As I read FinCEN's proposed rule on personal crypto wallets to write @paradigm’s response to it, I remembered a motto we had at the Department of Homeland Security’s general counsel’s office.

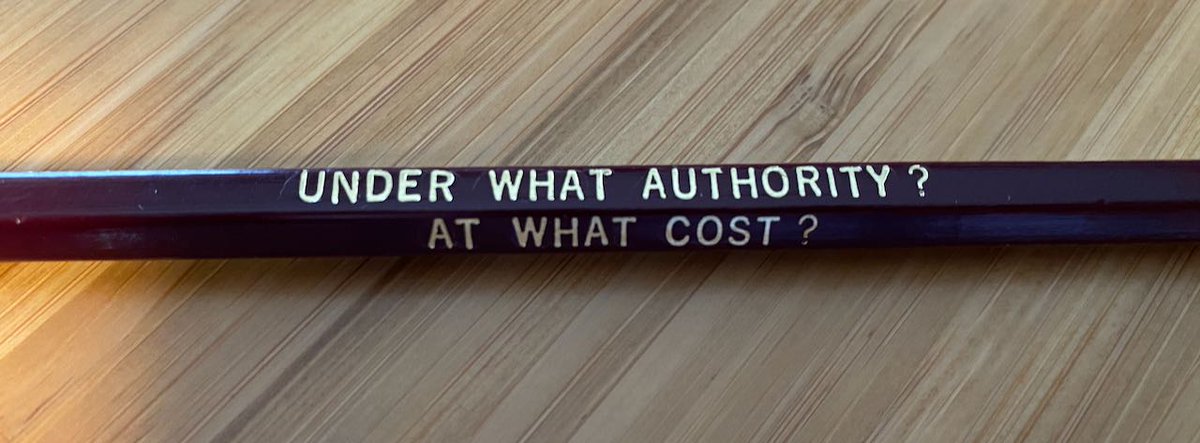

"Security Through Responsible Regulation: Under What Authority? At What Cost?"

"Security Through Responsible Regulation: Under What Authority? At What Cost?"

We even put it on our pencils.

It was a reminder that every regulation affects freedom, is a tax, and though security is deeply important, regulators must weigh the countervailing burdens on the impacted industry and the public at large before proposing a rule.

It was a reminder that every regulation affects freedom, is a tax, and though security is deeply important, regulators must weigh the countervailing burdens on the impacted industry and the public at large before proposing a rule.

My friends @jchervinsky and @katie_haun have detailed why rules shouldn't be done in the dark of night without a meaningful opportunity for the public to comment.

They're 100% right. You should read their tweetstorms:

https://twitter.com/jchervinsky/status/1340135040399904770?s=20 https://twitter.com/katie_haun/status/1340521235264860161?s=20

They're 100% right. You should read their tweetstorms:

https://twitter.com/jchervinsky/status/1340135040399904770?s=20 https://twitter.com/katie_haun/status/1340521235264860161?s=20

But people beyond the crypto faithful should come out against this rule, because it fails to weigh the potentially disastrous effects on national security, privacy, innovation, and financial access, and it'll make law enforcement's job harder, not easier.

Given that the comment period is a mere 15 days during the holidays, we wanted to raise the alarm to organizations, elected officials, and others whose focus is understandably elsewhere, but might want to weigh in. The rule is here: https://public-inspection.federalregister.gov/2020-28437.pdf

Interested in national security? China wants to use its already-existing lead in digital currency against the US. @DNI_Ratcliffe has already identified this as a national security threat. https://www.washingtonexaminer.com/news/trump-spy-chief-seeks-sec-scrutiny-of-chinese-dominance-in-cryptocurrency

This rule would further Beijing’s goals. If it's harder to conduct transactions from US regulated companies, the activity won't stop, but could shift from existing networks to China’s digital yuan or another of its surveillance-laden alternatives. https://edition.cnn.com/2020/12/04/economy/china-digital-yuan-currency-intl-hnk/index.html

It can then collect info on Americans' economic relationships and digital lives, squelch dissenting views worldwide, and project power beyond its borders.

Not good, and inconsistent with @realDonaldTrump's foreign policy.

@SenTomCotton

@SenToomey

@MikeCrapo

@Liz_Cheney

Not good, and inconsistent with @realDonaldTrump's foreign policy.

@SenTomCotton

@SenToomey

@MikeCrapo

@Liz_Cheney

Privacy advocates: the rule would require US crypto companies to keep a database of names, physical addresses, and other PII not just on their users, but on anyone else to whom their users send $3,000 worth of crypto.

And if the transaction is over $10,000, that info would go straight into a FinCEN database.

Given the OPM hack and now SolarWinds, orgs like @CenDemTech @EFF @EPICprivacy might have something to say about these big, centralized databases. https://www.bloomberg.com/news/articles/2020-12-18/russia-linked-solarwinds-hack-ensnares-widening-list-of-victims

Given the OPM hack and now SolarWinds, orgs like @CenDemTech @EFF @EPICprivacy might have something to say about these big, centralized databases. https://www.bloomberg.com/news/articles/2020-12-18/russia-linked-solarwinds-hack-ensnares-widening-list-of-victims

Interested in US innovation? This rule would make it harder for US persons to connect to "Web 3.0" projects that'll disintermediate not just financial services, but social media, file storage, gaming, and countless other things.

The projects won't cease, thankfully, but fewer US persons will be able to use them, and other countries will both foster the technology's development and reap the economic benefits. Not a good legacy for @realdonaldtrump.

And remember how the rule requires a "physical address"? This would affect the ability of the homeless, or anyone else without an address, to participate in the crypto economy. FYI @DavidColeACLU.

As if those aren’t enough, the rule isn't likely to accomplish its supposed goal: preventing illicit transactions. Those would simply migrate to non-US exchanges that don’t report suspicious activity to FinCEN, resulting in a "going dark" problem for the USG.

So we have a rule that's likely to be ineffective, but will almost certainly negatively affect American innovation, security, privacy, and financial access.

We're eager to work with the USG on a system that works. A midnight reg with a 15-day comment period isn't how to do it.

We're eager to work with the USG on a system that works. A midnight reg with a 15-day comment period isn't how to do it.

@paradigm will definitely be submitting a comment on the proposed rule. But this is a rallying cry: if you're interested in preventing this rule’s ill effects, let your voice be heard. Comments can be filed at http://regulations.gov starting 12/23.

Read on Twitter

Read on Twitter