@DaveRamsey has great advice on how to get out of debt.

The rest of his advice is has not been updated in 30 years and is

// MEGA THREAD //

The rest of his advice is has not been updated in 30 years and is

// MEGA THREAD //

1) Investment Returns of 12%!

Dave says you can plan on an annual return of 12%. I wish this was true... https://www.daveramsey.com/blog/the-12-reality

Dave says you can plan on an annual return of 12%. I wish this was true... https://www.daveramsey.com/blog/the-12-reality

...but a return of 6-8% are much more realistic.

Here is another article breaking down why this is a bad idea. https://www.forbes.com/sites/feeonlyplanner/2011/11/15/dave-ramseys-plan-for-12-returns-is-not-achievable/?sh=75b46ee55b1b

Here is another article breaking down why this is a bad idea. https://www.forbes.com/sites/feeonlyplanner/2011/11/15/dave-ramseys-plan-for-12-returns-is-not-achievable/?sh=75b46ee55b1b

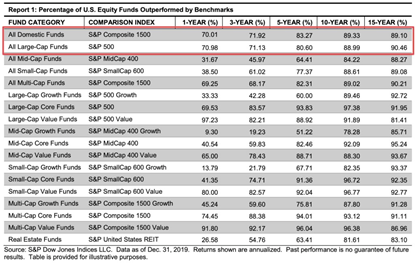

2) Buy Actively Managed Funds

Dave says to buy actively managed funds because the returns are better. I wish this was the case, but over long periods of time active managers lose. After 15 years only about 10% actually beat the S&P 500. Why?

Dave says to buy actively managed funds because the returns are better. I wish this was the case, but over long periods of time active managers lose. After 15 years only about 10% actually beat the S&P 500. Why?

Strategies that worked this year, probably do not work in 15 years. If you aren’t sure how to buy individual stocks, buy a broad basket of index funds. https://www.daveramsey.com/blog/daves-investing-philosophy

Here is a tweet on why you should include mid-small cap funds in your portfolio https://twitter.com/UncommonYield/status/1329001436852723713?s=20

Don’t trust me, or want someone really smart to build a portfolio for you? Paul Merriman has some great portfolios and sites like @M1_Finance makes portfolio allocation simple.

https://paulmerriman.com/best-in-class-recommended-portfolios-2019/

https://paulmerriman.com/best-in-class-recommended-portfolios-2019/

3) Investment Fees Don’t Matter

Just like interest on your investments compound over time, so do fees. Why do fees matter so much? Fees are guaranteed, returns are not. Control what you can control. https://www.daveramsey.com/blog/are-mutual-fund-fees-destroying-my-retirement

Just like interest on your investments compound over time, so do fees. Why do fees matter so much? Fees are guaranteed, returns are not. Control what you can control. https://www.daveramsey.com/blog/are-mutual-fund-fees-destroying-my-retirement

I did a thread on how much fees can impact your returns and it is staggering! https://twitter.com/UncommonYield/status/1331282139183247365?s=20

4) Buy Front Loaded Mutual Funds

You are paying all the fees up front and they can be hefty, like 5%!

Low cost index funds are a much better choice, and far less expensive over time. I wonder if he recommends these because he makes money on them https://www.daveramsey.com/blog/why-dave-prefers-up-front-fees

https://www.daveramsey.com/blog/why-dave-prefers-up-front-fees

You are paying all the fees up front and they can be hefty, like 5%!

Low cost index funds are a much better choice, and far less expensive over time. I wonder if he recommends these because he makes money on them

https://www.daveramsey.com/blog/why-dave-prefers-up-front-fees

https://www.daveramsey.com/blog/why-dave-prefers-up-front-fees

5) Your Credit Score doesn't matter

Dave is rich enough to NEVER need credit again. This is not most people. Better to have it and not need it, than need it and not have it.

Dave is rich enough to NEVER need credit again. This is not most people. Better to have it and not need it, than need it and not have it.

There are ways to have a high credit score while pay ZERO in interest. Play the game don’t let the game play you. https://www.nerdwallet.com/article/finance/how-to-build-credit

6) Credit Cards Rewards

If you cannot control your spending DO NOT USE CREDIT CARDS. If you have some control use them for Medical Expenses, Utility Bills, Car Repairs to get cash back on money you HAVE TO SPEND ANYWAY.

If you cannot control your spending DO NOT USE CREDIT CARDS. If you have some control use them for Medical Expenses, Utility Bills, Car Repairs to get cash back on money you HAVE TO SPEND ANYWAY.

If you have control of your spending see how I took my family on vacation for free. https://twitter.com/UncommonYield/status/1322933768114634752?s=20

7) Debit Cards Do Everything Credit Cards Do

Credit Cards offer superior fraud protection in comparison to Debit Cards. I’ve had multiple instances of fraud over the last 10 years on my credit cards. They have all be resolved in minutes. Debit Cards on the other hand?

Credit Cards offer superior fraud protection in comparison to Debit Cards. I’ve had multiple instances of fraud over the last 10 years on my credit cards. They have all be resolved in minutes. Debit Cards on the other hand?

https://www.investopedia.com/articles/personal-finance/050214/credit-vs-debit-cards-which-better.asp

8) Paying off Low Interest Debt

15 to 20 years ago Dave’s encouragement to pay off your mortgage was great advice. Rates were 6-9% and you could GUARANTEEE saving lots of money by taking out a 15 year mortgage or AGGRESSIVELY paying down a 30 year mortgage.

15 to 20 years ago Dave’s encouragement to pay off your mortgage was great advice. Rates were 6-9% and you could GUARANTEEE saving lots of money by taking out a 15 year mortgage or AGGRESSIVELY paying down a 30 year mortgage.

However,

the interest rate environment has changed. I wrote a thread on this inspired by @roncaruthers on a better option. https://twitter.com/UncommonYield/status/1337419849497268224?s=20

the interest rate environment has changed. I wrote a thread on this inspired by @roncaruthers on a better option. https://twitter.com/UncommonYield/status/1337419849497268224?s=20

9) Crypto

Dave doesn’t like Bitcoin because it is not backed by anything. News flash, neither is the dollar! The 25% of dollars that have ever existed have been created THIS YEAR! There will never be more than 21M #bitcoin . https://www.daveramsey.com/blog/what-is-bitcoin

. https://www.daveramsey.com/blog/what-is-bitcoin

Dave doesn’t like Bitcoin because it is not backed by anything. News flash, neither is the dollar! The 25% of dollars that have ever existed have been created THIS YEAR! There will never be more than 21M #bitcoin

. https://www.daveramsey.com/blog/what-is-bitcoin

. https://www.daveramsey.com/blog/what-is-bitcoin

If you want some exposure, but are not sure where to start, I wrote this thread. https://twitter.com/UncommonYield/status/1327078503192342528?s=20

Bonus Whole Life Insurance

If you buy Whole Life Insurance for only the death benefit, you were sold, and that really sucks. There is too much to go into on this thread, but if you work with someone that knows how to maximize the cash value...

If you buy Whole Life Insurance for only the death benefit, you were sold, and that really sucks. There is too much to go into on this thread, but if you work with someone that knows how to maximize the cash value...

...it becomes the best savings account you have ever seen. @ChroniclesNate knows.

How do I plan on using my policy? See the thread. https://twitter.com/UncommonYield/status/1329114087754768388?s=20

How do I plan on using my policy? See the thread. https://twitter.com/UncommonYield/status/1329114087754768388?s=20

If Dave helped you get out of debt, awesome!

However, there are some MAJOR problems with his advice on just about EVERYTHING else.

However, there are some MAJOR problems with his advice on just about EVERYTHING else.

Read on Twitter

Read on Twitter