Our @SOMO report ‘Engineering digital monopolies: The financialisation of Big Tech’ is out. Co-authored with @fernandezamster, @ilkitaG and Tobias Klinge, we unpack the apex of capital accumulation at the frontier of capitalist development.

https://www.somo.nl/the-financialisation-of-big-tech/

THREAD

https://www.somo.nl/the-financialisation-of-big-tech/

THREAD

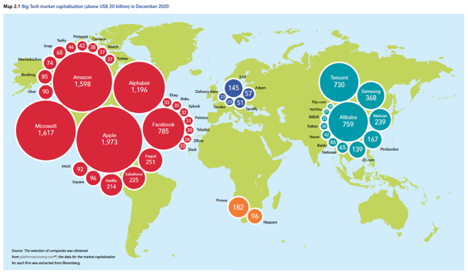

In essence, we qualify and quantify the notion Big Tech i.e. the world’s most powerful companies. Based on market cap, we’ve analysed the annual accounts of seven Big Techs dominating the tech universe: Alibaba, Alphabet (Google), Amazon, Apple, Facebook, Microsoft and Tencent.

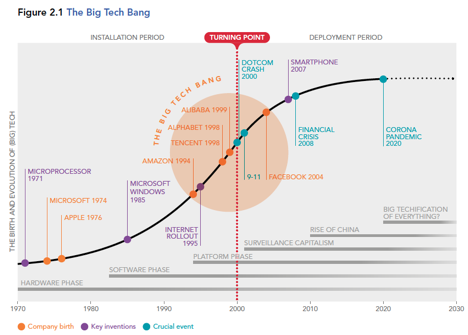

Inspired by the work of @CarlotaPrzPerez, and building on ideas developed by @shoshanazuboff and @michielvanmeeteren, we historicize the rise of Big Tech, and stylize the birth and evolution of our seven Big Techs.

Our seven Big Techs constitute what @javdijck and others call ‘the infrastructural core’ of the larger tech universe, with thousands of platforms and millions of applications built and relying upon them, and paying rent for doing so.

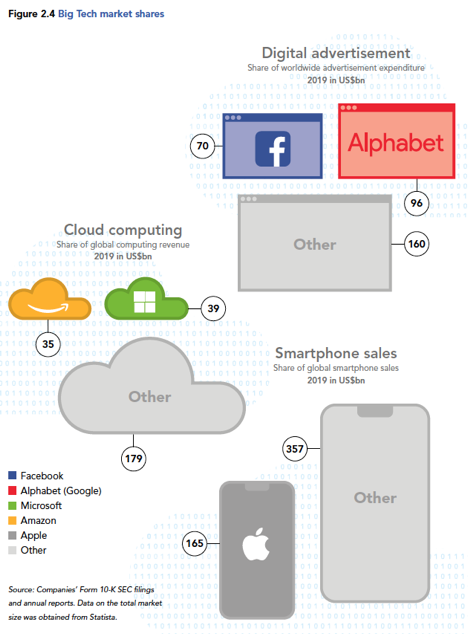

Building on the work of @n_srnck, @_paullangley, @MazzucatoM and others, although our seven Big Techs have come to monopolise different corners of the tech universe, we develop a common ‘Big Tech model’ based on the concepts monopoly rents, platformisation, and financialisation.

As one of the key rent-seeking strategies, we unpack the offshore geography of Big Tech, enabling tax avoidance and the preservation of huge financial reserves. Interestingly, the Chinese Big Techs operate most offshore subsidiaries – not least to access global capital markets.

As Brett Christophers argues, financialisation is ‘the leading edge’ of rentierisation, and we unpack the financialisation of Big Tech along three components: the size of (1) the balance sheet; (2) shareholders payouts, and (3) intangible assets.

Below some highlights:

Below some highlights:

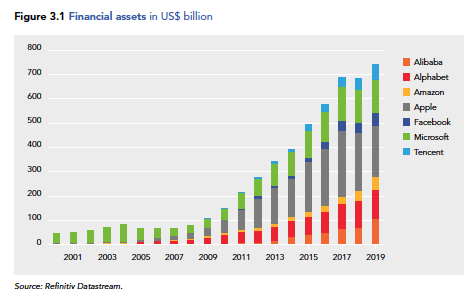

First, untrammeled Big Tech development and deployment has allowed for the accumulation of stellar profits and the buildup of vast financial reserves, reaching beyond a staggering $700 billion in 2019, with the older Big Techs Apple and Microsoft leading the pack.

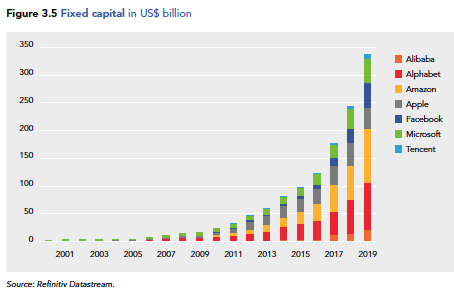

Accumulating massive reserves hasn’t kept Big Tech from expanding its physical presence, with fixed capital investments nearing $350 billion in 2019, with Alphabet and Amazon making up the bulk of the investments in Big Tech’s infrastructural core.

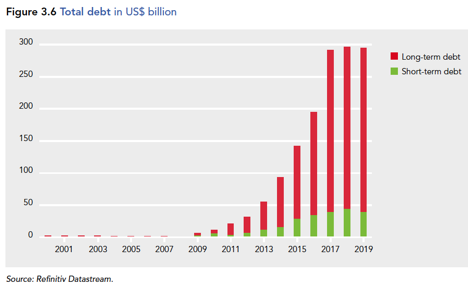

Capitalising on mounting monopoly power augmented by unprecedented monetary policies, Big Tech has been able to assure itself the cheapest possible funding, resulting in a significant uptake in debts in recent years, in particular long-term debt.

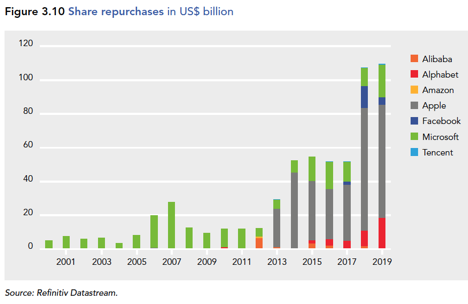

Besides funding fixed capital investments and research and development, mounting Big Tech debts have been used to increase shareholder payouts in the form of dividends and, more importantly, share buybacks – first and foremost in case of Apple.

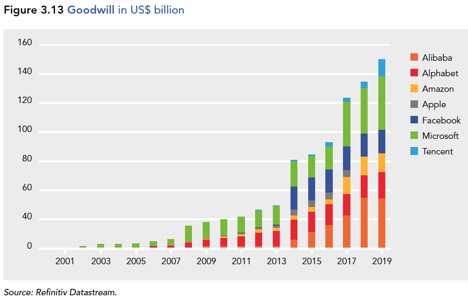

Besides share buybacks, debts and reserves have been used to acquire other tech firms, hence consolidating Big Tech's monopoly power. This is reflected in rising goodwill on the balance sheets of our Big Techs.

As indicated, these are just some highlights. The report features many more figures and tables unpacking the financialisation of Big Tech.

In conclusion, we summarize the stepping stones through which Big Tech engineers digital monopoly capitalism, giving rise to ‘Big Tech Barons’ like Jeff Bezos, Mark Zuckerberg, and Jack Ma, in what is often seen as a 21st-century replay of the ‘Gilded Age’ and its Robber Barons.

Building on the work of @BJMbraun, we argue that data-hungry Big Techs are steadily accumulating infrastructural power vis-à-vis sovereign states, as they continuously augment their positions as obligatory digital interfaces.

Ceteris paribus, the 2020s will be characterised by ‘the Big Techification of everything’ and mounting geopolitical and economic strive, with digitising China showing how Big tech’s infrastructural power becomes interdigitated with - and central to - political control.

In closing, its sway augmented by COVID-19 whilst under increasing scrutiny by politicians and regulators, we end with some reflections to rein in the power of Big Tech, and how we might appropriate its spoils for more meaningful ends.

END https://www.somo.nl/covid-19-pandemic-accelerates-the-monopoly-position-of-big-tech-companies/

END https://www.somo.nl/covid-19-pandemic-accelerates-the-monopoly-position-of-big-tech-companies/

Read on Twitter

Read on Twitter