1/ $NPA merger w/ @ast_spacemobile: Invest in the Space Mobile Provider that Will Disrupt the Entire Wireless Industry.

A Different Perspective on What's Really at Stake. Thread Below. @jimcramer @arkinvest @djohnson_cpa @mindwalletbody @spacguru @spacbobby @jmacinvesting

A Different Perspective on What's Really at Stake. Thread Below. @jimcramer @arkinvest @djohnson_cpa @mindwalletbody @spacguru @spacbobby @jmacinvesting

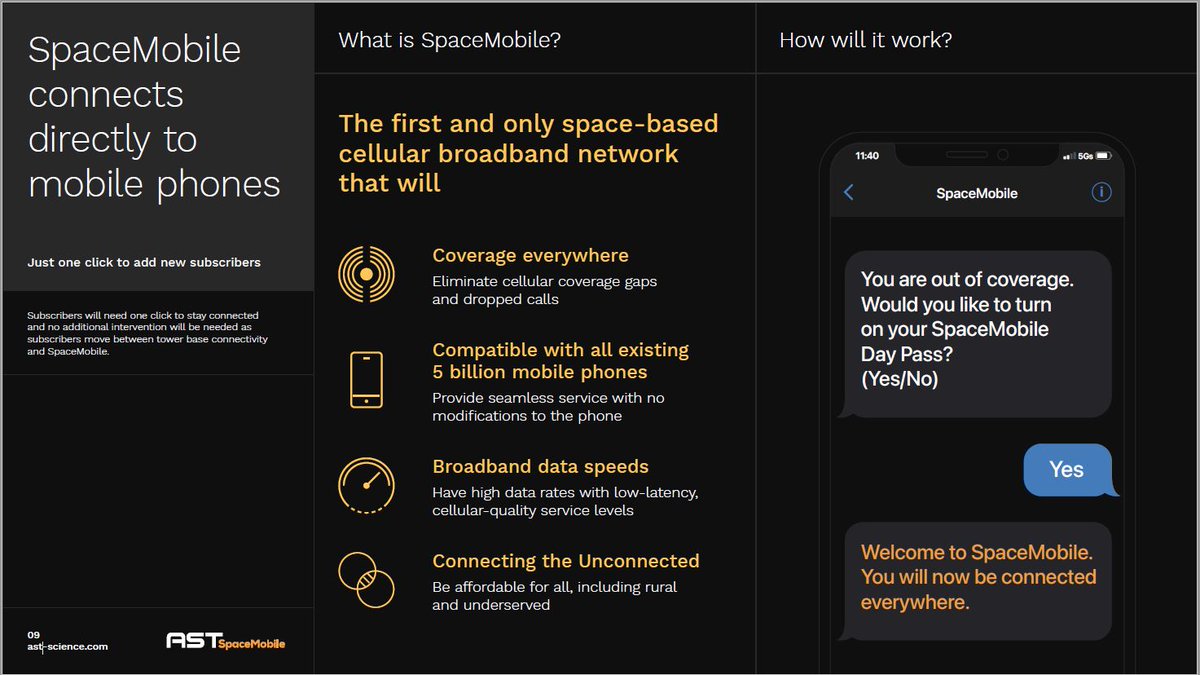

2/ SpaceMobile ($NPA) has created the first and only patented protected, space-based cellular broadband network that can provide coverage across the entire globe.

Service is compatible with all +5B mobile phones in use today featuring 4G & 5G data speeds with low latency.

Service is compatible with all +5B mobile phones in use today featuring 4G & 5G data speeds with low latency.

3/ Carriers that work with SpaceMobile will enjoy absolute and unparalleled cell coverage - a game changing advantage that will redefine the competitive landscape.

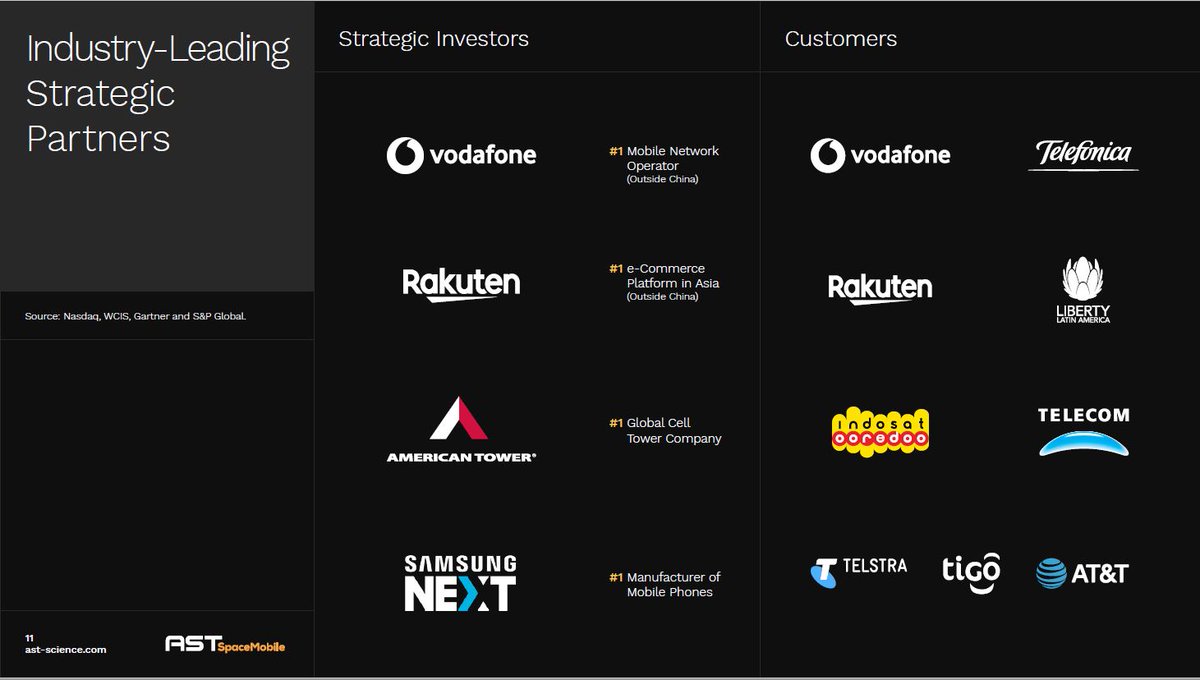

4/ SpaceMobile's technology has been validated through the successful launch and service test with BlueWalker-1 satellite in 2019. +$100M capital raised from strategic investors including Vodafone, Rakuten, Samsung, and American Tower.

5/ Another $230M in new private funding round led by the same strategic investors at $10 per share, in addition to +$232M in SPAC funding gives SpaceMobile over $420 net cash to fully fund Phase 1 launch in 2022.

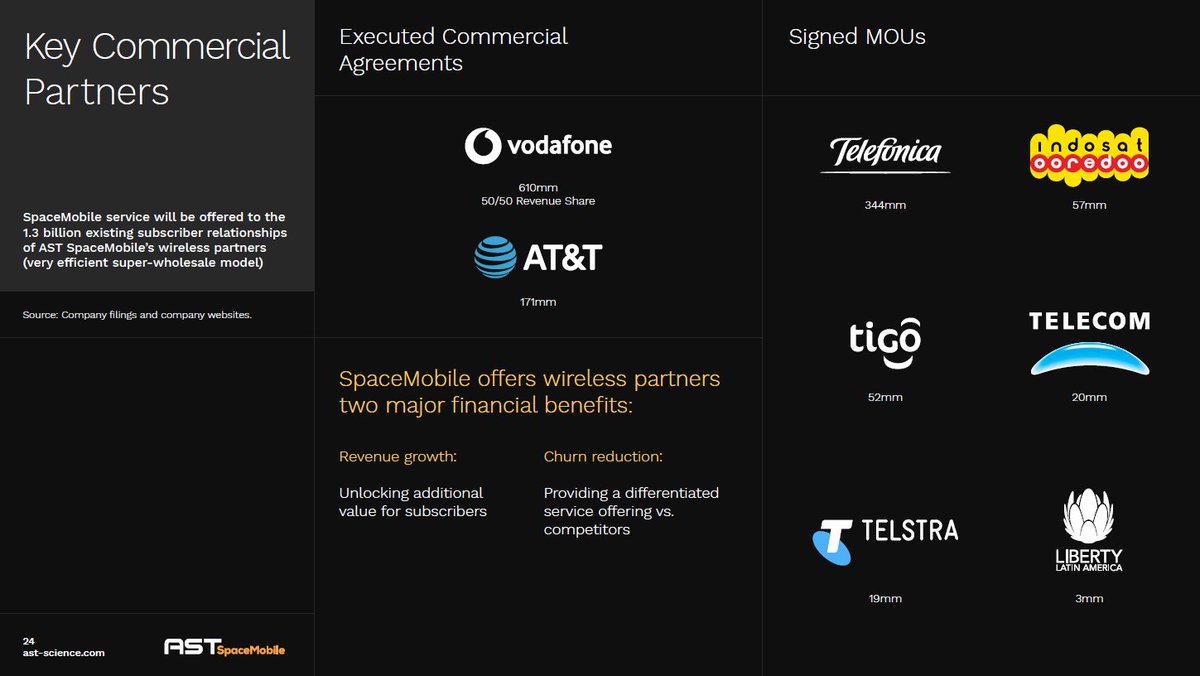

6/ Binding, mutually exclusive commercial agreements covering +$1.3B subscribers in place with Vodafone, AT&T, Telefonica, Indosat, Telecom Argentina, Telstra, Tigo, and Liberty LatAm.

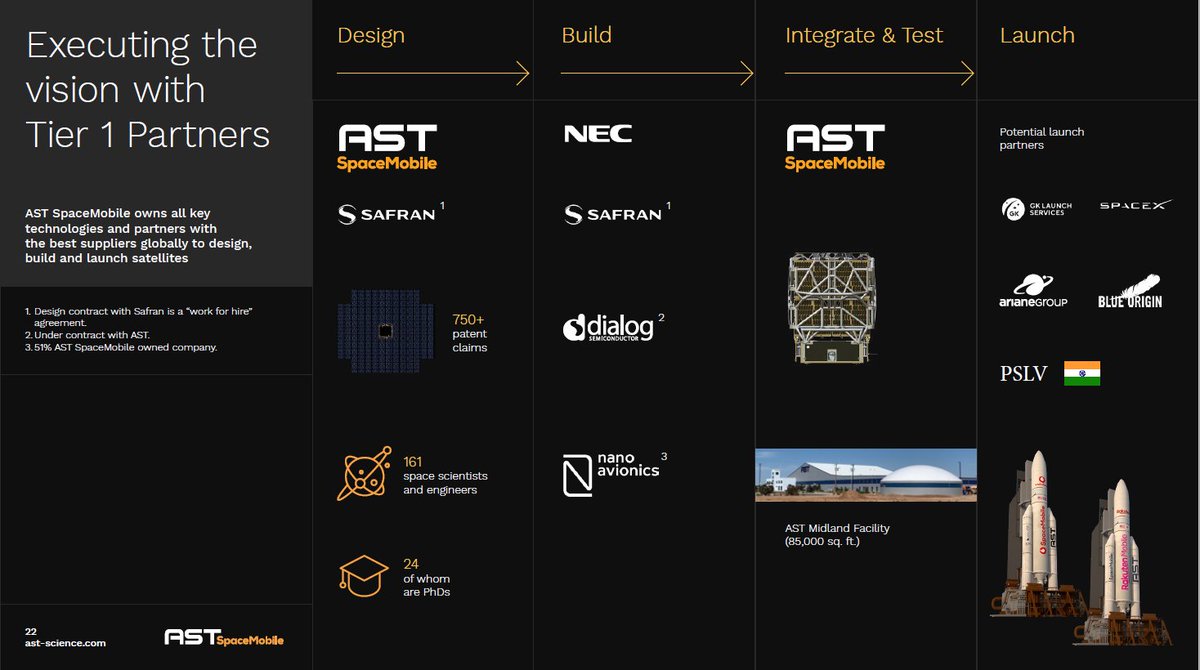

7/ SpaceMobile has built an insurmountable competitive advantage w/ +750 patent claims, 161 space scientists & engineers w/ 40 prior satellite builds/launches.

Industry-leading strategic partners/investors with deep tech moat and customer base.

Industry-leading strategic partners/investors with deep tech moat and customer base.

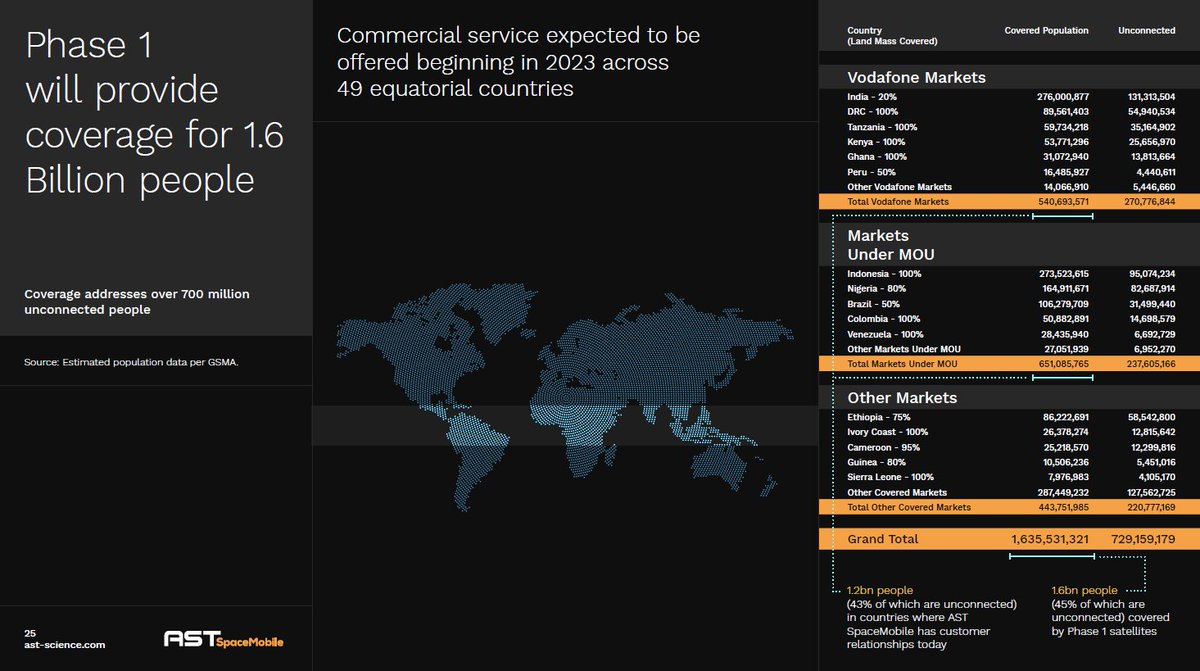

8/ Launch of 20 satellites in 2022 w/ commercial service beginning in 2023. Phase 1 cash flow will support Phase 2, Phase 3 and Phase 4 launches.

9/ SpaceMobile will be the kingmaker in the wireless market, creating clear winners (its partners) and losers.

SpaceMobile signed mutually exclusive contracts with marquee Wireless Carriers in select regions to get scale and demonstrate its business model.

SpaceMobile signed mutually exclusive contracts with marquee Wireless Carriers in select regions to get scale and demonstrate its business model.

10/ SpaceMobile could auction off partnerships to single Wireless Carrier in each region which could generate more attractive economics.

Partners that SpaceMobile chooses to work with will drive substantial CapEx savings by reducing the need to buildout spectrum for coverage.

Partners that SpaceMobile chooses to work with will drive substantial CapEx savings by reducing the need to buildout spectrum for coverage.

11/ The competitive landscape in the US Wireless market may be forever changed by SpaceMobile.

If AT&T offers customers 100% 5G Global Coverage, how can Verizon & T-Mobile compete?

If AT&T offers customers 100% 5G Global Coverage, how can Verizon & T-Mobile compete?

12/ How will Verizon keep its premium pricing by advertising "America's 2nd best network for coverage"?

Coverage and reliability are the lifeblood of Wireless Carriers.

Coverage and reliability are the lifeblood of Wireless Carriers.

13/ Verizon and T-Mobile already feel pressure and are actively voicing concern and opposition to the FCC claiming that SpaceMobile's satellites may interfere with their networks. https://tinyurl.com/yaldccd7

14/ With enterprise values of $381B for Verizon and $260B for T-Mobile, there's a lot of value to protect!

AT&T also had much to lose - it committed to US Gov to build FirstNet, the US public safety network for disasters.

SpaceMobile could eliminate the need for FirstNet.

AT&T also had much to lose - it committed to US Gov to build FirstNet, the US public safety network for disasters.

SpaceMobile could eliminate the need for FirstNet.

15/ BTW: American Tower, the largest cell tower co. in the world at $129B EV, is increasing its investment through the $230M PIPE at $10/share.

This is a hedge for the AMT because SpaceMobile's tech could be an existential threat to cell tower industry.

This is a hedge for the AMT because SpaceMobile's tech could be an existential threat to cell tower industry.

16/ Partnering with Wireless Carriers through 50/50 rev share model provides immediate access to customers and removes need for marketing, customer acquisition or backhaul costs.

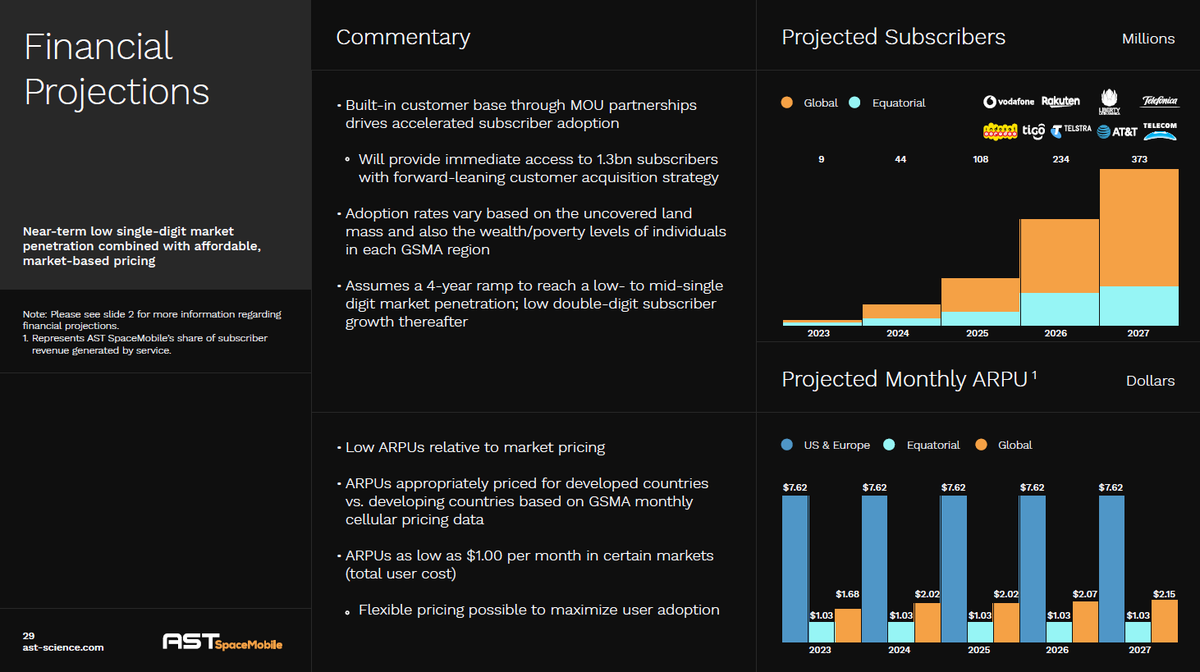

SpaceMobile projects 9M subs in 2023 growing to 373M in 2027 (153% CAGR)

SpaceMobile projects 9M subs in 2023 growing to 373M in 2027 (153% CAGR)

17/ 2027 projections represent under 30% of current potential subscriber base.

Revenue projected to grow rapidly from $181M in 2023 to $9.6B in 2027 (170% CAGR) with modest global ARPU assumption of $2.15 by 2027.

Revenue projected to grow rapidly from $181M in 2023 to $9.6B in 2027 (170% CAGR) with modest global ARPU assumption of $2.15 by 2027.

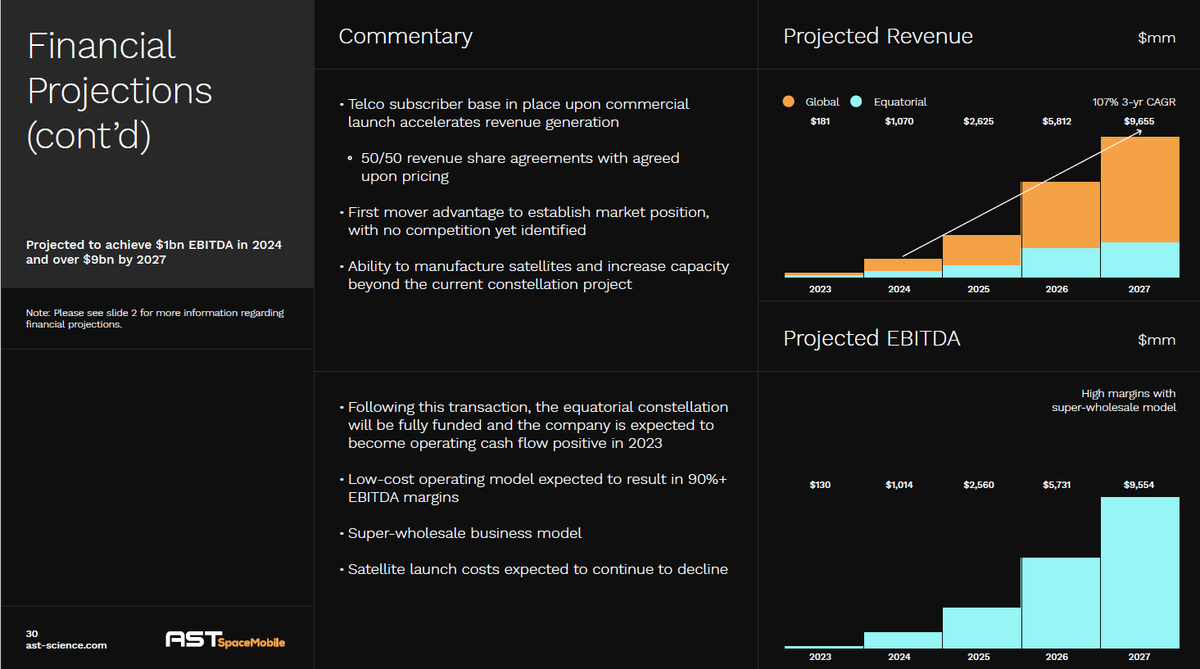

18/ Significant operating leverage will accelerate profitability once satellite constellation is launched & operational.

+$1B EBITDA by 2024, only 1 year into commercial service.

EBITDA margins to expand rapidly and reach +90% in steady state.

+$1B EBITDA by 2024, only 1 year into commercial service.

EBITDA margins to expand rapidly and reach +90% in steady state.

19/ $16.3B of unlevered free cashflow by 2030, leaving capital for reinvestments and R&D to expand service and extend market leadership.

SpaceMobile could institute a sizeable dividend comfortably beginning in 2024.

SpaceMobile could institute a sizeable dividend comfortably beginning in 2024.

20/ At $11/share, SpaceMobile is valued at 1.6x 2024E EBITDA compared to (updated as of 12/18):

Growth Space Companies: Iridium 13.5x, Virgin Galactic 26x, Momentus 4.7x

US Wireless Carriers: AT&T 7.1x, T-Mobile 8.3x, Verizon 7.5x

Growth Space Companies: Iridium 13.5x, Virgin Galactic 26x, Momentus 4.7x

US Wireless Carriers: AT&T 7.1x, T-Mobile 8.3x, Verizon 7.5x

21/ Using 4.3x to 7.2x 2024E EBITDA, SpaceMobile would be valued at $25-$40 per share, a conservative estimate based on low-growth carriers.

22/ Highly attractive risk/reward at $11 -> risking 90c to potentially make $14-$29.

NPA has a downside floor of $10.10 in cash NAV up until the merger closes.

The deal will likely close in late February to early March 2021.

NPA has a downside floor of $10.10 in cash NAV up until the merger closes.

The deal will likely close in late February to early March 2021.

23/ Stock supply dynamics: post merger 180-day lockup for sponsor, existing SpaceMobile shareholders subject to 12-month lock-up, employee stock options subject to 2-year lock-up, $230M PIPE anchored by long-term strategic investors subject to S-1 registration process

24/ Check out this thread on $NPA SpaceMobile @spac_insider @spactiger @billspacman @spacula @spacuity @spactori @stocklizardking @grassosteve @julianklymochko @spacul8r @spac_attack @doctorspac @pennycheck

Read on Twitter

Read on Twitter