#Bitcoin  is in a supply and liquidity crisis.

is in a supply and liquidity crisis.

This is extremely bullish! And highly underrated.

I believe we will see this significantly reflected in Bitcoin's price in the upcoming months.

Let's take a look at the data.

A thread

is in a supply and liquidity crisis.

is in a supply and liquidity crisis.This is extremely bullish! And highly underrated.

I believe we will see this significantly reflected in Bitcoin's price in the upcoming months.

Let's take a look at the data.

A thread

1/ Accumulation Balance

The amount of bitcoins held in accumulation addresses is 2.7M BTC.

Those are addresses that have only received bitcoins, and never spent funds.

True HODLers, hoarding 14.5 % of the circulating supply.

#Bitcoin

Chart: http://studio.glassnode.com/metrics?a=BTC&m=addresses.AccumulationBalance

The amount of bitcoins held in accumulation addresses is 2.7M BTC.

Those are addresses that have only received bitcoins, and never spent funds.

True HODLers, hoarding 14.5 % of the circulating supply.

#Bitcoin

Chart: http://studio.glassnode.com/metrics?a=BTC&m=addresses.AccumulationBalance

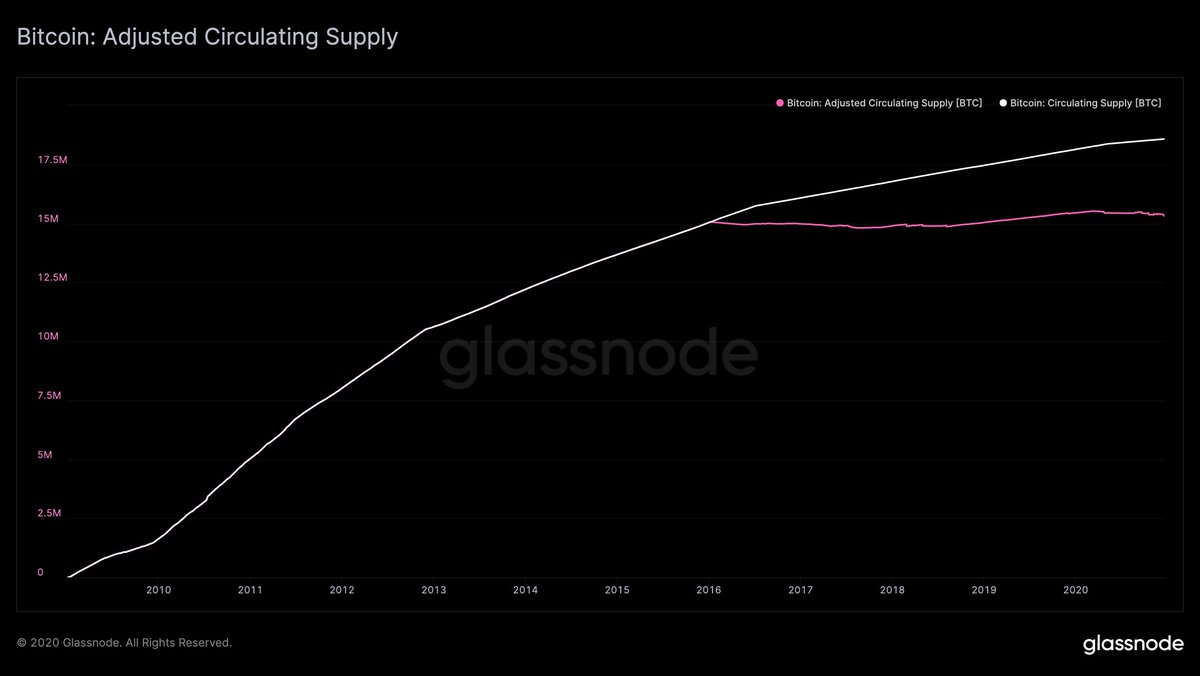

2/ Lost Coins

21 milltion bitcoins? You wish.

That's just the hard cap – considering lost coins, the real number is much less.

No one knows for sure how many, but estimations point to at least 3M.

That's 16% less circulating BTC available.

#Bitcoin

http://studio.glassnode.com/compare?a=BTC&a=BTC&m=supply.CurrentAdjusted&m=supply.Current&sameAxis=true

21 milltion bitcoins? You wish.

That's just the hard cap – considering lost coins, the real number is much less.

No one knows for sure how many, but estimations point to at least 3M.

That's 16% less circulating BTC available.

#Bitcoin

http://studio.glassnode.com/compare?a=BTC&a=BTC&m=supply.CurrentAdjusted&m=supply.Current&sameAxis=true

3/ Institutional #BTC  Demand

Demand

@Grayscale (573M BTC), @MicroStrategy ($475M), @sqcrypto ($50M), Ruffer ($745M), @massmutual ($100M) – all buying up supply.

Do you really think they're alone? Of course not.

Expect many more on the move. They're coming – gradually, then suddenly.

Demand

Demand@Grayscale (573M BTC), @MicroStrategy ($475M), @sqcrypto ($50M), Ruffer ($745M), @massmutual ($100M) – all buying up supply.

Do you really think they're alone? Of course not.

Expect many more on the move. They're coming – gradually, then suddenly.

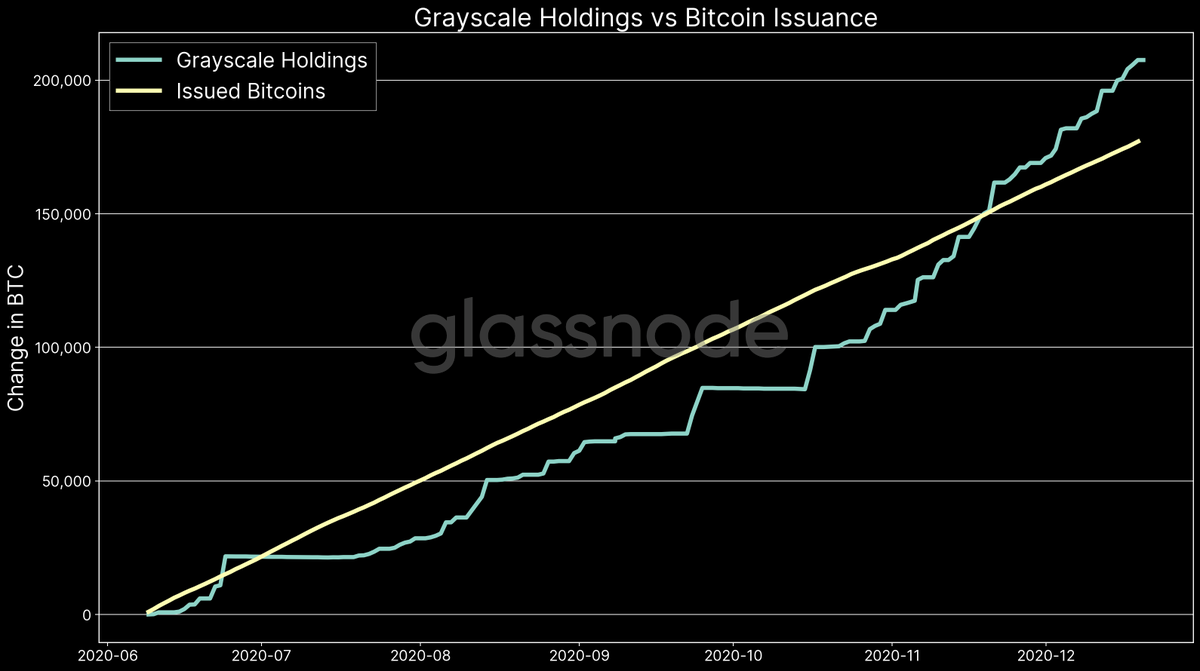

4/ Speaking of @Grayscale:

Bitcoins added to the Grayscale Bitcoin Trust in the past 6 months: ~210,000 BTC

Bitcoins mined in the past 6 months: ~185.000 BTC

That's right, Grayscale has been buying up more bitcoins than the amount issued.

Talk about a supply crisis!

#Bitcoin

Bitcoins added to the Grayscale Bitcoin Trust in the past 6 months: ~210,000 BTC

Bitcoins mined in the past 6 months: ~185.000 BTC

That's right, Grayscale has been buying up more bitcoins than the amount issued.

Talk about a supply crisis!

#Bitcoin

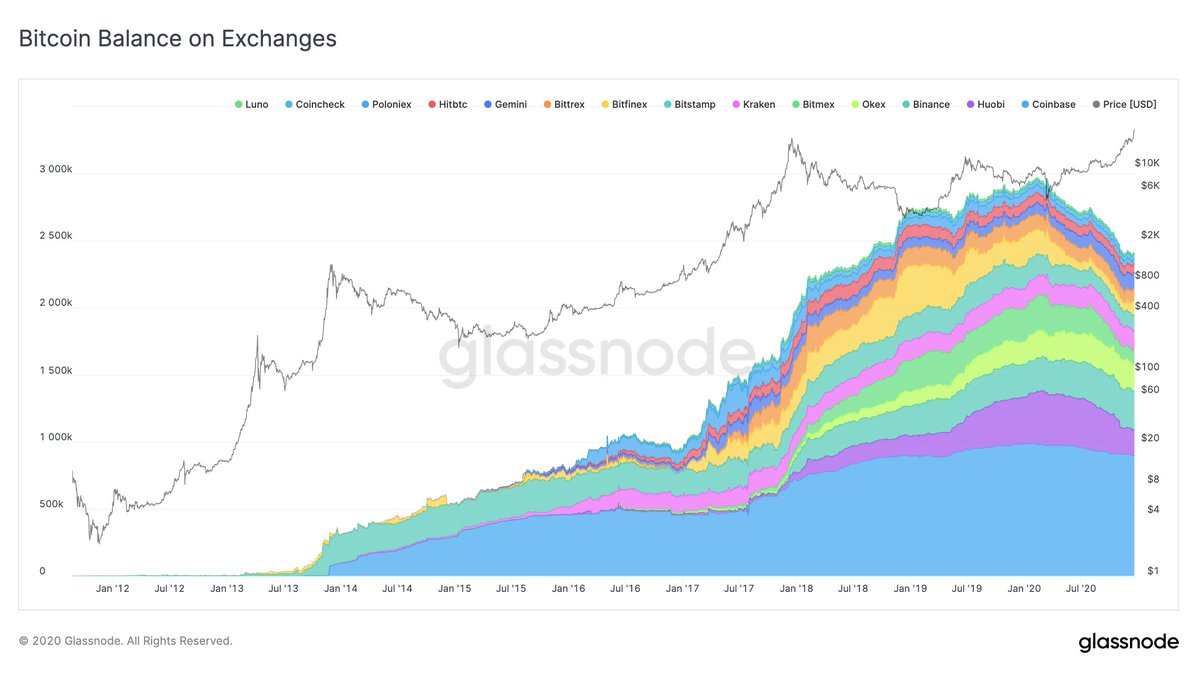

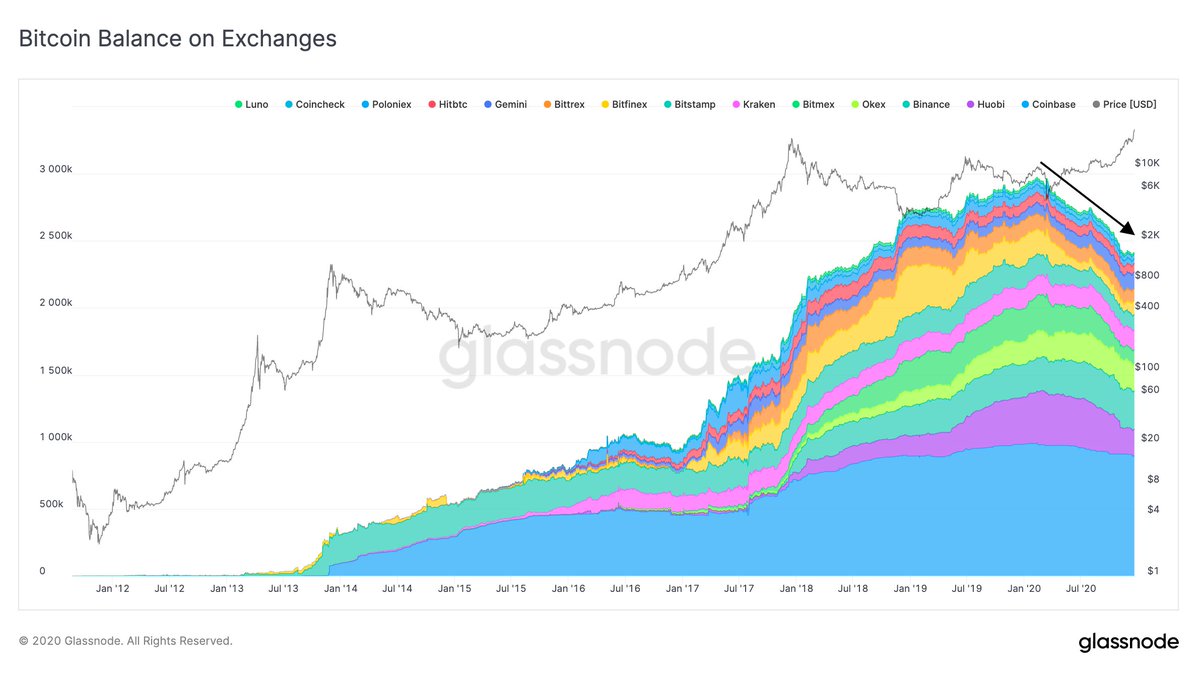

5/ Exchange Balances

Liquidity is vanishing from exchanges.

We're seeing the longest depletion of exchange funds.

Since January, the BTC supply on exchanges dropped a staggering 20%.

#BTC is being pulled to long-term storage, custodian wallets, etc.

is being pulled to long-term storage, custodian wallets, etc.

http://studio.glassnode.com/metrics?a=BTC&m=distribution.BalanceExchangesAll

Liquidity is vanishing from exchanges.

We're seeing the longest depletion of exchange funds.

Since January, the BTC supply on exchanges dropped a staggering 20%.

#BTC

is being pulled to long-term storage, custodian wallets, etc.

is being pulled to long-term storage, custodian wallets, etc.http://studio.glassnode.com/metrics?a=BTC&m=distribution.BalanceExchangesAll

6/ Liquid #Bitcoin  Supply

Supply

14.4M BTC is held by illiquid entities – that is 78% (!) of the current supply.

Illiquid entities spend less than 25% of the BTC they receive, acting as supply sinks in the network.

Yes, only 12% of the BTC supply is liquid, according to this metric.

Supply

Supply14.4M BTC is held by illiquid entities – that is 78% (!) of the current supply.

Illiquid entities spend less than 25% of the BTC they receive, acting as supply sinks in the network.

Yes, only 12% of the BTC supply is liquid, according to this metric.

7/ #Bitcoin  Miner Supply

Miner Supply

Are miners cashing out at these prices? I don't think so.

The amount of miner unspent supply (BTC that has never left the miner address) has been increasing since the last halving.

Current miner balance: 1.7M $BTC

Chart: http://studio.glassnode.com/metrics?a=BTC&m=mining.MinersUnspentSupply

Miner Supply

Miner SupplyAre miners cashing out at these prices? I don't think so.

The amount of miner unspent supply (BTC that has never left the miner address) has been increasing since the last halving.

Current miner balance: 1.7M $BTC

Chart: http://studio.glassnode.com/metrics?a=BTC&m=mining.MinersUnspentSupply

Read on Twitter

Read on Twitter