"Pets are family". Been tracking 13 stocks but only own $CHWY. I will add BarkBox, $STIC when it lists. The company has a valuation of $1.6B with $350M in revenue, profitable

Others: #PetsAreFamily

$CHD

$CHWY

$ELAN

$FRPT

$HSKA

$IDXX

$PAWZ

$PETQ

$PETS

$SPB

$TRUP

$TSCO

$ZTS

Others: #PetsAreFamily

$CHD

$CHWY

$ELAN

$FRPT

$HSKA

$IDXX

$PAWZ

$PETQ

$PETS

$SPB

$TRUP

$TSCO

$ZTS

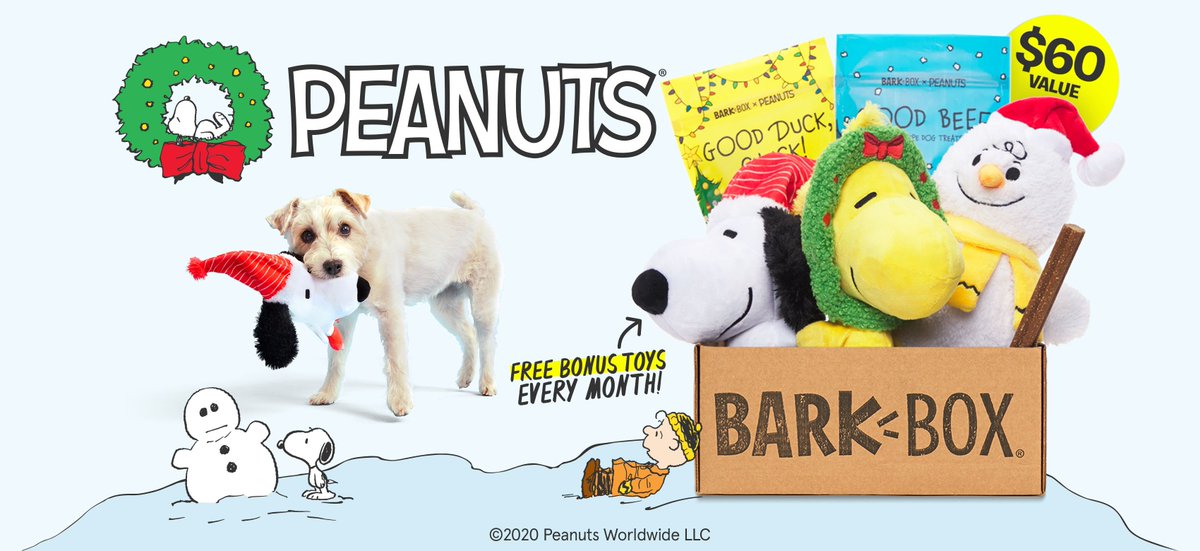

BarkBox is a monthly subscription box filled with dog toys and treats. Co. has 1 million + subscribers to its monthly box. Its sells its products on $TGT and $AMZN as well.

Founded in Dec 2011, by Matt Meeker, Carly Strife, Henrik Werdelin in New York.

Founded in Dec 2011, by Matt Meeker, Carly Strife, Henrik Werdelin in New York.

One month your dog might receive a collection of treats and toys. BarkBox might send him on a journey through Chewrassic Bark. Each box contains two innovative toys, two bags of all-natural treats, a chew, and a specially curated item from the month's themed collection.

Every toy is designed by in-house industrial designers, made for the way dogs play and approved by the company's own test dogs. You can choose a one-month subscription ($29), six months ($25/box), or 12 months ($22/box).

BarkBox is very allergy friendly. Every BarkBox is free from corn, wheat, and soy, which greatly reduces the risk for triggering allergies and food sensitivities.

You can reorder certain items or purchase items from other collections online.

There is a money-back guarantee

You can reorder certain items or purchase items from other collections online.

There is a money-back guarantee

Moats: 1 Million subscribers, 95% retention, + Smart use of AI / ML The team developed a ML algorithm that can predict 60-65% of future product scores of any toy they make. They are crediting the tool with selling out collections and driving substantial revenue growth.

They use an atomic design approach. Created a massive data set of 100s of toy attributes (size, color, materials, construction, expression) from the company’s 4,000 toys. Attributes are linked to a product score determined by how well the toy sold, how it was rated by customers

Despite the pandemic, during the first and second quarter of this year retail store sales were nearly double what they were a year ago and its Halloween 2020 Tails of the Boneyard collection at Target is performing 2x better than last year's collection.

The company’s 400-person team have grown the company to $375 million in annual revenue and recently closed its most profitable quarter in the company's history.

Revenue growth:

2016: $100M

2017: $150M, 350K subscribers

2019: $250M + profit, 500K subs

2020: $350M + 1M subs

Revenue growth:

2016: $100M

2017: $150M, 350K subscribers

2019: $250M + profit, 500K subs

2020: $350M + 1M subs

Total funding $81.7M, 17 investors

Convertible debt: Jan 9th, 2012, $25K

Seed: Jul 9th, 2012, $1.7M valuation $6M

Series A: April 9 2013, $5M – valuation $20M

Series B: July 11th, 2014, $15M, valuation $80M

Series C: May 17, 2016, $60M – valuation $200M

Convertible debt: Jan 9th, 2012, $25K

Seed: Jul 9th, 2012, $1.7M valuation $6M

Series A: April 9 2013, $5M – valuation $20M

Series B: July 11th, 2014, $15M, valuation $80M

Series C: May 17, 2016, $60M – valuation $200M

Investors: August Capital

RRE Ventures

Resolute Ventures

Slow Ventures

Vast Ventures

Columbia Partners

Daher Capital

BDMI

Founded in Dec 2011, by Matt Meeker (founder of Meetup) , Carly Strife, Henrik Werdelin in New York.

RRE Ventures

Resolute Ventures

Slow Ventures

Vast Ventures

Columbia Partners

Daher Capital

BDMI

Founded in Dec 2011, by Matt Meeker (founder of Meetup) , Carly Strife, Henrik Werdelin in New York.

Competition: Petco's PupBox,

Bullymake,

RescueBox for dogs, and

Chewy Goodybox.

Cat Lady Box and KitNipBox for Cats.

Fresh food delivery services like The Farmer's Dog, Nom Nom, PetPlate, Ollie, and Spot & Tango.

Bullymake,

RescueBox for dogs, and

Chewy Goodybox.

Cat Lady Box and KitNipBox for Cats.

Fresh food delivery services like The Farmer's Dog, Nom Nom, PetPlate, Ollie, and Spot & Tango.

Risks:

1. Small revenue, slower growth compared to big eCommerce players such as $SHOP and $ETSY

2. Toys and treats for dogs is a small market compared to health & food

3. There are 100's of subscription box competitors - what if the pet gets "bored" - but 95% retention

1. Small revenue, slower growth compared to big eCommerce players such as $SHOP and $ETSY

2. Toys and treats for dogs is a small market compared to health & food

3. There are 100's of subscription box competitors - what if the pet gets "bored" - but 95% retention

Verdict. I have known of the CEO (Manish Joneja) from my days at $AMZN and know him to be a strong operator, just like Sumit Singh from $AMZN

I am going to take a small lot (< 1% of portfolio) but this wont be my top pick for 2021

I am going to take a small lot (< 1% of portfolio) but this wont be my top pick for 2021

Consumers Affairs has 4.5/5 from 288 ratings.

MySubscriptionAddiction has 112 rating 3.7/5

https://www.consumeraffairs.com/pets/barkbox.html

MySubscriptionAddiction has 112 rating 3.7/5

https://www.consumeraffairs.com/pets/barkbox.html

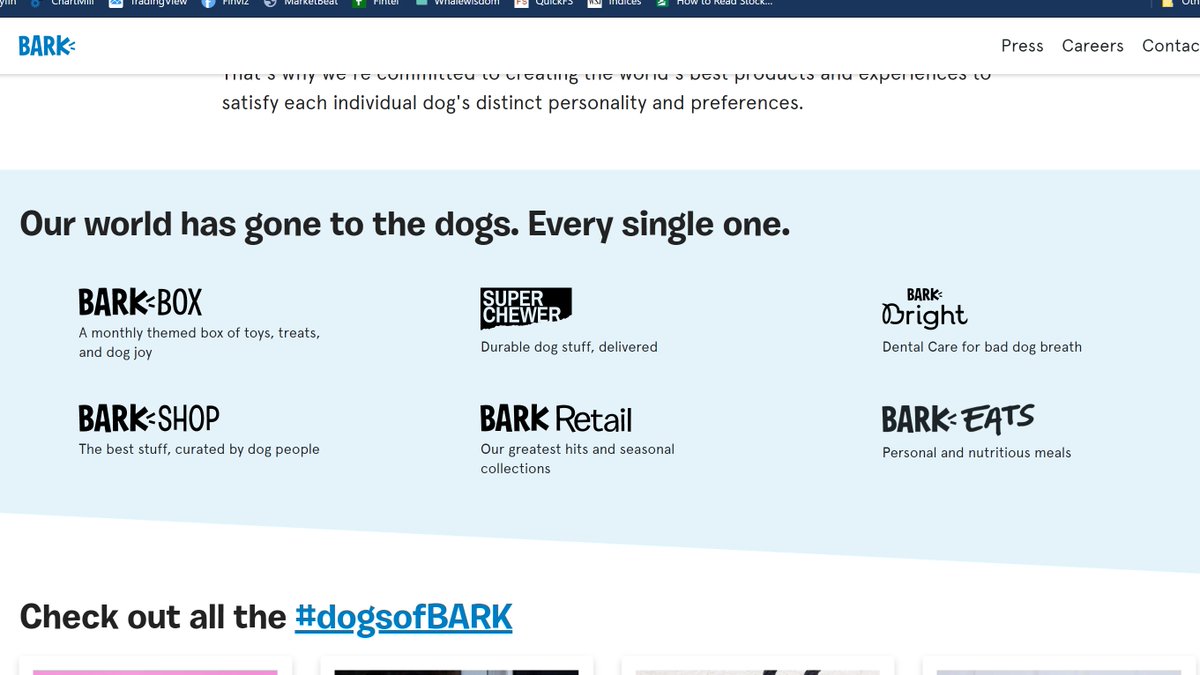

The company http://bark.co has multiple "brands" for BarkBox, Chewy toys, treats, etc. so they can branch into "omni channel" via partnerships with $TGT or online partnerships at the http://amazon.com BARK store

You can read more :

https://www.wsj.com/articles/barkbox-to-be-acquired-in-1-6-billion-deal-11608174012

https://finance.yahoo.com/news/barkbox-credits-amazon-250m-boom-183115169.html

https://www.businessinsider.com/barkbox-subscription-review#testing-the-barkbox

https://www.prnewswire.com/news-releases/bark-company-behind-barkbox-announces-ceo-succession-301133150.html

https://www.instagram.com/barkbox/

https://www.amazon.com/stores/BARK/page/8A5D646B-9743-4952-84D3-3A6C82C12B45

https://www.sramanamitra.com/2018/03/27/2018-ipo-prospects-will-barkbox-find-market-acceptance/

https://www.forbes.com/sites/martineparis/2020/10/31/what-every-dog-wants-this-halloween-barkbox-ai-knows/ https://pitchbook.com/profiles/company/54793-90

https://www.wsj.com/articles/barkbox-to-be-acquired-in-1-6-billion-deal-11608174012

https://finance.yahoo.com/news/barkbox-credits-amazon-250m-boom-183115169.html

https://www.businessinsider.com/barkbox-subscription-review#testing-the-barkbox

https://www.prnewswire.com/news-releases/bark-company-behind-barkbox-announces-ceo-succession-301133150.html

https://www.instagram.com/barkbox/

https://www.amazon.com/stores/BARK/page/8A5D646B-9743-4952-84D3-3A6C82C12B45

https://www.sramanamitra.com/2018/03/27/2018-ipo-prospects-will-barkbox-find-market-acceptance/

https://www.forbes.com/sites/martineparis/2020/10/31/what-every-dog-wants-this-halloween-barkbox-ai-knows/ https://pitchbook.com/profiles/company/54793-90

Total funding $81.7M, 17 investors

Convertible debt: Jan 9th, 2012, $25K

Seed: Jul 9th, 2012, $1.7M valuation $6M

Series A: April 9 2013, $5M – valuation $20M

Series B: July 11th, 2014, $15M, valuation $80M

Series C: May 17, 2016, $60M – valuation $200M

Convertible debt: Jan 9th, 2012, $25K

Seed: Jul 9th, 2012, $1.7M valuation $6M

Series A: April 9 2013, $5M – valuation $20M

Series B: July 11th, 2014, $15M, valuation $80M

Series C: May 17, 2016, $60M – valuation $200M

Update: Revenues of ~$365M and GM ~60% for fiscal year ending March 31, 2021. Net revenue CAGR FY2020-FY2023 of over 40%

Transaction values BARK at an EV of approximately $1.6 billion and is expected to provide up to $454 million of gross cash proceeds

Transaction values BARK at an EV of approximately $1.6 billion and is expected to provide up to $454 million of gross cash proceeds

Read on Twitter

Read on Twitter