Ok, so we now have the bill text for this nearly $900 billion relief bill. Let’s see what is in there. https://docs.house.gov/billsthisweek/20201221/BILLS-116HR133SA-RCP-116-68.pdf #TaxTwitter 1/x

First, it is what #TaxTwitter has been hoping for, there is #PPP expense DEDUCTIBILITY included (despite several ups and downs the past few days). This provision makes the PPP loans tax-free as Congress intended despite any tax technical arguments to the contrary. 2/x

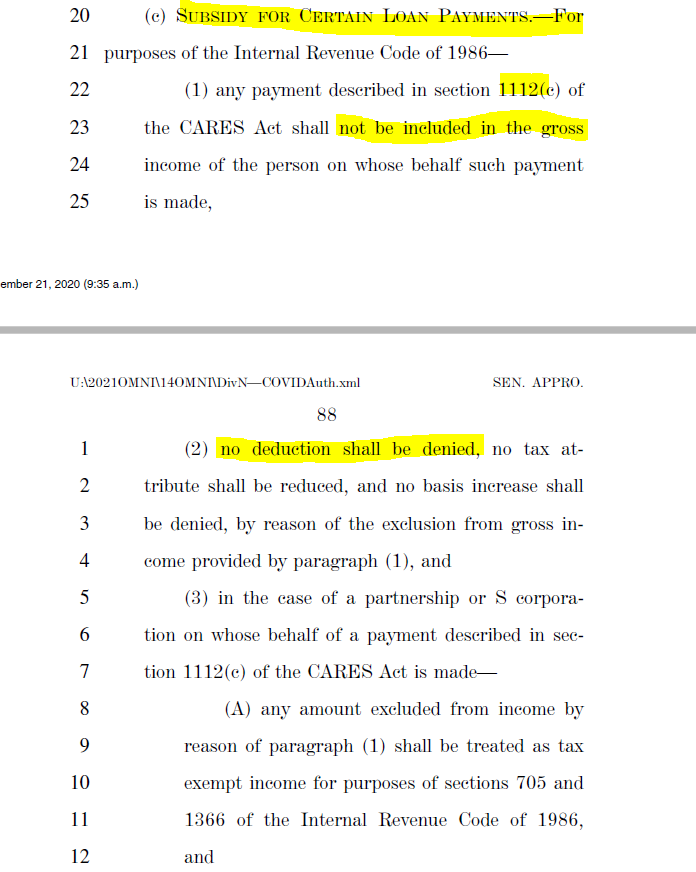

Second, speaking of taxability, a similar “tax free” provision is also applicable to EXISTING @sba Section 7(a) loan borrowers that were granted relief in the CARES act (6 month payment relief) This aligns with the #PPP language. 3/x

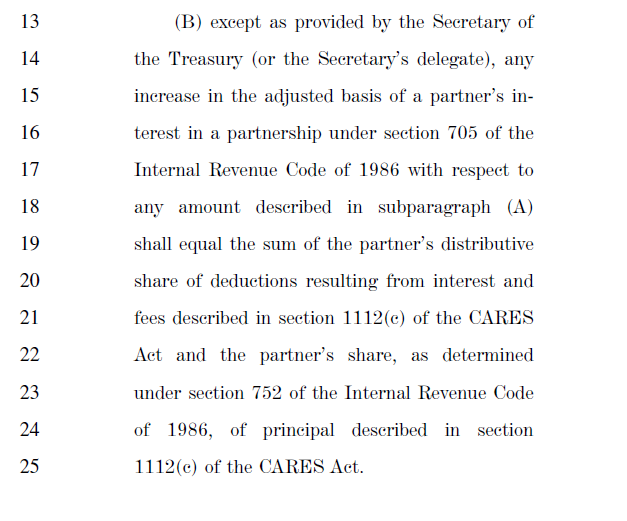

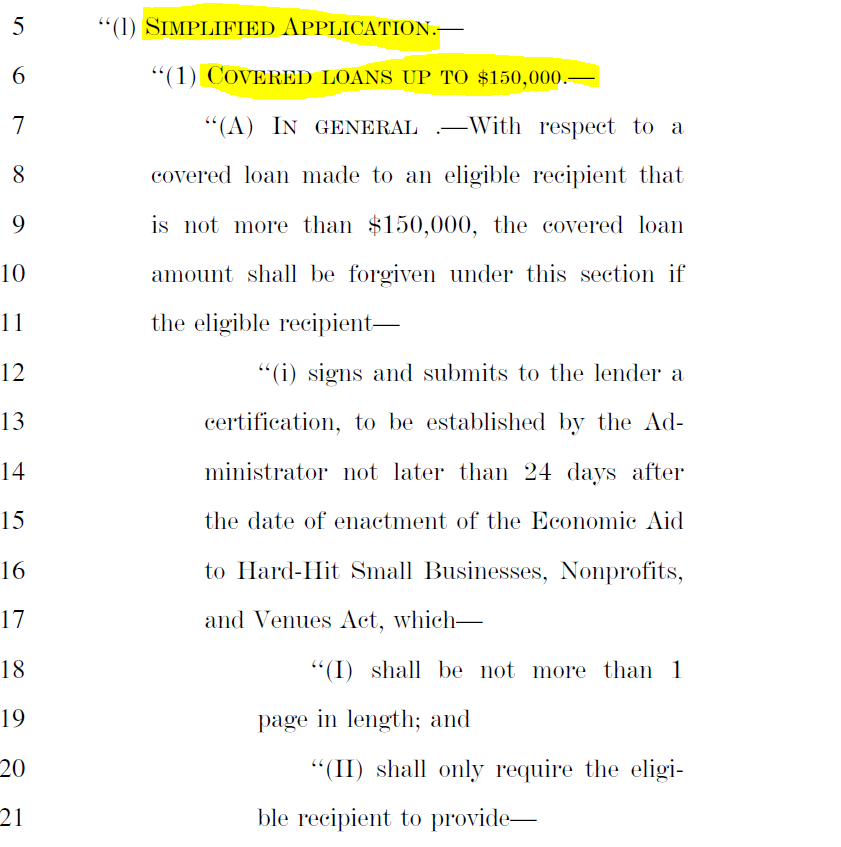

Now, let’s talk forgiveness of #PPP loans. There is in fact a simper form for forgiveness for those PPP loans under $150,000. So basically, it is the “rubber stamp” that had been talked about this summer. 60% payroll requirement is n/a, etc. 4/x

For #PPP loans between $150K and $2 million, the supporting documentation WILL still be necessary (this is a change from prior version of the bill which did not require that). 5/x

Now let’s talk #PPP round 2. There IS a second iteration of #PPP loans for those companies with under 300 employees and who suffered a 25% drop in any quarter revenues from 2019 to 2020. 6/x

Nonprofits are still able to participate in #PPP which now includes 501(c)(6) organizations such as chambers of commerce and also includes "destination marketing" organizations. This had been on the table most of the year. 7/x

For farmers and ranchers, there IS a revision to #PPP that indicates the maximum loan of $20,833 can be obtained for anyone with $100,000 of GROSS revenues on Sch F. Previously the law indicated the cap would be $100,000 of net income. 8/x

There is also the “save our stages” act included, which will help live theatres, movie theatres, talent representatives, and museums get additional government relief. MANY more stipulations in this bill as compared to previous bill but the 45% of revenue grant amount stayed. 9/x

FFCRA Paid Sick Leave and Paid Family Leave extended to 3/31/2021. Plus certain "technical improvements" 11/x

Back to #PPP, there is a special provision which allows for larger loan draws for the "accommodation and food service" industry (NACIS 72). Multiple is 3.5 times payroll, up from 2.5 times. Choice of which base payroll period to use as well. 12/x

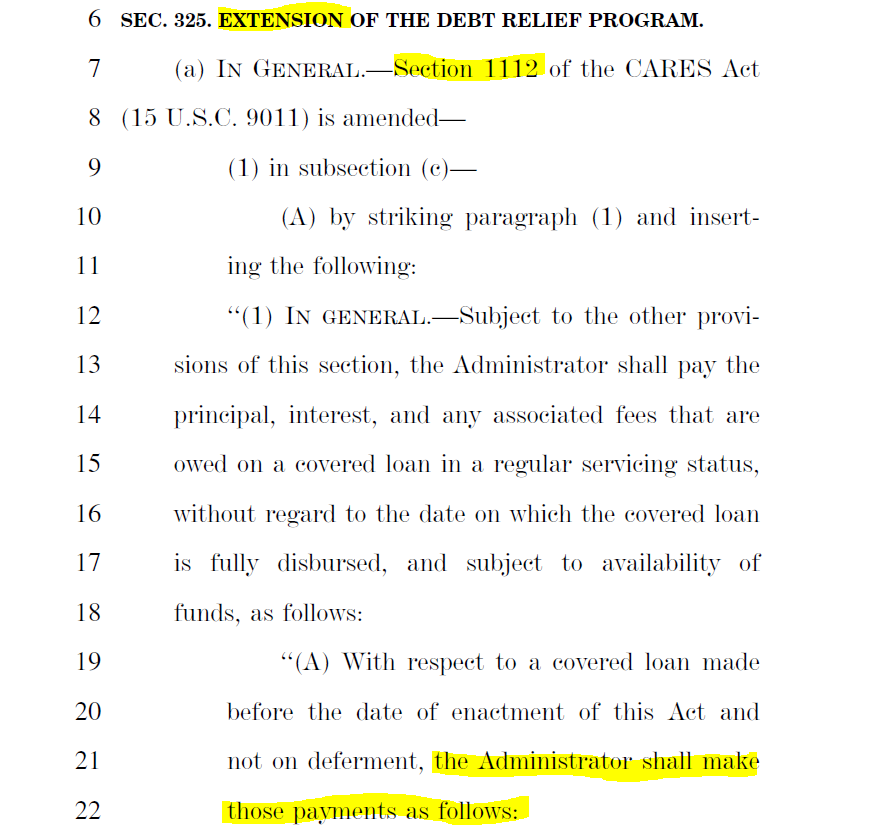

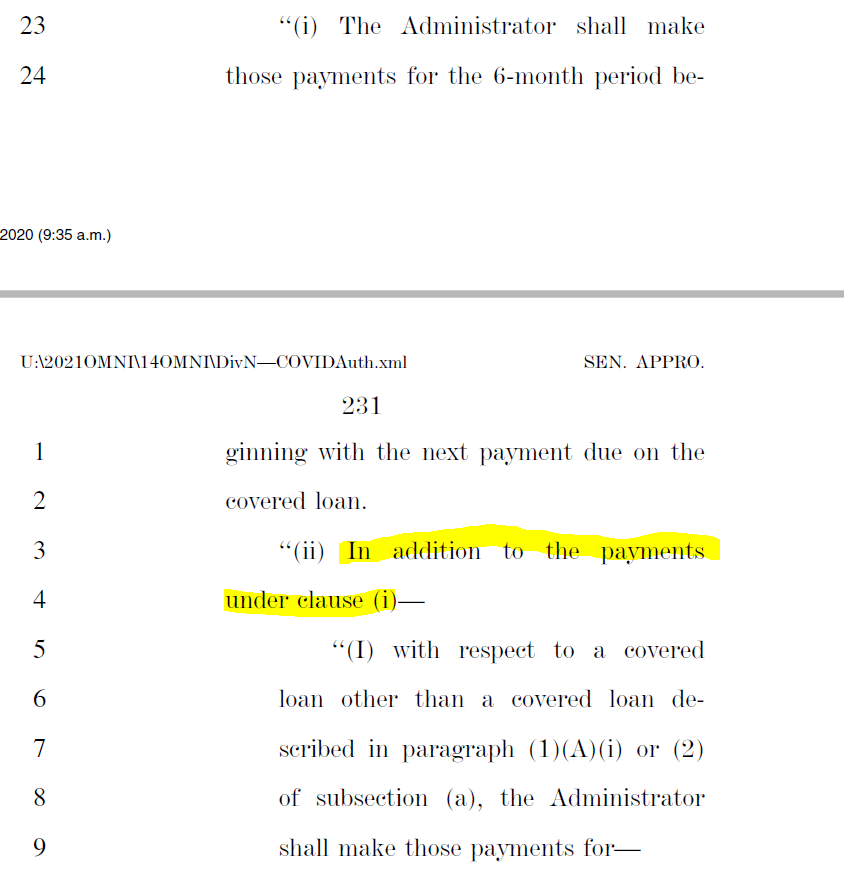

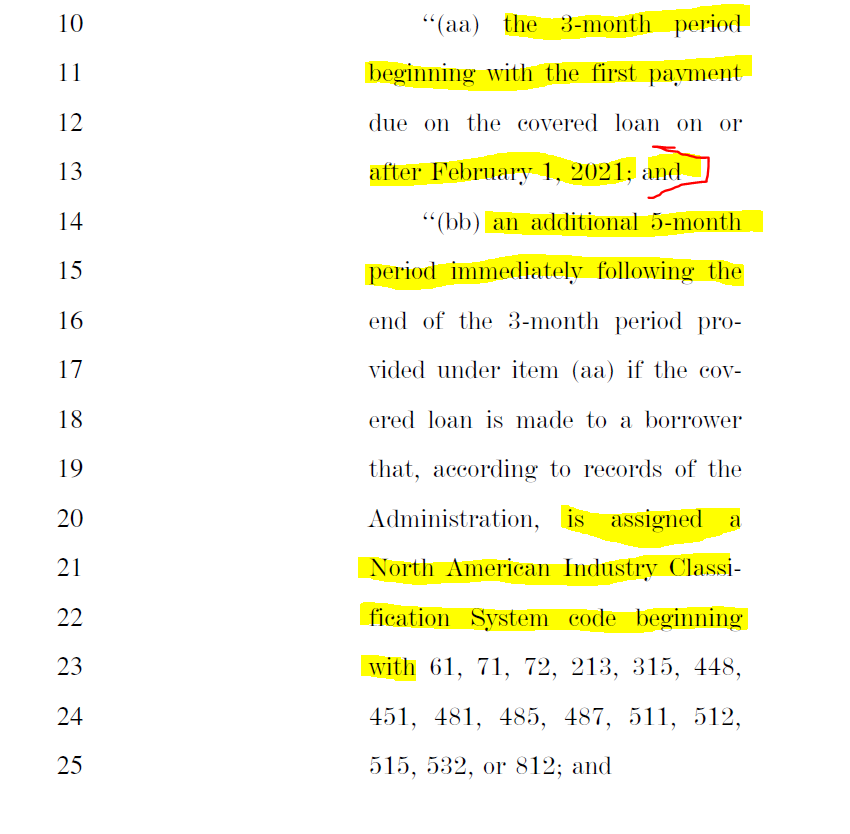

Section 1112 of the CARES act debt relief for existing SBA 7(a) loans is EXTENDED by 3 months for all industries and 8 months for certain industries. 13/x

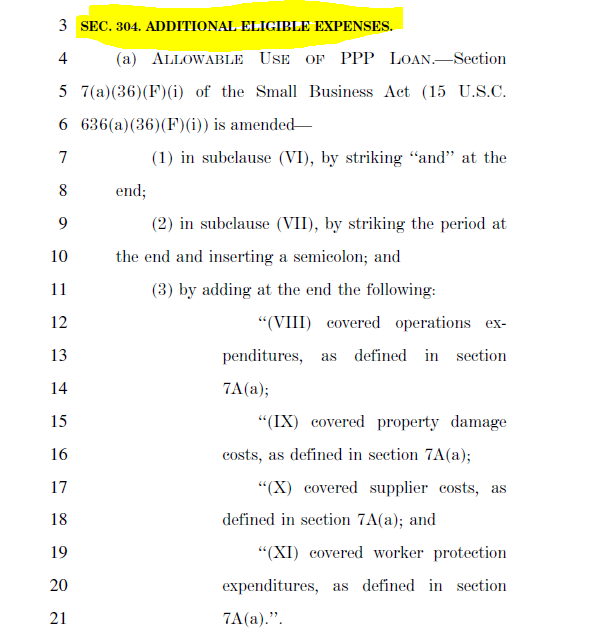

The are more eligible expenses that constitute an "allowable use" of #PPP loans. 14/x

Read on Twitter

Read on Twitter