Lets do this right-1/random thoughts-Wild couple years. 2 crashes:q418-Feb-March this year,VOL>20, amazing trading opportunities,high growth,super high valuation/momentum factors drove the bus on returns. For most part these stocks priced for a perfect decade. Few experience that

2/no one knows when the current basket of leadership will end but it surely will, it always does so at least be on lookout for signs of new leadership and be willing to pivot with it vs staying tethered to the Ark names-cherry picking those now=crowded trade warnings everywhere

3/let’s talk about the crowded trades and areas where few if any critique the conventional wisdom which is likely where we need to be cautious:A)momo names will continue to crush it- B)next year will be a recovery year for economy-rates should trend higher but not too high

4/C)vaccine will be taken en mass(skeptical),allowing a “get back to normal behavior”, D)vaccines ABSOLUTELY will be effective(early data mixed) E)unemployed level gets ignored-bad idea. F)value cyclicals will play big catch up, growth to lag G)small caps>large cap =sure thing

5/H)stimulus=sure thing-I)dollar should keep falling-commodities and emerging markets win

Here’s what no one seems to talk about: q1 reported in April could be the last easy lap-able quarter, had 2 good months and a dreadful and getting worse March month. I hate the comp game..

Here’s what no one seems to talk about: q1 reported in April could be the last easy lap-able quarter, had 2 good months and a dreadful and getting worse March month. I hate the comp game..

6/I prefer "how did u do and what's the confidence in future quarters" vs comp game.

For laggards=saw business drop off cliff in March-struggled to recover fully=comps are much easier-think apparel, travel, restaurants, airlines, probably banks and energy etc.

For laggards=saw business drop off cliff in March-struggled to recover fully=comps are much easier-think apparel, travel, restaurants, airlines, probably banks and energy etc.

7/The big winners in 2020 generally will see massively high bar to beat starting in April making YOY growth look much less inspiring for all but a few current favorites.

Technically we seeing some warning signs-negative divergences in MACD/RSI with internals making lower highs

Technically we seeing some warning signs-negative divergences in MACD/RSI with internals making lower highs

8/but we have a seasonally strong period right in front of us with a potentially big speed bump Jan 5 GA run-offs-read through, who has big cap gains that people may still want to sell? Earnings start again mid Jan, last easy comp for most popular stocks

9/then we have tougher comps for most popular names, stubbornly high unemployment leaving big chunk of population behind, waning appetite for more stimulus but a fed with his foot duct taped to the gas pedal.

Conclusion as I see it: 2021 might not be a consensus GREAT recovery

Conclusion as I see it: 2021 might not be a consensus GREAT recovery

10/The recovery will not be linear until we get to herd immunity and it takes time for old consumer behaviors to get back to normal, some won't even return to normal, we like some of those habits.

11/Vaccine could have published side effects causing doubt in taking it, many won’t take it right away anyway so slower consumption could linger a bit longer.

Companies will be stingy with pace of hiring because they need to see 2 qtrs of confirmed recovery-they like margins++

Companies will be stingy with pace of hiring because they need to see 2 qtrs of confirmed recovery-they like margins++

12/So where is pent up consumption most acute? Where are comps really low? Travel/going out/recreation/social gathering/in-store experiences stocks struggling now.

I’m not sure the desire to gather/explore has ever been this huge. Picture a stampede of bulls at the gate waiting

I’m not sure the desire to gather/explore has ever been this huge. Picture a stampede of bulls at the gate waiting

13/Caveat-Most of these cos have been forced to raise a ton of debt to stay alive so the next 12-18mos starting around April should start to see wild demand profiles. At what point does everyone at once start reserving flights, hotels,Airbnb? Demand will be insatiable & historic

14/we could see numbers from this group that NOONE forecasts assuming green light on vaccine developments happens. That first “holy crap” quarter akin to the stay at home stocks in April will bring in massive new buyers - Bonus-this group is smaller cap and lower volume

15/So when coast seems clear, there's a wall of flows coming to a group that's NEVER experienced this kind of attention, what happens? Well we saw what happened to the stay at home stocks, perhaps the real opportunity is in the GET THE HELL OUT OF HOME STOCKS,that's the next wave

16/Example: $HLT trades 2m shares a day, $BKNG <100k shares a day. Heres what Im doing now: Map the flow chart of a travel and experience and see what areas are touched then map to the leaders in those categories and next look at those charts and put wish list on the wall.

17/ I've started building this basket slowly because many of these names have already started to reflect this theme & recovery but when the speed bumps come, consider building for bigger position size so when the first Ah-ha quarter is reported and analysts start scrambling

18/ to raise numbers, target prices and the momentum really starts to build, you want a chunky position already.

Conclusion- My prediction is we have a decent correction coming, its well needed, then we have a major pivot in leadership 1H and for the next 12-18 months.....

Conclusion- My prediction is we have a decent correction coming, its well needed, then we have a major pivot in leadership 1H and for the next 12-18 months.....

19/ We have an epic focus and run in the GET OUT OF THE HOUSE, EXPLORE, TRAVEL, MEET, GREET, VISIT, EXPERIENCE categories, leaders will take market share coming out of slowdowns, they always do but even the "garbage" cited by @biotequity will crush it,typically the most leveraged

20/ Will experience the biggest returns. Just remember, many of these currently do NOT reflect how bad it currently is so this believe=somewhat reflected in names-the real party, hasn't even begin yet, that starts with the 1st gate opening & masses running through a narrow door!

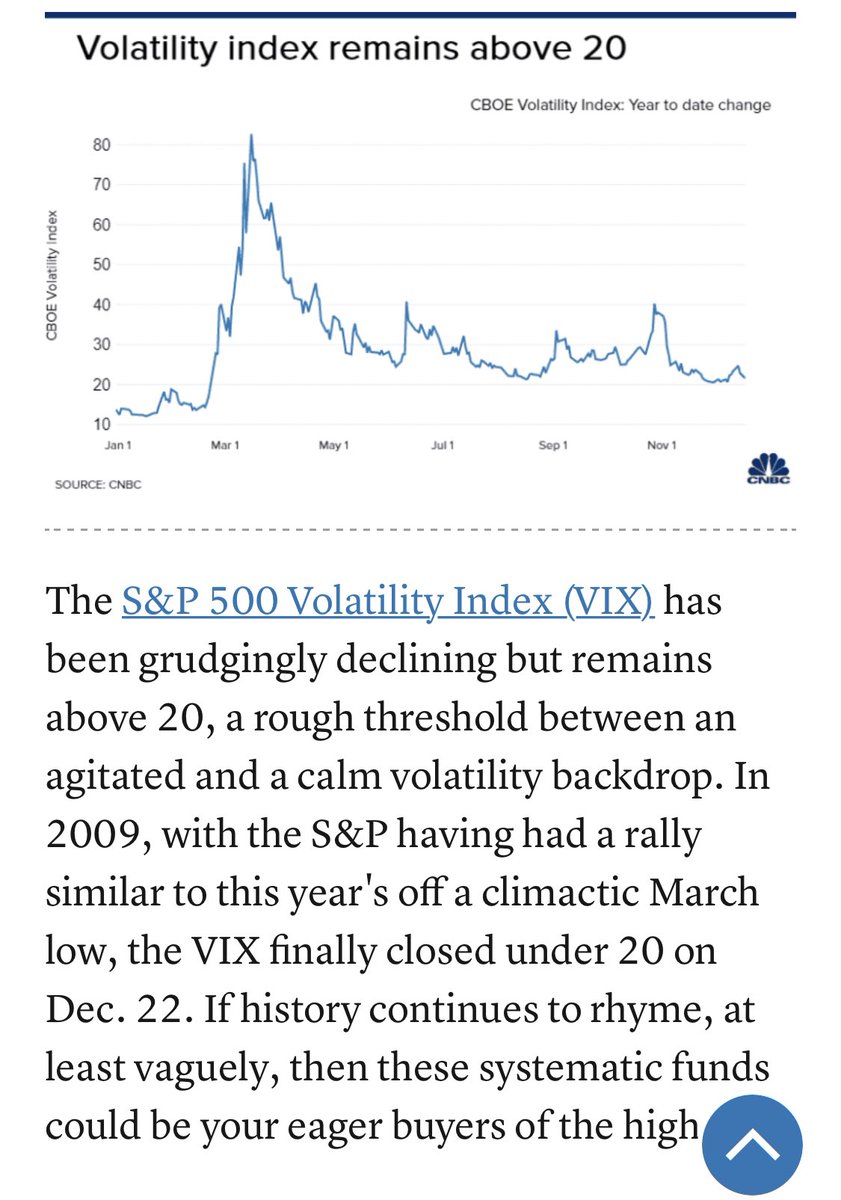

21/great extra thought from @michaelsantoli Systematic investors, CTA’s are that’s a big group of assets, start getting more exposure on confirmed moves of $VIX under 20. I don’t think we r that far off from that eventuality so that’s another big buyer waiting in the shadows

Last-Current portfolio link here https://www.globalbrandsmatter.com/dynamic-portfolio

Read on Twitter

Read on Twitter