Spent some time this weekend researching $SKLZ investor presentation. Thread

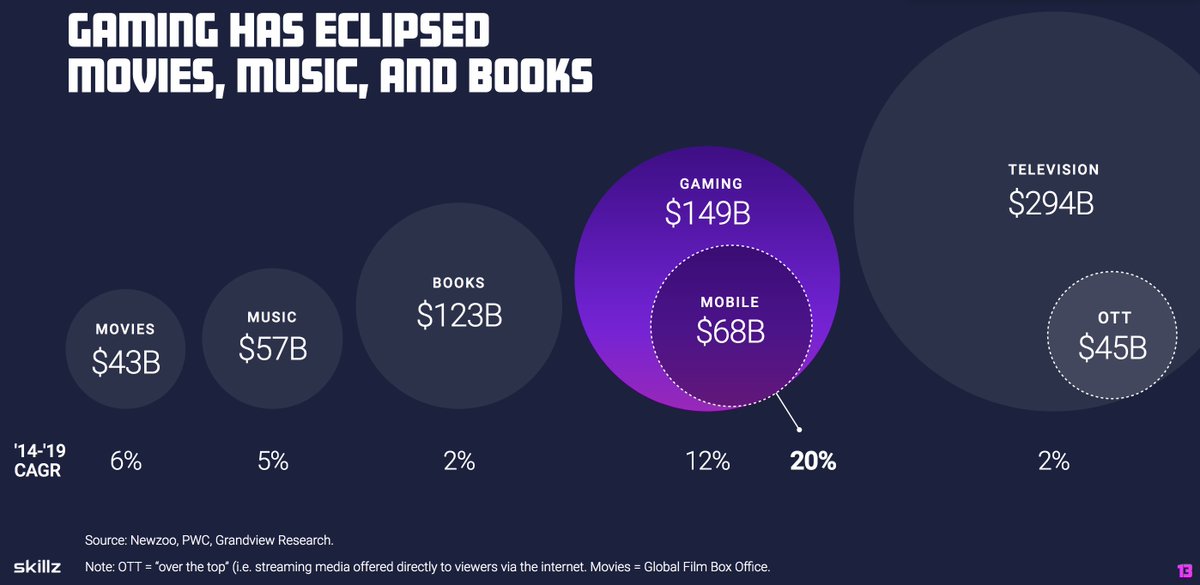

The gaming industry is larger than movies, music, and books, with more than 2.7 billion gamers playing monthly and 10 million developers worldwide. Image Source - Skillz Investor Relations

The gaming industry is larger than movies, music, and books, with more than 2.7 billion gamers playing monthly and 10 million developers worldwide. Image Source - Skillz Investor Relations

Mobile is the fastest-growing segment of the gaming market, expected to increase from $68 billion last year to $150 billion in 2025 (according to Newzoo and GlobalData).

eSports is a nascent industry and as per Statista, in 2020, the global eSports Revenues valued at just over $ 950M . eSports market revenue expected to reach 1.6 billion U.S. dollars in 2023.Skillz $SKLZ is the first mobile esports platform to go public.

$SKLZ started trading as a public company last week after completion of its merger with Flying Eagle Acquisition Corp, SPAC headed by Hollywood industry veterans Harry Sloan and Jeff Sagansky. The acquisition valued the company at $3.5 billion

Skillz has earned recognition as one of Fast Company’s Most Innovative Companies, a two-time winner of CNBC’s Disruptor 50, Forbes’ Next Billion-Dollar Startups, and the #1 fastest-growing company in America on the Inc. 5000

Skillz has pioneered the future of the gaming industry, enabling developers to monetize their content five times better than ads or in-app purchases

Skillz is an online mobile multiplayer competition platform that is integrated into a number of iOS and Android games. Players use it to compete in competitions against other players across the world.

$SKLZ makes money when participants pay to take part in games (built using its platform) involving cash prizes. Take rate is currently at 14% and the company intends to increase it to 20% in the long term.

Andrew Paradise, the founder & CEO owns 18% of the company. $SKLZ will have a dual class stockholder structure with super voting rights for Andrew at a ratio of 20:1

24 Month lockup period for the majority of all the stocks owned by existing stockholders. 1.5M stocks release per stockholder commencing every quarter after 180 days post-closing

As would be expected, $SKLZ is unprofitable now, massively so and aggressively investing in new customer acquisition. Its Revenue YTD is $162M, Up 91% YOY. Estimated revenue for 2020 is $225M. Gross margin was 95% during the third quarter of 2020

All company specific info from Skillz Investor Presentation and Investor Relations page - https://s26.q4cdn.com/331039098/files/doc_multimedia/presentations/Skillz-Overview-Q2-20-TTW-v090120vFinal.pdf

Read on Twitter

Read on Twitter