1) A look into bullish/bearish engulfing candles:

I know some ppl complain about the definition of what an engulfing candle is, for this example I was just using tradingview's version of how they define it.

They have their own indicator for candlestick patterns:

I know some ppl complain about the definition of what an engulfing candle is, for this example I was just using tradingview's version of how they define it.

They have their own indicator for candlestick patterns:

2) Do engulfing candles have any value at all in them in Bitcoin?

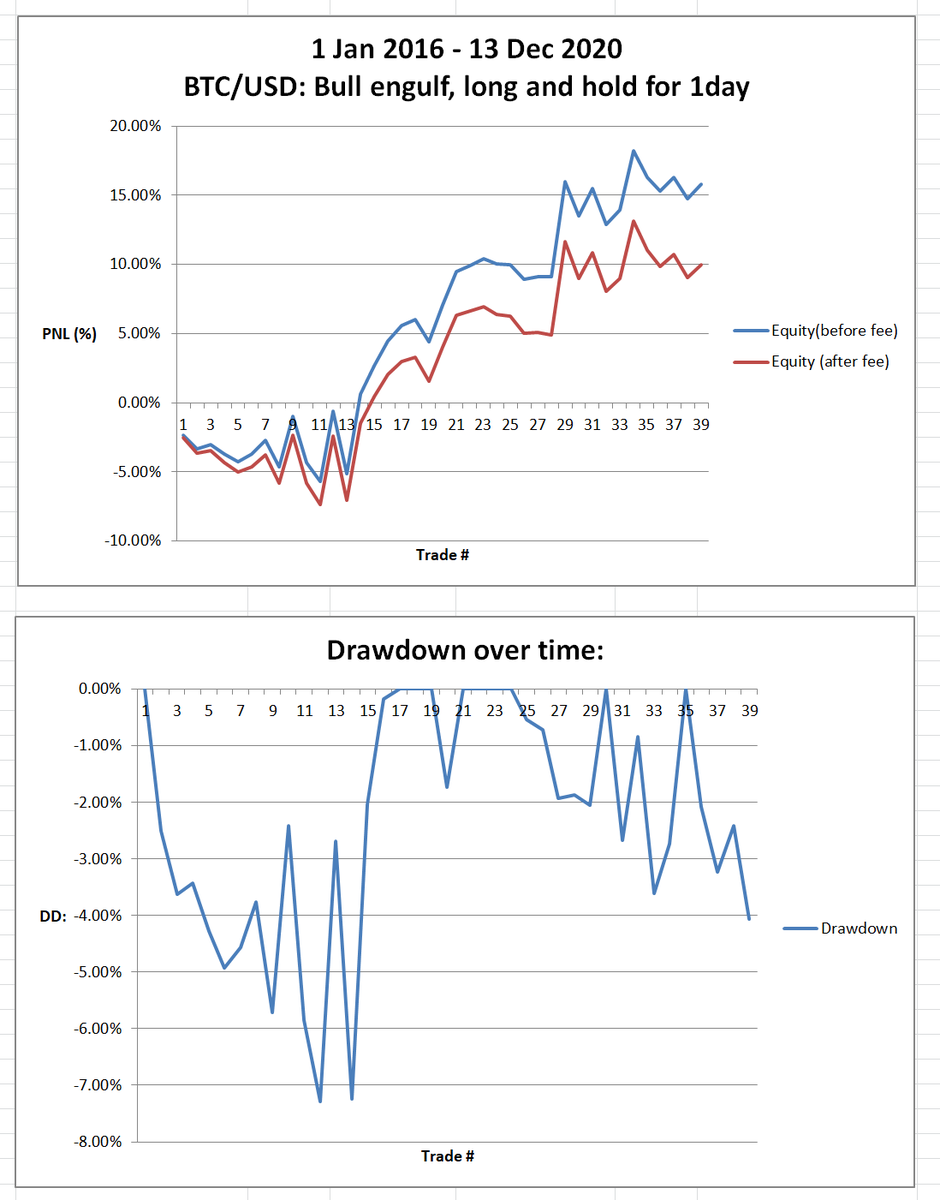

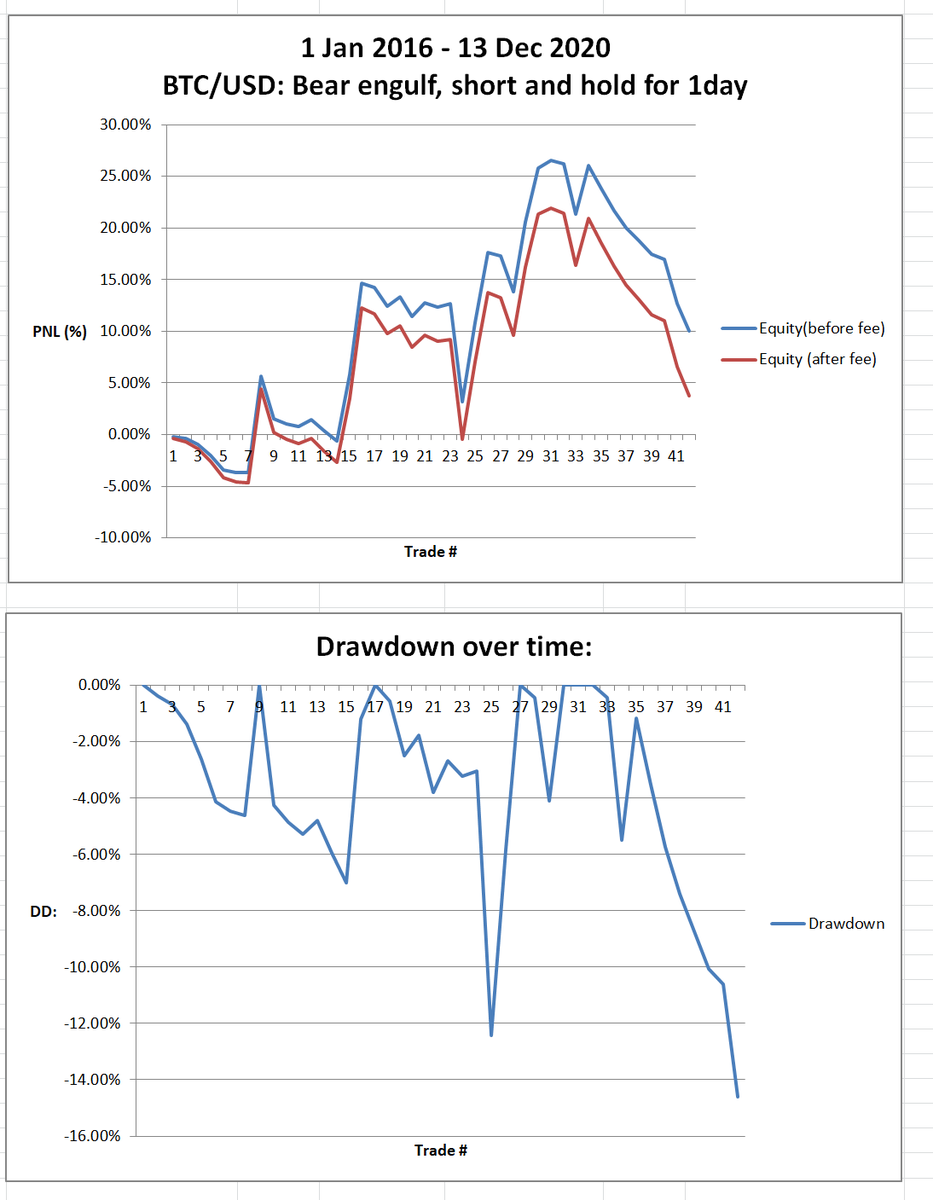

Lets look at a random strategy:

If daily candle closes as bear engulf, then market short and close after 1 day.

If daily candle closes as a bull engulf, then market long and close after 1 day.

Visual example:

Lets look at a random strategy:

If daily candle closes as bear engulf, then market short and close after 1 day.

If daily candle closes as a bull engulf, then market long and close after 1 day.

Visual example:

4)

Results showed much better performance on the long side rather than the short side.

Equity curve looks more appealing too.

Results showed much better performance on the long side rather than the short side.

Equity curve looks more appealing too.

5)

Is this a strategy that u should go live with?

Probably not, the results are garbage and barely any trade frequency either lol.

Is this a strategy that u should go live with?

Probably not, the results are garbage and barely any trade frequency either lol.

6) Why bother testing something like this then?

The more tests that you do on the market you trade, the more you understand it's behavior.

The more you understand it's behavior, the more inspiration you get to test more complex ideas which might have good alpha hidden in it.

The more tests that you do on the market you trade, the more you understand it's behavior.

The more you understand it's behavior, the more inspiration you get to test more complex ideas which might have good alpha hidden in it.

Read on Twitter

Read on Twitter