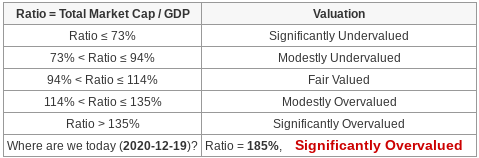

According to the Buffett Indicator (total market cap divided by the GDP) the market is significantly overvalued. But the Buffett Indicator may not work anymore today. 1/10

A thread to explain why...

A thread to explain why...

First, a definition. The Buffett Indicator is the market cap of all stocks on the  markets divided by the GDP and then x100.

markets divided by the GDP and then x100.

It got its name after Warren Buffett called it "probably the best single measure of where valuations stand at any given moment.”

2/10

markets divided by the GDP and then x100.

markets divided by the GDP and then x100. It got its name after Warren Buffett called it "probably the best single measure of where valuations stand at any given moment.”

2/10

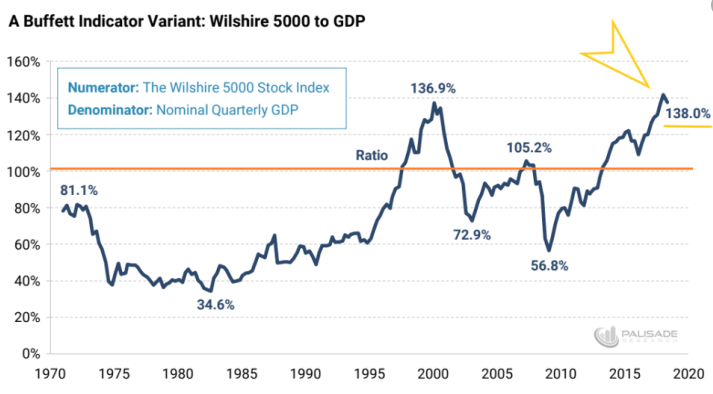

Buffett used it in a speech in 1999 claiming the market was overvalued. Not shortly after that, there was the dotcom crash and people were amazed by the little-known indicator.

Under public scrutiny and backtesting, the Buffett Indicator also showed its validity. 3/10

Under public scrutiny and backtesting, the Buffett Indicator also showed its validity. 3/10

Since 2014, the Buffett Indicator has been in overvalued territory all of the time. Even in the March crash, the Buffett indicator showed 'overvalued'.

The fact that the Buffett Indicator has surpassed the dotcom levels now, makes bears predict a huge crash will come soon 4/10

The fact that the Buffett Indicator has surpassed the dotcom levels now, makes bears predict a huge crash will come soon 4/10

But just like all simple ratios (think of the PE ratio) the Buffett Indicator has inherent flaws and they are showing now, imo.

There are several reasons why the Buffett Indicator stays so high for so long and probably will continue to warn for overvaluation for a long time 5/10

There are several reasons why the Buffett Indicator stays so high for so long and probably will continue to warn for overvaluation for a long time 5/10

Reason #1

In 2014, the year the Buffett Indicator started to go up above the 'overvalued' line, $BABA had its IPO, the biggest IPO ever.

Alibaba now has a market cap of $700B+. That was added to the numerator of the Buffett Indicator, making the ratio higher. 6/10

In 2014, the year the Buffett Indicator started to go up above the 'overvalued' line, $BABA had its IPO, the biggest IPO ever.

Alibaba now has a market cap of $700B+. That was added to the numerator of the Buffett Indicator, making the ratio higher. 6/10

The market cap of foreign stocks on the US markets has kept going up since then: $JD, $MELI, $SE, $PDD, $TSM, $SHOP ... have a market cap of around or above $100B each. And there numerous companies of ~$10B: $FVRR, $NVCR, $WIX, $TEVA from Israel, for example. 7/10

Reason #2: low interest rates.

Buffett himself in 2017: "“The most important item over time in valuation is obviously interest rates."

With the interest rates near ar at zero %, it is normal that stocks are more expensive. 8/10

Buffett himself in 2017: "“The most important item over time in valuation is obviously interest rates."

With the interest rates near ar at zero %, it is normal that stocks are more expensive. 8/10

Reason #3: margins.

$AYX has gross margins of 90%+ and most tech companies have much higher gross margins than those in 'old' sectors.

The tech industry is now responsible for 37% of all earnings and that means that it's normal that the overall market cap is higher. 9/10

$AYX has gross margins of 90%+ and most tech companies have much higher gross margins than those in 'old' sectors.

The tech industry is now responsible for 37% of all earnings and that means that it's normal that the overall market cap is higher. 9/10

The Buffett Indicator also doesn't take into account what % of companies trade on the public markets and what % of their shares they make available to the public.

I just wanted to post this to show that you should never panic because of 1 number. Context is everything. 10/10

I just wanted to post this to show that you should never panic because of 1 number. Context is everything. 10/10

Read on Twitter

Read on Twitter