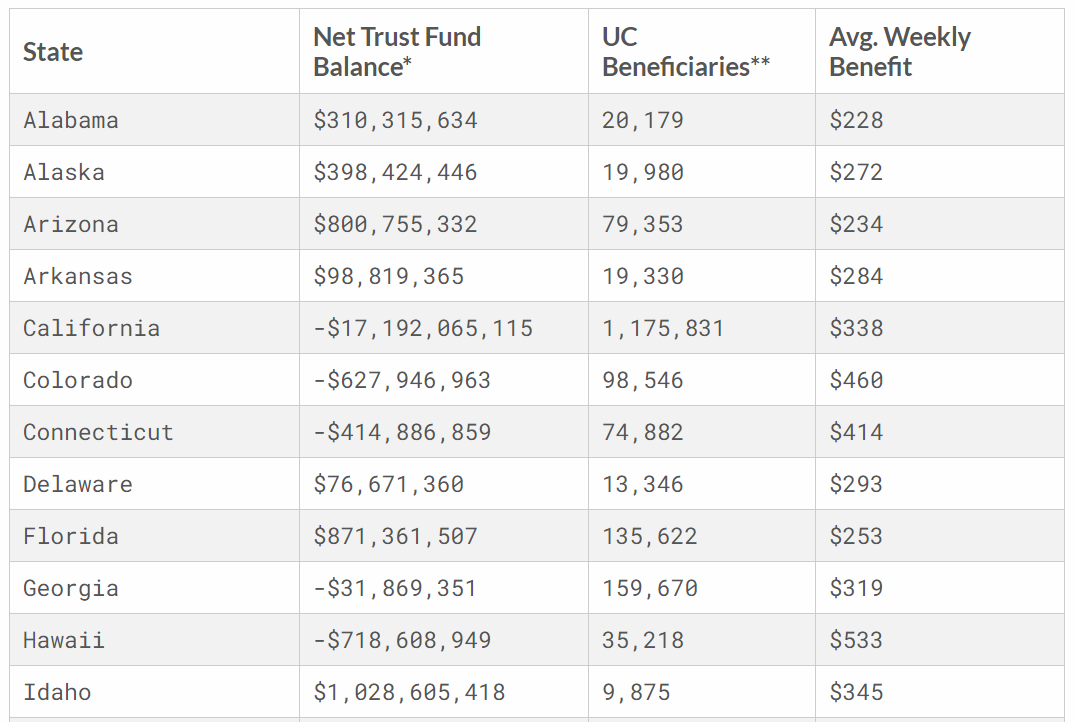

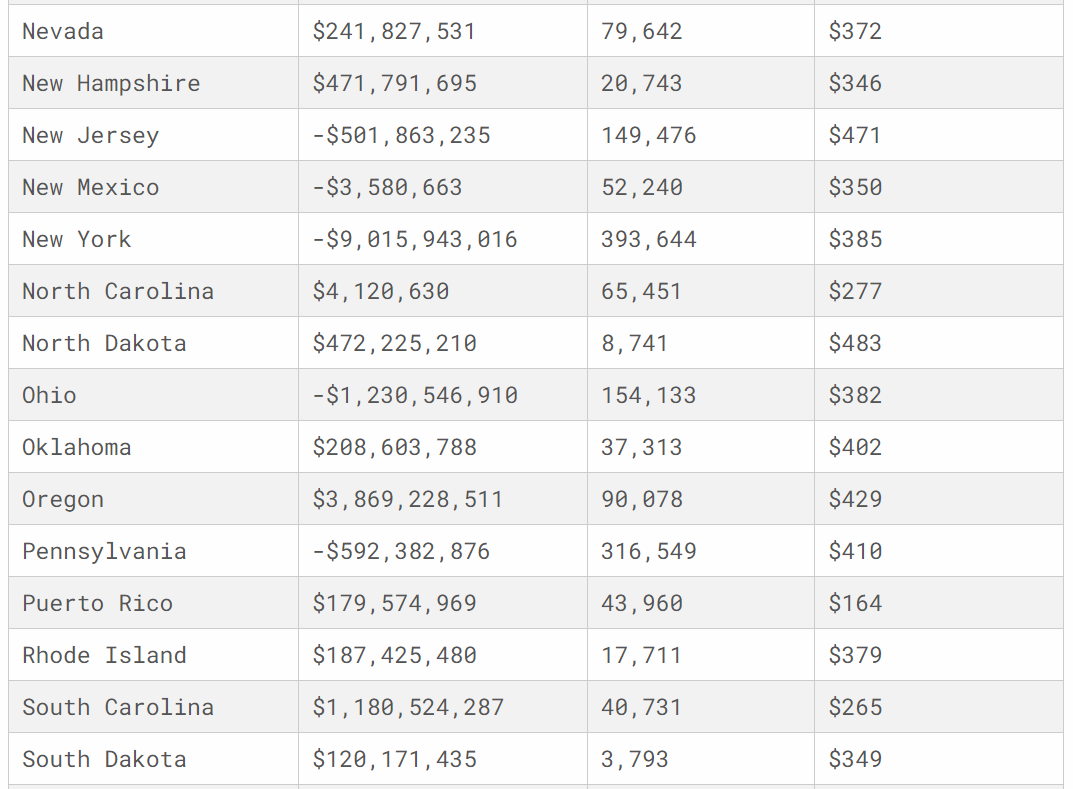

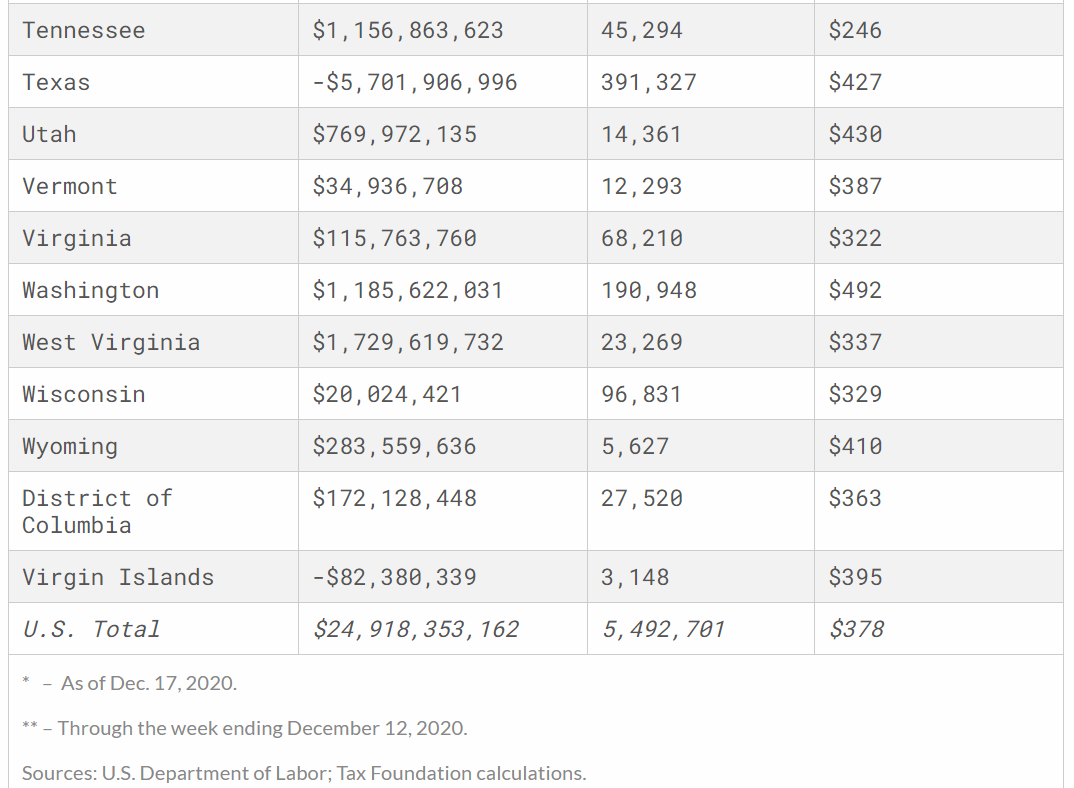

Unemployment Compensation Trust Funds have stabilized in some states as unemployment levels have declined, but 17 states have negative balances, and in aggregate, the net trust fund balance has declined from $75 to $25B so far this year: http://tax.foundation/3oZz8Qs

From worst to least bad, on the basis of how many weeks of current payments in arrears they are, the states (and one territory) with negative balances are the Virgin Islands, NY, CA, HI, TX, KY, OH, MA, IL, CO, CT, NJ, MN, LA, PA, GA, and NM.

Several other states—NC, WI, IN, MI, MD, VA, and VT leading the way—are closing in on insolvency.

NE, ID, WV, MS, UT, and WY are currently in the best shape.

A faster-than-expected jobs recovery has helped many states remain solvent. In May, active unemployment claims peaked at 22.79m. As of 12/12, they stand at 5.294m—still over 3 million more claims than pre-pandemic, but a dramatic improvement from the early months of the pandemic.

(Claims have begun to spike again as states have reimposed tighter restrictions, with new jobless claims the week ending December 12th hitting the highest levels seen since early September.)

In July, the CBO projected the U.S. would return to 6.7% unemployment in Q1 of 2023, a level in fact reached in Nov. 2020, over 2 years ahead of schedule.

Significantly lower unemployment levels have stretched unemployment compensation trust funds further than initially expected

Significantly lower unemployment levels have stretched unemployment compensation trust funds further than initially expected

Unemployment insurance taxes are imposed on a taxable wage base that is generally fairly low, so in many states, the majority—sometimes the overwhelming majority—of all UI tax revenues arrive in the first quarter of each calendar year.

States can, therefore, look forward to a substantial boost in trust fund balances in the early months of 2021.

Nevertheless, outlooks in some states remain gloomy.

Nevertheless, outlooks in some states remain gloomy.

States will ultimately need to raise UI taxes to pay back the federal loans w/ interest and replenish their trust funds, but for now, states should take a page from their Great Recession playbook and delay substantial UI tax hikes as long as possible to avoid penalizing rehiring.

Read on Twitter

Read on Twitter