1/n Need holiday reading?

New paper w/ 𝐌𝐚𝐫𝐜 𝐌𝐞𝐥𝐢𝐭𝐳:

"𝐴𝑔𝑔𝑟𝑒𝑔𝑎𝑡𝑒-𝐷𝑒𝑚𝑎𝑛𝑑 𝐴𝑚𝑝𝑙𝑖𝑓𝑖𝑐𝑎𝑡𝑖𝑜𝑛 𝑜𝑓 𝑆𝑢𝑝𝑝𝑙𝑦 𝐷𝑖𝑠𝑟𝑢𝑝𝑡𝑖𝑜𝑛𝑠: 𝑇𝘩𝑒 𝐸𝑛𝑡𝑟𝑦-𝐸𝑥𝑖𝑡 𝑀𝑢𝑙𝑡𝑖𝑝𝑙𝑖𝑒𝑟"

https://tinyurl.com/yc3j7g2t

Slides https://tinyurl.com/y8yt4dbm

A Thread

New paper w/ 𝐌𝐚𝐫𝐜 𝐌𝐞𝐥𝐢𝐭𝐳:

"𝐴𝑔𝑔𝑟𝑒𝑔𝑎𝑡𝑒-𝐷𝑒𝑚𝑎𝑛𝑑 𝐴𝑚𝑝𝑙𝑖𝑓𝑖𝑐𝑎𝑡𝑖𝑜𝑛 𝑜𝑓 𝑆𝑢𝑝𝑝𝑙𝑦 𝐷𝑖𝑠𝑟𝑢𝑝𝑡𝑖𝑜𝑛𝑠: 𝑇𝘩𝑒 𝐸𝑛𝑡𝑟𝑦-𝐸𝑥𝑖𝑡 𝑀𝑢𝑙𝑡𝑖𝑝𝑙𝑖𝑒𝑟"

https://tinyurl.com/yc3j7g2t

Slides https://tinyurl.com/y8yt4dbm

A Thread

2/n Entry-exit central in the COVID-19, i.a. @skalemliozcan @pogourinchas @JHaltiwanger_UM

We built endogenous-entry business-cycle Macro models for ~2 decades, joint work w/ @FabioGhironi

We revisit that model class to understand the role of entry-exit in COVID-19 recession

We built endogenous-entry business-cycle Macro models for ~2 decades, joint work w/ @FabioGhironi

We revisit that model class to understand the role of entry-exit in COVID-19 recession

3/n -> build a theory of aggregate-demand AD amplification of supply disruptions.

Contributions/Results:

𝐓𝐡𝐞 𝐄𝐧𝐭𝐫𝐲-𝐄𝐱𝐢𝐭 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫: The endogenous response of entry-exit to a TFP shock is amplified by sticky prices P.

Contributions/Results:

𝐓𝐡𝐞 𝐄𝐧𝐭𝐫𝐲-𝐄𝐱𝐢𝐭 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫: The endogenous response of entry-exit to a TFP shock is amplified by sticky prices P.

4/n The entry-exit response w/ sticky P is θ >1, θ elasticity of demand/substitution btw goods. It is 1 under flexible P. (U=lnC & C a CES aggreg) Reason: flex P→increase P when bad shock. If cannot (sticky P)→losses→exit, further (endogenous) TFP-like round, etc:

A Multiplier

A Multiplier

5/n Works in any model w/ endog. entry & sticky P, astonishingly not noticed before (including by us).

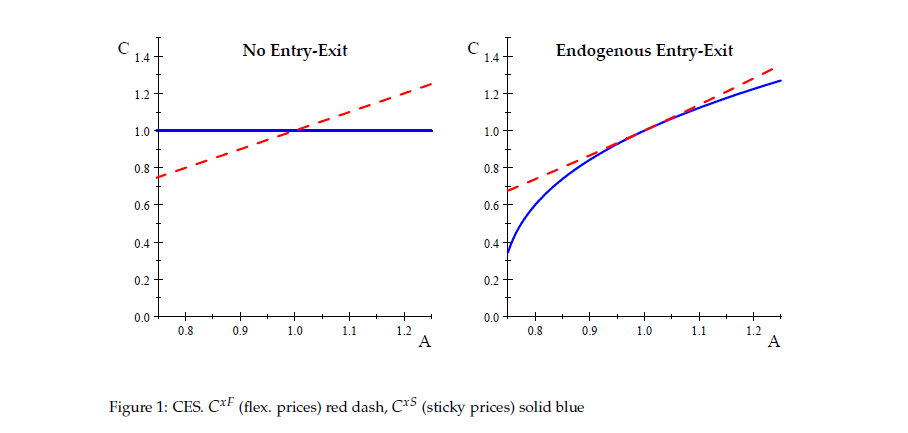

NOW: Is 𝐚𝐠𝐠𝐫𝐞𝐠𝐚𝐭𝐞 𝐚𝐜𝐭𝐢𝐯𝐢𝐭𝐲 similarly amplified? YES. Remember first with no entry, standard model (no capital): w/ flex P, TFP fall by 1 = fall in C & Y by 1.

NOW: Is 𝐚𝐠𝐠𝐫𝐞𝐠𝐚𝐭𝐞 𝐚𝐜𝐭𝐢𝐯𝐢𝐭𝐲 similarly amplified? YES. Remember first with no entry, standard model (no capital): w/ flex P, TFP fall by 1 = fall in C & Y by 1.

6/n w/ sticky P (labor elastic, no rationing) + quantity equation:

TFP ↓ does nothing to C & Y (L ↑ to produce more, optimal as profits ↓ income effect).

Standard, known NK problem

𝐄𝐧𝐝𝐨𝐠𝐞𝐧𝐨𝐮𝐬 𝐄𝐧𝐭𝐫𝐲-𝐞𝐱𝐢𝐭 𝐟𝐥𝐢𝐩𝐬 𝐭𝐡𝐢𝐬!

TFP ↓ does nothing to C & Y (L ↑ to produce more, optimal as profits ↓ income effect).

Standard, known NK problem

𝐄𝐧𝐝𝐨𝐠𝐞𝐧𝐨𝐮𝐬 𝐄𝐧𝐭𝐫𝐲-𝐞𝐱𝐢𝐭 𝐟𝐥𝐢𝐩𝐬 𝐭𝐡𝐢𝐬!

7/n Flex P→already amplification of TFP disruption, standard variety effect i.a. BGM JPE 2012: C & Y fall by x>1.

But w/ sticky P, Y falls by more X(da)>x. Larger disruption da→larger amplification.

Several features drive this when added to our entry-exit multiplier:

But w/ sticky P, Y falls by more X(da)>x. Larger disruption da→larger amplification.

Several features drive this when added to our entry-exit multiplier:

8/n concavity of C function in number of varieties; inefficiently low entry in market equilibrium (->amplification to first order)

So, negative TFP→positive output gap w/o entry, negative with entry-exit (potential output falls by more, but stick-P output falls by even more).

So, negative TFP→positive output gap w/o entry, negative with entry-exit (potential output falls by more, but stick-P output falls by even more).

9/n Corollary: mind the nonlinearities! Linearizing may miss the whole point (w/ CES, you see nothing at the 1st order; COVID-19 shock very large).

10/n Important side result: response of hours w/ entry-exit is similar across flex-sticky P. Unlike no-entry model, where sticky P→hours countercyclical to TFP.

Here, procyclical, related to Y gap response.

Profits make hours go wild w/ no entry, entry-exit cleans them up

Here, procyclical, related to Y gap response.

Profits make hours go wild w/ no entry, entry-exit cleans them up

11/n W/ CRRA utility, generalized requirement for both entry-exit multiplier & AD amplification

θ > σ

(σ Elast. Intertemp. Subst. EIS)

Entirely plausible: θ > 4, σ < 2. (w/ U=lnC restriction θ >1)

θ > σ

(σ Elast. Intertemp. Subst. EIS)

Entirely plausible: θ > 4, σ < 2. (w/ U=lnC restriction θ >1)

12/n

θ > σ is the OPPOSITE of 𝑠𝑒𝑚𝑖𝑛𝑎𝑙 @VeronicaGuerri7 @guido_lorenzoni @ludwigstraub Werning paper (2-sector, rep-agent part)

Difference: here, endogenous change in number of varieties to aggregate TFP (there, sectoral TFP, as if exogenous fall in number of varieties).

θ > σ is the OPPOSITE of 𝑠𝑒𝑚𝑖𝑛𝑎𝑙 @VeronicaGuerri7 @guido_lorenzoni @ludwigstraub Werning paper (2-sector, rep-agent part)

Difference: here, endogenous change in number of varieties to aggregate TFP (there, sectoral TFP, as if exogenous fall in number of varieties).

13/n Here, both intensive & extensive margins->aggreg. C Our condition

→ extensive margin elastic enough → aggregate C amplified even though intensive margin dampened.

→ Edgeworth substitutability of individual goods in utility (GLSW=complementarity)

→ extensive margin elastic enough → aggregate C amplified even though intensive margin dampened.

→ Edgeworth substitutability of individual goods in utility (GLSW=complementarity)

14/n Our complementary mechanism: 𝐞𝐧𝐝𝐨𝐠𝐞𝐧𝐨𝐮𝐬 entry-exit, extensive-margin.

We abstract from interesting and important two-agent liquidity-constrained mechanism that GLSW find relaxes θ < σ and complementarity.

We abstract from interesting and important two-agent liquidity-constrained mechanism that GLSW find relaxes θ < σ and complementarity.

15/n More loosely related to other COVID-19 amplif. theories @DBaqaee Farhi, @LucaFornaro3 Wolf, Woodford

Vast entry literature: Corsetti Bergin Jaimovich @FZanettiOxford Colciago @lorenzarossi3 @chrisedmond @virgiliu79 @Basile_G etc.

Let us know if we missed a relevant paper!

Vast entry literature: Corsetti Bergin Jaimovich @FZanettiOxford Colciago @lorenzarossi3 @chrisedmond @virgiliu79 @Basile_G etc.

Let us know if we missed a relevant paper!

Read on Twitter

Read on Twitter