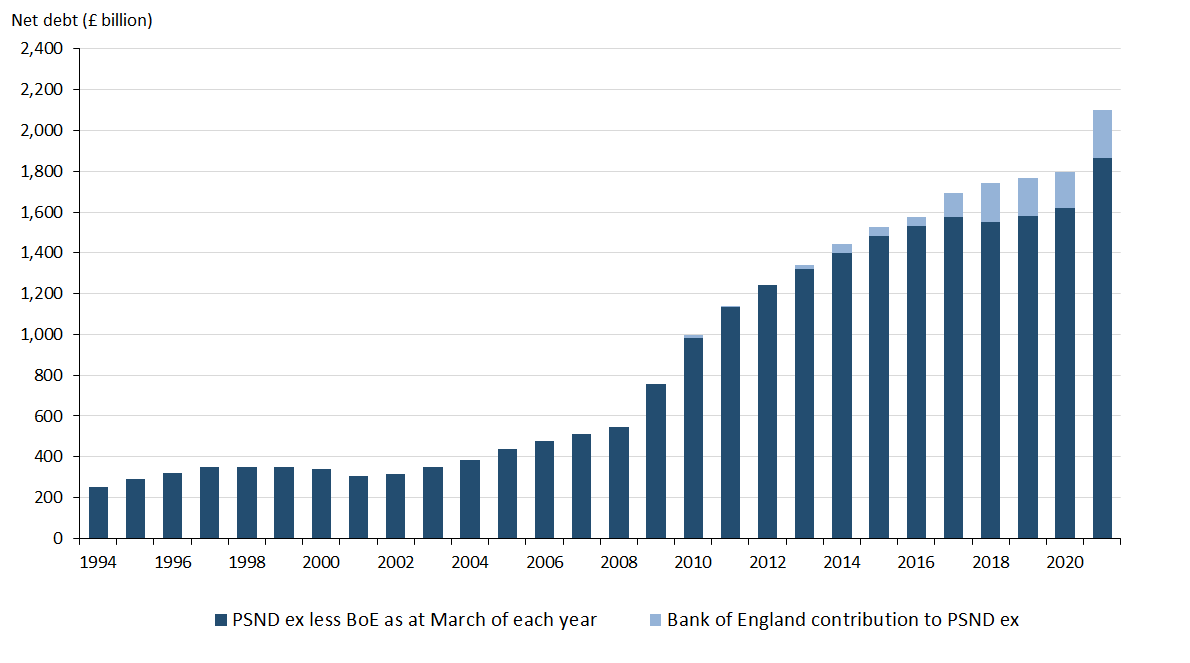

Removing Bank of England’s contribution to net debt (mainly quantitative easing activities) reduces it by £233.9 bn (or 11.1 percentage points of GDP) at the end of November 2020 – from £2,099.8 bn (99.5% of GDP) to £1,865.9 bn (88.4% of GDP). http://ow.ly/HdmL50CRNC4

Public debt now stands at just over £2 trillion. So how big is a trillion? A million seconds is about 12 days, a billion seconds is about 32 years, but a trillion seconds is nearly 32 thousand years or back to the Ice Age (or the Upper Paleolithic age). It’s that big !!!!

Funding for the COVID-19 relief schemes have helped push debt to £2,099.8 billion, while borrowing in the financial year-to-November 2020 was £240.9 billion. Here we explain the difference between debt and deficit.

https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/articles/thedebtanddeficitoftheukpublicsectorexplained/2016-03-16

https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/articles/thedebtanddeficitoftheukpublicsectorexplained/2016-03-16

Government liabilities are the largest component of public sector net debt but who owns government debt? See Table 5.2.12 for a breakdown of the larger components of UK debt ownership compiled as a part of the UK Economic Accounts. #deficit #debt

https://www.ons.gov.uk/economy/nationalaccounts/uksectoraccounts/datasets/unitedkingdomeconomicaccountssectorgeneralgovernment

https://www.ons.gov.uk/economy/nationalaccounts/uksectoraccounts/datasets/unitedkingdomeconomicaccountssectorgeneralgovernment

Read on Twitter

Read on Twitter