Here’s me trying to make sense of the unprecedented 2020 bull rally of stock markets.

(A thread)

(A thread)

1/ The simple answer to why stock markets are up is always that there’s more demand for stocks than supply.

So the real question is: why is there more demand for stocks?

So the real question is: why is there more demand for stocks?

2/ Actually, what’s happening is what should happen.

Central banks across the world, especially the fed in the US, are providing cheap liquidity across the board to institutions.

With interest rates falling to 0% and below, bonds are no longer attractive.

Central banks across the world, especially the fed in the US, are providing cheap liquidity across the board to institutions.

With interest rates falling to 0% and below, bonds are no longer attractive.

3/ The central banks are injecting this extra liquidity to stimulate economic activity.

They’ve made risk-free investments such as bonds so unattractive that the only place for money to go is towards relatively risky investments which are stocks.

They’ve made risk-free investments such as bonds so unattractive that the only place for money to go is towards relatively risky investments which are stocks.

4/ More than anything else, what central banks want is inflation.

They want things to become pricey so wages grow, profits grow and people’s perception of recession goes away because you’re getting more money than last year.

They want things to become pricey so wages grow, profits grow and people’s perception of recession goes away because you’re getting more money than last year.

5/ Of course, it doesn’t work this simply.

Instead of inflation of wages and consumer products, we are seeing inflation of stock prices.

We are not seeing inflation of employee wages and consumer products because supply of these is more than demand.

Instead of inflation of wages and consumer products, we are seeing inflation of stock prices.

We are not seeing inflation of employee wages and consumer products because supply of these is more than demand.

6/ Instead what’s scarce by definition - stocks - is going up in price.

Central banks are underestimating how many people are needed to run economies these days.

It’s tech and tech causes decrease in prices for consumers.

Central banks are underestimating how many people are needed to run economies these days.

It’s tech and tech causes decrease in prices for consumers.

7/ So no matter how much liquidity you pump, prices will not go up.

What will go up is stocks.

What will go up is stocks.

8/ But in a way, economy is doing what central banks want it to do: chasing riskier projects which hopefully will create more jobs in future.

9/ So when investors ditch the sureshot 0% return by a bank (that further invests in sureshot projects) to chase high-risk, high-returns gambles like Tesla, that’s exactly what central banks want.

10/ So when investors ditch the sureshot 0% return by a bank (that further invests in sureshot projects) to chase high-risk, high-returns gambles like Tesla, that’s exactly what central banks want.

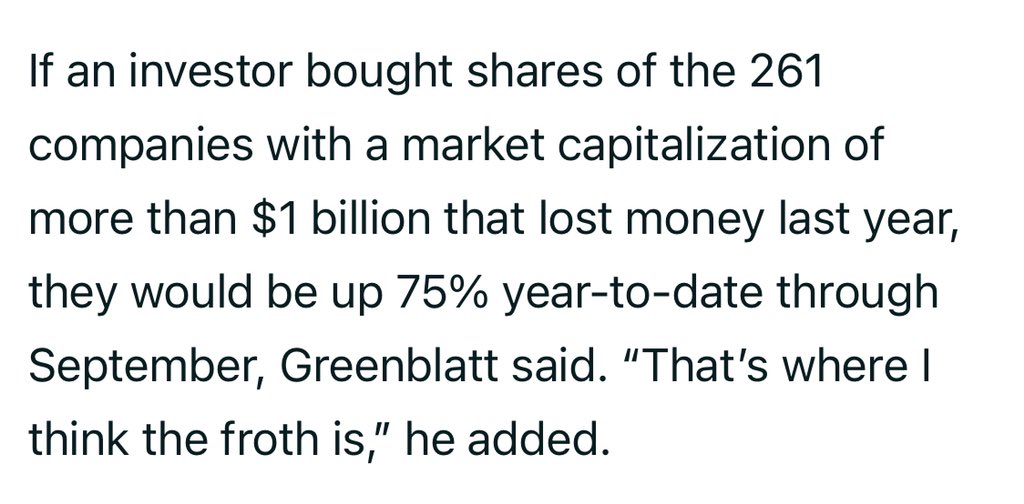

11/ What’s most fascinating to me about the whole game is that it’s the *loss* making companies that’s getting their shares touch the moon.

Why?

https://www.barrons.com/articles/what-investors-need-to-know-todays-market-values-according-to-joel-greenblatt-51604574001

Why?

https://www.barrons.com/articles/what-investors-need-to-know-todays-market-values-according-to-joel-greenblatt-51604574001

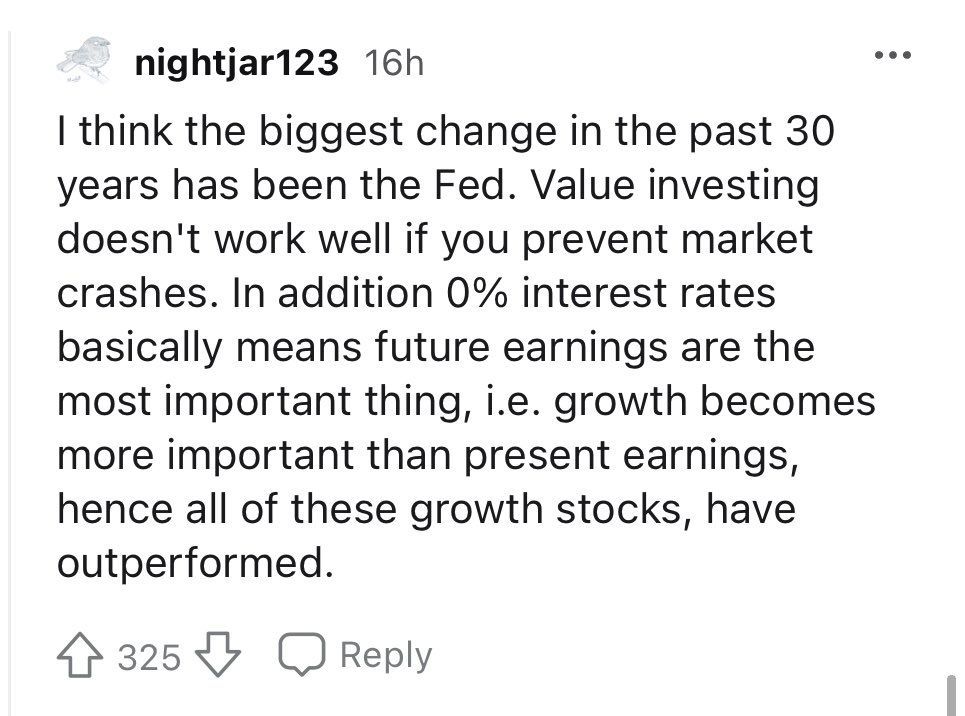

12/ I think the answer to it is beautifully put by this Redditor

https://www.reddit.com/r/investing/comments/kg89w8/with_how_much_the_world_has_changed_the_past_30/?utm_source=share&utm_medium=ios_app&utm_name=iossmf

https://www.reddit.com/r/investing/comments/kg89w8/with_how_much_the_world_has_changed_the_past_30/?utm_source=share&utm_medium=ios_app&utm_name=iossmf

13/ Think about it: when interest rates are low, and the money you’re investing is something you *dont* want to consume today: you prefer future profits than today’s profits.

14/ You start preferring companies that reinvest all their profits at a >0% return vs returning you profits as dividends and you not knowing what to do with that money.

15/ This is why loss making companies are having sky-high valuations.

Nobody wants their money back at 0% interest regime.

Nobody wants their money back at 0% interest regime.

16/ In that sense, “safe stocks” that return a healthy profit/dividend are more like 0% interest bonds.

You don’t want a dollar today. You want five tomorrow, even if that comes with a risk.

You don’t want a dollar today. You want five tomorrow, even if that comes with a risk.

17/ I feel there may be a certain natural bias towards growth-oriented companies like Tesla.

When you invest in stock market, you really dont want to consume that money and hence naturally seek future growth over today’s growth.

When you invest in stock market, you really dont want to consume that money and hence naturally seek future growth over today’s growth.

18/ In nutshell: when there’s excess money in circulation, it seeks risk.

That’s what’s happening today (including bitcoin price rise IMO).

This looks like a long term trend. No central bank is willing to risk not risk taking.

That’s what’s happening today (including bitcoin price rise IMO).

This looks like a long term trend. No central bank is willing to risk not risk taking.

19/ That’s it.

Hopefully that made sense.

If you have any other perspective or have read an interesting article on this, let me know.

Hopefully that made sense.

If you have any other perspective or have read an interesting article on this, let me know.

Read on Twitter

Read on Twitter