Following Coinbase's IPO announcement, we value the company at $28 billion. Coinbase is one of the most prominent exchanges with $1 billion daily volume in Dec-20.

Check out our model and edit it to your own assumptions. https://messari.io/article/coinbase-ipo-could-command-28-billion-valuation?utm_source=asiahodl&utm_medium=thread&utm_campaign=coinbaseipo

Check out our model and edit it to your own assumptions. https://messari.io/article/coinbase-ipo-could-command-28-billion-valuation?utm_source=asiahodl&utm_medium=thread&utm_campaign=coinbaseipo

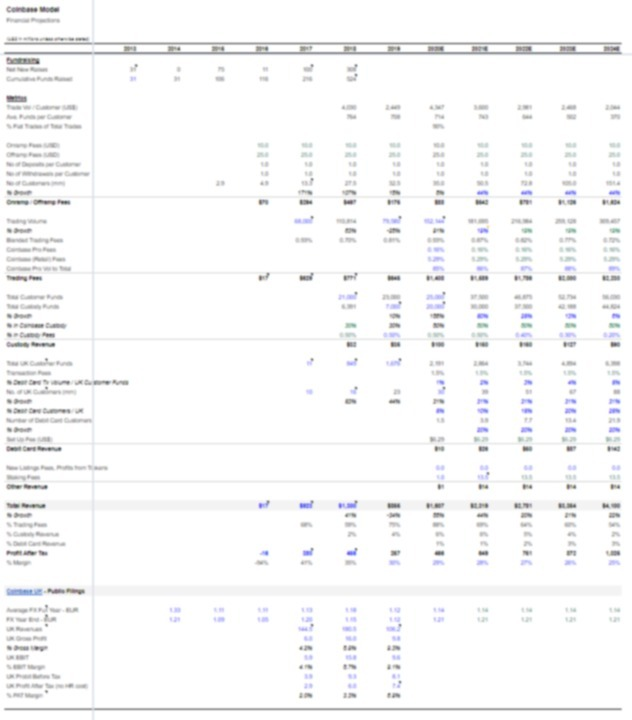

In our model, we split Coinbase's business segments by trading fees, custody fees, debit cards and others.

Trading: volume mostly comes from insitutional clients but average holdings per client is $703

Trading: volume mostly comes from insitutional clients but average holdings per client is $703

Custody held $7bn in 2019, growing to $20bn in 2020

Custody held $7bn in 2019, growing to $20bn in 2020

Trading: volume mostly comes from insitutional clients but average holdings per client is $703

Trading: volume mostly comes from insitutional clients but average holdings per client is $703  Custody held $7bn in 2019, growing to $20bn in 2020

Custody held $7bn in 2019, growing to $20bn in 2020

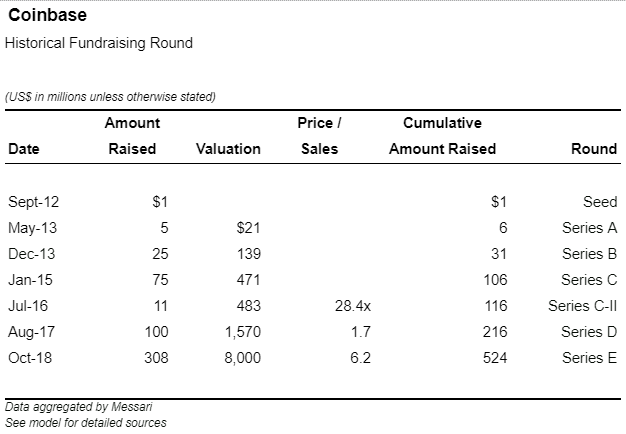

VALUATIONS: Launched in 2012, with a seed investment from @ycombinator, CB reached unicorn status in 2017. Below are past fundraises.

To achieve our valuation, we look at the multiples of prior fundraisings, TradFi comparables and listed crypto exchanges.

To achieve our valuation, we look at the multiples of prior fundraisings, TradFi comparables and listed crypto exchanges.

Equity investors are hungry for crypto exposure:

@bctechgroup share price is up 130%

@bctechgroup share price is up 130%

@Microstrategy Dec-20 convertible was upsized to $650m million

@Microstrategy Dec-20 convertible was upsized to $650m million

@Grayscale assets trade at a 20% to 6,000% premium

@Grayscale assets trade at a 20% to 6,000% premium

@bctechgroup share price is up 130%

@bctechgroup share price is up 130%  @Microstrategy Dec-20 convertible was upsized to $650m million

@Microstrategy Dec-20 convertible was upsized to $650m million @Grayscale assets trade at a 20% to 6,000% premium

@Grayscale assets trade at a 20% to 6,000% premium

Crypto and equity markets valuations have traded independently. This listing is important even for Token valuations as Coinbase will provide a valuation anchor -- not only for future equity listings -- but also for crypto-native exchange tokens. https://messari.io/article/coinbase-ipo-could-command-28-billion-valuation?utm_source=asiahodl&utm_medium=thread&utm_campaign=coinbaseipo

Read on Twitter

Read on Twitter