1/ US Dollar Thread.

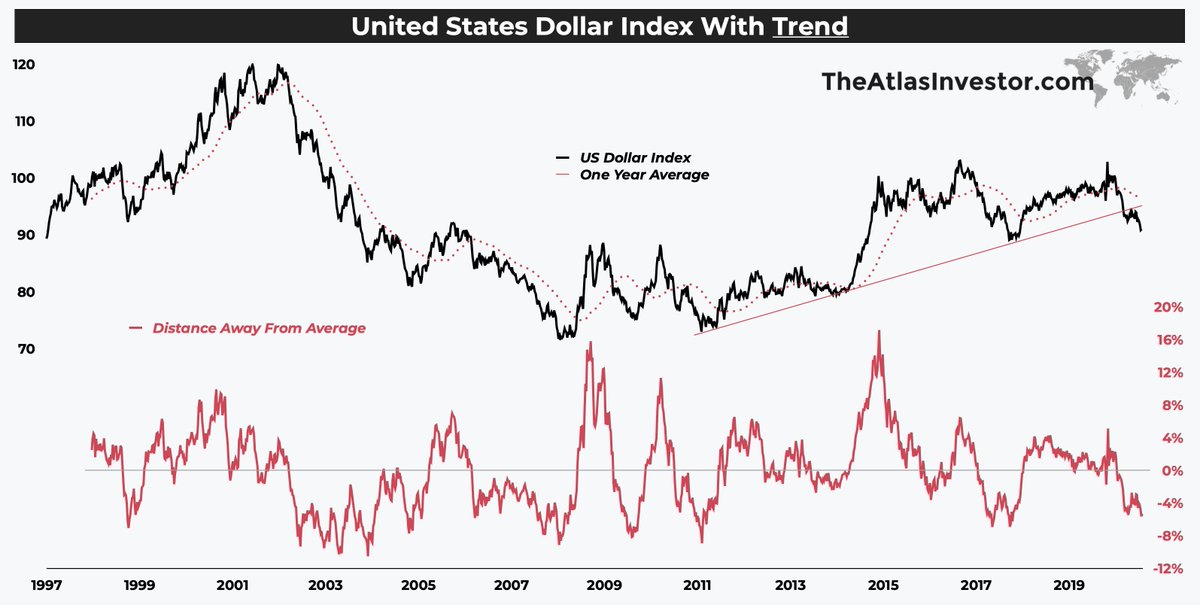

The medium-term technical picture shows the bull market (uptrend) — which started in the 2008/11 period — has come to an end with a recent break down of an important trend line support.

The trend is now clearly down.

The medium-term technical picture shows the bull market (uptrend) — which started in the 2008/11 period — has come to an end with a recent break down of an important trend line support.

The trend is now clearly down.

2/ Why is this important?

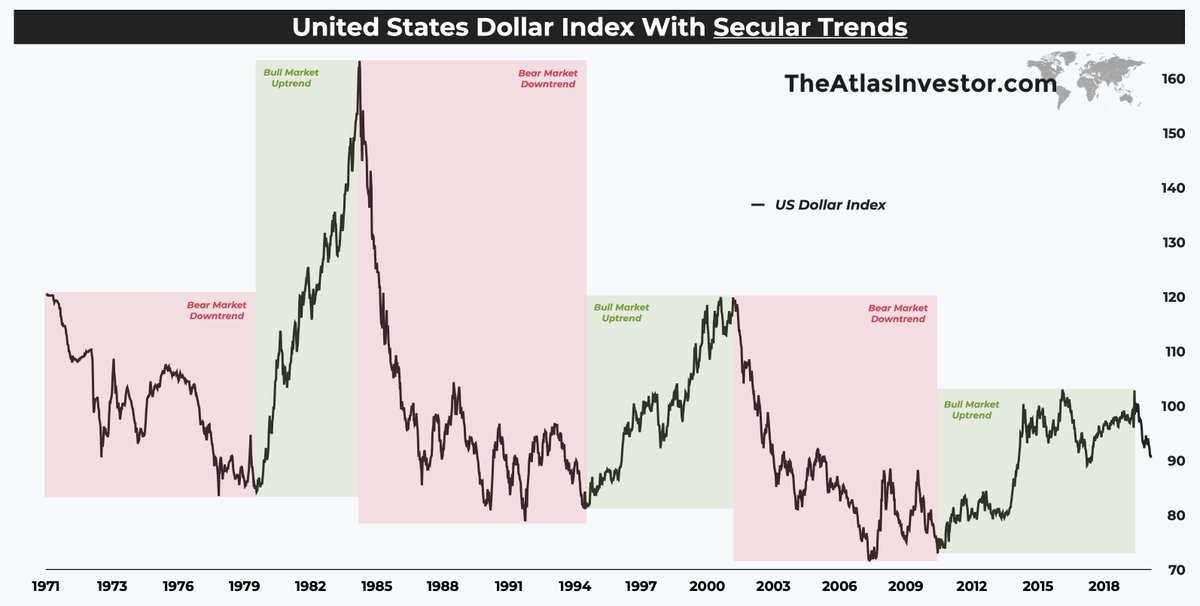

Since President Nixon took off the Gold standard, floating the $USD in 1971, it has gone through 3 secular bull & bear markets.

History shows that currencies enter multi-year trends & the probability is high $USD is entering a multi-year downtrend now.

Since President Nixon took off the Gold standard, floating the $USD in 1971, it has gone through 3 secular bull & bear markets.

History shows that currencies enter multi-year trends & the probability is high $USD is entering a multi-year downtrend now.

3/ What does this mean for global investors?

• exit $USD denominated assets

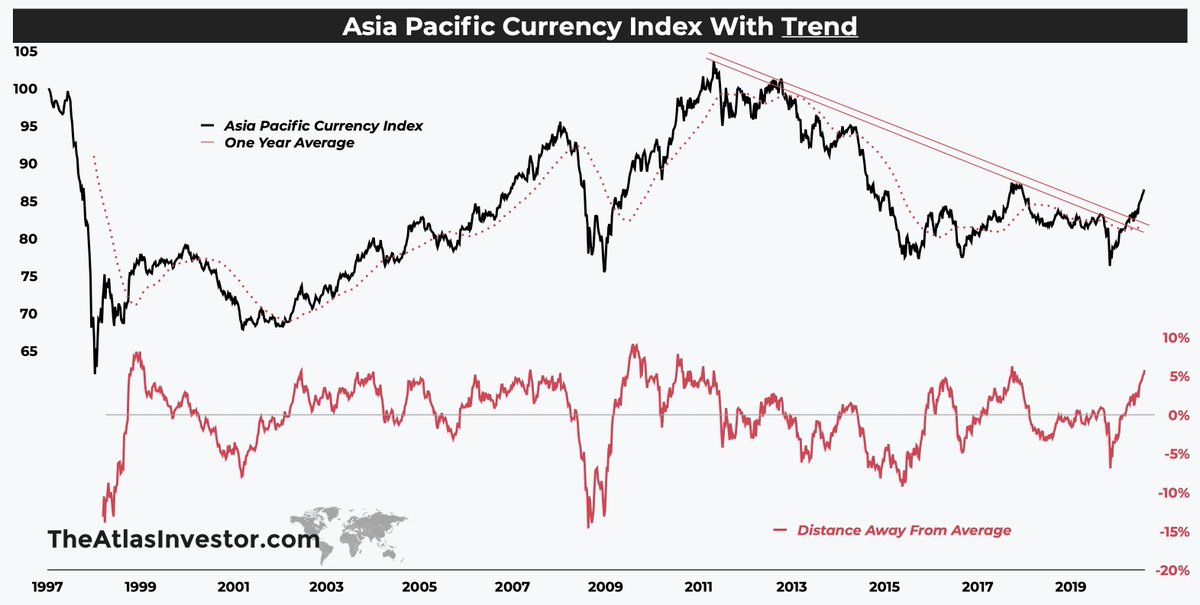

• increase stock exposure Asia Pacific & EM countries

• focus on small & value, not large & growth

• become a real estate LP in EU & UK deals

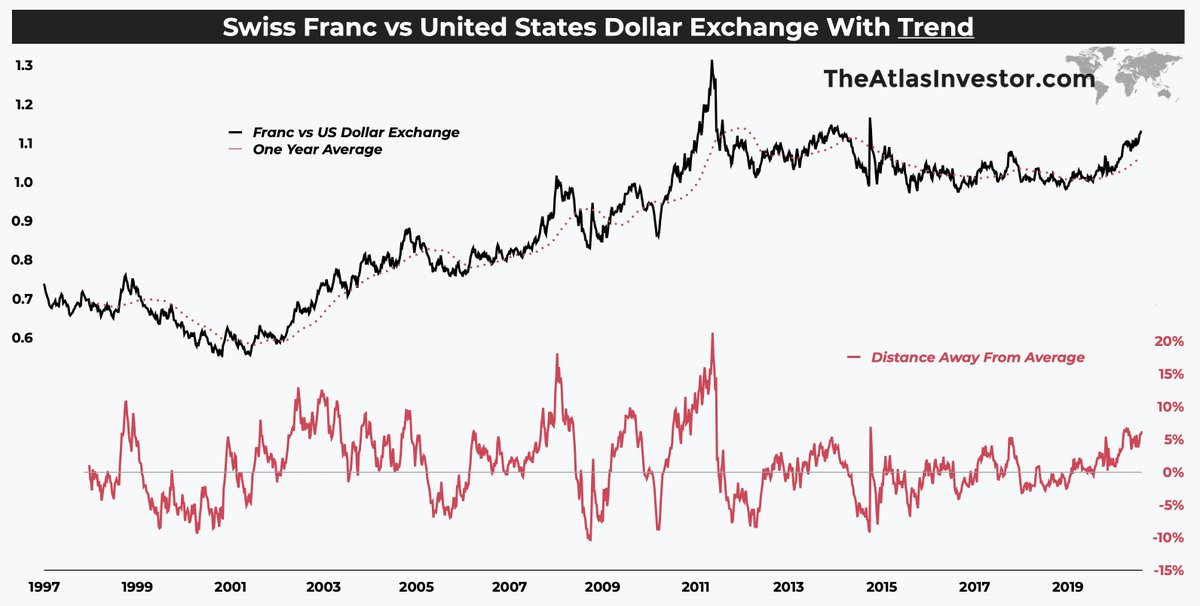

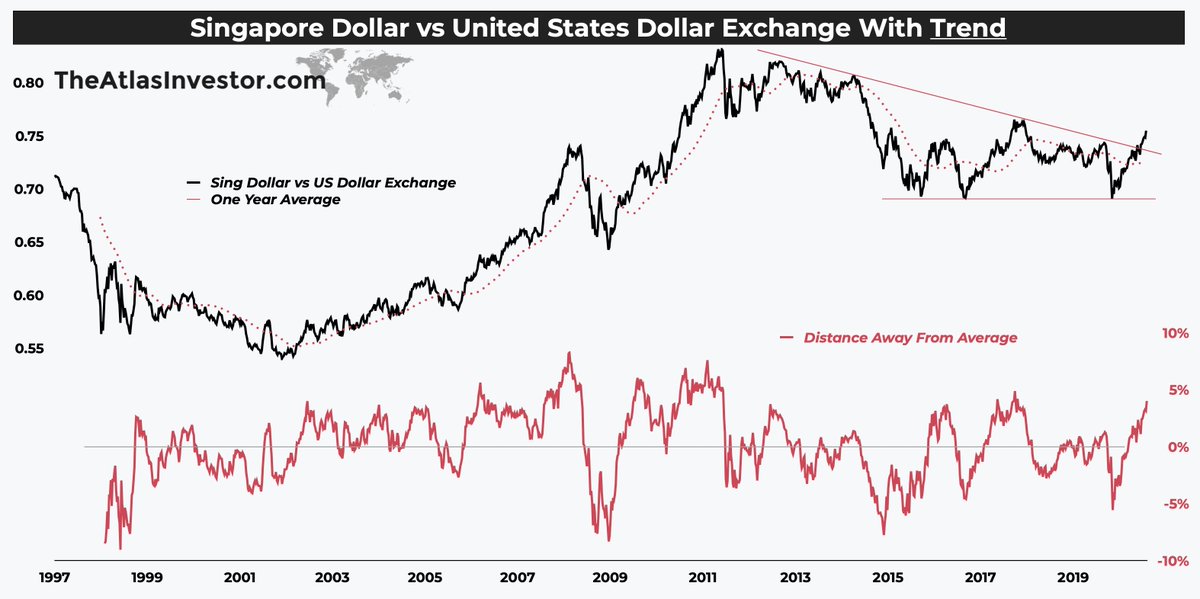

• hold cash reserves in Singapore Dollar & Swiss Franc

• exit $USD denominated assets

• increase stock exposure Asia Pacific & EM countries

• focus on small & value, not large & growth

• become a real estate LP in EU & UK deals

• hold cash reserves in Singapore Dollar & Swiss Franc

4/ What would be the catalyst?

First of all, we don't know if it will decline (unlike every other Twitter guru predicting the future), but we can discuss probabilities.

More & more international heavyweights are moving away from the greenback! https://twitter.com/TihoBrkan/status/1339582977920004098?s=20

First of all, we don't know if it will decline (unlike every other Twitter guru predicting the future), but we can discuss probabilities.

More & more international heavyweights are moving away from the greenback! https://twitter.com/TihoBrkan/status/1339582977920004098?s=20

5/ Swiss Franc is one of the few stronger currencies which never really lost any ground vs the greenback over the last decade — unlike the Pound or the Euro.

6/ Singapore is probably the best city/country in the world right now,

And as a financial center, it is becoming perceived as Switzerland of Asia.

Sing Dollar ferocious break out vs $USD in the chart below!

And as a financial center, it is becoming perceived as Switzerland of Asia.

Sing Dollar ferocious break out vs $USD in the chart below!

Read on Twitter

Read on Twitter