1/5

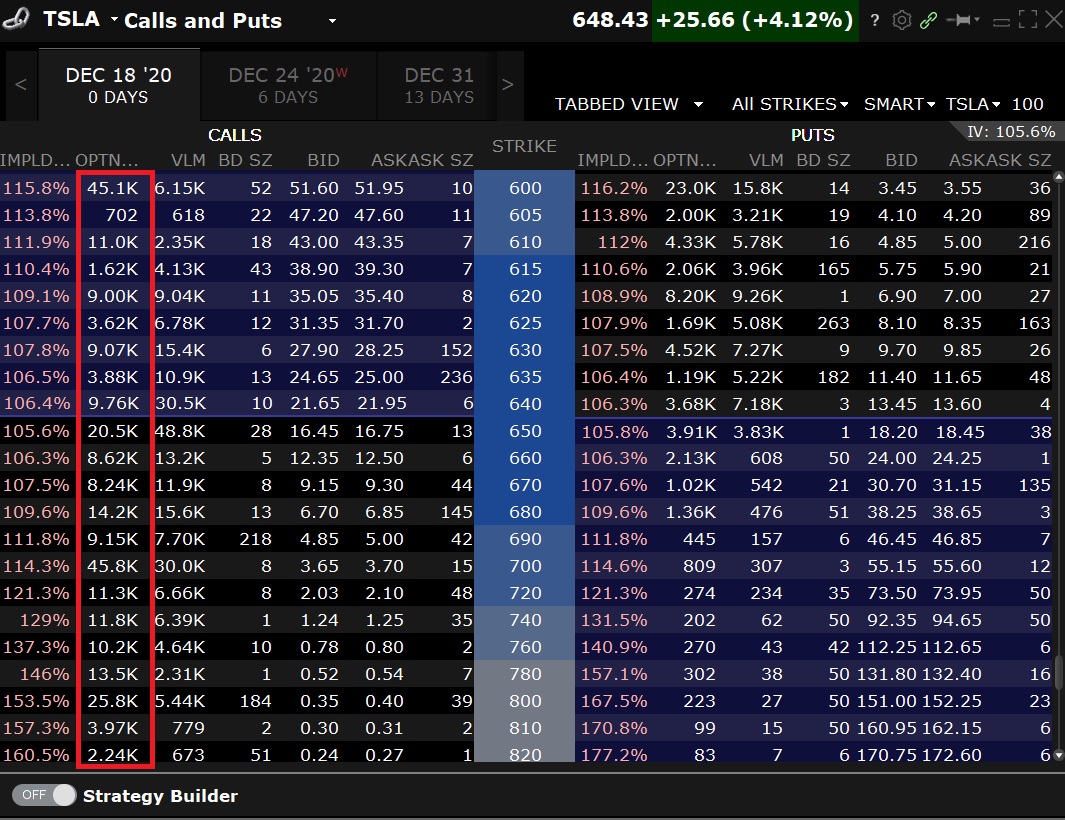

I am SO glad I am not a $TSLA options market maker this week. In this table, for each strike price, the number in the red column times 100 is approx. the number of shares market makers risk having to sell, if the stock ends above that level and the options are exercised.

I am SO glad I am not a $TSLA options market maker this week. In this table, for each strike price, the number in the red column times 100 is approx. the number of shares market makers risk having to sell, if the stock ends above that level and the options are exercised.

2/5

If $TSLA ends above $650 tomorrow, sellers of the $650 strike calls (mostly MMs) will be forced to sell over 2M shares to the call holders. If MMs don't have these shares, they'll have to be short over the weekend, and risk losing a ton if the stock runs up during weekend.

If $TSLA ends above $650 tomorrow, sellers of the $650 strike calls (mostly MMs) will be forced to sell over 2M shares to the call holders. If MMs don't have these shares, they'll have to be short over the weekend, and risk losing a ton if the stock runs up during weekend.

3/5

On the other hand, if $TSLA ends under $650 tomorrow, and MMs own 2M shares because they thought they'd most likely have to sell them to options holders, they have a net long position over the weekend, and risk losing a ton if the stock drops before open on Monday.

On the other hand, if $TSLA ends under $650 tomorrow, and MMs own 2M shares because they thought they'd most likely have to sell them to options holders, they have a net long position over the weekend, and risk losing a ton if the stock drops before open on Monday.

4/5

Imagine the stock being right at $650 or $700 (or almost any price for that matter), 30 minutes before close tomorrow, and not knowing whether to prepare for a closing price above or below certain strikes. Not knowing whether to prepare millions of shares or not.

Imagine the stock being right at $650 or $700 (or almost any price for that matter), 30 minutes before close tomorrow, and not knowing whether to prepare for a closing price above or below certain strikes. Not knowing whether to prepare millions of shares or not.

5/5

This is called pin risk, and this is why $TSLA options market makers have a very interesting and challenging, but also an extremely difficult and scary job to do this week.

https://en.wikipedia.org/wiki/Pin_risk_%28options%29

This is called pin risk, and this is why $TSLA options market makers have a very interesting and challenging, but also an extremely difficult and scary job to do this week.

https://en.wikipedia.org/wiki/Pin_risk_%28options%29

Read on Twitter

Read on Twitter