1/

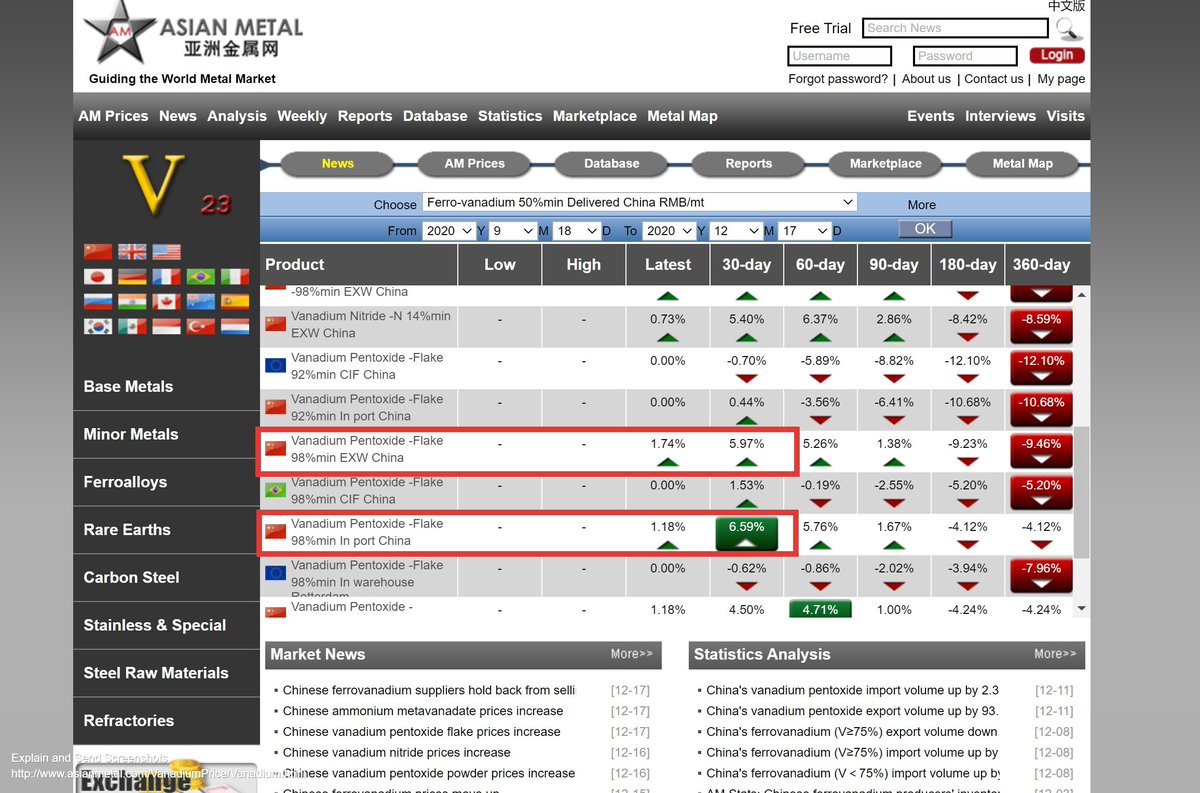

Agreed because the rises are now kicking in across all products. However, its China flake prices that have really got my attention.

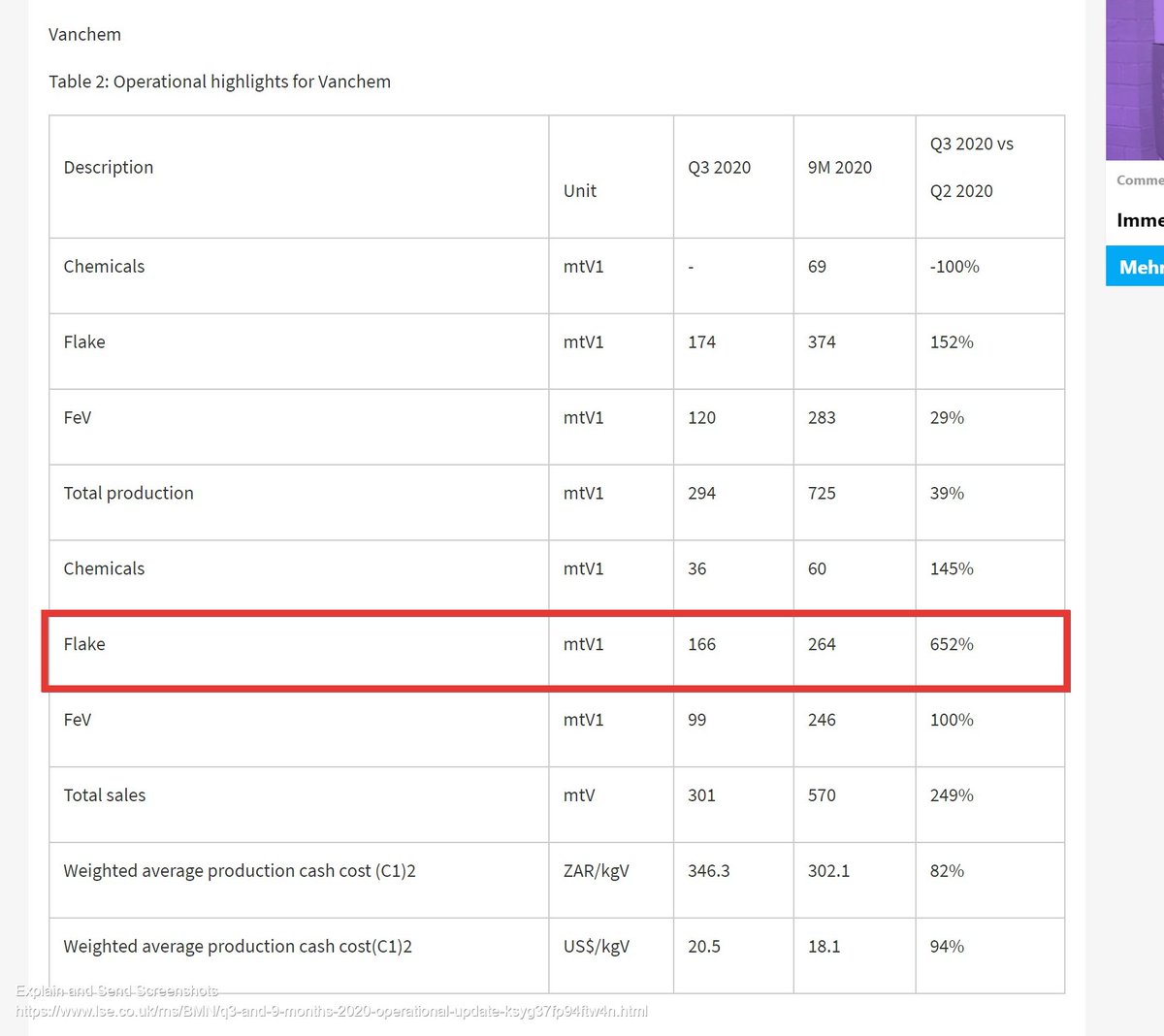

If we remind ourselves of #BMN Vanchem product sales update from 24th Nov, then we can see the product variation...

https://twitter.com/Sanch3z599/status/1339473498461368320?s=20

Agreed because the rises are now kicking in across all products. However, its China flake prices that have really got my attention.

If we remind ourselves of #BMN Vanchem product sales update from 24th Nov, then we can see the product variation...

https://twitter.com/Sanch3z599/status/1339473498461368320?s=20

2/

..benefits that Vanchem's beginning to deliver in 2020, which simply weren't there in previous years.

All of which adds considerable weight to an expedited expansion of capacity at that plant, which itself is supported by BMN's immediate full draw down of the $65m from Orion.

..benefits that Vanchem's beginning to deliver in 2020, which simply weren't there in previous years.

All of which adds considerable weight to an expedited expansion of capacity at that plant, which itself is supported by BMN's immediate full draw down of the $65m from Orion.

3/

I would encourage investors in #BMN to take a look at previous years V price performance in the run up to Christmas and then into the Chinese Spring Festival in early Feb.

Admittedly the 2018/19 period was particularly volatile but the process still holds true.

I would encourage investors in #BMN to take a look at previous years V price performance in the run up to Christmas and then into the Chinese Spring Festival in early Feb.

Admittedly the 2018/19 period was particularly volatile but the process still holds true.

4/

Vanadium prices have tended to fall in the Nov/Dec period and then rise into the Spring Festival, as Chinese steel mills build up inventory prior to their 2-3 week shutdown.

One good reason for the earlier start may well be lead times and the affects of Covid.

Vanadium prices have tended to fall in the Nov/Dec period and then rise into the Spring Festival, as Chinese steel mills build up inventory prior to their 2-3 week shutdown.

One good reason for the earlier start may well be lead times and the affects of Covid.

5/

However, what we could also be beginning to see is the return of speculators and traders. It is they that drove V prices to those unsustainable heights in 2018.

We are certainly seeing rises in other key metals and inputs, such as iron ore, nickel, even lithium.

However, what we could also be beginning to see is the return of speculators and traders. It is they that drove V prices to those unsustainable heights in 2018.

We are certainly seeing rises in other key metals and inputs, such as iron ore, nickel, even lithium.

6/

The belief being that governments are going to spend big coming out of Covid and that economies are going to see some form of bounce, however sustainable it may or may not be.

So there's good support for an argument o speculation.

The belief being that governments are going to spend big coming out of Covid and that economies are going to see some form of bounce, however sustainable it may or may not be.

So there's good support for an argument o speculation.

7/

The big issue this time around, if indeed the theory is correct, is of course VRFBs. These companies right now can compete at current V prices but it wouldn't take too much of a rise to begin to strangle them.

That's of course where rental comes in and where more reliance...

The big issue this time around, if indeed the theory is correct, is of course VRFBs. These companies right now can compete at current V prices but it wouldn't take too much of a rise to begin to strangle them.

That's of course where rental comes in and where more reliance...

8/

... on the BMN's of this world, becomes all the more critical.

You would be hard pushed to find a Chinese or Russian co-producing steel mill, that thinking about renting out its vanadium.

Some may draw back in fear, when thinking about a VRFB industry struggling but...

... on the BMN's of this world, becomes all the more critical.

You would be hard pushed to find a Chinese or Russian co-producing steel mill, that thinking about renting out its vanadium.

Some may draw back in fear, when thinking about a VRFB industry struggling but...

9/

...its so important to remember, that within this wider greater VRFB worls, there exists a BMN VRFB value chain micro version, which is already protected against such volatility and can actually thrive on such circumstances, whilst all the time...

...its so important to remember, that within this wider greater VRFB worls, there exists a BMN VRFB value chain micro version, which is already protected against such volatility and can actually thrive on such circumstances, whilst all the time...

10/

...enjoying any gains such V prices drive in their core steel markets.

Such benefits drive more expansion, more investment into their energy storage businesses, helping deliver greater market share and control, or so the story goes...

2021 looks good for BMN either way.

...enjoying any gains such V prices drive in their core steel markets.

Such benefits drive more expansion, more investment into their energy storage businesses, helping deliver greater market share and control, or so the story goes...

2021 looks good for BMN either way.

Read on Twitter

Read on Twitter