1) With Bitcoin reaching for new highs and most crypto metrics having recorded new yearly/all-time highs in November, the yearly performance of Binance, the dominant spot exchange, deserves attention. https://www.theblockcrypto.com/genesis/87766/binance-continues-to-build-market-dominance

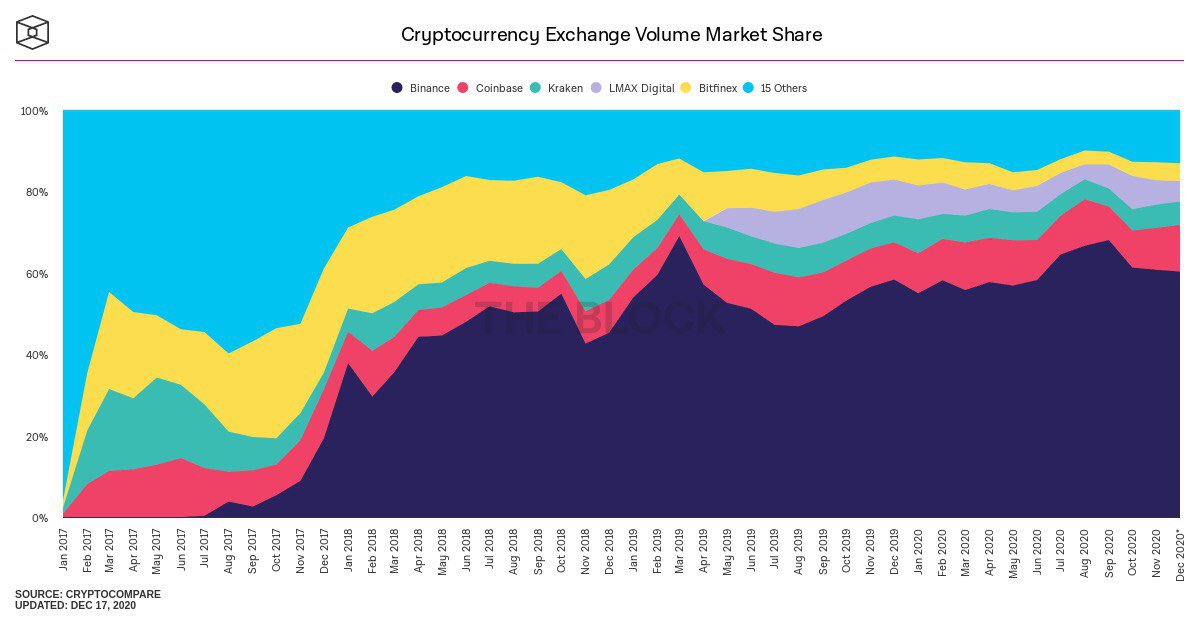

2) Overall, Binance's market share of legitimate spot volume has grown from about 55% in January to about 60.7% in November:

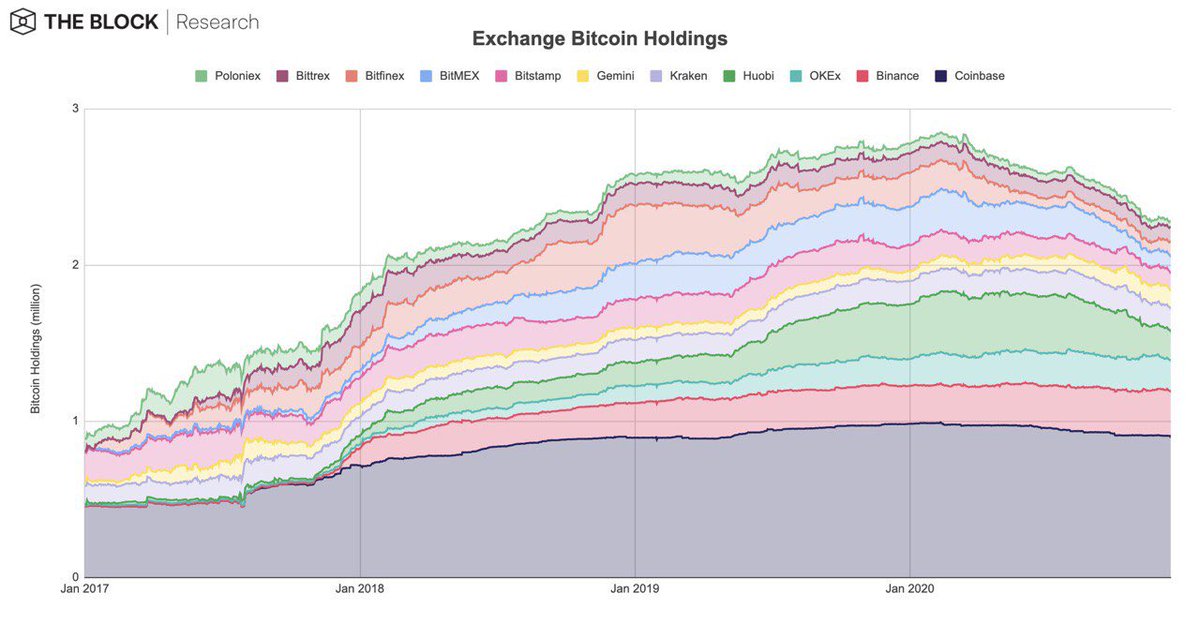

3) Moreover, Binance was able to grow its Bitcoin holdings by about 19.6% — from about 243k BTC in January to about 290.6k BTC in November. This is noteworthy, considering that during the same period, the overall Bitcoin holdings of our sample exchanges declined by 18%:

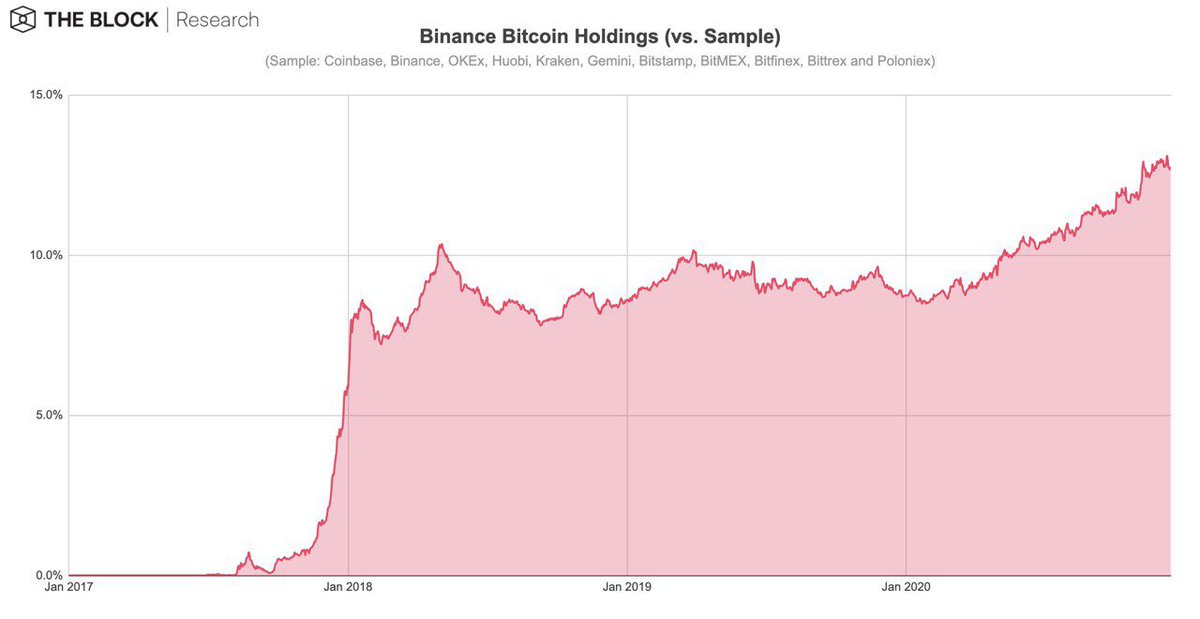

4) Inline with Binance’s Bitcoin holdings growth, its Bitcoin holdings share (vs. above sample exchanges) grew from 8.7% in January to 12.8% in November (a similar picture can be observed for Binance's Ethereum holdings):

5) The growth in Bitcoin / Ethereum holdings can largely be attributed to the increased spot volume market share, and the below covered increase in derivatives (futures for now) market share.

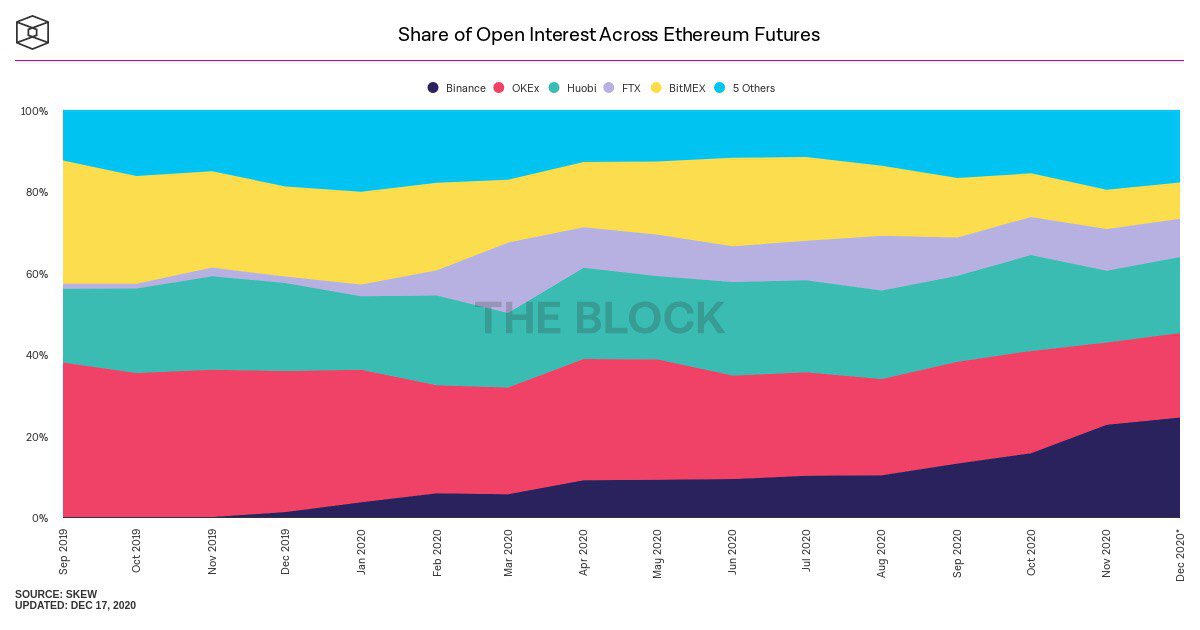

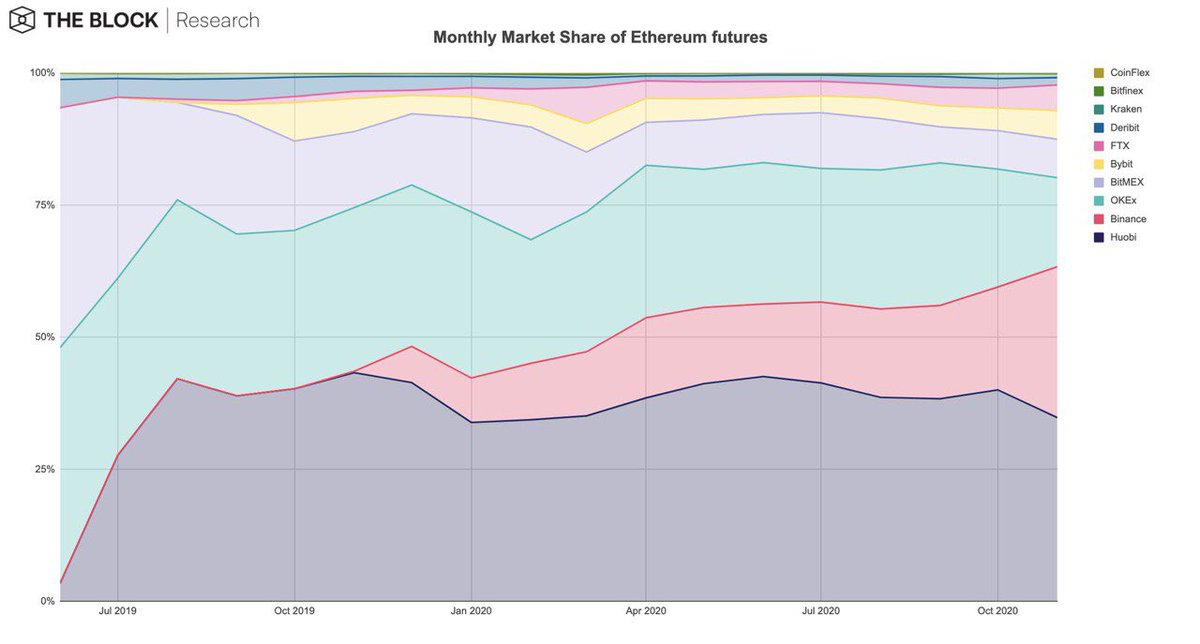

6) On the futures side, Binance was able to gain substantial ground. Taking Ethereum futures as an example, Binance grew its open interest by 2,938% — from $13 million in January to $395 million in December, increasing its market share from 3.6% in January to 22.7% in November:

7) Simultaneously, Binance’s monthly Ethereum futures volume has grown by about 1,908% — from $3.5 billion in January to $70.3 billion in November. Simultaneously, Binance’s market share of monthly Ethereum futures volume has more than tripled — from 8.4% to 28.6%:

8) Given that in 2020, options trade volume growth outperformed futures trade volume growth by about 5.4 times, it seems likely that Binance will focus extensively on its options offering going into 2021 — posing serious potential competition to Deribit. https://www.theblockcrypto.com/genesis/86919/cryptocurrency-options-growth-2020

Read on Twitter

Read on Twitter