So many HUGE factors of @orion_protocol being overlooked. Liquidity of every DEX, CEX, and swap pool is just the tip of the iceberg!

VCs have yet to buy, revenue yet unforkable, liquidity to ANY chain, contender for ultimate oracle, thick liquidity, freely listed on top CEXes

1/

VCs have yet to buy, revenue yet unforkable, liquidity to ANY chain, contender for ultimate oracle, thick liquidity, freely listed on top CEXes

1/

Shillers holding bigcap #DeFi peddle their fat bags claiming traditional funds will buy $SNX, $YFI, $AAVE, etc. Most of the traditional guys only now started with Bitcoin...

But you know which funds are RIGHT NOW buying DeFi coins? #crypto VCs.

2/

But you know which funds are RIGHT NOW buying DeFi coins? #crypto VCs.

2/

This coin kicked off with no VC.

Sale had average buy of less than $7k. It’s only a matter of time till the crypto VCs fomo into the one DeFi coin that can manage a real business model.

3/

Sale had average buy of less than $7k. It’s only a matter of time till the crypto VCs fomo into the one DeFi coin that can manage a real business model.

3/

HUGE problem for DEX. If they take slice of the fee, they can be forked and LPs will just move to the no-slice option.

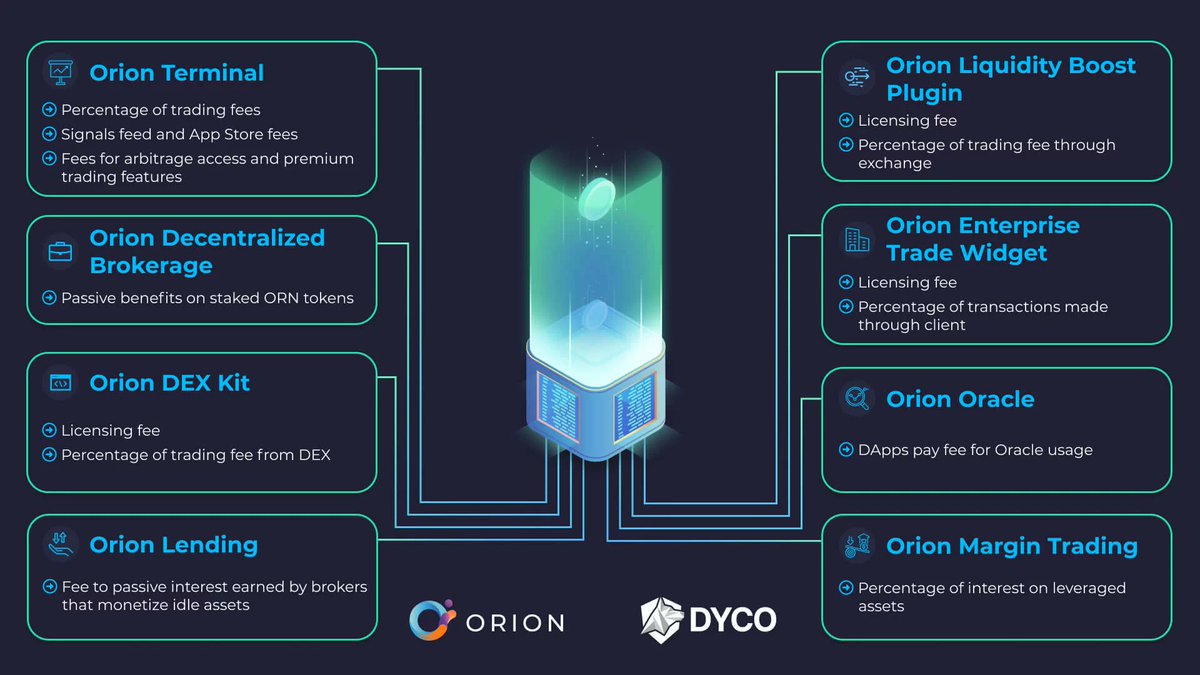

$ORN is the only place where you keep your keys, while network token enjoys revenue, and liquidity still beats any DEX.

4/

$ORN is the only place where you keep your keys, while network token enjoys revenue, and liquidity still beats any DEX.

4/

Leading DEX has a 0.3% fee. Leading CEX has a 0.075% fee. Orion brings that 0.075% fee while letting you keep your key. Result? You pay a fee to the ORN token but still pay less for your trade!

Liquidity? BEST

Fee? LEAST

Slippage? LEAST

5/

Liquidity? BEST

Fee? LEAST

Slippage? LEAST

5/

$ORN valuation is misleading. Gecko does not state that the token is deflationary. When non-sale tokens even start release, business model would have burned so many tokens to oblivion.

Marketcap? Still unbelievably low.

6/

Marketcap? Still unbelievably low.

6/

Finally tech bringing every market’s liquidity while letting you hold on to your privacy and key.

Somehow it’s still just $40M mcap, but this won’t last if weaker tech is already trading at 10x - 50x higher mcap.

7/

Somehow it’s still just $40M mcap, but this won’t last if weaker tech is already trading at 10x - 50x higher mcap.

7/

Accumulation is already happening. Several page 1 holders have been buying for weeks. Most people will finally pick this when it’s a unicorn, rather than a gem.

Yesterday’s sale release got gobbled up!

Price is up

8/

Yesterday’s sale release got gobbled up!

Price is up

8/

Just months since TGE, already data PROVIDER to Chainlink, next to hugecaps.

This is just a start on this vector. Data from all DEX/CEX, stake ensures quality. Juggernaut of onchain data is born.

Best: biz model is trading, so easily outprice any other oracle. On any chain.

9/

This is just a start on this vector. Data from all DEX/CEX, stake ensures quality. Juggernaut of onchain data is born.

Best: biz model is trading, so easily outprice any other oracle. On any chain.

9/

Max liquidity. Least slippage. Least fees.

Oracle that outprices/performs competitors.

Deepest margn liquidity, products for CEX (clients sealed!), liquid derivatives beyond CEX.

2 years in the making. Bootstrapped till recently. Massively experienced founder.

#vcFOMOimminent

Oracle that outprices/performs competitors.

Deepest margn liquidity, products for CEX (clients sealed!), liquid derivatives beyond CEX.

2 years in the making. Bootstrapped till recently. Massively experienced founder.

#vcFOMOimminent

Read on Twitter

Read on Twitter