Doing an EOY audit and trying to learn from the data. Some takeaways from LIMITED DATA in my 1st yr as a VC (2016)

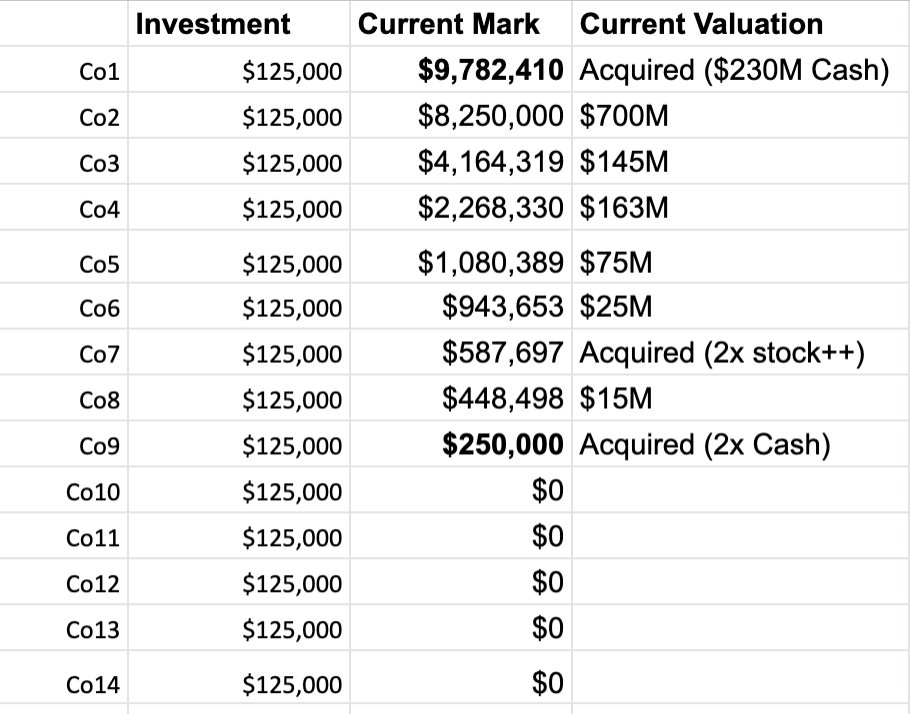

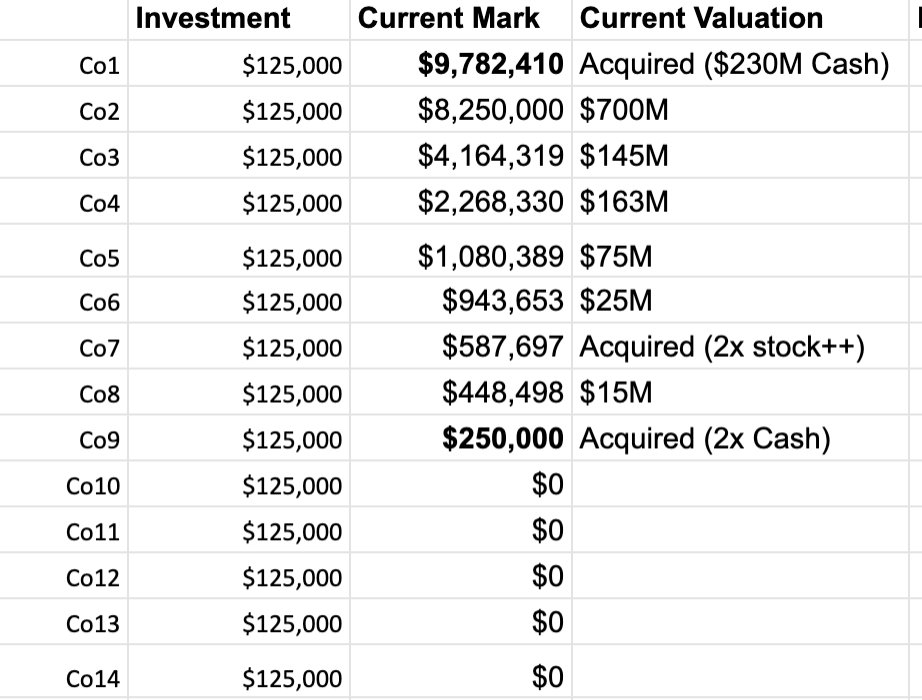

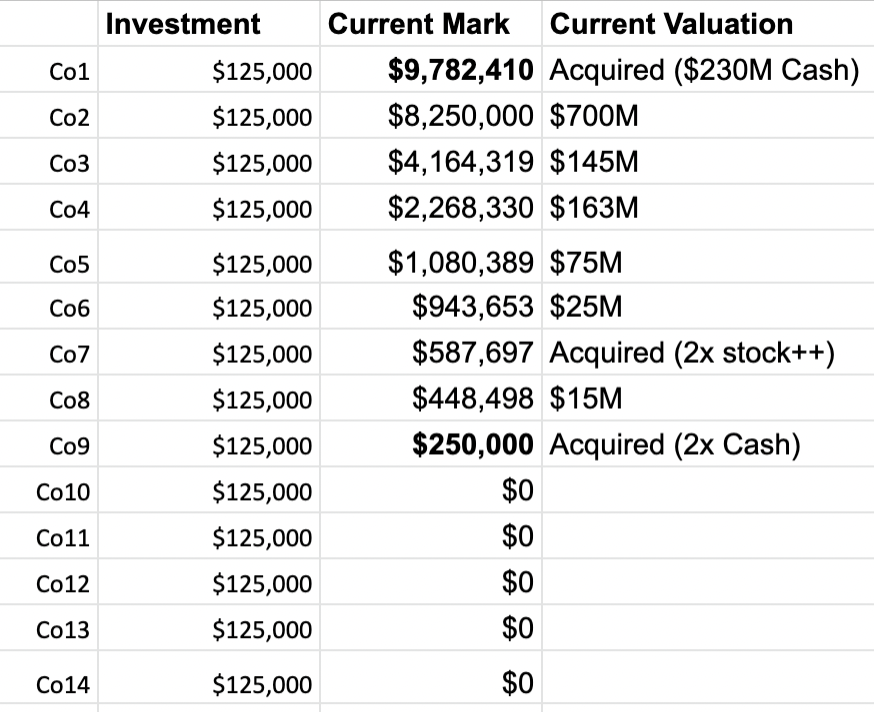

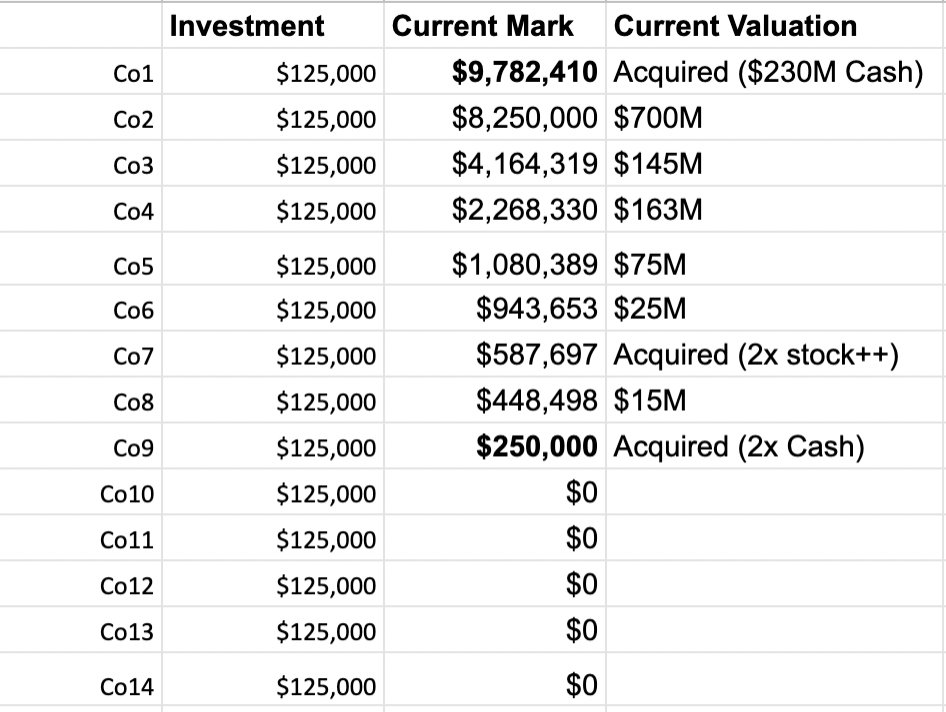

at 500Fintech, we did 14 $125k 1st check investments @$2.5M valuations ($1.75M) in 2016

This cohort was amazing:

Current FMV: $27.8M

Co1 returned $9.8M already

at 500Fintech, we did 14 $125k 1st check investments @$2.5M valuations ($1.75M) in 2016

This cohort was amazing:

Current FMV: $27.8M

Co1 returned $9.8M already

Looks great now but NO ONE wanted to invest at that time.

"Any good founder would reject your deal; you'll end up with losers who didn't get into YC"

"Fintech won't work"

So I "bootstrapped" - warehoused 36 investments into the fund (huge % of my net worth, stupidly)

"Any good founder would reject your deal; you'll end up with losers who didn't get into YC"

"Fintech won't work"

So I "bootstrapped" - warehoused 36 investments into the fund (huge % of my net worth, stupidly)

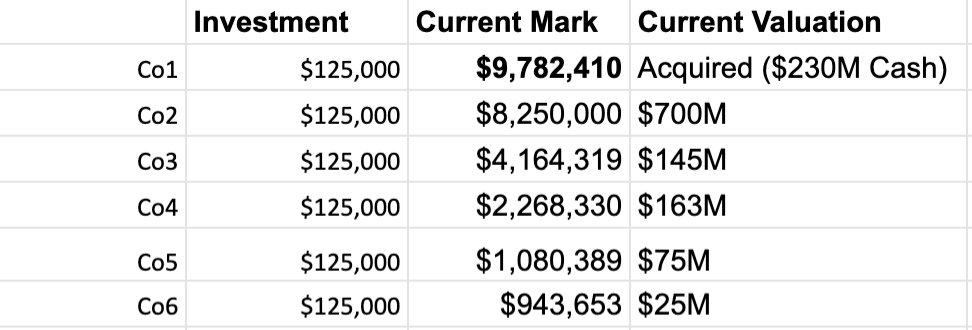

Lesson 1) Dilution matters

This was NUTS for me to see.

Co1: acquired for $230M

Co2: worth $700M.

Due to dilution, our stake in Co1 is worth more, even though we initially owned 5% of each.

Co2 and Co4 both shovel $ to $FB to sell to consumers, Co1 and Co3 are enterprise-y

This was NUTS for me to see.

Co1: acquired for $230M

Co2: worth $700M.

Due to dilution, our stake in Co1 is worth more, even though we initially owned 5% of each.

Co2 and Co4 both shovel $ to $FB to sell to consumers, Co1 and Co3 are enterprise-y

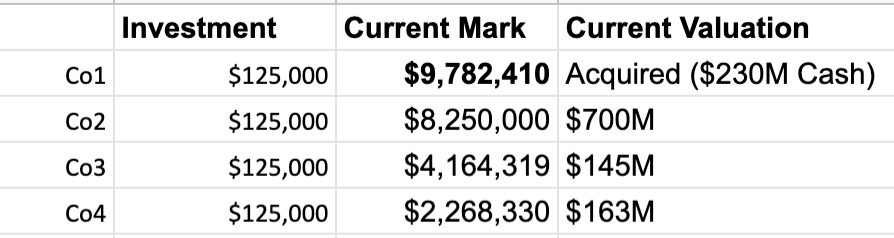

2) Cos trade at different multiples; capital efficiency matters! Related to the prev tweet.

Cos 1 and 3 trade at ~50X ARR, Cos 2 and 4 at ~15-20X.

Cos 1 and 3 are high LTV enterprise sales,

Cos 2 and 4 are consumer-focused.

Cos 1 and 3 trade at ~50X ARR, Cos 2 and 4 at ~15-20X.

Cos 1 and 3 are high LTV enterprise sales,

Cos 2 and 4 are consumer-focused.

3) At pre-seed/seed, Team matters most, everything else can change.

Co1 & 3 are complete pivots from what we invested in, Co2 & 6 were minor pivots too.

All of them have amazing teams and post-pivot very strong clarity in the business they wanted to build.

Co1 & 3 are complete pivots from what we invested in, Co2 & 6 were minor pivots too.

All of them have amazing teams and post-pivot very strong clarity in the business they wanted to build.

4) Revenue turned out to be a shitty indicator of future success

Co1-3 had $0 revenue, Co 4,7,8,10,12,14 had rev when we invested

This seems obvious now (esp fintech) but at the time I would get into fights with ppl at 500 when I wanted to invest in cos with no revenue

Co1-3 had $0 revenue, Co 4,7,8,10,12,14 had rev when we invested

This seems obvious now (esp fintech) but at the time I would get into fights with ppl at 500 when I wanted to invest in cos with no revenue

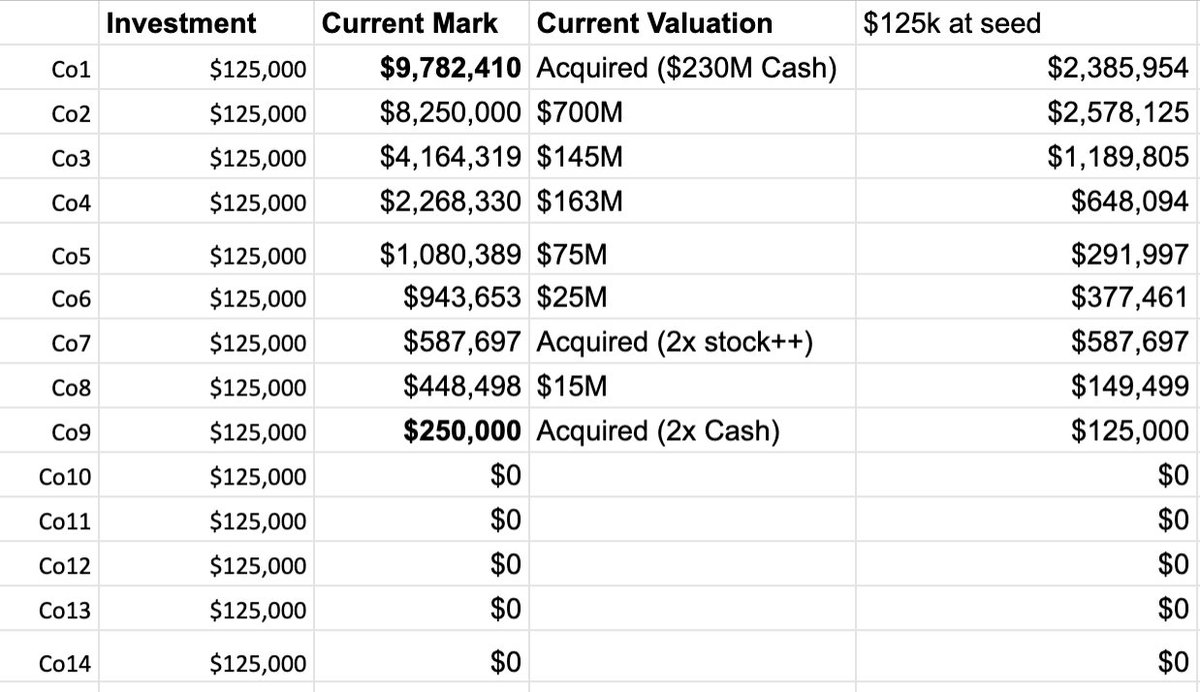

5) Entry price matters a lot; accelerators are a great business (though a lot of work) if you do it right

If we invested $125k in the seed rounds (bw $5-$9m val, would be 30% higher today) instead of at the accelerator price, the FMV would be $8.3M rather than $27.8M.

If we invested $125k in the seed rounds (bw $5-$9m val, would be 30% higher today) instead of at the accelerator price, the FMV would be $8.3M rather than $27.8M.

6) Go all-in on winners

I followed on into 1,2,3,4,5,8,10; investing 3x the 1st check; but only 1x in the next round. It would have been better to put all reserves that next round.

There are various theses on what is best here, and dynamics change as allocations get tighter.

I followed on into 1,2,3,4,5,8,10; investing 3x the 1st check; but only 1x in the next round. It would have been better to put all reserves that next round.

There are various theses on what is best here, and dynamics change as allocations get tighter.

running out to lunch - will spend more time on it this weekend, there might be some other learnings. Obviously all of this is with a grain of salt as I have very limited data in my portfolio that is old enough to analyze.

Read on Twitter

Read on Twitter