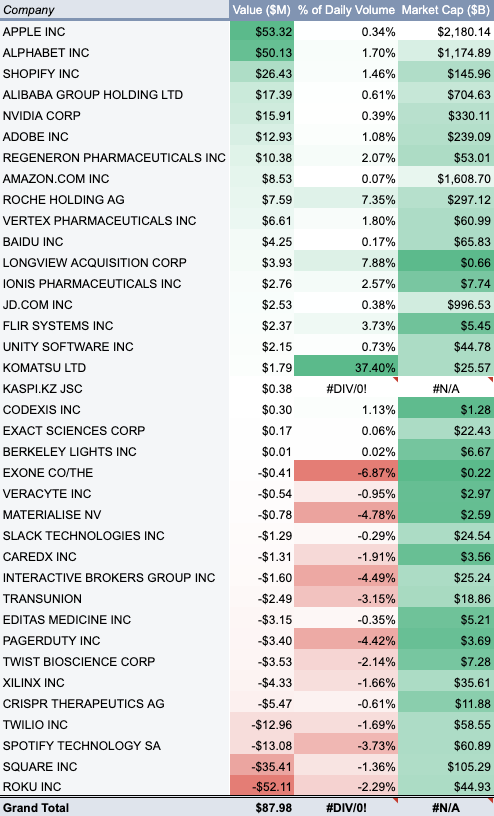

Today Ark Invest

Bought:

$AAPL, $53.3M - &

&

?

?

$GOOGL, $50.1M -

$SHOP, $26.4M -

$BABA, $17.4M

$NVDA, $15.9M

$ADBE, $12.9M

$REGN, $10.4M

$AMZN, $8.5M -

$RHHBY, $7.6M

$VRTX, $6.6M

Sold:

$CRSP, $-5.5M

$TWLO, $-13M

$SPOT, $-13.1M

$SQ, $-35.4M -

$ROKU, $-52.1M -

Bought:

$AAPL, $53.3M -

&

&

?

?$GOOGL, $50.1M -

$SHOP, $26.4M -

$BABA, $17.4M

$NVDA, $15.9M

$ADBE, $12.9M

$REGN, $10.4M

$AMZN, $8.5M -

$RHHBY, $7.6M

$VRTX, $6.6M

Sold:

$CRSP, $-5.5M

$TWLO, $-13M

$SPOT, $-13.1M

$SQ, $-35.4M -

$ROKU, $-52.1M -

Cathie Wood on 12/18 regarding when Ark invests in FAANG stocks:

"As a bull market extends, we do move into more 'cash-like' equities; they would be the less volatile stocks.

Certainly FAANG & $MSFT fit that.

We would do that increasingly."

Link:

"As a bull market extends, we do move into more 'cash-like' equities; they would be the less volatile stocks.

Certainly FAANG & $MSFT fit that.

We would do that increasingly."

Link:

Loading up on $AAPL $AMZN $GOOGL while at the same time selling the flagship positions of $SQ and $ROKU could be a signal that Ark is feeling that a bearish period is near.

This is just my speculation. Not a prediction.

This is just my speculation. Not a prediction.

There are also reasons to invest in $AAPL & $GOOGL right now for these specific ETF's based on new developments regarding the respective themes beyond just going to "cash":

$ARKG & $GOOGL - https://www.nature.com/articles/d41586-020-03348-4

$ARKG & $GOOGL - https://www.nature.com/articles/d41586-020-03348-4

$AAPL & $ARKW:

Cloud Computing & Cyber Security

E-Commerce

Big Data & Artificial Intelligence (AI)

Mobile Technology and Internet of Things

Social Platforms

Blockchain & P2P

and obviously this story: https://www.engadget.com/apple-car-2024-233505759.html

Cloud Computing & Cyber Security

E-Commerce

Big Data & Artificial Intelligence (AI)

Mobile Technology and Internet of Things

Social Platforms

Blockchain & P2P

and obviously this story: https://www.engadget.com/apple-car-2024-233505759.html

Read on Twitter

Read on Twitter