1/ INSIDE THE EVENT HORIZON with @MimesisCapital

THREAD #4 https://mimesiscapital.medium.com/should-you-follow-microstrategy-use-debt-to-buy-bitcoin-6b208d5beec3

THREAD #4 https://mimesiscapital.medium.com/should-you-follow-microstrategy-use-debt-to-buy-bitcoin-6b208d5beec3

2/ @MicroStrategy adopted Bitcoin as its primary treasury reserve asset, and is now launching a speculative attack on the $USD by issuing $650M of corporate debt at a 0.75% interest rate to buy more #Bitcoin  .

.

.

.

3/ This is being issued as unsecured corporate debt that is not due until 2025 (after the 2024 halving). All MicroStrategy must do for each of the next 5 years is pay $4.9M in interest which their cash flows are more than enough to cover this expense.

4/ MicroStrategy is in a phenomenal position to leverage long Bitcoin, but is it something you should do personally?

Unfortunately, most people are going to have a very difficult time getting access to long duration unsecured debt, but let’s dive into some potential options.

Unfortunately, most people are going to have a very difficult time getting access to long duration unsecured debt, but let’s dive into some potential options.

5/

#1 Real Estate as collateral

Pros:

- Historically low mortgage rates.

- Potential to generate cash flow (renters).

- Not as volatile as stocks.

Cons:

- You have to make a (somewhat significant) down payment.

#1 Real Estate as collateral

Pros:

- Historically low mortgage rates.

- Potential to generate cash flow (renters).

- Not as volatile as stocks.

Cons:

- You have to make a (somewhat significant) down payment.

6/

#2 Stocks as collateral

Pros:

- Easy to borrow money through a brokerage account (Etrade, Fidelity, etc.)

Cons:

- Higher interest rates than mortgages.

- Risk of a margin call because they are volatile and traded daily.

#2 Stocks as collateral

Pros:

- Easy to borrow money through a brokerage account (Etrade, Fidelity, etc.)

Cons:

- Higher interest rates than mortgages.

- Risk of a margin call because they are volatile and traded daily.

7/

#3 Bitcoin as collateral

Pros:

- If you want to buy more Bitcoin you likely already have Bitcoin.

- You can do it in a non rehypothecated manner ( @unchainedcap).

Cons:

- High interest rates (nascent market).

- Risk of a margin call due to extreme volatility.

#3 Bitcoin as collateral

Pros:

- If you want to buy more Bitcoin you likely already have Bitcoin.

- You can do it in a non rehypothecated manner ( @unchainedcap).

Cons:

- High interest rates (nascent market).

- Risk of a margin call due to extreme volatility.

8/ All three of those options require you to post those assets as collateral for your debt. Unlike $MSTR, you are taking on extreme short term volatility risk, especially if you use stocks or Bitcoin as collateral.

9/ Taking on debt will amplify your returns (to the upside OR the downside). Due to potential tail risks and unexpected volatility, debt makes your portfolio fragile.

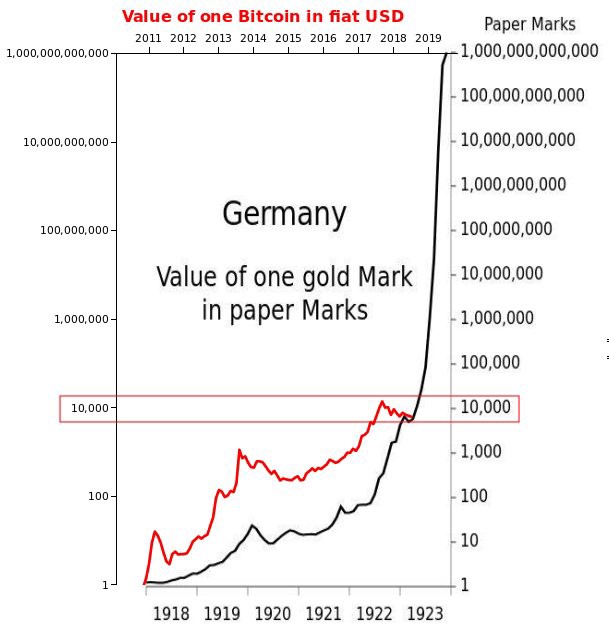

10/ In The Investor’s Podcast with @PrestonPysh and @LukeGromen, they talk about how volatile gold traded (on a month to month basis) during the Weimar hyperinflation and what would’ve happened to anyone being long gold with leverage. https://www.theinvestorspodcast.com/episodes/tip324-the-great-reset-w-luke-gromen/

11/ If you look back to a chart of the price of gold in the Weimar Republic, the line appears to be going entirely up, but if you zoom in to see the price of gold at the end of each month, nasty quick down swings tended to occasionally follow the endless parabolic upswings.

12/ Luke referenced this and mentioned that if you were using leverage to buy more gold, you were likely “wiped out four or five times”.

This is an extremely important point to understand. Debt makes you fragile, especially if you haven’t structured it correctly.

This is an extremely important point to understand. Debt makes you fragile, especially if you haven’t structured it correctly.

13/ With that said, if you have found Bitcoin to be the world’s safest asset, and you have extra steady cash flow from your job, business, or real estate, it may make sense to use a small amount of debt to purchase Bitcoin.

14/ As long as you have more than enough steady cash flow to cover all potential payments on your debt, and the value of all your assets (bitcoin, real estate, stocks, etc.) is significantly higher than the amount you own on your liabilities, then it might be worth considering.

15/ And if you’re a company like $MSTR that has steady positive cash flows and access to issuing unsecured debt for long durations, then it’s a no brainer to buy, and save the world’s safest asset.

Read on Twitter

Read on Twitter