Little do people know that 𝐈𝐧𝐝𝐢𝐚 has silently built the best 𝐝𝐢𝐠𝐢𝐭𝐚𝐥 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 infrastructure in the world.

While most of the world is still using credit cards and cash, India has 𝐥𝐞𝐚𝐩-𝐟𝐫𝐨𝐠𝐠𝐞𝐝 into the future.

Here is how it all started...

While most of the world is still using credit cards and cash, India has 𝐥𝐞𝐚𝐩-𝐟𝐫𝐨𝐠𝐠𝐞𝐝 into the future.

Here is how it all started...

India has had a long history of 𝐜𝐨𝐫𝐫𝐮𝐩𝐭𝐢𝐨𝐧 and 𝐛𝐥𝐚𝐜𝐤 𝐦𝐨𝐧𝐞𝐲.

Examples of black money include money obtained through selling illegal goods (e.g. drugs) and activities (e.g. human trafficking, funding terrorism)... you get the point.

Examples of black money include money obtained through selling illegal goods (e.g. drugs) and activities (e.g. human trafficking, funding terrorism)... you get the point.

Obviously, this is not conducive to economic growth and prosperity, and is especially not conducive to collecting taxes ;)

Therefore, curtailing this shadow economy became a priority for the Indian government starting in the last 90s and early 2000s with the 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧 𝐨𝐟 𝐌𝐨𝐧𝐞𝐲 𝐋𝐚𝐮𝐧𝐝𝐞𝐫𝐢𝐧𝐠 𝐀𝐜𝐭.

That was a good first step, but not enough to extinguish the shadow economy.

That was a good first step, but not enough to extinguish the shadow economy.

In November 2016, the government of India took sweeping measures to combat the shadow economy. They 𝐝𝐞𝐦𝐨𝐧𝐞𝐭𝐢𝐳𝐞𝐝 ALL ₹500 and ₹1,000 banknotes.

Indians were given 50 days trade in their old demonitized notes for the freshly printed ₹2,000 notes.

Next thing we knew, there were long lines at banks and ATMs as people scurried to trade in their hard-earned money. It got so bad that some people even died in the process.

Next thing we knew, there were long lines at banks and ATMs as people scurried to trade in their hard-earned money. It got so bad that some people even died in the process.

The government predicted that 𝟐𝟎% of the demonitized notes would be removed from circulation. It turned out that they were VERY wrong.

After all is said and done, 𝟗𝟗.𝟑% of all the demonetised banknotes were deposited with banks and only 0.7% was not.

Why?

After all is said and done, 𝟗𝟗.𝟑% of all the demonetised banknotes were deposited with banks and only 0.7% was not.

Why?

Because black money holders keep 6% or less of their wealth in cash. Most of it is held in the form of real estate, bullion, and jewelry.

So targeting cash was not a successful strategy.

So targeting cash was not a successful strategy.

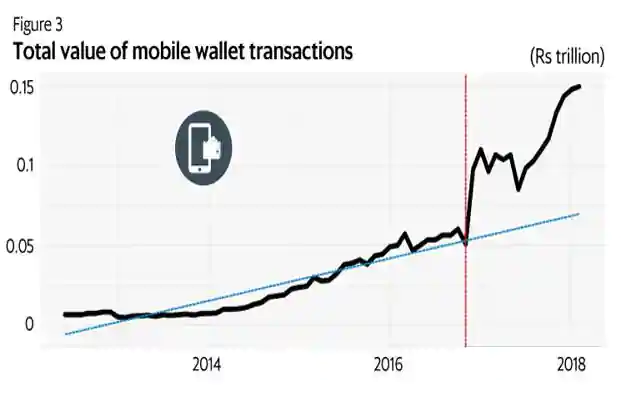

Something interesting was also happening in parallel to the 2016 demonitization.

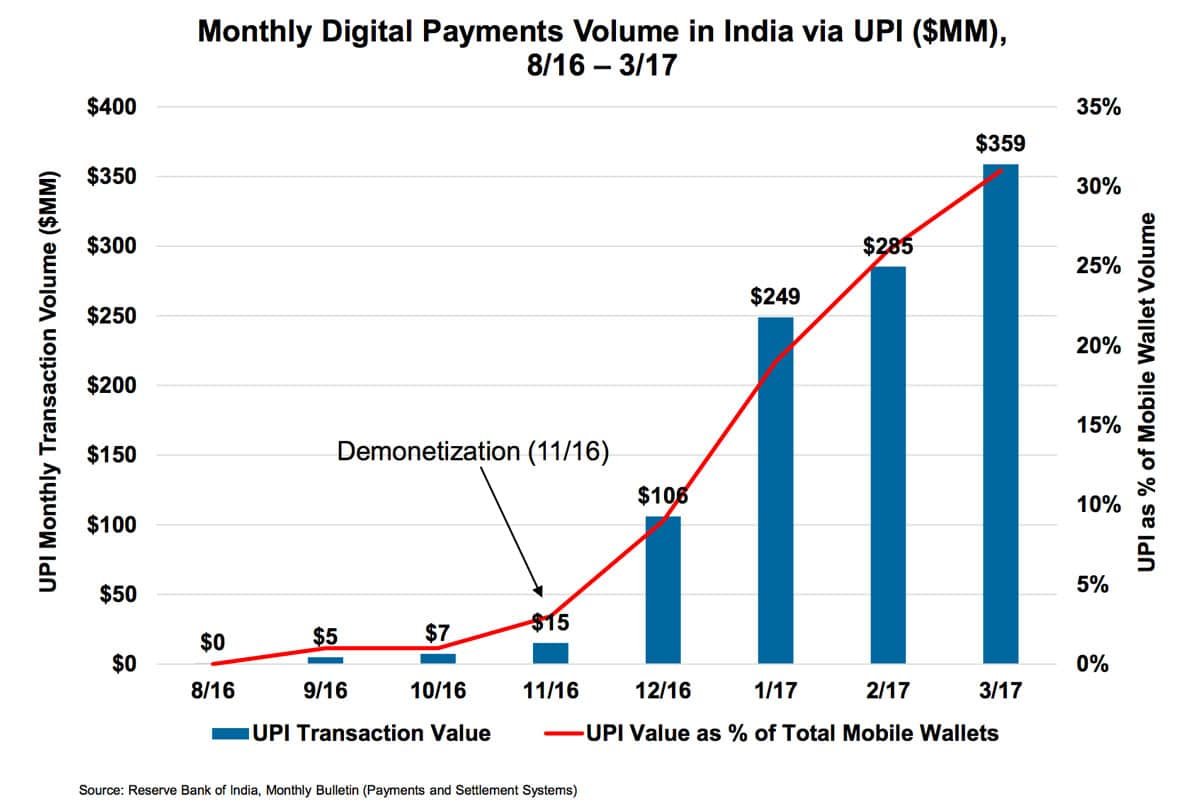

About 6 months before the demonetization, there was the launch of something revolutionary called “𝐔𝐏𝐈” by the Indian government.

About 6 months before the demonetization, there was the launch of something revolutionary called “𝐔𝐏𝐈” by the Indian government.

UPI is a real-time 𝐢𝐧𝐭𝐞𝐫-𝐛𝐚𝐧𝐤 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐬𝐲𝐬𝐭𝐞𝐦 built by National Payments Corporation of India (NPCI) and is regulated by the Reserve Bank of India (i.e. the central bank of India)

http://cashlessindia.gov.in/upi.html

http://cashlessindia.gov.in/upi.html

Any bank or financial institution can provide its own UPI-based app for Android, Windows and iOS.

Anyone who has a 𝐛𝐚𝐧𝐤 𝐚𝐜𝐜𝐨𝐮𝐧𝐭, 𝐦𝐨𝐛𝐢𝐥𝐞 𝐩𝐡𝐨𝐧𝐞, and 𝐢𝐧𝐭𝐞𝐫𝐧𝐞𝐭 can download a UPI app and send money to another person who has a bank account.

Anyone who has a 𝐛𝐚𝐧𝐤 𝐚𝐜𝐜𝐨𝐮𝐧𝐭, 𝐦𝐨𝐛𝐢𝐥𝐞 𝐩𝐡𝐨𝐧𝐞, and 𝐢𝐧𝐭𝐞𝐫𝐧𝐞𝐭 can download a UPI app and send money to another person who has a bank account.

Owing to 𝐬𝐡𝐨𝐫𝐭𝐚𝐠𝐞𝐬 𝐨𝐟 𝐜𝐚𝐬𝐡 after the demonitization, everyone started accepting UPI-based digital payments, including street vendors.

Indians were now able to digitally pay for their groceries, drivers, phone bills, and so much more.

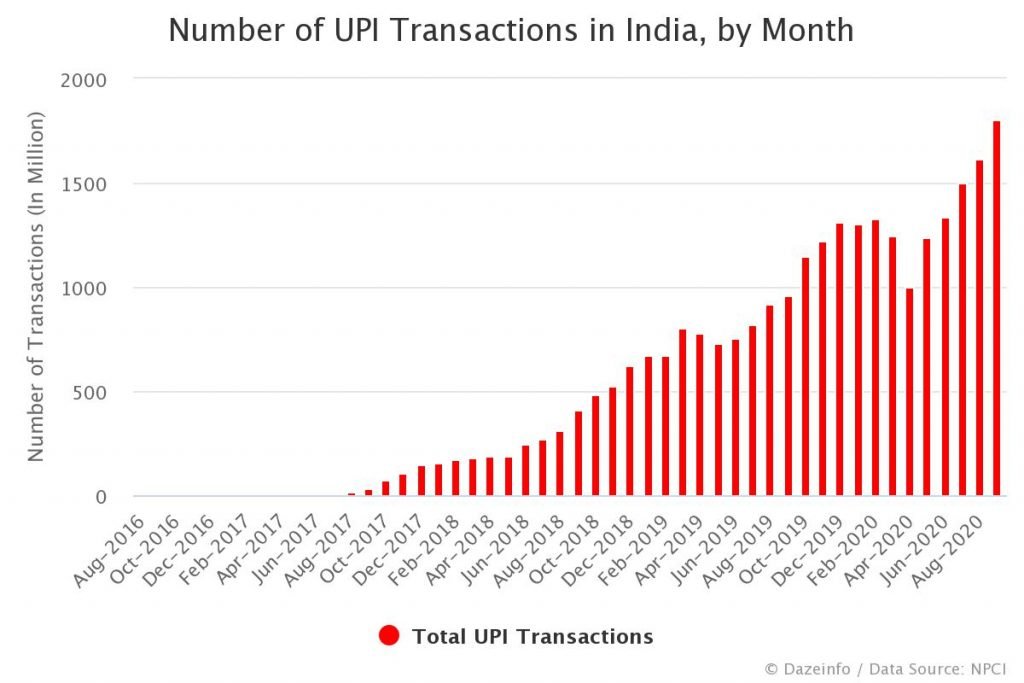

UPI-based digital payments exploded.

UPI-based digital payments exploded.

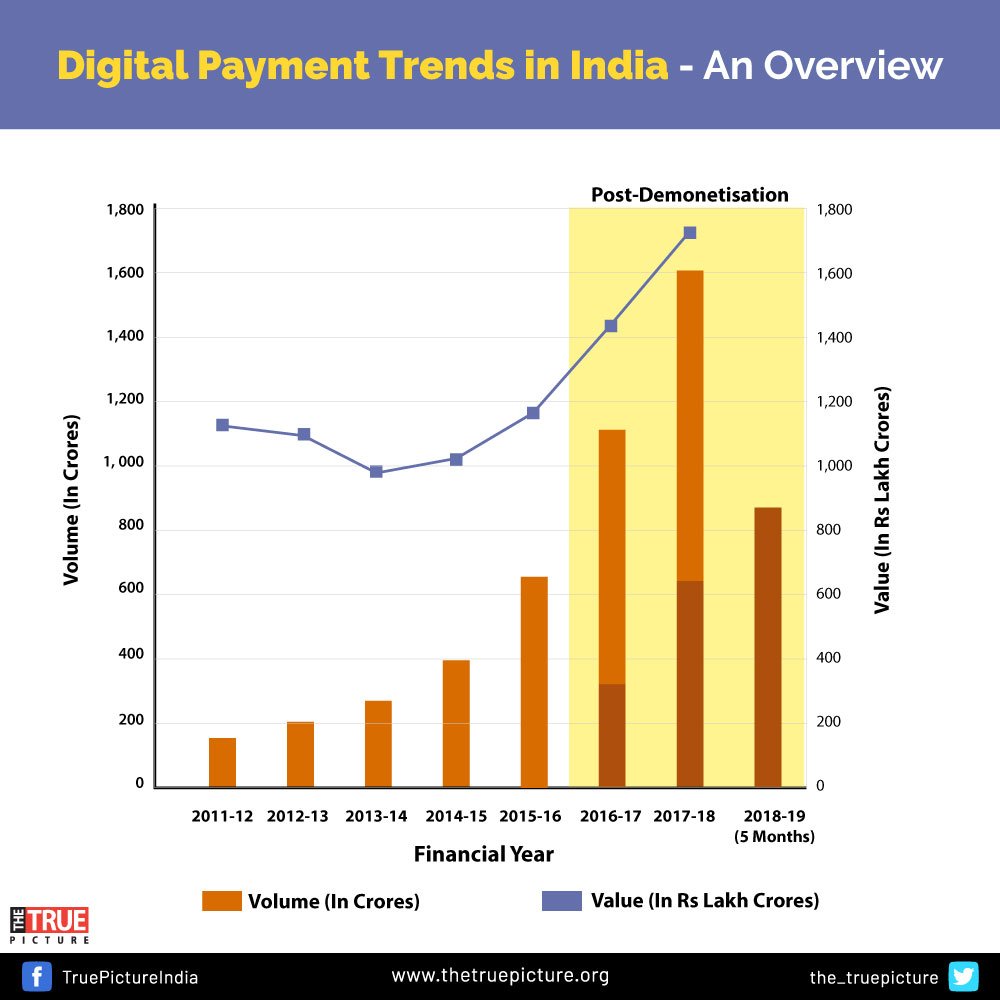

So while the 2016 demonetization was not very successful, a second order effect of it was the 𝐞𝐱𝐩𝐥𝐨𝐬𝐢𝐨𝐧 𝐨𝐟 𝐝𝐢𝐠𝐢𝐭𝐚𝐥 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 in India.

By April 2018, the volume of the digital payments had doubled.

By April 2018, the volume of the digital payments had doubled.

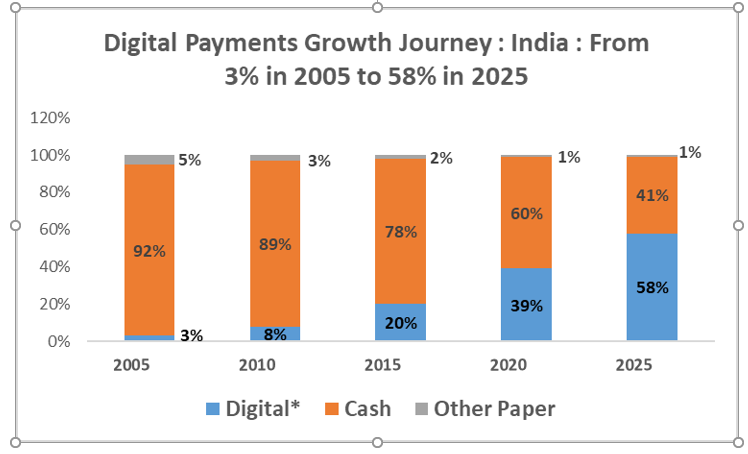

Indians went from a cash economy to a digital one almost overnight.

And that trend is expected to grow.

And that trend is expected to grow.

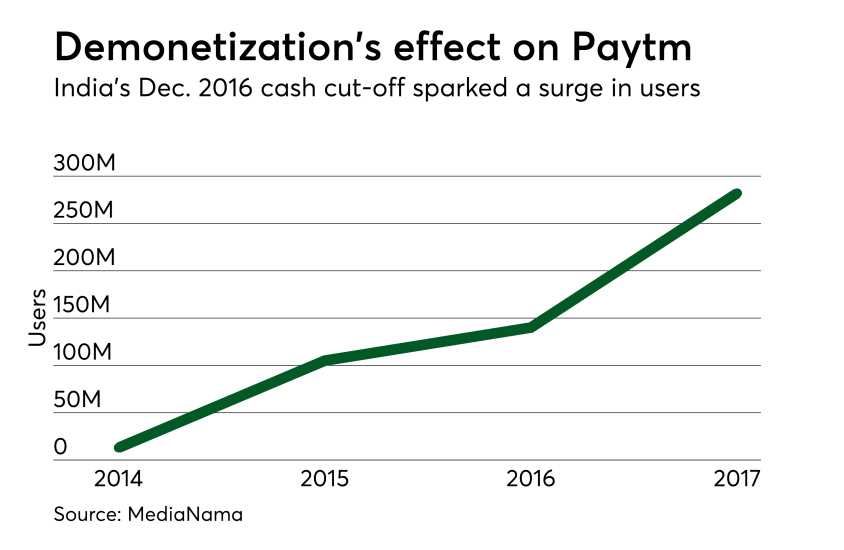

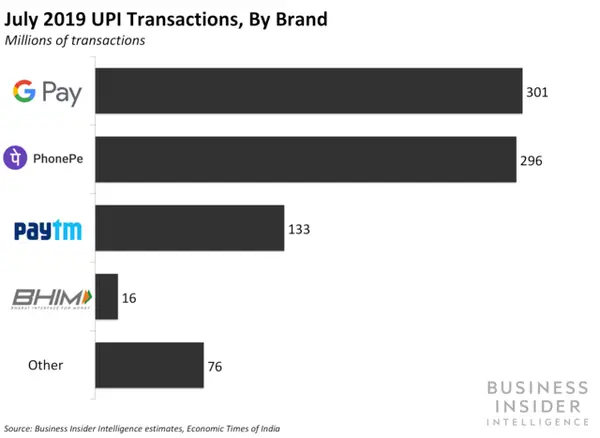

𝐆𝐨𝐨𝐠𝐥𝐞 was quick to realize the huge potential of UPI and launched a UPI based app in 2017 called 𝐆𝐨𝐨𝐠𝐥𝐞 𝐏𝐚𝐲.

It was an instant hit in India. Within 2 years, it beat all the other local players like PayTm and PhonePe:

It was an instant hit in India. Within 2 years, it beat all the other local players like PayTm and PhonePe:

𝐖𝐡𝐚𝐭𝐬𝐀𝐩𝐩 also just launched WhatsApp payments in India which lets people send money as easily as sending a message.

Mark Zuckerberg said WhatsApp payments was only possible because of the UPI system. https://www.indiatoday.in/technology/news/story/whatsapp-pay-in-india-was-possible-because-of-upi-system-says-facebook-s-zuckerberg-1749802-2020-12-15

Mark Zuckerberg said WhatsApp payments was only possible because of the UPI system. https://www.indiatoday.in/technology/news/story/whatsapp-pay-in-india-was-possible-because-of-upi-system-says-facebook-s-zuckerberg-1749802-2020-12-15

The scale and speed of UPI is unimaginable. Over 𝟏𝟒𝟎 𝐛𝐚𝐧𝐤𝐬 are now on UPI.

UPI transactions nearly doubled in Q3 2020 due to COVID and it hit 𝟐.𝟐 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬 𝐩𝐞𝐫 𝐦𝐨𝐧𝐭𝐡 in November 2020.

UPI transactions nearly doubled in Q3 2020 due to COVID and it hit 𝟐.𝟐 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬 𝐩𝐞𝐫 𝐦𝐨𝐧𝐭𝐡 in November 2020.

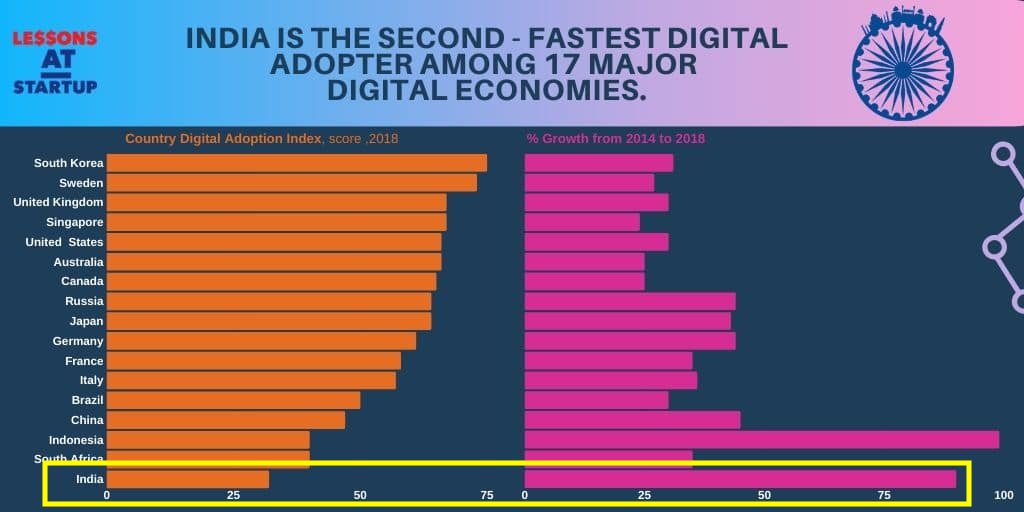

Emerging countries around the world are starting to take notice. They asked NPCI to develop similar technologies for their countries. https://trak.in/tags/business/2020/10/30/upis-success-will-be-replicated-across-asia-npci-plans-expansion-in-malaysia-uae-singapore-more/

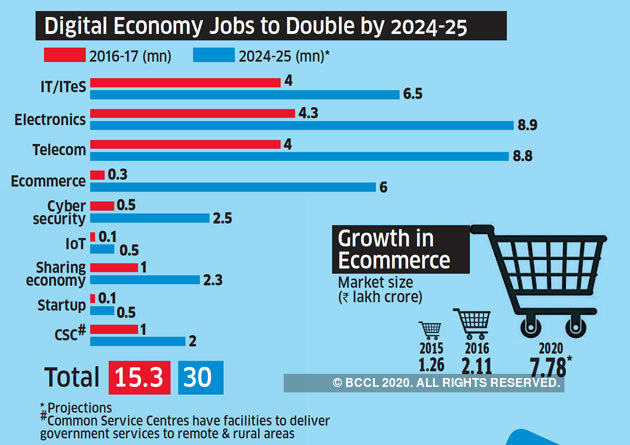

With the most advanced financial infrastructure in the world, India is undoubtedly going to see a massive explosion in the digital economy.

Read on Twitter

Read on Twitter