The new SEC complaint against Robinhood gives one of the first inside views of a shadowy practice known as 'payment for order flow' that sits at the base of how retail investors trade stocks

The details show how RH used the system to make money at the expense of customers/1

The details show how RH used the system to make money at the expense of customers/1

With payment for order flow, retail brokers like Robinhood let Wall Street firms trade again their customers in exchange for a fee.

These firms, like Citadel and Virtu, have long said they can give small investors the best prices for their stocks/2

These firms, like Citadel and Virtu, have long said they can give small investors the best prices for their stocks/2

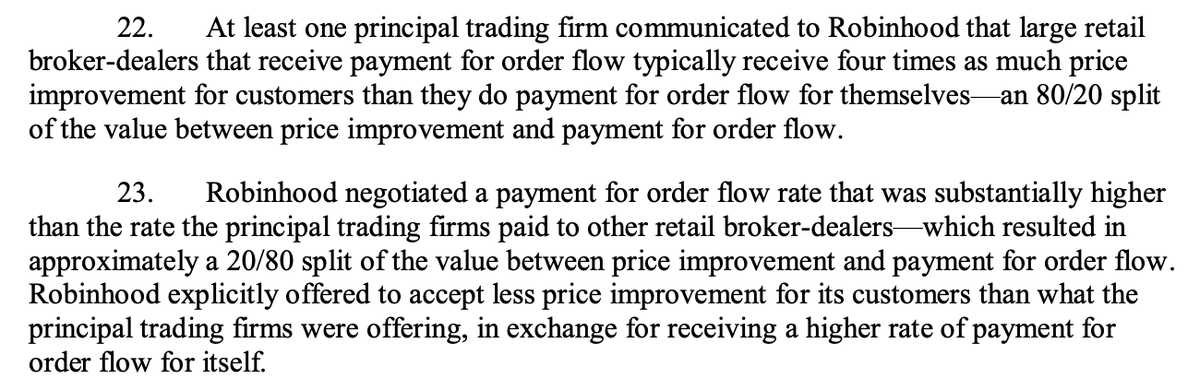

But the SEC says it found records of a conversation where one Wall Street firm told Robinhood that it could choose between getting higher fees for itself or better deals for its customers (a higher price when a customer is selling, and a lower price when they are buying)/3

The firm told Robinhood that most retail brokers chose to pass 80% of the money along to customers – in the form of better stock prices -- and take 20% in fees for themselves.

Robinhood, the SEC says, chose to do the opposite, and take 80% in fees for itself/4

Robinhood, the SEC says, chose to do the opposite, and take 80% in fees for itself/4

When one Wall Street firm said it would no longer pay Robinhood such high fees, Robinhood chose to stop sending trades to the firm, the SEC reports/4

Internally, Robinhood employees noticed that its customers could get better prices if they went to almost any other retail brokerage – even when Robinhood’s lack of trading fees was taken into account.

While senior execs were told about this, nothing was done/5

While senior execs were told about this, nothing was done/5

Robinhood said this week that this was all a part of the company's history and had stopped.

But the most recent filings from Robinhood show that it still gets paid almost twice as much other retail brokers for each share it it sends to the trading firms/6

cc @ltabb

But the most recent filings from Robinhood show that it still gets paid almost twice as much other retail brokers for each share it it sends to the trading firms/6

cc @ltabb

This leads to a question that could determine whether Robinhood is out of the woods with regulators:

Why are Wall Street firms still paying RH so much more than competitors for customer trades if RH has stopped the practice of taking bigger fees at the expense of customers?

Why are Wall Street firms still paying RH so much more than competitors for customer trades if RH has stopped the practice of taking bigger fees at the expense of customers?

I wish @matt_levine, the great wonk of payment for order flow was not on parental leave.

But one of the best explicators of the practice, @felixsalmon is still around.

In any case, here is the whole complaint.

https://www.sec.gov/litigation/admin/2020/33-10906.pdf

But one of the best explicators of the practice, @felixsalmon is still around.

In any case, here is the whole complaint.

https://www.sec.gov/litigation/admin/2020/33-10906.pdf

And here is our story this week on the different issues Robinhood is facing this week. https://www.nytimes.com/2020/12/17/business/robinhood-sec-charges.html

Read on Twitter

Read on Twitter