One of the best reads is "Agony & Ecstasy" by JP Morgan from 2014

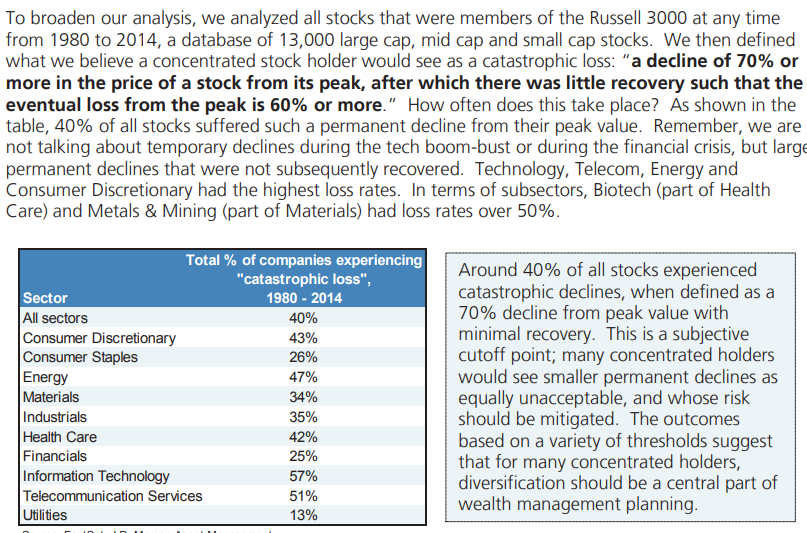

It found that 40% of all stocks experienced catastrophic declines, when defined as a 70% decline from peak value with minimal recovery. This was lowest for Consumer Staples and Utilities

https://www.valuewalk.com/wp-content/uploads/2014/09/eotm_2014_09_02_agonyescstasy_3.pdf

It found that 40% of all stocks experienced catastrophic declines, when defined as a 70% decline from peak value with minimal recovery. This was lowest for Consumer Staples and Utilities

https://www.valuewalk.com/wp-content/uploads/2014/09/eotm_2014_09_02_agonyescstasy_3.pdf

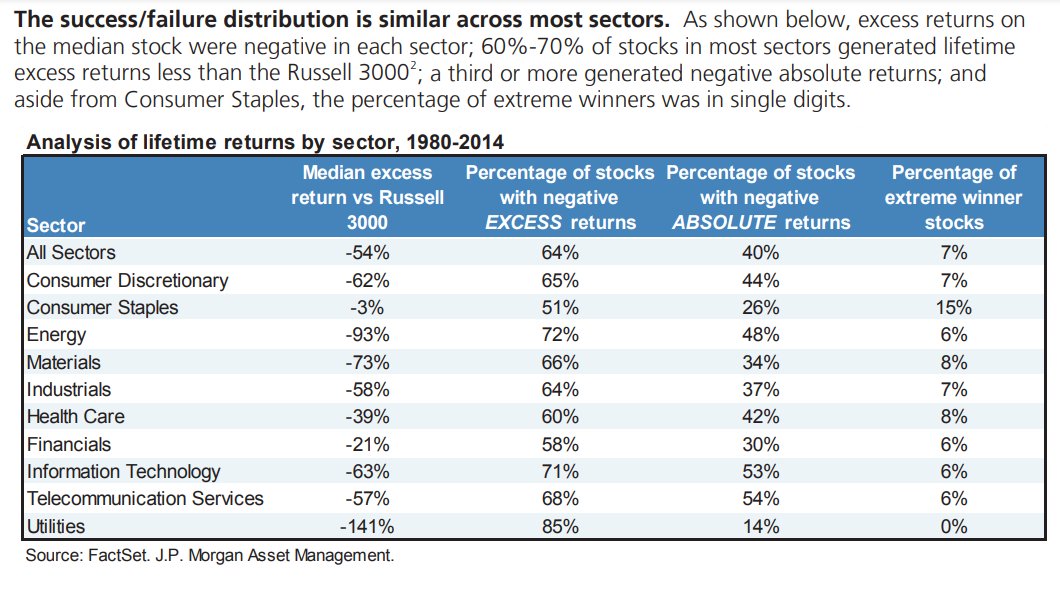

The median stock did worse than the stock market

Two-thirds of all excess returns vs. the Russell 3000 were negative, and for 40% of all stocks, returns were negative in absolute terms

The right tail is ~7% of the universe and includes companies that generated excess returns

Two-thirds of all excess returns vs. the Russell 3000 were negative, and for 40% of all stocks, returns were negative in absolute terms

The right tail is ~7% of the universe and includes companies that generated excess returns

Consumer Staples seemed to offer the best risk/reward of any other sectors. They offered the smallest %-age of failures, and an above percentage of companies that generate excess returns

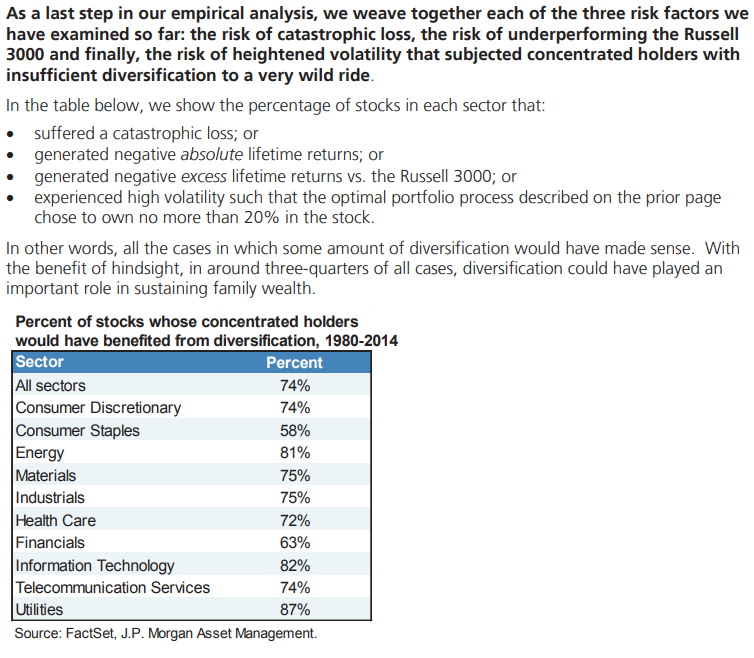

This study is one of the best reasons against the mantra to concentrate a portfolio

Diversification would have provided protection for preserving family wealth

Diversification would have provided protection for preserving family wealth

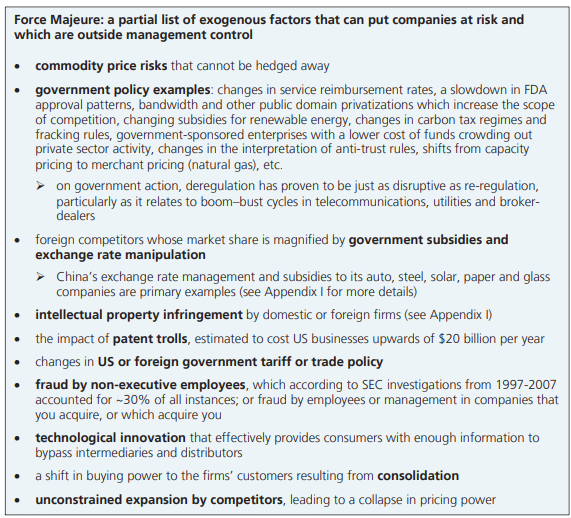

A partial list of exogenous factors that can put companies at risk and which are outside management control

Read on Twitter

Read on Twitter