Especially since the global financial crisis, the efficient markets hypothesis has not been in high repute. Yet, economists implicitly rely on that hypothesis when they downplay concerns about currency manipulation. 1/5

With efficient markets, selling your currency to buy a foreign currency has no effect. Private investors adjust their portfolios in the opposite direction to fully neutralize any effect on exchange rates and keep rates of return equalized. 2/5

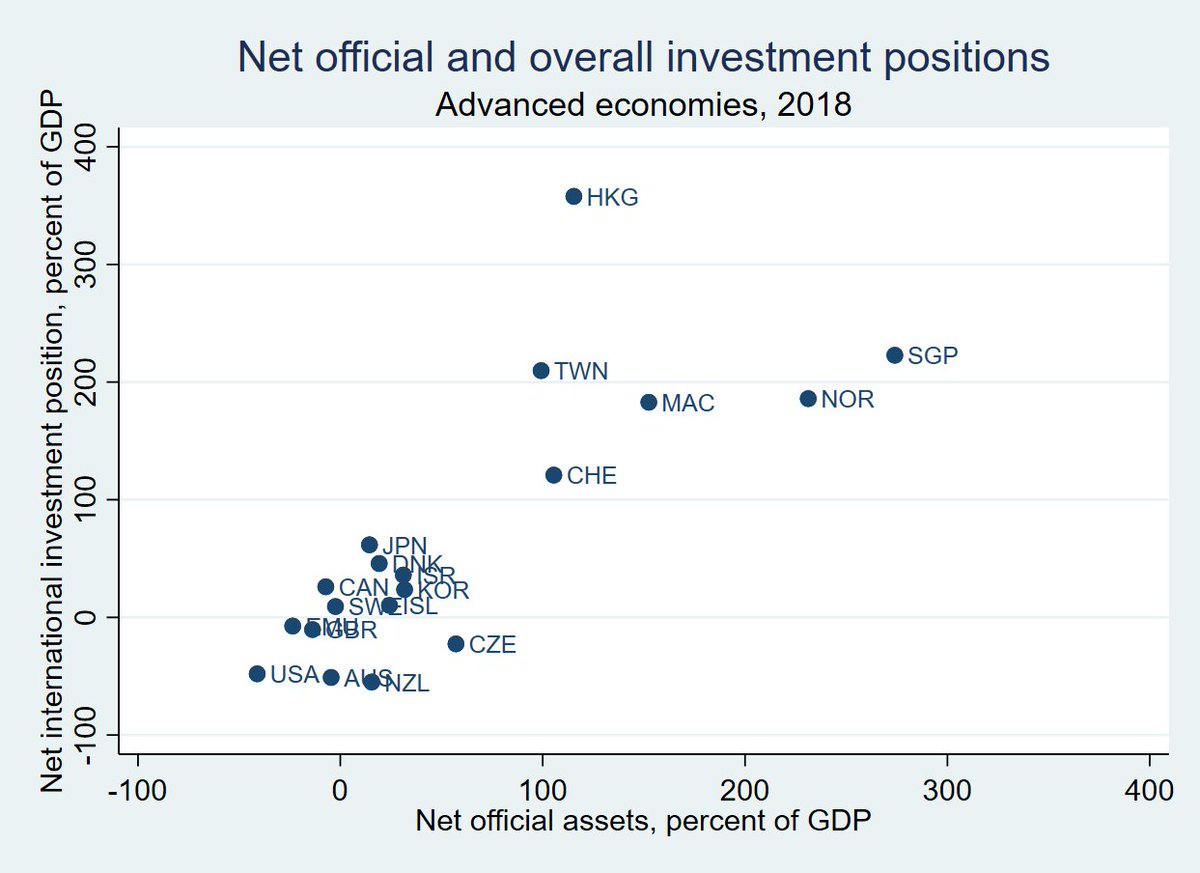

In an efficient-markets world, official currency intervention has no effect on a country’s trade surplus and thus on its overall net international investment position, which is the cumulation of past trade surpluses. 3/5

Data strongly reject efficient markets across currencies. This figure from my latest policy brief shows that a country’s overall net investment position moves dollar-for-dollar with its cumulated official currency intervention (net official assets). 4/5

Here’s the policy brief. In a forthcoming working paper, I show that this conclusion is not sensitive to allowing for other potentially important factors behind investment positions, including fiscal debts. It also holds for developing economies. 5/5 https://www.piie.com/publications/policy-briefs/taming-us-trade-deficit-dollar-policy-balanced-growth

Read on Twitter

Read on Twitter