1/ As I've got some new funds available, I've been looking into what I'd love to add.

- $Silver Juniors

- #Silver $LEAPs

- #Uranium Juniors

Unfortunately, I don't consider LEAPs cheap at this moment ...

But what do I mean with "cheap"

#options #mintwit #fintwit

- $Silver Juniors

- #Silver $LEAPs

- #Uranium Juniors

Unfortunately, I don't consider LEAPs cheap at this moment ...

But what do I mean with "cheap"

#options #mintwit #fintwit

2/ When I'm speaking of "cheap" options, the correct term would be undervalued. All LEAPs on the miners are cheap given my own targets at this moment, but that doens't mean I'll buy whatever I can get.

3/ Of the four $greeks, being $Gamma (Change of delta over time and thus the options chance on being profitable), $Delta (reaction of option to a changing price of the underlying), $Theta (time to exp). and $Vega (volatility of the underlying security).

4/ Vega is the one which is thus controlled by how the underlying security trades. Agressive up and down moves, makes #volatility (and vega) spike (= option is rather "expensive"). Stable and stuck in trading range (for 30 days)

5/ As quite some people have told me, the effects of Vega aren't that well explained (which I agree on), therefore an example on why I don't consider $AG #options 'undervalued' right now. I'm sorry, still my favourite $LEAPs, but not right now.

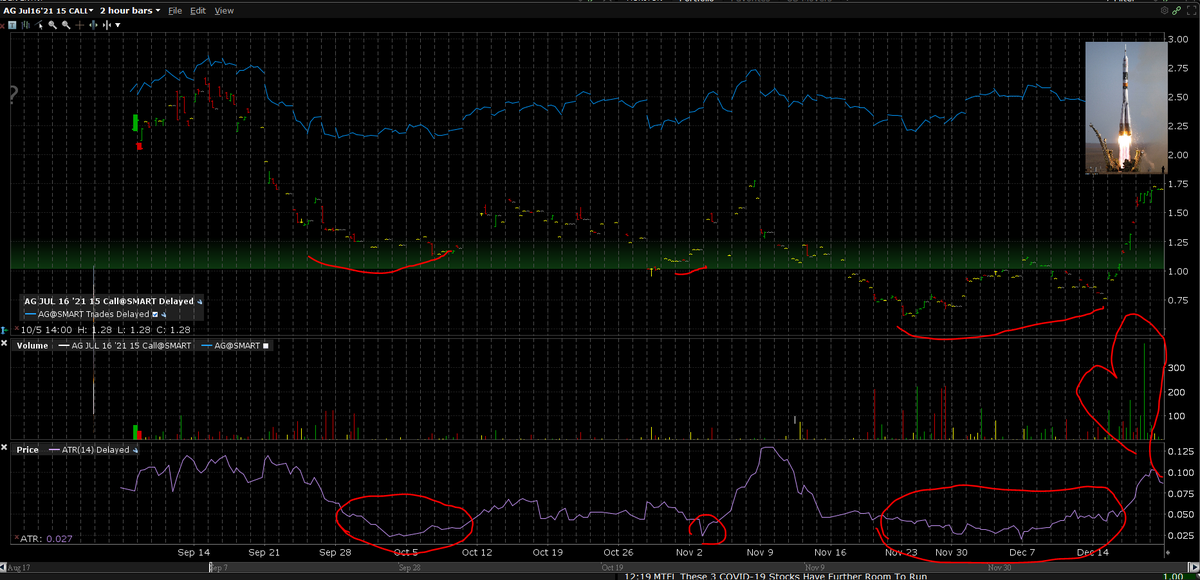

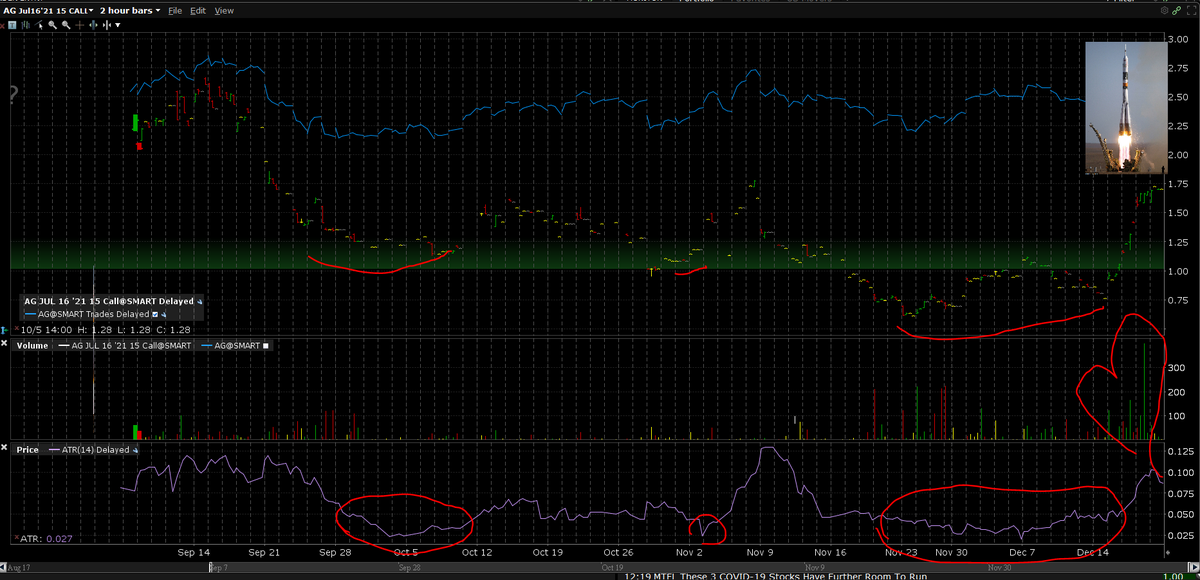

6/ Example on the $AG JUL'21 15 CALL.

First things first, volume on this option was through the roof last week with $Silver breaking out. I like that. Confirms bullishness to me.

In addition, I am using the Average True Range (ATR) indicator (14 period window).

First things first, volume on this option was through the roof last week with $Silver breaking out. I like that. Confirms bullishness to me.

In addition, I am using the Average True Range (ATR) indicator (14 period window).

7/ ATR is a tool to measure volalitity in the underlying option, and as you can see the ATR has had significant lows (while as the underlying asset did not breach support). In these red circles, I'd consider these options bargains.

8/ Currently the ATR is thus running hot and we would either need a bit of consolidation at the current levels prior to me calling options "bargains" once more.

9/ 𝐀𝐫𝐞 𝐲𝐨𝐮 𝐧𝐞𝐜𝐞𝐬𝐬𝐚𝐫𝐢𝐥𝐲 𝐛𝐮𝐲𝐢𝐧𝐠 𝐭𝐡𝐞 𝐥𝐨𝐰𝐞𝐬𝐭 𝐩𝐫𝐢𝐜𝐞𝐬 𝐚𝐯𝐚𝐢𝐥𝐛𝐥𝐞?

No, since option pricing depends on more as vega alone (helloooo delta). Strong sell-offs in the underlying security, lowers prices, despite volatility going up a little bit!

No, since option pricing depends on more as vega alone (helloooo delta). Strong sell-offs in the underlying security, lowers prices, despite volatility going up a little bit!

10/ But it's a way to valuate options in a more rational way and cut out the #FOMO! It's far from perfect, but it allows me to position myself when the market is actually "mispricing" my beloved options.

11/ Just to be clear, I actually had option trading experience prior to being invested in the #preciousmetals. I was (and still am) a notorious seller of options on stocks that go ballistic (to collect it's rich, vega-inflated premium).

Read on Twitter

Read on Twitter