1/ What does a shrinking market for internal combustion engine cars (ICEs)

in the EU mean for the future competitiveness of the

in the EU mean for the future competitiveness of the  petrochemical industry? Some initial thoughts and questions. Thread: #EUGreenDeal #industry

petrochemical industry? Some initial thoughts and questions. Thread: #EUGreenDeal #industry

in the EU mean for the future competitiveness of the

in the EU mean for the future competitiveness of the  petrochemical industry? Some initial thoughts and questions. Thread: #EUGreenDeal #industry

petrochemical industry? Some initial thoughts and questions. Thread: #EUGreenDeal #industry

2/ Let's first take a look at some targets for bans of ICE sales:

2025:

2030:

2035: California

California

2040:

I'm sure I forgot some countries. Pls let me know.

Thanks @PhilippLitz for inspiration

2025:

2030:

2035:

California

California2040:

I'm sure I forgot some countries. Pls let me know.

Thanks @PhilippLitz for inspiration

3/ Note that all these targets were announced before the EU Council decision to increase the EU 2030 climate target from -40% to at least -55%. But even in countries without ICE bans, market penetration of e-mobility will have enormous consequences for refinery output.

4/ Fulfilling the  2030 target of -55% will likely lead to a significant decline in refinery output. According to our modelling results for

2030 target of -55% will likely lead to a significant decline in refinery output. According to our modelling results for  : -46% refinery output by 2030

: -46% refinery output by 2030

The main drivers for this:

1.) increase of electric mobility in transport

2.) reduced heating oil demand

2030 target of -55% will likely lead to a significant decline in refinery output. According to our modelling results for

2030 target of -55% will likely lead to a significant decline in refinery output. According to our modelling results for  : -46% refinery output by 2030

: -46% refinery output by 2030The main drivers for this:

1.) increase of electric mobility in transport

2.) reduced heating oil demand

5/ What's the typical output of an EU refinery? Most of them are optimised to produce high yields of transport fuel. Numbers are rough estimates:

Usually around 80% of refinery output are liquid fuels (gasoline and diesel approx. 65%, heating oil 15%). Around 10% is naphtha.

Usually around 80% of refinery output are liquid fuels (gasoline and diesel approx. 65%, heating oil 15%). Around 10% is naphtha.

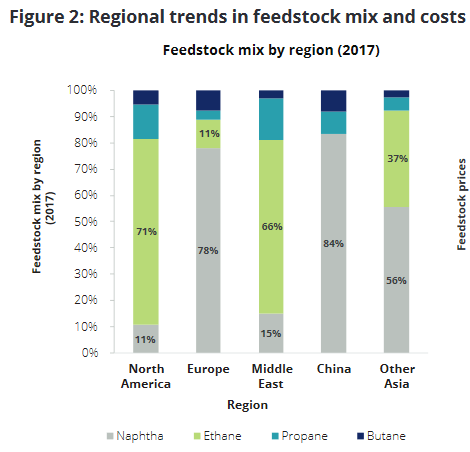

6/ Why does it matter for the EU petrochemical industry? Because it relies to a large extent on naphtha as a feedstock, which is a refinery product. For EU petrochemicals, naphtha makes up a staggering 78%. Figure from @Deloitte Report "The Future of Petrochemicals"

7/ Now, if the demand for transport fuels decreases significantly because of e-mobility, what does it mean for the business cases of refineries and the production of naphtha? Are single refineries with significantly decreased sales volumes still profitable or will they close?

8/ Also: I don't know to what extent refineries can adjust their product split so that some oil fractions that used to go into transport fuel markets are used for production of naphtha. But no matter what, from the perspective of EU petrochemicals the trend is not your friend.

9/ What are solutions to this problem? What can compensate for refinery-based naphtha as a feedstock?

1.) chemical recycling (feedstock from plastic waste)

2.) innovative bio-based polymers

3.) PtX (green naphtha, likely imported)

4.) BiotX (requires sustainable biomass)

1.) chemical recycling (feedstock from plastic waste)

2.) innovative bio-based polymers

3.) PtX (green naphtha, likely imported)

4.) BiotX (requires sustainable biomass)

10/ These climate-neutral technologies need to be developed and deployed before 2030 if the  petrochemicals want to sustain current production levels. Considering current TRL levels of these technologies, this is a challenge but definitively possible. What's the alternative?

petrochemicals want to sustain current production levels. Considering current TRL levels of these technologies, this is a challenge but definitively possible. What's the alternative?

petrochemicals want to sustain current production levels. Considering current TRL levels of these technologies, this is a challenge but definitively possible. What's the alternative?

petrochemicals want to sustain current production levels. Considering current TRL levels of these technologies, this is a challenge but definitively possible. What's the alternative?

11/ Fossil-based intermediary solutions are tricky imo:

1. Import fossil naphtha -> no CO2 reduction for EU 2030 -55%

2. Ethane -> requires capital-intensive retrofit or new cracker ->long amortisation ->what happens if shale gas production in US is banned before 2050?

1. Import fossil naphtha -> no CO2 reduction for EU 2030 -55%

2. Ethane -> requires capital-intensive retrofit or new cracker ->long amortisation ->what happens if shale gas production in US is banned before 2050?

12/ With battery prices declining at such a rapid pace as described by @BloombergNEF , some analysts project that by 2023 the price of e-cars may be similar to ICE cars. This would only accelerate the trends I described. https://about.bnef.com/blog/battery-pack-prices-cited-below-100-kwh-for-the-first-time-in-2020-while-market-average-sits-at-137-kwh/

13/ Maybe I'm missing something substantial, but to me it seems we urgently need a strategy for the EU petrochemical industry - and we need it fast. Otherwise, this may cause massive carbon leakage. @Cefic @gnievchenko, @andreasgraf @JMGlachant @RENEWIndustry @Sustainable2050

Read on Twitter

Read on Twitter