Today we learn if the Governor's budget will yet again include an income tax on capital gains. Here is a tweet thread with facts from years of research on this topic . . . https://www.washingtonpolicy.org/publications/detail/capital-gains-income-tax-background-information #waleg @WAPolicyCenter

A capital gains tax IS an income tax. This fact is not in dispute anywhere outside of WA.

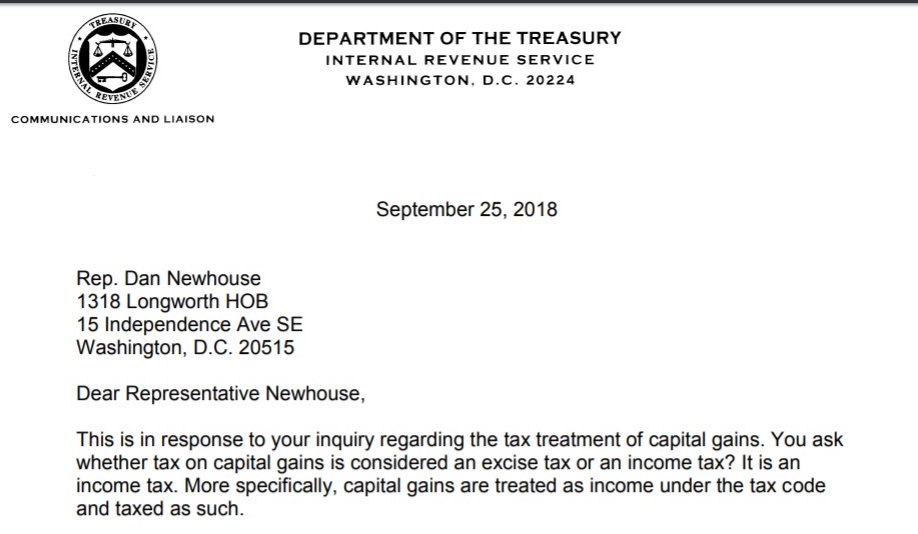

IRS: “You ask whether tax on capital gains is considered an excise tax or an income tax? It is an income tax. More specifically, capital gains are treated as income under the tax code and taxed as such." #waleg

Nonpartisan #waleg staff: “Most states do not have separate capital gains tax rates. Instead, most states tax capital gains as ordinary income subject to the state's income tax rates.” https://www.washingtonpolicy.org/publications/detail/nonpartisan-legislative-staff-summarizes-governors-capital-gains-tax-proposal

Do states without personal income taxes tax capital gains? No. https://www.washingtonpolicy.org/library/docLib/statedorscapitalgainsincome-1.pdf

Florida: "There is currently no Florida income tax for individuals and, therefore, no Florida capital gains tax for individuals."

Alaska: "No personal capital gains tax. Alaska currently does not have a personal income tax." #waleg

Alaska: "No personal capital gains tax. Alaska currently does not have a personal income tax." #waleg

Nevada: "Nevada does NOT have a capital gains tax similar to federal income tax."

Texas: “No capital gains tax. Texas does not have a state income tax.”

Texas: “No capital gains tax. Texas does not have a state income tax.”

Wyoming: "No capital gains tax because Wyoming does not have an income tax." #waleg

Not a single state with an income tax on capital gains describes this type of tax as dependable or stable. Instead, here are a few examples discussing the extreme volatility problems inherent with taxing this type of income . . . https://www.washingtonpolicy.org/publications/detail/state-tax-officials-across-country-agree-capital-gains-income-taxes-are-extremely-volatile-and-unpredictable #waleg

Delaware: "As in every other state, capital gains are extremely volatile and unpredictable. This is particularly problematic toward the end of market cycles, when they represent a greater share of personal income tax revenues.”

“For the Commonwealth of Massachusetts, taxes on capital gains are among the most volatile and unpredictable major sources of revenue. Obviously, that is very much in line with the experience of other states."

"California's tax revenues have numerous volatile elements, but among the more significant sources of revenue volatility are the state's tax levies on net capital gains through the personal income tax."

Virginia: “Capital gains is the most volatile tax source that any state has to forecast. It is not dependable or stable.”

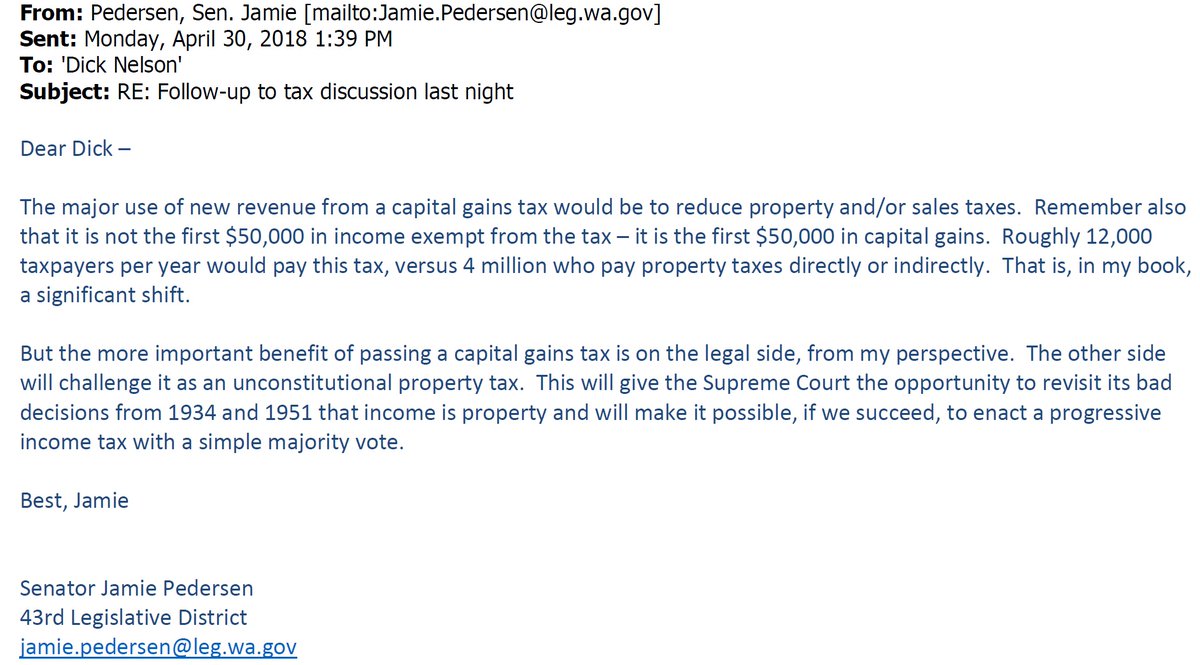

What are the motivations behind the WA income tax on capital gains proposals? Thanks to public records we know the goal is to set up a lawsuit in hopes of imposing a graduated income tax without a constitutional amendment. https://www.washingtonpolicy.org/publications/detail/lawmakers-emails-confirm-goal-for-capital-gains-proposal-is-broad-income-tax #waleg

Read on Twitter

Read on Twitter