1/ Happy HODL Day!

Today was the day the term “HODL” was created.

Where did it come from? Most people think it stands for “Hold On for Dear Life,” but that's not correct. Here's the origin story of "HODL."

A thread

Today was the day the term “HODL” was created.

Where did it come from? Most people think it stands for “Hold On for Dear Life,” but that's not correct. Here's the origin story of "HODL."

A thread

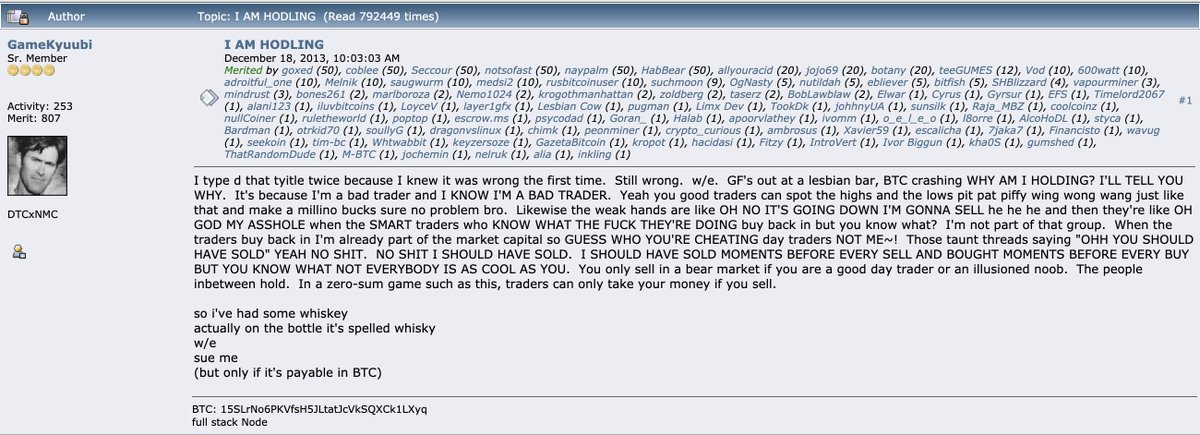

2/ "I AM HODLING"

Is yelled out by user "GameKyuubi" on the Bitcointalk forums, the most popular place for Bitcoiners to hang out at in the early days.

It was December 18, 2013 at the top of the 2nd 2013 bull market cycle.

https://bitcointalk.org/index.php?topic=375643.0

Is yelled out by user "GameKyuubi" on the Bitcointalk forums, the most popular place for Bitcoiners to hang out at in the early days.

It was December 18, 2013 at the top of the 2nd 2013 bull market cycle.

https://bitcointalk.org/index.php?topic=375643.0

3/ The price action along the path to $1,200 was intense. In the year 2013, we actually had 2 bull runs. One in March 2013, from $10 to $260, and one in the winter from $100 to $1,200.

4/ Kyuubi is shook, and in a drunken rant, he posts this to complain about how bad of a trader he is:

"It's because I'm a bad trader and I KNOW I'M A BAD TRADER."

"It's because I'm a bad trader and I KNOW I'M A BAD TRADER."

5/ "Yeah you good traders can spot the highs and the lows pit pat piffy wing wong wang just like that and make a millino bucks sure no problem bro."

6/ "Likewise the weak hands are like OH NO IT'S GOING DOWN I'M GONNA SELL he he he and then they're like OH GOD MY ASSHOLE when the SMART traders who KNOW WHAT THE FUCK THEY'RE DOING buy back in but you know what? I'm not part of that group."

7/ "When the traders buy back in I'm already part of the market capital so GUESS WHO YOU'RE CHEATING day traders NOT ME~! Those taunt threads saying "OHH YOU SHOULD HAVE SOLD" YEAH NO SHIT. NO SHIT I SHOULD HAVE SOLD."

8/ "I SHOULD HAVE SOLD MOMENTS BEFORE EVERY SELL AND BOUGHT MOMENTS BEFORE EVERY BUY BUT YOU KNOW WHAT NOT EVERYBODY IS AS COOL AS YOU."

9/ "HODL" came from this thread as a warning to newbies.

The fact is, it's really hard to time the market.

When is the top?

When is the bottom?

I don't know and I've been staring at these charts for 8 years!

The fact is, it's really hard to time the market.

When is the top?

When is the bottom?

I don't know and I've been staring at these charts for 8 years!

10/ "HODL" is the call to be convicted about a trade. To believe in it.

Early hodlers believed in Bitcoin despite overwhelming negativity and false information (ex: labeled as a currency for money launderers and drug dealers, price fluctuations).

Early hodlers believed in Bitcoin despite overwhelming negativity and false information (ex: labeled as a currency for money launderers and drug dealers, price fluctuations).

11/ Satoshi built Bitcoin for the believers in new financial system, the hodlers, the revolutionaries. The ones who were disenfranchised with the existing financial system. The ones who are attracted by the prospect of sudden and spectacular change in their life.

12/ "As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.” — Satoshi Nakamoto

13/ “Hodling bootstrapped bitcoin into existence. Hodling increases value, which increases demand, hash rate, and network security, which, in turn, attracts new hodlers and devs. This... feedback loop drives bitcoin’s network effects, security, and value.” — @TobiasAHuber

14/ The increase in Bitcoin’s price has corresponding virality. And as it expands, hodling becomes popular with people with a lower risk appetite, pulling in more and more network effect into the Bitcoin black hole .

15/ The faith in a new financial system is what binds everything together. Bitcoin is not just a software project. It’s a method of coordination for a large group of people who face powerful adversaries. Bitcoin isn’t just a technological breakthrough, it’s also a social one.

16/ Money is a winner-take-all technology, driven by network effects. The crypto with the most hodlers, therefore, is the most demanded by consumers and will be the ultimate winner.

17/ By owning Bitcoin, you become the central bank, the backbone of the financial system. Hodling isn’t about finding another buyer at a higher price someday in the future, if hyperbitcoinization occurs you’ll never have to sell.

18/ Bitcoin promises an alternative for citizens across the world to keep their savings in a form of money that can neither be confiscated nor diluted. If Bitcoin grows much larger, it may force governments to become a voluntary organization.Through hodling we may finally be free

19/ Those who opt-in to Bitcoin (the red pill), are trading something abundant for something scarce, trading the past for the future, trading financial dependence for financial sovereignty.

20/ Want to hear more thoughts like these?

Sign up for my newsletter to learn more about Bitcoin https://danheld.substack.com/

https://danheld.substack.com/

Sign up for my newsletter to learn more about Bitcoin

https://danheld.substack.com/

https://danheld.substack.com/

Read on Twitter

Read on Twitter