Stop spending all your time figuring out the new hot trends in the DeFi space. Don't chase yields paying your childs tuition every time your little bag swaps Dapps on that dumby thicc L1 Ethereum chain.

A love story about a little in a brave new world

in a brave new world

A love story about a little

in a brave new world

in a brave new world

Early 2020 provided users the opportunity to try out various Dapps all while not having to pay too much for gas. As a curious new person to the space with not much funds to play with it provided me a chance to try out Dapps like @compoundfinance @AaveAave @UniswapProtocol, etc.

"Wow!", I thought. The space is incredible and I want all the pieces that made make up the DeFi pie but as the year progressed I simply couldn't keep up with the trends or afford to be paying such a premium gas fee. A was kicked out of the club (financially).

Fast foreword to later this year I came across @PieDAO_DeFi and we've been lovers ever since. PieDAO has two types pies:

1) Smart AMM Pools

2) PieVaults

Let's start with smart pools.

1) Smart AMM Pools

2) PieVaults

Let's start with smart pools.

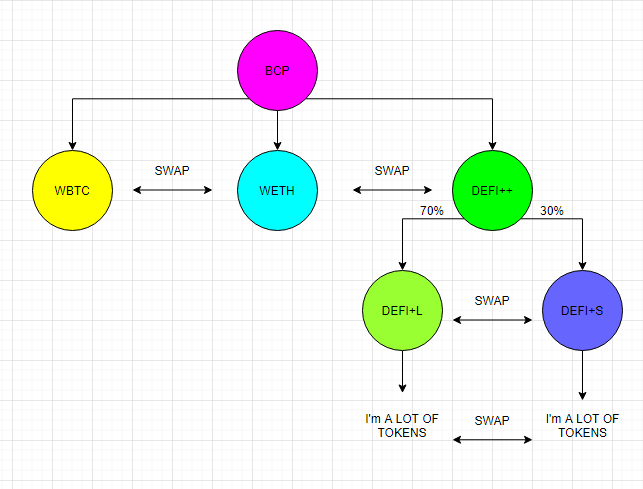

PieDAO's private smart pools are built on top of @BalancerLabs. This means the assets within the pool have an opportunity to be traded for a small fee which goes back to LP holders. This ALSO means that we can have multi layered pools (Pies) containing other pies.

BCP for example has an allocation of:

1) 1/3 WBTC (Soon to be it's own pie)

2) 1/3 WETH (see where I'm going here )

)

3) 1/3 DEFI++ (Which is a pie of 70% DEFI+L/30% DEFI+S)

1) 1/3 WBTC (Soon to be it's own pie)

2) 1/3 WETH (see where I'm going here

)

)3) 1/3 DEFI++ (Which is a pie of 70% DEFI+L/30% DEFI+S)

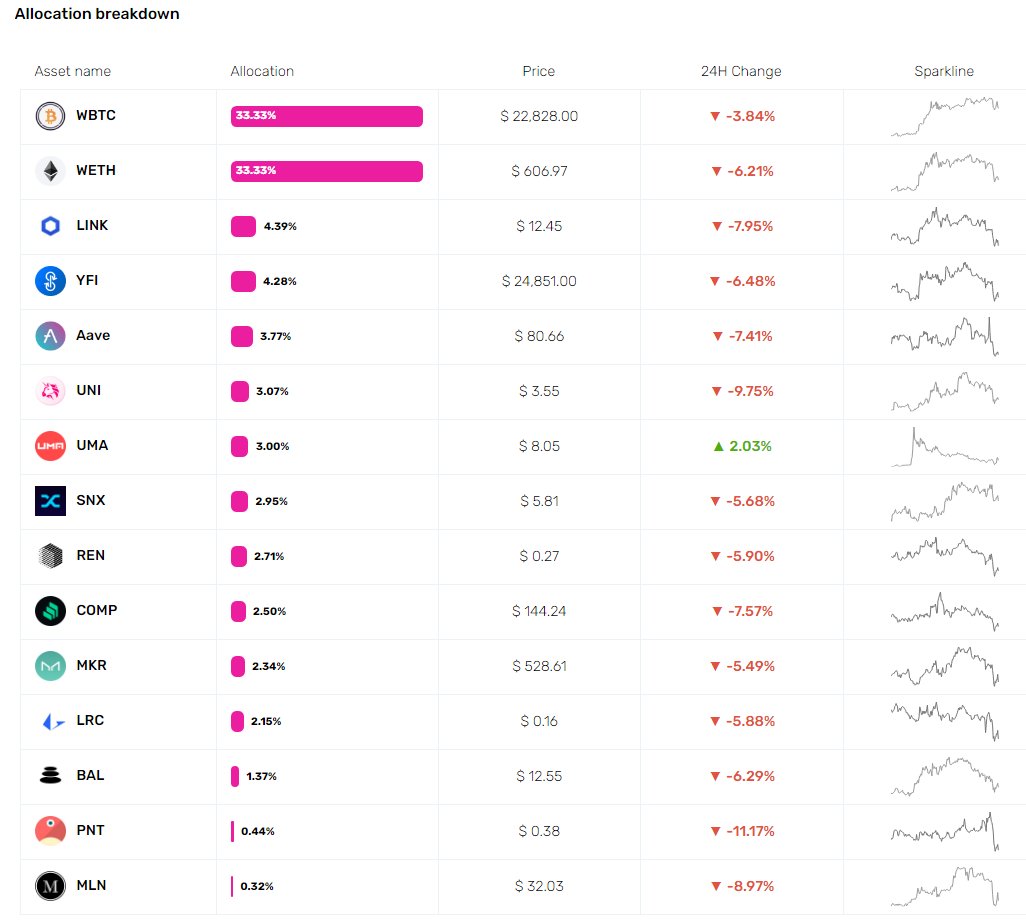

If you dig into pies like DEFI++/DEFI+L/DEFI+S you'll notice the weights of each underlying asset aren't even. That's where folks like @uegabs come in. If you want to learn more about the methodology of how pies are crafted have a read here https://medium.com/piedao/inside-the-bakery-how-we-build-pies-e8932718beaf

Another feature I like is the DAOs ability to pause trading of the swaps *inside* the smart pool, protecting the other assets and user funds in the event a bug were to be found/exploited (remember the issue ImBTC earlier this year?)

At this point though you may be thinking:

"BUT SIR! I have been an LP provider in the past and am aware of what impermanent loss is. If one of the tokens in the pie go to 0, wouldn't that that put other funds at risk?"

"BUT SIR! I have been an LP provider in the past and am aware of what impermanent loss is. If one of the tokens in the pie go to 0, wouldn't that that put other funds at risk?"

It would! That's why pies need to be carefully crafted and monitored by the DAO. An asset can be removed/replaced at any point pending the approval of governance.

These AMM risks are avoid in PieDAO's new pool design called PieVaults.

These AMM risks are avoid in PieDAO's new pool design called PieVaults.

PieVaults, are much different then their smart pool. They do not provide internal swaps between assets (No IL  ) but have the flexibility to do much more with its underlying assets. The audited v1.0 contracts can be found here https://github.com/pie-dao/ExperiPie

) but have the flexibility to do much more with its underlying assets. The audited v1.0 contracts can be found here https://github.com/pie-dao/ExperiPie

) but have the flexibility to do much more with its underlying assets. The audited v1.0 contracts can be found here https://github.com/pie-dao/ExperiPie

) but have the flexibility to do much more with its underlying assets. The audited v1.0 contracts can be found here https://github.com/pie-dao/ExperiPie

YPIE is the first pie launched on mainnet that you can play around with that's built on this new architecture. It's in beta and currently has over 90% of it's assets deposited and earning interest in @AaveAave and @CreamdotFinance. This is just the start for PieVaults

"BUT SIR, how can I be capital efficient with my precious little  wallet and such high minting costs!"

wallet and such high minting costs!"

That's where Ovens come into the mix (pun intended). If someone were to mint such as BCP, it would require 73 transaction to purchase each individual asset and mint new BCP.

wallet and such high minting costs!"

wallet and such high minting costs!" That's where Ovens come into the mix (pun intended). If someone were to mint such as BCP, it would require 73 transaction to purchase each individual asset and mint new BCP.

Oven allows users to pool their assets together to mint new pies, creating a 97.5% reduction is gas costs comparing to a users minting pies for themselves.

A deep dive https://medium.com/piedao/how-to-mint-pies-gas-free-with-oven-1d11e902fab8

https://medium.com/piedao/how-to-mint-pies-gas-free-with-oven-1d11e902fab8

A deep dive

https://medium.com/piedao/how-to-mint-pies-gas-free-with-oven-1d11e902fab8

https://medium.com/piedao/how-to-mint-pies-gas-free-with-oven-1d11e902fab8

By creating the oven PieDAO has significantly reduced the cost of participation in the space, unlocking DeFi for a whole new group of folks who otherwise wouldn't have been able to explore this new frontier.

Lending/staking/meta-governance is some of the many things possible with PieVaults.

This is really is only scratching the surface of the new pool design. If you're a coder, please please PLEASE have a look at the github. All are welcome in the discord :) https://discord.gg/qv2MhZvf

This is really is only scratching the surface of the new pool design. If you're a coder, please please PLEASE have a look at the github. All are welcome in the discord :) https://discord.gg/qv2MhZvf

Read on Twitter

Read on Twitter