $fubo public.

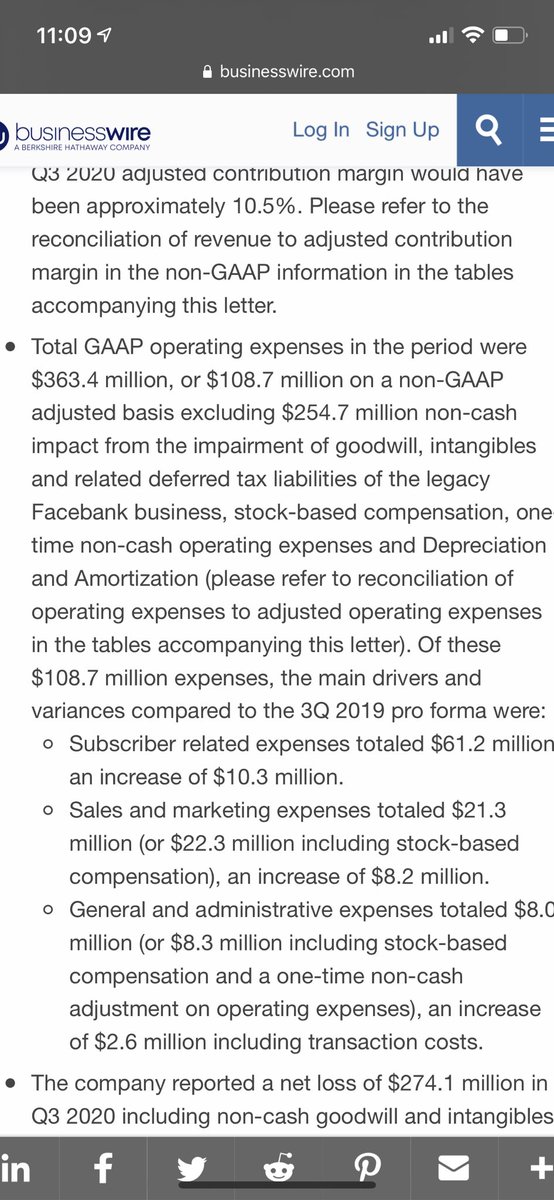

7) just one q later $fubo just wrote off 255M from intangible assets/goodwill from the acquisition already...imo facebank (makes digital humans) has little to no value as they had 5.8M revs in first 9 months of 2019 & was just used to get $fubo public along with that 100M loan..

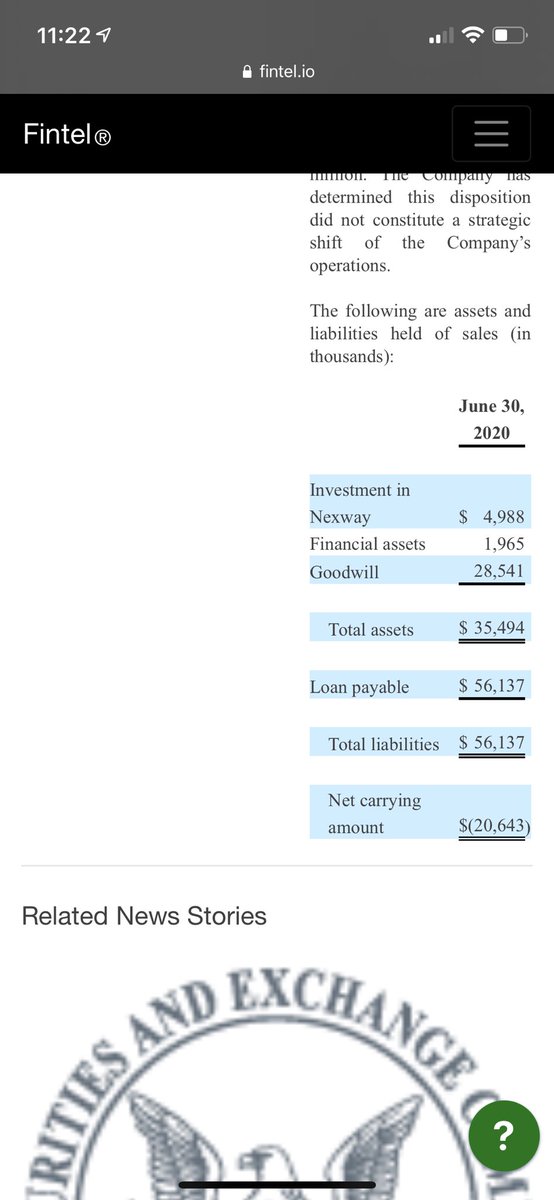

8) upon facebanks acquisition of $fubo a big reason that was pumped about the value was Facebanks ownership of an entity named nexway AG which had an e-commerce subscription platform that was highly touted and 3 months later $fubo just sold it for a loss...

9) the meteoric rise in $fubo driven by what can i can only describe as retail mania to find the next niche small market cap company as the next $roku has provided $fubo with fantastic good fortune and i would not be surprised if they raised a lot of shares soon...

10) some ppl say $roku is expensive as they dont count hardware revs at all given their low margins in which case $roku platform revs at 1.2B this yr vs 45B mrkt cap is 37x this yrs sales & 25x next yr sales.

11) Well $fubo subtracting their negative gross margin subscription sales will likely have 20M in ad sales this yr which against 8B mrtk cap is 400x this yr sales and if they double that to 40M next yr 200x next years?!

12) the other huge difference between $roku and $fubo is that $roku has ZERO content costs, people provide them with free content to get on roku channel or rev share subscriptions & ad inventory for the large platforms which proves $roku has power over them as a gatekeeper

13) this is NOT the case for $fubo who has to purchase content... so what happens if at expiration those networks want more $? Its not clear to me (unlike $roku) that $fubo has any leverage & would have to drop content & potentially lose subs or lose more $ on future deals...

Can $fubo keep rising & make me look stupid? Absolutely as Im convinced the recent rally is all short covering (25% of float is held short). As a trade it could still work until the squeeze is over but if u want to know what ur holding, its not much & imo will end badly sometime

Why did i do all this? Many ppl i follow are super excited about $fubo & I was too as i started this to see if this was the next great small cap oppty that could 5x. I went into this WANTING TO INVEST not to trash it like some all knowing ego project but kept finding red flags

I will not be investing in $fubo and just hope that im wrong and ppl make $ and i look stupid, however i thought if i happen to be right & i can save someone a loss then id provide my thinking and let u decide what u want to do for urself. Worried bout those looking for 2-3x here

Read on Twitter

Read on Twitter