Alright, here's my first attempt at a thread: $LMND!

Lemonade aims to change how the multi-TRILLION dollar insurance industry operates. Only 5 years old and already available & licensed in 35 U.S states and in the EU, currently live in Germany, France, and The Netherlands

Lemonade aims to change how the multi-TRILLION dollar insurance industry operates. Only 5 years old and already available & licensed in 35 U.S states and in the EU, currently live in Germany, France, and The Netherlands

1/ "Lemonade offers renters, homeowners, and pet health insurance in the United States, and contents and liability insurance in Germany and the Netherlands, through its full-stack insurance carriers. Powered by artificial intelligence and behavioral economics...

2/ ... Lemonade set out to replace brokers and bureaucracy with bots and machine learning, aiming for zero paperwork and instant everything. A Certified B-Corp, Lemonade gives unused premiums to nonprofits selected by its community, during its annual Giveback."

3/ One of the first things to mention is that $LMND's brand is extremely accessible. Part of that is how "easy" management / IR teams have made it to properly understand what is actually a fundamentally complex business, and quite a sophisticated value proposition.

4/ If you have 30 minutes, watch the founders explain what they've built (this is the company's IPO roadshow video for investors). Well worth it!

https://vimeo.com/437029189

If you prefer reading - this founder's letter is a great place to start: https://www.lemonade.com/blog/our-lemonade-stand/

https://vimeo.com/437029189

If you prefer reading - this founder's letter is a great place to start: https://www.lemonade.com/blog/our-lemonade-stand/

5/ Others have gone over the financials, so I'll only touch on the main KPIs; my main focus will be qualitative. I recommend you start by checking out the great threads published by @StockMarketNerd and @GetBenchmarkCo

https://twitter.com/StockMarketNerd/status/1296071702569529345 https://twitter.com/GetBenchmarkCo/status/1316494419324010500

https://twitter.com/StockMarketNerd/status/1296071702569529345 https://twitter.com/GetBenchmarkCo/status/1316494419324010500

6/ Some of the metrics Lemonade reports are unique to insurance, so I'll briefly explain them. Kinda boring yet important:

In-Force Premium (IFP) = aggregate annualized premium for customers as of the period end date.

Premium per customer (PPC) = IFP divided by # of customers.

In-Force Premium (IFP) = aggregate annualized premium for customers as of the period end date.

Premium per customer (PPC) = IFP divided by # of customers.

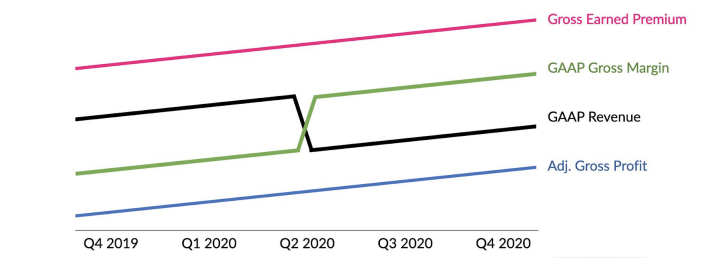

7/ Gross Earned Premium (GEP): Closest proxy to revenue. Sum of $ of gross *written* premium (GWP) which the company has *earned* in a specific period.

Loss Ratio: What % of premium $'s are paid out in claims. Lemonade wants this metric below 75%. Here's why:

Loss Ratio: What % of premium $'s are paid out in claims. Lemonade wants this metric below 75%. Here's why:

8/ Ceding commission: $LMND buys reinsurance from some of the biggest reinsurers on the planet. So what is reinsurance and what do they cede?

Spoiler alert: loss ratio < 75% means everyone (reinsurers, LMND & hopefully charities) makes money. Why?

Spoiler alert: loss ratio < 75% means everyone (reinsurers, LMND & hopefully charities) makes money. Why?

9/ Insurance usually has a predictable top-line, but volatile bottom-line ("literally fluctuates with the weather" - Schreiber). So Lemonade uses reinsurance: a reinsurer agrees to cover part of the claims for the primary insurer (LMND), in return for a portion of the premium.

10 Last Q, LMND changed their reinsurance structure. Now, 75% of cust. premiums are ceded to reinsurers, who then cede a 25% commish back to LMND. Then reinsurers cover claims beyond 75% of premiums (important). This affects GAAP revenue numbers; ceded

premium doesn't "count":

premium doesn't "count":

11/ So if this: "OMG $LMND REVS DOWN YoY WHO IS BUYING THIS RUBBISH" looks familiar - someone read a seeking alpha bot headline without reading the shareholder letter.

No biggie, happens.

IFP/GEP (see above for a refresher) were up 99/104% YoY respectively in Q3. All good.

No biggie, happens.

IFP/GEP (see above for a refresher) were up 99/104% YoY respectively in Q3. All good.

12/ "The motivation for this restructuring is the capital efficiency it delivers, with *every dollar of surplus now expected to support roughly three times the amount of premium that it did in Q2*, rendering Lemonade a capital-light business" Mind the GAAP https://s24.q4cdn.com/139015699/files/doc_downloads/2020/08/Shareholder-Letter-Q2-2020-(1).pdf

13/ So, basic terminology & reinsurance done. Let's peel away the layers from the loaded buzz-word "disruptor". What excites me about $LMND?

Any order works, but my research process is this: I start with the opportunity/overview -> financials. If I like what I see, I dive into:

Any order works, but my research process is this: I start with the opportunity/overview -> financials. If I like what I see, I dive into:

14/ First, management. Schreiber (CEO) tech entrepreneur since the 90's. $LMND's visionary, masterfully raised $ in VC world, commanding high valuations.

He also seems a deep thinker, and a genuine and sincere guy. Insane Glassdoor ratings. I know $LMND employees; they love him!

He also seems a deep thinker, and a genuine and sincere guy. Insane Glassdoor ratings. I know $LMND employees; they love him!

15/ Shai (CTO & more) co-founded $FVRR before co-founding $LMND. Schreiber describes Shai as "his Da Vinci", famous for combining artistic aesthetic and science. World-class coder, product, and designer. I love the synergies their dynamic creates.

16/ Second, and tied into the management, is the culture. People just love working there. In an interview with @TomGardnerFool, Schreiber said the biggest cultural attribute at $LMND is empathy. Gotta love that, especially in 2020. But I double-love it when it drives $$$! -->

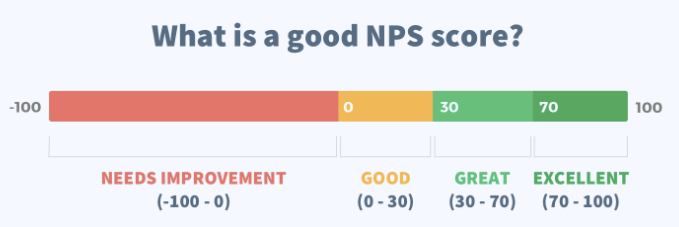

17/ Together, these affect customers. Lemonade boasts an NPS of 70 (considered ‘World Class’), $AMZN & $AAPL league. The top insurers in the US have an average NPS of under 20, & some are negative. No surprise though, right? No one likes their insurance company. Why should they?

18/ Classic insurance is inherently conflicted. Every dollar paid to customers, is a dollar less to the insurer's bottom line; they're competing for the same $. So customers don't trust the insurer will pay in their hour of need. That breeds fraud. And fraud = higher premiums.

19/ So Lemonade has an NPS of 70, similar to Amazon and Apple. What a stark contrast.

After all, we're talking about an insurance company.

So, what does $LMND do differently?

Essentially? Everything.

OK too much pathos, fair enough. But really, a lot.

After all, we're talking about an insurance company.

So, what does $LMND do differently?

Essentially? Everything.

OK too much pathos, fair enough. But really, a lot.

20/ The business model:

Borrows from Odysseus' Greek mythology travels. I'll sidetrack to tell the story for a second, I think it's worth it.

The Sirens were dangerous creatures, who lured nearby sailors to shipwreck on their island's rocky coast with their enchanting voices.

Borrows from Odysseus' Greek mythology travels. I'll sidetrack to tell the story for a second, I think it's worth it.

The Sirens were dangerous creatures, who lured nearby sailors to shipwreck on their island's rocky coast with their enchanting voices.

21/ Odysseus was curious to hear the Siren's voice - but no man had heard it and survived. So, he ordered his crew to plug their ears with wax and tie him to the mast, and not untie him no matter what, so he could hear their singing without killing himself and the crew.

22/ When he heard their beautiful song, he shouted to the sailors to untie him, but they did not. Only once out of Siren earshot did he signal to them it was safe to untie him. Odysseus didn't trust his future self with temptation, so he bound himself ahead of time.

23/ $LMND operates similarly: removing the inherent conflict which brings temptation. Co' takes a 25% flat fee of the premiums no matter how many claims there are. Broadly, if >75% of premiums are claimed, reinsurance pays. If less, excess $ go to charity of policyholder's choice

24/ There's double-whammy alignment there. One: consumers aren't fighting a nameless faceless greedy behemoth for their claims; the company doesn't make a cent denying the claim. Two: Embellishing claims doesn't hurt "big insurance", it hurts "local soup kitchen". Continued -->

25/ That's powerful. If you aren't a $LMND customer & you can't quite quantify whether or not this matters, talk to one; you're likely to hear good things (70 NPS). Sometimes, good customer reviews can be enough of a thesis. And compare those reviews to traditional insurers.. Eek

26/ So we've said management, company culture, customer satisfaction and alignment, capital-light proportional reinsurance, & brand new (brilliant) business model.

Let's talk experience.

Let's talk experience.

27/ Buying a renter's policy (as little as $5) takes a median time of 90 seconds; buying a coffee at $SBUX takes 4x that. Talking to AI-Maya (the onboarding bot) is breezy, cute and OMG level easy. Much fewer questions than usual, hassle-free, and dare I say - fun.

28/ Ah, shucks. You need to file a claim. You chat with AI Jim (claims bot), upload your police filing and a selfie video describing the incident. Today, $LMND pays around 1/3 claims automatically, WITHIN 3 SECONDS. Zero human interaction. Lots of fraud detection algorithms. Cool

29/ $LMND has 0 insurance brokers. Incumbents have tens of thousands. As Schreiber has said: those brokers, who were once THE asset, are now more of a liability. They cost money, they cost the potential customer's time, they don't scale, and CX will vary greatly accordingly.

30/ Schreiber (rough quote): "Historically, crushing costs comes at the expense of the consumer. Only technology can enable companies to crush costs WHILE delighting consumers." The company cuts cost while creating scalable solutions, and the consumer saves time, money & energy.

31/ So let's talk competish.

Incumbents are, on average, one hundred and twenty five years old (spelled out for extra emphasis). They are built upon legacy systems (Schreiber's interviews have nice anecdotes) and are very slow to move.

Incumbents are, on average, one hundred and twenty five years old (spelled out for extra emphasis). They are built upon legacy systems (Schreiber's interviews have nice anecdotes) and are very slow to move.

32/ "But wait. The incumbents are giants with savvy business people heading them, infinitely deep pockets, and they aren't going to let a nice UI overthrow them."

Ignoring the UI argument (by now so should you), there is truth in that.

Ignoring the UI argument (by now so should you), there is truth in that.

33/ Incumbents won't sit around and wait for their lunch to be eaten. I'm sure they will react, and do whatever they can to adapt to the 21st century.

Personally, I want to be long the actor and not the reactor.

Personally, I want to be long the actor and not the reactor.

34/ That's not it though. Deeply technological infrastructure - being built from scratch on a digital substrate - is a very powerful advantage.

Let's think about data, for a moment.

Incumbents are 125 years old. They must have virtually unlimited data and insights, no?

Let's think about data, for a moment.

Incumbents are 125 years old. They must have virtually unlimited data and insights, no?

35/ You guessed it. Not really.

When you talk to a broker and buy a policy, think how many signals are lost to the aether. The customer comes at 3 AM, is shifty, asks strange questions, and then buys a policy. Where does that info go?

You guessed it again. Nowhere much

When you talk to a broker and buy a policy, think how many signals are lost to the aether. The customer comes at 3 AM, is shifty, asks strange questions, and then buys a policy. Where does that info go?

You guessed it again. Nowhere much

36/ AI Maya collects around 1,000 times more data points in her interaction with a customer than traditional brokers, in a fraction of the time and while asking many fewer questions.

Thanks to the aforementioned infrastructure, that data is super useful.

Thanks to the aforementioned infrastructure, that data is super useful.

37/ It can then drive smarter ad campaigns, ultimately lowering CAC. But that's just the obvious part.

Story time: Customer tells AI Maya he keeps his scuba gear in his car, and just wants to make sure it's covered if stolen from there. Maya says yes, yes it is.

Story time: Customer tells AI Maya he keeps his scuba gear in his car, and just wants to make sure it's covered if stolen from there. Maya says yes, yes it is.

38/ Surprise! A week later, the scuba gear was stolen from his car.

A legacy provider wouldn't know that Q was ever asked. What connection is there b/w the sales rep in state X and the claims officer in state Y? Beats me.

$LMND has one system, mapping customers' entire journey.

A legacy provider wouldn't know that Q was ever asked. What connection is there b/w the sales rep in state X and the claims officer in state Y? Beats me.

$LMND has one system, mapping customers' entire journey.

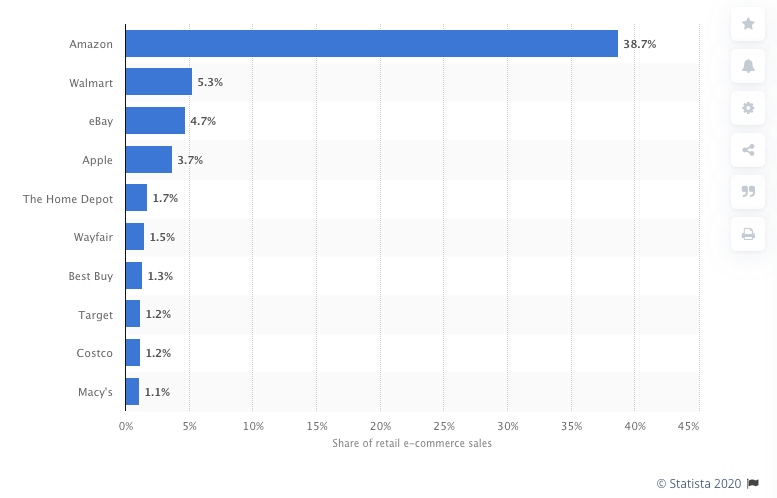

39/ Throwback to the early 00s. $AMZN is gearing up, and a common bear case was that all $WMT had to do is make a website. Then - $AMZN is toast.

That particular bear case didn't quite play out, obviously. But more interestingly, the divergence just became more acute.

That particular bear case didn't quite play out, obviously. But more interestingly, the divergence just became more acute.

40/ So yes, 15 years later, Walmart has joined the E-commerce game and is still around. But the 7X winner is clear to everyone, and $AMZN is now so much more than e-commerce.

Insurance is 11% of GDP. There's plenty of room for winners. Fortune 100 insurers have <4% market share.

Insurance is 11% of GDP. There's plenty of room for winners. Fortune 100 insurers have <4% market share.

41/ Naturally, I don't know how this plays out. My guess & my hope:

$LMND keeps aggressively expanding to new geographies and launching new product lines. Pet has been a great case study: the snowball's rolling. Let's see how:

$LMND keeps aggressively expanding to new geographies and launching new product lines. Pet has been a great case study: the snowball's rolling. Let's see how:

42/ New product lines boost LTV, and cross-selling is very lucrative. A large part of the business model is dependant on "graduation": acquiring customers young, by being a digital-first and 21st-century brand, keeping them satisfied, and "growing with them as their needs grow".

43/ A renter who adopts a pet is suddenly bringing in 4X premium with 0$ of additional CAC. Then they become a homeowner & pay 6X. Then get term-life, & hopefully auto in the future - and you get the picture. 0 extra CAC

That kind of upselling doesn't exist outside of insurance.

That kind of upselling doesn't exist outside of insurance.

44/ So an expanding product line, bringing in more $'s, faster & cheaper than the first $'s - demonstrate the operating leverage we're starting to see. LMND has a top-heavy model, spending a lot now to acquire cust., to have them pay back faster later w/ more product lines.

45/ That's the goal management states. Over time, they intend to offer all the insurance products their customers need, in as many geographies as possible. Par exemple, they just launched France, where homeowner's insurance is mandated by law

46/ I have a lot more to say about $LMND (and other companies I like), but it looks like Twitter really isn't the right medium for this kind of thing. Maybe I should have made this shorter, but wanted to try and capture the intangibles a little, since the financials are available

47/ Disclaimer 1: Generally, valuations are worth discussing. That being said, I have no edge when it comes to assessing bubbles or whatnot - so I won't be pondering on the valuation too much. Technical analysts can recommend entry points, if that's your kind of thing.

48/ Disclaimer 2: I am NOT a professional advisor, this is NOT advice or a recommendation to take any action regarding any equities. I hope readers got some color on what I think is a very exciting company, and are perhaps inspired to do their own DD.

@DivCultivator @LemonadeInvest @Couch_Investor @heydave7 @InvestmentTalkk @7investingSteve @TheMarkCooke Hey I know you guys follow the stock too, might interest you!

Read on Twitter

Read on Twitter