Today, we launch our report on @WeWork.

We aggregated public data, interviewed 10 experts, and built a model to understand what’s happened since the company’s failed IPO.

What we found is a distressed company that appears to be turning it around:

https://sacra.com/research/wework-engineering-a-comeback/

We aggregated public data, interviewed 10 experts, and built a model to understand what’s happened since the company’s failed IPO.

What we found is a distressed company that appears to be turning it around:

https://sacra.com/research/wework-engineering-a-comeback/

Our model gives WeWork an equity value of $3.5B.

At this price, WeWork equity resembles a call option, with limited downside and asymmetric upside.

WeWork has issues. But there are also reasons for optimism going forward.

At this price, WeWork equity resembles a call option, with limited downside and asymmetric upside.

WeWork has issues. But there are also reasons for optimism going forward.

WeWork’s core operation can be viable.

24 months after opening, the average WeWork location can generate a 20% contribution margin. We cross checked this with WeWork’s more stable peers.

24 months after opening, the average WeWork location can generate a 20% contribution margin. We cross checked this with WeWork’s more stable peers.

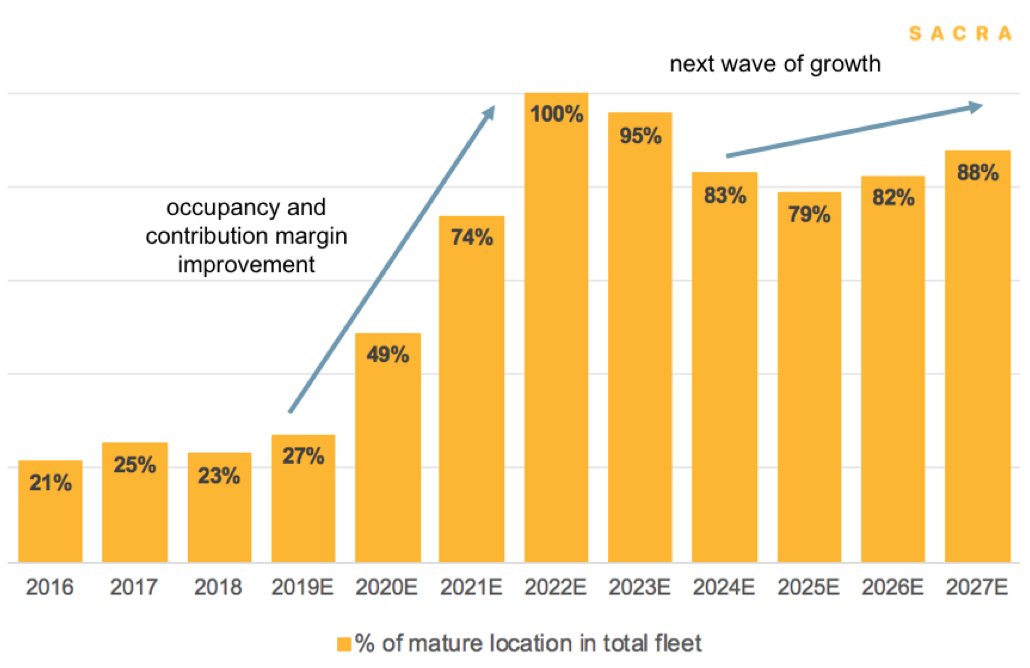

A big reason for WeWork’s cash burn was its lack of mature locations. In 2019, WeWork had the biggest flexible workspace footprint, but the lowest % of mature sites:

- WeWork 30%

- IWG 84%

- ServCorp 88%

- Ucommune 60%

- WeWork 30%

- IWG 84%

- ServCorp 88%

- Ucommune 60%

Over 2020, WeWork has become much more prudent in new location openings.

Mature locations are expected to grow to 50% by the end of 2020 and reach 100% in 2022.

Mature locations are expected to grow to 50% by the end of 2020 and reach 100% in 2022.

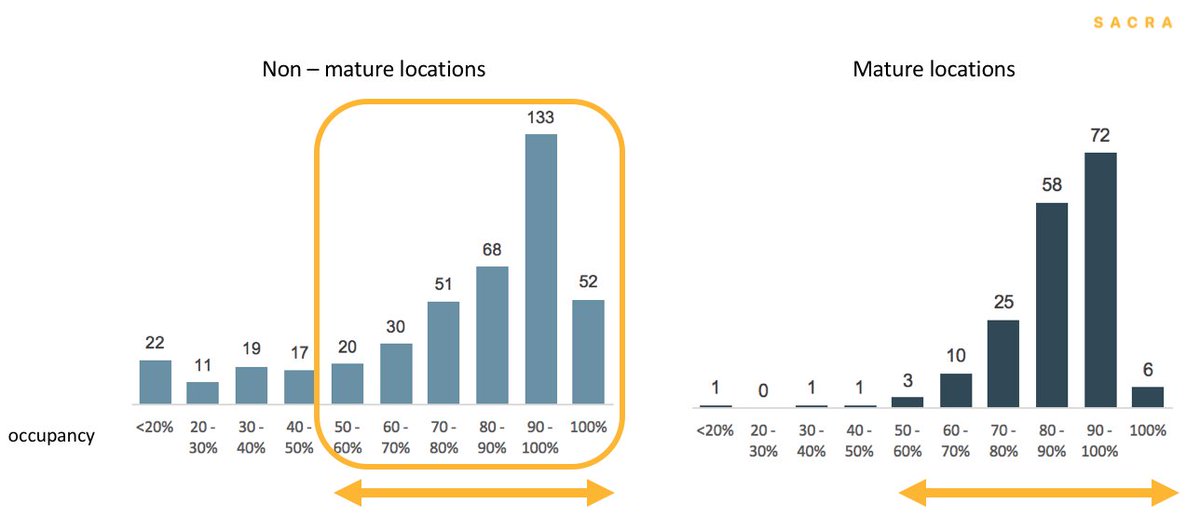

WeWork is also rightsizing its real estate portfolio.

We estimate WeWork has exited 66 locations and amended about 150 leases, driving higher average occupancy and margins across their portfolio.

We estimate WeWork has exited 66 locations and amended about 150 leases, driving higher average occupancy and margins across their portfolio.

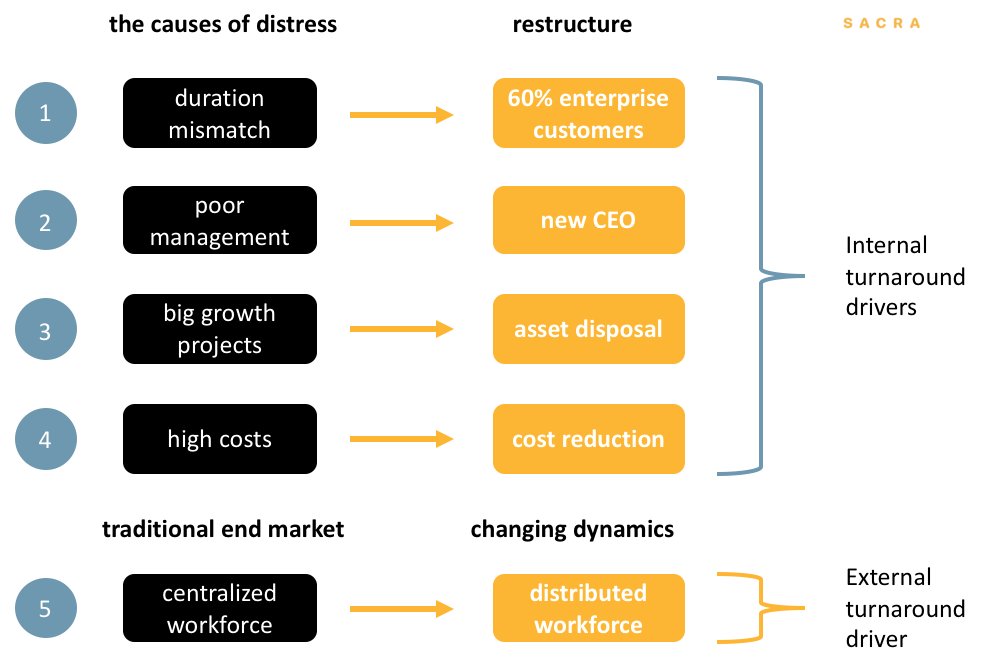

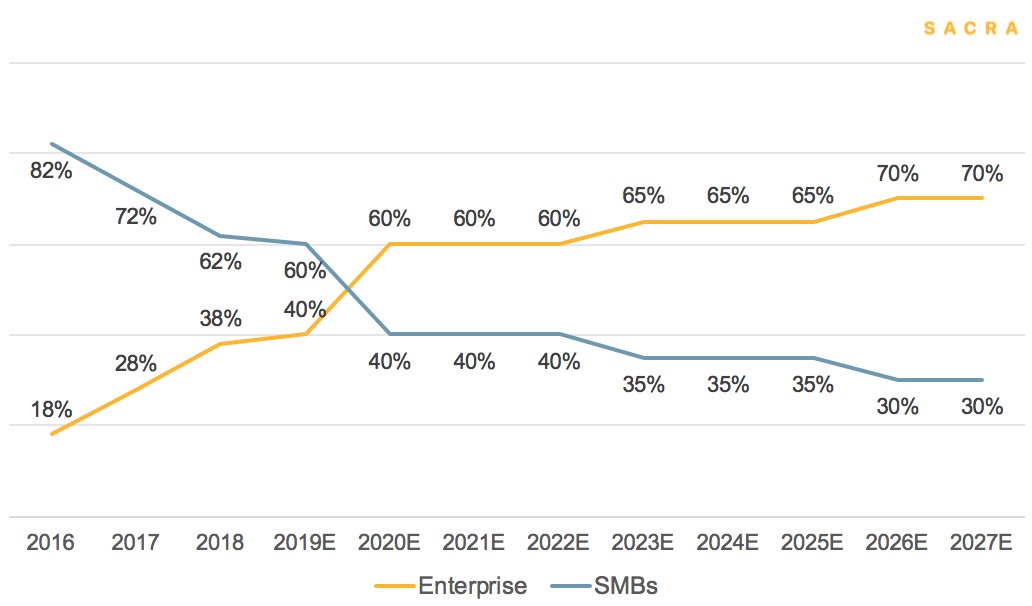

WeWork's enterprise customer base has grown from 18% to 54%. That means:

- More attractive tenant for landlords

- Higher desk sales

- Longer contract lengths

- More reliable revenue (50% of SMBs canceled contracts in 2020; 100% of enterprises paid)

- More attractive tenant for landlords

- Higher desk sales

- Longer contract lengths

- More reliable revenue (50% of SMBs canceled contracts in 2020; 100% of enterprises paid)

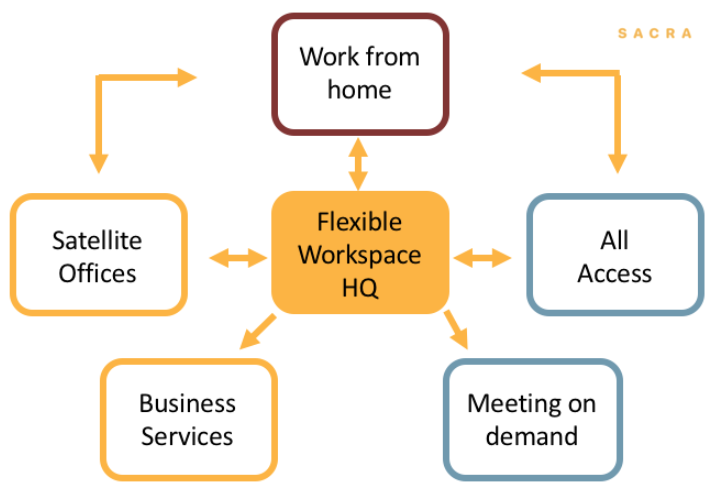

Last, market dynamics are changing. Post-COVID, the majority want to return to the office a few days a week but keep the benefit of flexibility.

Ironically, the downturn many thought would sink WeWork may become the very cause of its survival.

Ironically, the downturn many thought would sink WeWork may become the very cause of its survival.

Our research suggests that WeWork has a viable path to stabilizing its core operations and transitioning to an integrated, tech-enabled ecosystem coordinator.

What WeWork is building now is a franchise business.

Instead of subleasing office space, it provides management services to landlords.

This model is highly attractive because it is capital-light and growth can accrue without too much incremental cost.

Instead of subleasing office space, it provides management services to landlords.

This model is highly attractive because it is capital-light and growth can accrue without too much incremental cost.

This new strategy bears similarities with how hotel companies over the last few decades transitioned from owning and operating buildings to a more asset-light franchise model.

An asset light strategy would improve WeWork’s business quality. Instead of leasing buildings, WeWork could focus on business services and flex office management.

But WeWork will face tough competition from a range of new PropTechs with much lighter balance sheets and advanced tech, like @Flowscape, @SwitchHQ, and @sensorflowsg.

One ironic lesson from their success may be that WeWork’s original plan wasn’t wrong—just ahead of its time.

One ironic lesson from their success may be that WeWork’s original plan wasn’t wrong—just ahead of its time.

For more, check out the report and sign up for our list to join a WeWork analyst call exclusive to Sacra subscribers.

https://sacra.com/research/wework-engineering-a-comeback/

https://sacra.com/research/wework-engineering-a-comeback/

Read on Twitter

Read on Twitter