How many times have you heard that Bitcoin is too risky... that Bitcoin is too volatile... that Bitcoin is a bubble?

Personally, all I can see is that #Bitcoin is off the charts.

is off the charts.

Time for a thread

Personally, all I can see is that #Bitcoin

is off the charts.

is off the charts.Time for a thread

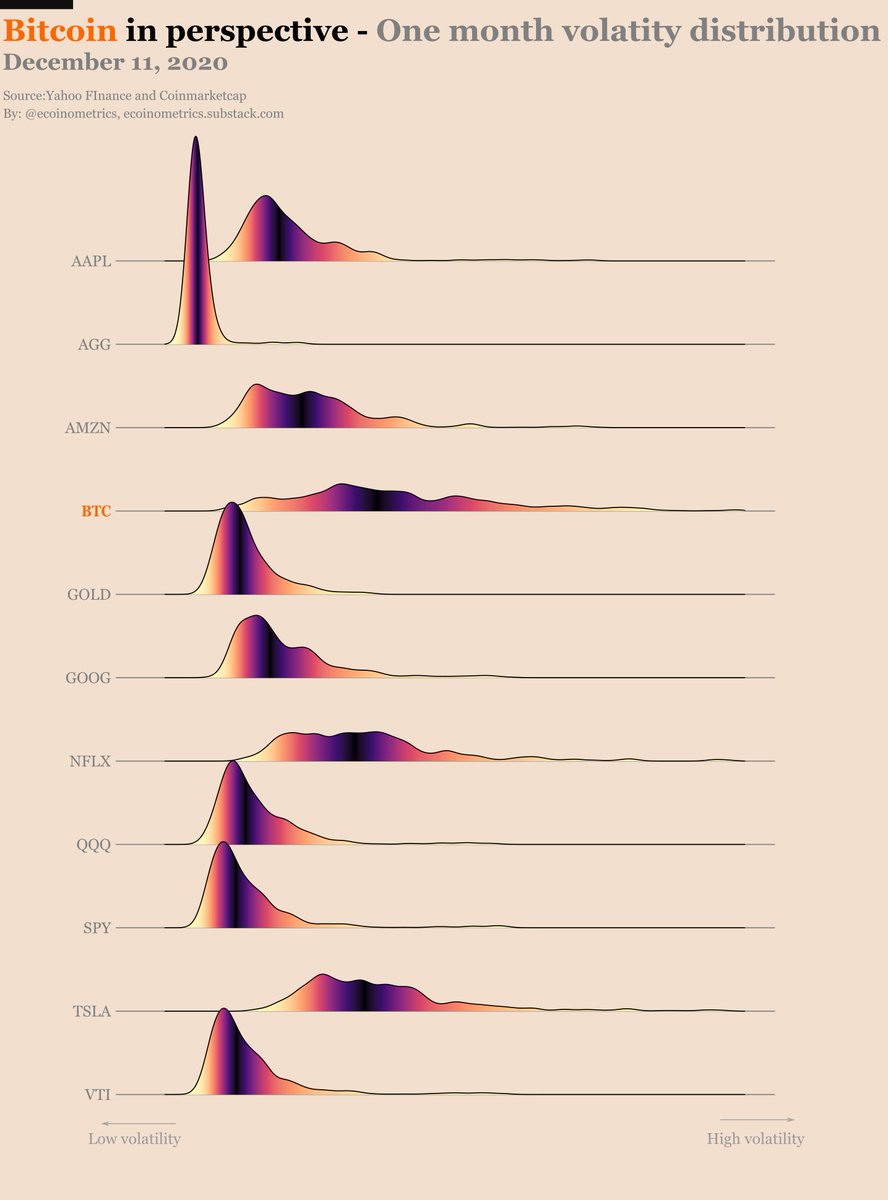

1/ When it comes to volatility #Bitcoin  behaves more like a high growth tech stock than gold or your standard ETF.

behaves more like a high growth tech stock than gold or your standard ETF.

Among other things that means a big part of this volatility comes from upside moves.

behaves more like a high growth tech stock than gold or your standard ETF.

behaves more like a high growth tech stock than gold or your standard ETF.Among other things that means a big part of this volatility comes from upside moves.

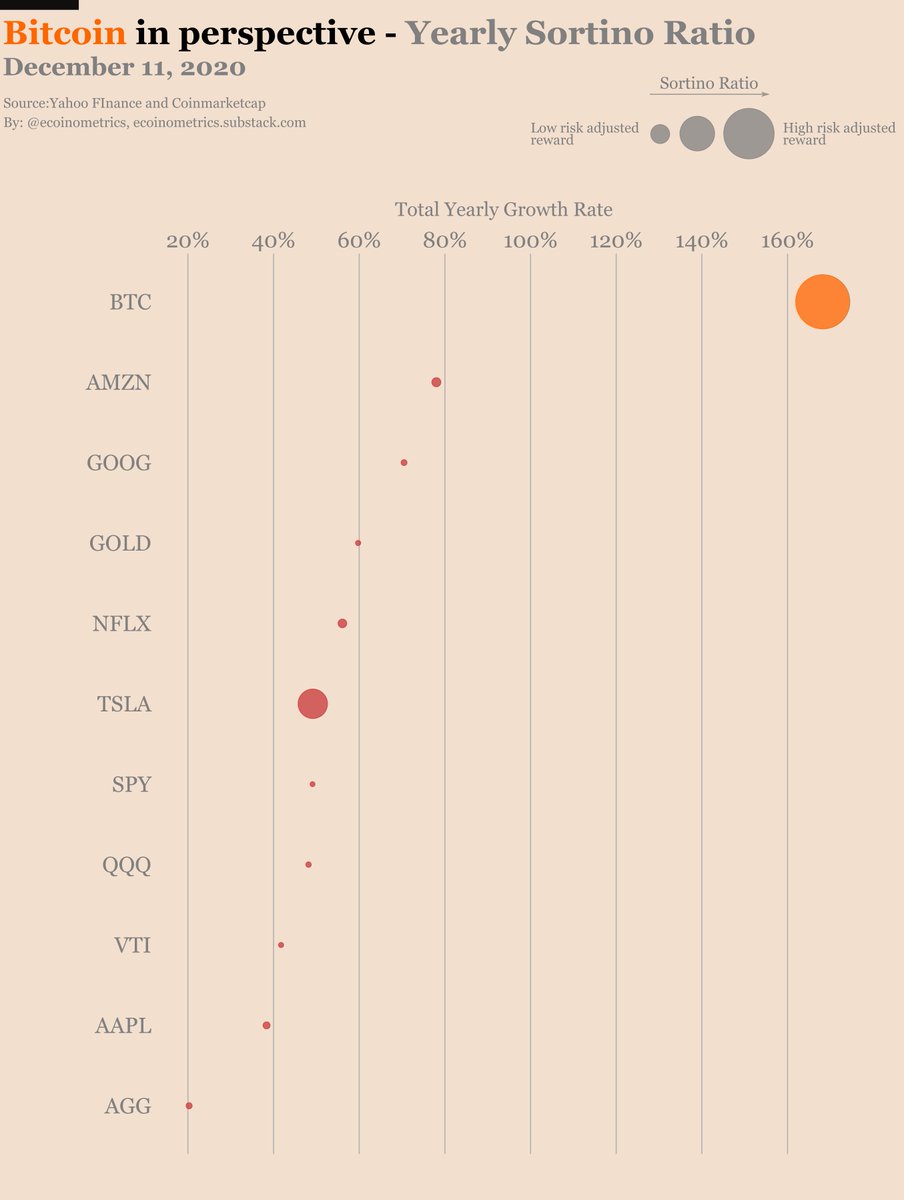

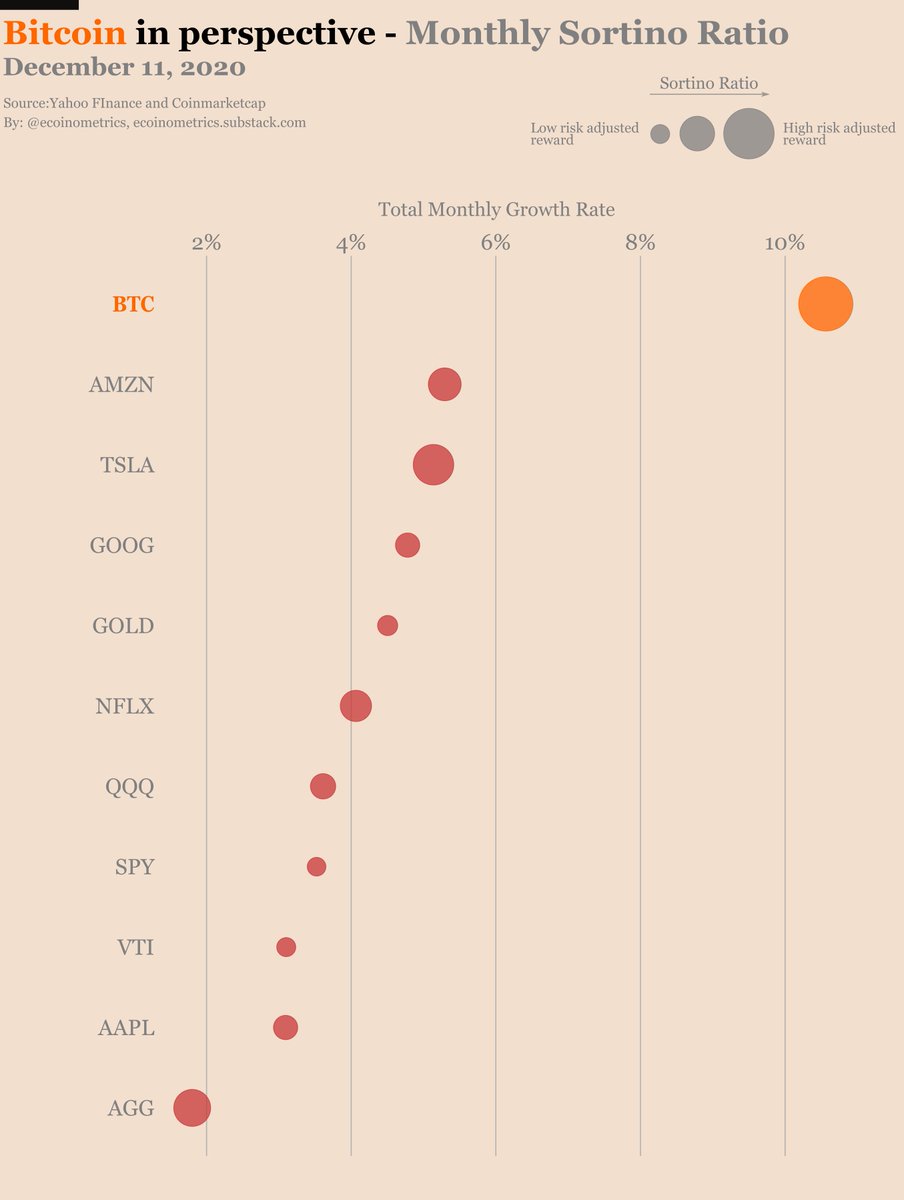

2/ To compare #Bitcoin  with those assets I’ve looked at two metrics calculated over their lifetime:

with those assets I’ve looked at two metrics calculated over their lifetime:

- The growth rate as a measure of total returns.

- The Sortino ratio as a measure of risk adjusted returns.

Results

with those assets I’ve looked at two metrics calculated over their lifetime:

with those assets I’ve looked at two metrics calculated over their lifetime:- The growth rate as a measure of total returns.

- The Sortino ratio as a measure of risk adjusted returns.

Results

3/ On a yearly basis #Bitcoin  has the best risk adjusted return and the fastest growth rate by a huge margin.

has the best risk adjusted return and the fastest growth rate by a huge margin.

has the best risk adjusted return and the fastest growth rate by a huge margin.

has the best risk adjusted return and the fastest growth rate by a huge margin.

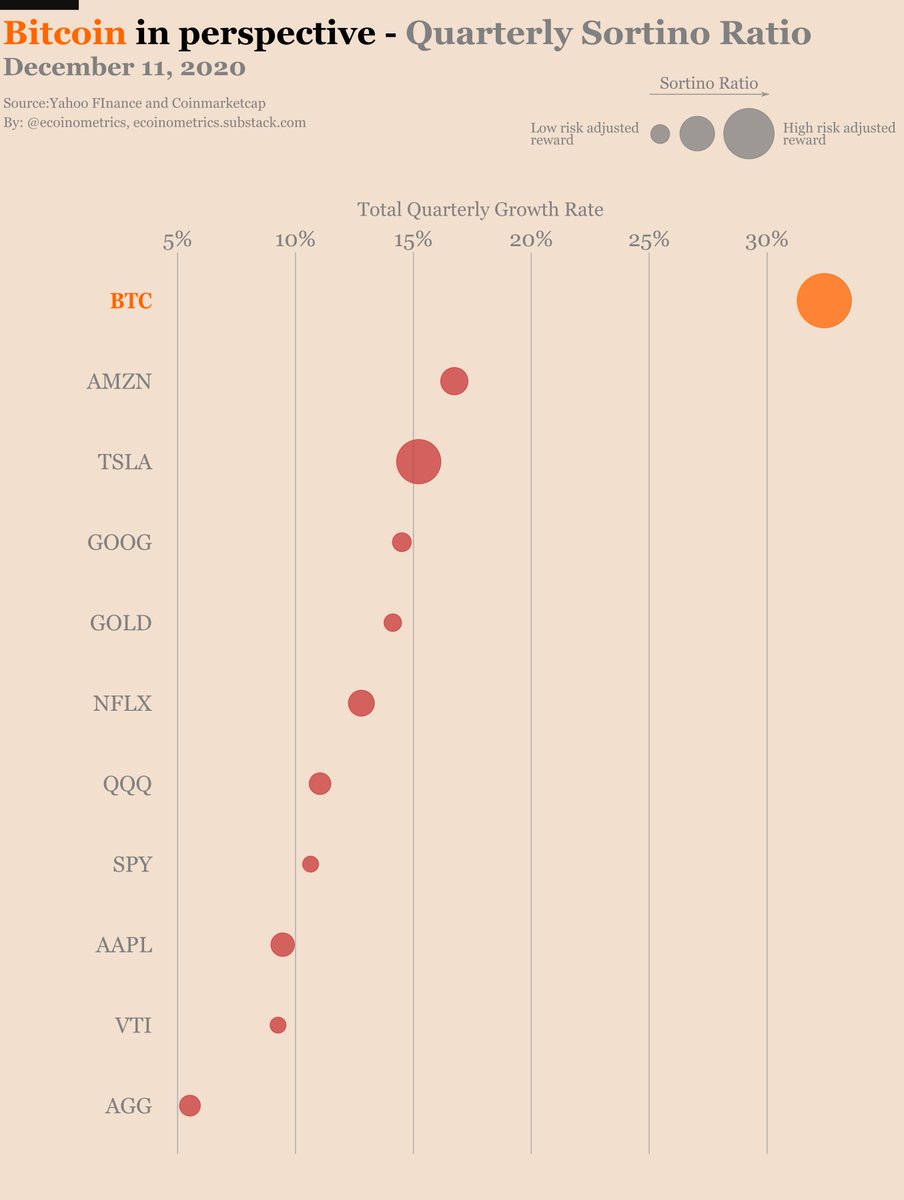

4/ On a quarterly basis #Bitcoin  has the best risk adjusted return and the fastest growth rate.

has the best risk adjusted return and the fastest growth rate.

At this scale #BTC is closer to $TSLA in terms of risk adjusted returns but still grows much faster.

is closer to $TSLA in terms of risk adjusted returns but still grows much faster.

has the best risk adjusted return and the fastest growth rate.

has the best risk adjusted return and the fastest growth rate. At this scale #BTC

is closer to $TSLA in terms of risk adjusted returns but still grows much faster.

is closer to $TSLA in terms of risk adjusted returns but still grows much faster.

6/ TL;DR by investing in #Bitcoin  you are betting on the fastest horse with the best risk adjusted returns.

you are betting on the fastest horse with the best risk adjusted returns.

So there is really no reason for leaving it out of your portfolio.

Full details in here https://ecoinometrics.substack.com/p/ecoinometrics-december-16-2020

https://ecoinometrics.substack.com/p/ecoinometrics-december-16-2020

you are betting on the fastest horse with the best risk adjusted returns.

you are betting on the fastest horse with the best risk adjusted returns. So there is really no reason for leaving it out of your portfolio.

Full details in here

https://ecoinometrics.substack.com/p/ecoinometrics-december-16-2020

https://ecoinometrics.substack.com/p/ecoinometrics-december-16-2020

Read on Twitter

Read on Twitter