Motivation, Mindset, Failure and Luck

Losing in order to win - thoughts for new investors

[Thread]

I started investing in July 2017

I had £20,000 / $25,000 saved

I had realised that we were in a middle-class trap & wanted to change our future

Losing in order to win - thoughts for new investors

[Thread]

I started investing in July 2017

I had £20,000 / $25,000 saved

I had realised that we were in a middle-class trap & wanted to change our future

MOTIVATION

I spent my 20s working on a business idea that failed

The saga had cost a lot of time, energy & money. It put a big strain on my relationship

It put me in a financial hole that had taken years to dig out from. I ended up at a big consulting firm

I spent my 20s working on a business idea that failed

The saga had cost a lot of time, energy & money. It put a big strain on my relationship

It put me in a financial hole that had taken years to dig out from. I ended up at a big consulting firm

I consulted to the UK's National Health Service but I wasn't always convinced about the value for money being delivered through our projects

I ended up switching sides & working for the NHS

Less travel, more relationship time

Job security & a stable income

I ended up switching sides & working for the NHS

Less travel, more relationship time

Job security & a stable income

There were tradeoffs though

A smaller salary for one

Got married. Bought a house. Had kids.

The kids changed everything. Your worldview shifts

I was scared for their future

The cost of living, the cost of education, the cost of property

All. Going. Up.

A smaller salary for one

Got married. Bought a house. Had kids.

The kids changed everything. Your worldview shifts

I was scared for their future

The cost of living, the cost of education, the cost of property

All. Going. Up.

I turned to investing to improve our future.

Waiting till I was 68 years old to pay off our mortgage and collect a pension was not what I wanted from life

A family friend had talked to me about investing when I was a teenager. But I had never taken action.

Waiting till I was 68 years old to pay off our mortgage and collect a pension was not what I wanted from life

A family friend had talked to me about investing when I was a teenager. But I had never taken action.

I thought the startup would be my route to freedom

I was wrong. I had failed

I liked my job but knew that I was trading time for money

Ownership leads to freedom

I could see digital transformation taking place around me

I decided to start investing

I was wrong. I had failed

I liked my job but knew that I was trading time for money

Ownership leads to freedom

I could see digital transformation taking place around me

I decided to start investing

If you don't have a strong motivation to invest, it's an easy thing to ignore

Time in the market is your greatest asset

Don't waste it

Work out your "why"

Otherwise you won't give investing the respect it deserves

Set goals that are meaningful for you

Time in the market is your greatest asset

Don't waste it

Work out your "why"

Otherwise you won't give investing the respect it deserves

Set goals that are meaningful for you

MINDSET

Mindset isn't about staring in the mirror and whispering affirmations

It's about your attitude

Discipline

Your willingness to learn

Big dreams backed up by a realisation that you need to do the work

Delaying gratification, embracing the process

Mindset isn't about staring in the mirror and whispering affirmations

It's about your attitude

Discipline

Your willingness to learn

Big dreams backed up by a realisation that you need to do the work

Delaying gratification, embracing the process

You will be a bad investor -

if you won't do the work

if you are unable to take responsibility for your decisions and their consequences

if you are always looking for someone else to blame

If you are unable to deal with uncertainty

You'll need to change

if you won't do the work

if you are unable to take responsibility for your decisions and their consequences

if you are always looking for someone else to blame

If you are unable to deal with uncertainty

You'll need to change

But if you believe in the power of compounding

Can learn to be patient

Reflect on your weakness

Adopt continuous improvement

Can act on asymmetrical opportunities

And can accept it is largely a game of probabilities

Investing could change your life

Can learn to be patient

Reflect on your weakness

Adopt continuous improvement

Can act on asymmetrical opportunities

And can accept it is largely a game of probabilities

Investing could change your life

You are vulnerable to your emotions

We are wired to be pretty bad investors

https://twitter.com/jposhaughnessy/status/1084197172789329920?s=20

It isn't all you fault. Dopamine, adrenaline, and cortisol are a potent cocktail

You still have to take responsibility

Audit your behaviour to improve

We are wired to be pretty bad investors

https://twitter.com/jposhaughnessy/status/1084197172789329920?s=20

It isn't all you fault. Dopamine, adrenaline, and cortisol are a potent cocktail

You still have to take responsibility

Audit your behaviour to improve

What inputs do you consistently use

What do you tune out?

Review every transaction in your brokerage account

Why did you make it? How much work did you do?

Did you stick to your strategy?

You should be able to sum up your strategy on a single page

What do you tune out?

Review every transaction in your brokerage account

Why did you make it? How much work did you do?

Did you stick to your strategy?

You should be able to sum up your strategy on a single page

FAILURE AND LUCK

One of the biggest problems I had as a new investor came from early success

I invested in $SHOP.CA $SHOP at CAD$115 ($US 90), and $SQ below $27 in July 2017

I invested in $TTD at $53 in April 2018

Early success can lead to overconfidence

One of the biggest problems I had as a new investor came from early success

I invested in $SHOP.CA $SHOP at CAD$115 ($US 90), and $SQ below $27 in July 2017

I invested in $TTD at $53 in April 2018

Early success can lead to overconfidence

"Investing isn't *that* hard" I thought...

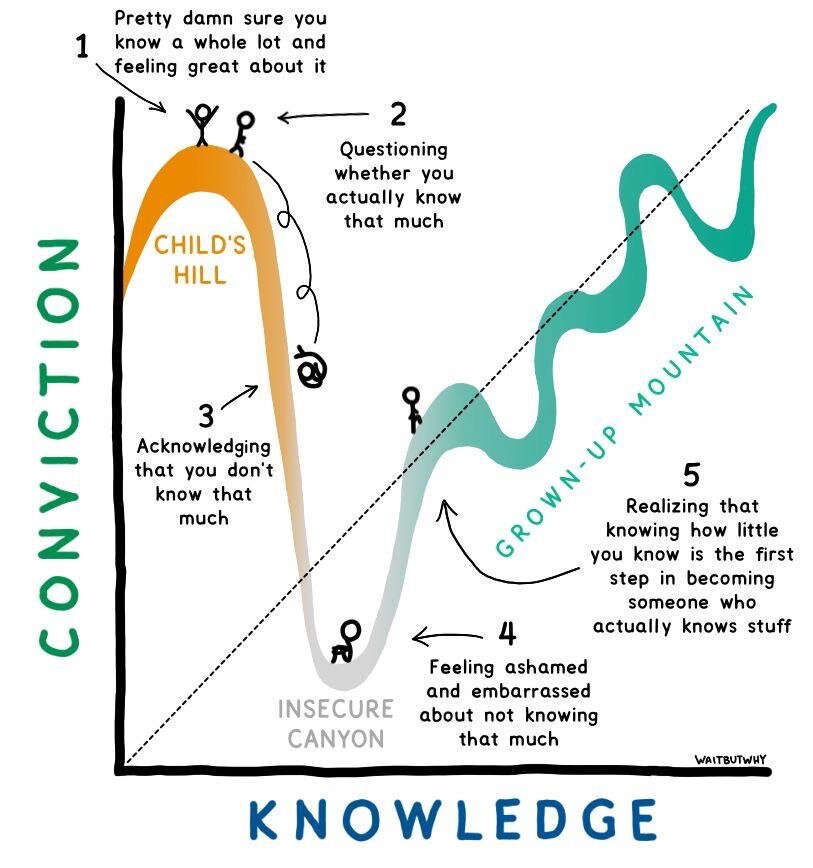

When you are on the left of the Dunning Kruger Curve you won't realise it

I didn't have a clear framework for how to manage my portfolio and I screwed up 3 potentially lifechanging investments

image h/t @waitbutwhy

When you are on the left of the Dunning Kruger Curve you won't realise it

I didn't have a clear framework for how to manage my portfolio and I screwed up 3 potentially lifechanging investments

image h/t @waitbutwhy

I listened to podcasts, subscribed to newsletters.

But I didn't respect the process enough.

I was drifting through decisions rather than being intentional

You can learn a lot from losses

But only if you are honest with yourself when things go wrong

But I didn't respect the process enough.

I was drifting through decisions rather than being intentional

You can learn a lot from losses

But only if you are honest with yourself when things go wrong

You have to be willing to break down your past decisions and look at where you are going wrong to figure out how to get better

It took me till summer 2019 to get better.

I reviewed all of my previous transactions and worked on how to make better decisions

It took me till summer 2019 to get better.

I reviewed all of my previous transactions and worked on how to make better decisions

It came down to writing a clear Investor Policy Statement laying out what I wanted to do, why it was important, and how I planned to do it

Your investor policy statement should reflect your personality & mitigate the risks of your biases and behaviour

Your investor policy statement should reflect your personality & mitigate the risks of your biases and behaviour

I am an optimist and a pragmatic dreamer.

I believe in technologically driven change.

I want to find 3x, 5x and 10x opportunities and will accept the risks that can come with that approach.

It might look like madness to others. That is ok by me.

I believe in technologically driven change.

I want to find 3x, 5x and 10x opportunities and will accept the risks that can come with that approach.

It might look like madness to others. That is ok by me.

I don't have a traditional finance background

I understand the risk of failure and accept it

I try to stay open-minded

We are all wired differently, and trying to achieve different goals. It is the source of so much Fintwit conflict

Do what works for you

I understand the risk of failure and accept it

I try to stay open-minded

We are all wired differently, and trying to achieve different goals. It is the source of so much Fintwit conflict

Do what works for you

There are many tribes on Fintwit.

Find one that suits your goals.

Find people that inspire you and make you think. Be ok with having your thoughts challenged and don't take it personally.

Accept that luck plays a role in investing. Don't rely on it.

Find one that suits your goals.

Find people that inspire you and make you think. Be ok with having your thoughts challenged and don't take it personally.

Accept that luck plays a role in investing. Don't rely on it.

Drop the ego and don't be defined by your portfolio.

I get excited about what my portfolio might represent one day. It's not about the money but about the freedom for my family.

That motivates me far more than the idea of money for its own sake.

I get excited about what my portfolio might represent one day. It's not about the money but about the freedom for my family.

That motivates me far more than the idea of money for its own sake.

I probably spend too much time on Twitter.

I joined in October 2019 and have connected with life-enhancing people on this service. DMs are Twitter's killer app.

I'm humbled by the number of readers who have found some value in my thoughts.

Thank you.

I joined in October 2019 and have connected with life-enhancing people on this service. DMs are Twitter's killer app.

I'm humbled by the number of readers who have found some value in my thoughts.

Thank you.

As my account has grown I've looked at other ways to how to create value for others

In 2020 I've written a monthly summary of my portfolio on Substack

I thought about introducing a paid tier to my Substack account

But what would it really add for readers?

In 2020 I've written a monthly summary of my portfolio on Substack

I thought about introducing a paid tier to my Substack account

But what would it really add for readers?

I like the open model and the journaling process. I like the "liquidity" of the output

There are many great stock research services

I am thinking of reducing the frequency of updates next year - My 'folio companies don't change much. I want to be LT focused

There are many great stock research services

I am thinking of reducing the frequency of updates next year - My 'folio companies don't change much. I want to be LT focused

I get a number of DMs from newer investors.

DMs tend to cover similar themes and questions.

Should I buy $RANDOM stock?

What do you think of [insert company]

How many stocks should I own?

Do you think the market will crash?

It shouldn't matter what I think

DMs tend to cover similar themes and questions.

Should I buy $RANDOM stock?

What do you think of [insert company]

How many stocks should I own?

Do you think the market will crash?

It shouldn't matter what I think

I am just a guy on the internet. I try to put these types of questions back to the asker

What they are usually missing is a guiding strategy and philosophy

Defining it is the single most important thing that you should do as an investor

Run your own race

What they are usually missing is a guiding strategy and philosophy

Defining it is the single most important thing that you should do as an investor

Run your own race

After reflecting, I realised that I could create something valuable for newer investors that had the potential to be "evergreen" and could accelerate the first years of learning

You hear about everyone's wins. But not much about losses. Everyone has them.

You hear about everyone's wins. But not much about losses. Everyone has them.

I've put together a course based on my greatest investing mistakes and what I've learned from them.

If you take the Charlie Munger approach and invert/avoid them, you'll be well on your way to being a better investor.

If you take the Charlie Munger approach and invert/avoid them, you'll be well on your way to being a better investor.

"The single most important thing if you want to avoid all the stupid errors

is knowing where you're competent and where you're not...

It's very hard because the human mind tries to make you think you're smarter than you really are" http://latticeworkinvesting.com/2020/12/16/charlie-munger-full-transcript-of-caltech-zoom-talk-dec-2020/

is knowing where you're competent and where you're not...

It's very hard because the human mind tries to make you think you're smarter than you really are" http://latticeworkinvesting.com/2020/12/16/charlie-munger-full-transcript-of-caltech-zoom-talk-dec-2020/

My mistakes are pretty embarrassing to revisit.

But seeing the progress, understanding and learning points that have resulted in my growth as an investor is now a source of pride

I've put together ideas, frameworks and tools to help others avoid making them

But seeing the progress, understanding and learning points that have resulted in my growth as an investor is now a source of pride

I've put together ideas, frameworks and tools to help others avoid making them

I'm going to release it in the New Year on Gumroad

I'd love you to check it out

http://gum.co/Losing-to-Win

The investing opinion I feel most strongly about to give is:

Craft your own investor policy statement

The course will show you why it's so important

I'd love you to check it out

http://gum.co/Losing-to-Win

The investing opinion I feel most strongly about to give is:

Craft your own investor policy statement

The course will show you why it's so important

In addition to learning from mistakes

it helps you work through a suggested framework of

factors to consider when crafting your own Investor Policy Statement.

Your strategy should reflect your goals and priorities, your financial situation and psychology

Not those of others

it helps you work through a suggested framework of

factors to consider when crafting your own Investor Policy Statement.

Your strategy should reflect your goals and priorities, your financial situation and psychology

Not those of others

It's a 1hr 30 video course with supplementary materials that you can customise to your needs.

It's focused on principles, process, and checklists.

For a flavour of how I think

Please take a look at my blog https://adventuresinfi.substack.com/

It's focused on principles, process, and checklists.

For a flavour of how I think

Please take a look at my blog https://adventuresinfi.substack.com/

Read on Twitter

Read on Twitter