1/ A Thread For Normies On Robinhood And Options Trading.

This is Part 1 of A Series Of Informative Tweet Threads For Normies About How Most Of The Financial Services Industry Fleeces Poors And What To Do About That.

Want Investment Advice? LISTEN UP NORMIE.

This is Part 1 of A Series Of Informative Tweet Threads For Normies About How Most Of The Financial Services Industry Fleeces Poors And What To Do About That.

Want Investment Advice? LISTEN UP NORMIE.

2/ NOT INVESTMENT ADVICE.

3/ The other day, Robinhood (RH) was ordered to pay a $65M fine by the SEC for a number of violations: bad execution, fraud, and bad recordkeeping.

4/ As is usual with the SEC, violations generally occur for what you don't properly disclose, not what you do.

If you say "punch buggy" before someone allows you to punch them in the arm, it's ruled as legit.

If you say "punch buggy" before someone allows you to punch them in the arm, it's ruled as legit.

5/ There are many misconceptions about what happened, but I want to actually make a stronger point: how most of the financial services industry seeks to fleece retail. ("Retail" means a non-professional investor - often refered to on Twitter as "poors.")

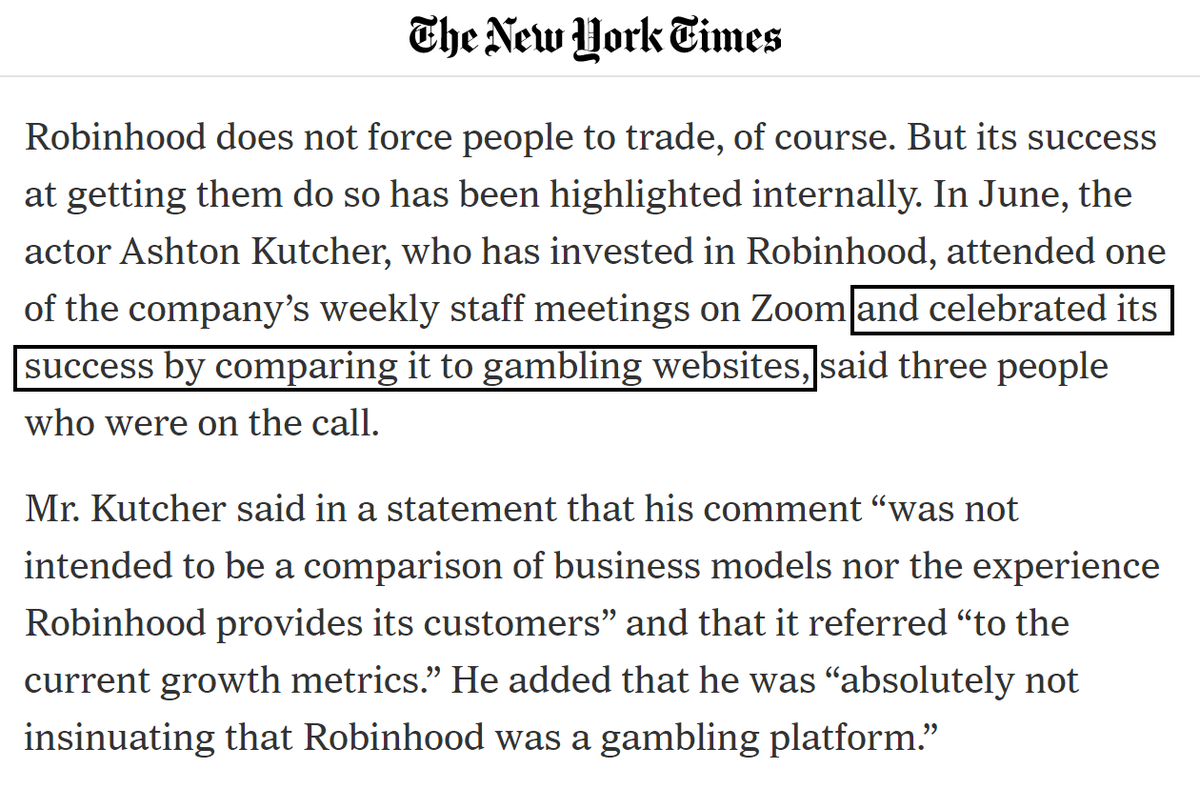

6/ Contrary to popular belief, RH is not accused of engaging in frontrunning (directly or indirectly) in the SEC order, and frontrunning is highly illegal.

7/ Let's now dive deeper to understand options trading, and how it's played out on these platforms over the years.

You're about to learn how the sausage is made.

You're about to learn how the sausage is made.

8/ First, all "derivatives" are sidebets on the price of an asset.

Options are a derivative.

You may have heard the terms "call" and "put" used - these refer to essentially bets the price of the asset will go up or down.

Options are a derivative.

You may have heard the terms "call" and "put" used - these refer to essentially bets the price of the asset will go up or down.

9/ When you purchase equities (such as TSLA), on average you gain because on average stocks generally go up.

Maybe you won't do as well as in an optimal portfolio allocation though, but at least on average you'll make money.

Maybe you won't do as well as in an optimal portfolio allocation though, but at least on average you'll make money.

10/ When you purchase any derivative, you're engaging in negative-sum betting, similar to "casino gambling." Without any edge on the market, on average you will lose, because there is a built in headwind against you.

11/ This headwind comes from paying fees and commission, the spread (difference between best bid and offer, which is a proxy for the difference between fair value and your execution price), and the opportunity cost of having spare capital used (or borrowing capital.)

12/ You can think of the derivatives markets as essentially blackjack or roulette, because for a normie they are essentially the same. Both have a "house edge", and thus both guarantee that you will lose all your money if you continue to bet.

13/ This creates an conflict of interest for broker-dealers (which RH is). If someone buys equities, they pay (relatively) a little bit of fees. If they start buying options, then similar to an online casino, generally they keep playing until they lose every dollar they deposit.

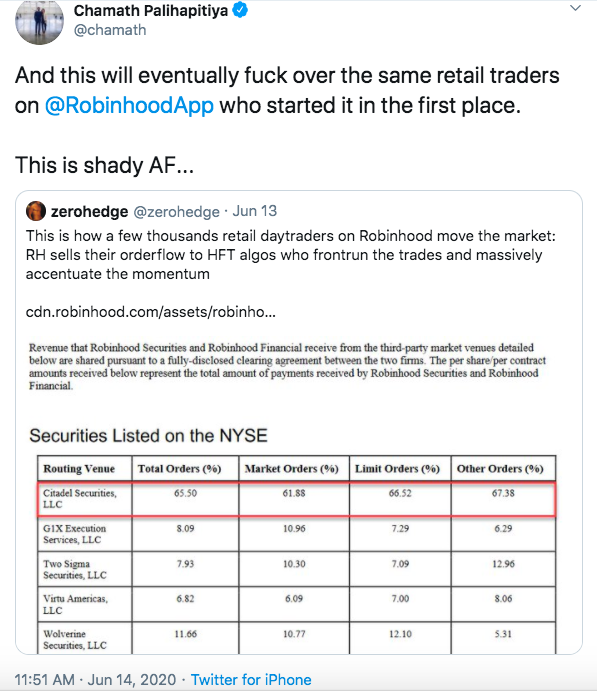

14/ This is well understood by senior RH officials. Ashton Kutcher (an investor in RH) just said the quiet part loud by accident after a meeting, but his initial statement is accurate.

15/ At minimum, for a retail investor, purchasing options is NOT "investing". Investing requires a reasonable expectation of profit. Trading options is gambling with negative edge, which always leads to eventually losing all your money.

16/ Options AREN'T just "more risky", they have negative edge.

Risk refers to how much the price can deviate from expectation. For example, having 100% of your portfolio in TSLA versus an index is "more risky", as the diversified portfolio is likely to be closer to expectation.

Risk refers to how much the price can deviate from expectation. For example, having 100% of your portfolio in TSLA versus an index is "more risky", as the diversified portfolio is likely to be closer to expectation.

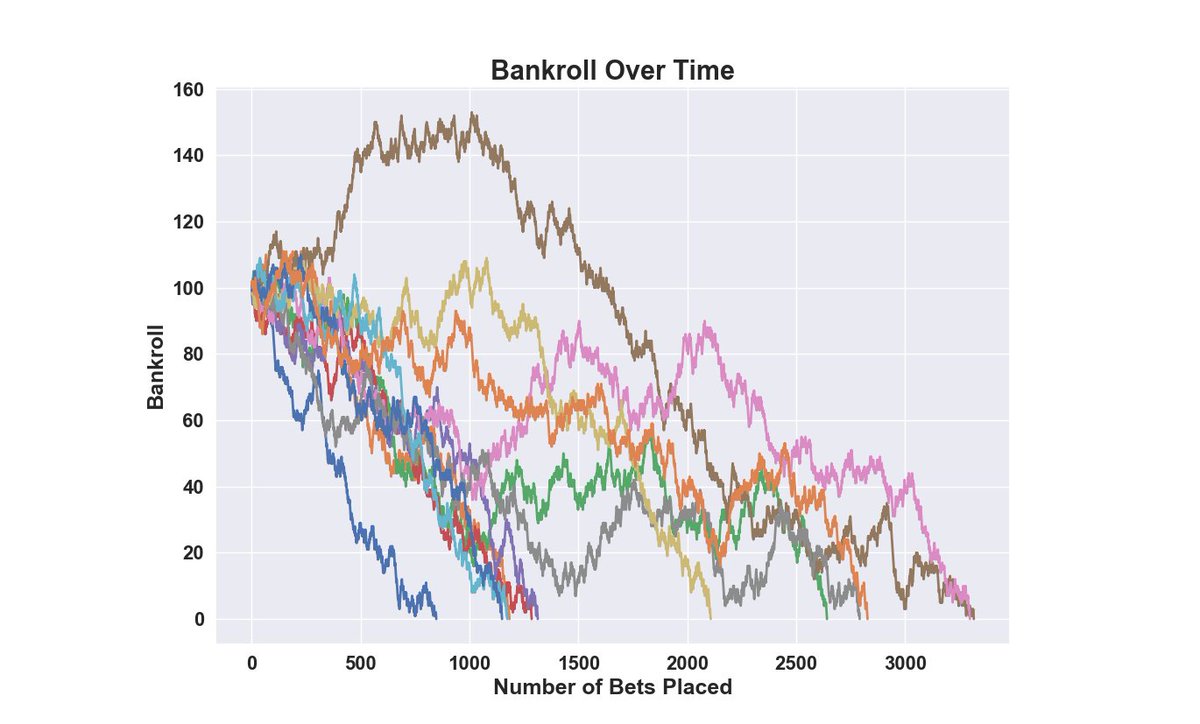

17/ Retail traders have a negative expectation trading options, not a positive one, because they have no edge over the market, so they can't beat the headwind.

Regardless of how you bet, your bankroll is on average the negative expectation times how much you bet.

Regardless of how you bet, your bankroll is on average the negative expectation times how much you bet.

18/ Every market participant besides the retail trader has reasons to glorify options trading as "investing."

IMO it is an absolutely disgusting practice to label this form of gambling as "investing", but it is par for the course in the financial services industry.

IMO it is an absolutely disgusting practice to label this form of gambling as "investing", but it is par for the course in the financial services industry.

19/ However, as someone with libertarian-leaning views, I accept that people are free to make bad choices. I never really was pro regulation.

But reading through different public forums full of normies, it is appalling how little they understand about what they are buying.

But reading through different public forums full of normies, it is appalling how little they understand about what they are buying.

20/ Advice to "teach people about investing" like what a call spread is, is like advice on how to play blackjack, and learning that "doubling down" on 11 is a good strategy. It preys on people.

These are simulations of what happens to the bankrolls of those gamblers - all lose.

These are simulations of what happens to the bankrolls of those gamblers - all lose.

21/ It preys on their lack of knowledge. For example, with options you could structure a trading strategy like "selling covered calls", which means you hold say 1 share of TSLA and sell off any upside.

22/ To normies this seems attractive: you get paid money (the premium), and then if it goes up, you make the premium, and if it goes down, you still have the share. It almost seems like you are making "free money".

23/ However, this ends badly, as your bet is negative expectation and you cannot escape that. The graph of your bankroll will look like the image I posted – ultimately going to zero regardless of strategy.

24/ As is the case in the gambling world, there are many lives destroyed by gambling. Even though I ultimately advocate for personal responsibility, we can't lose sight of the reality of retail traders in derivatives.

AS A NORMIE, NEVER TRADE OPTIONS. YOU WILL LOSE EVERYTHING.

AS A NORMIE, NEVER TRADE OPTIONS. YOU WILL LOSE EVERYTHING.

25/ Let's wrap up for now. In the next parts, I'll discuss why Payment For Order Flow (PFOF) is legit, finish discussing RH, shit on DCC, Mutual Funds, & Whole Life Insurance, discuss how to invest passively, and why you need to be in crypto and what makes it different.

Cheers~

Cheers~

Read on Twitter

Read on Twitter