I’m a former $Affirm employee. Here’s my take on Affirm’s upcoming IPO & growth so far.

TL;DR below

Full blog in my bio on Substack.

https://shelleyolivia.substack.com/p/affirms-going-public-honest-financing

(All info discussed is publicly available. Most can be found in its 300 page S-1)

TL;DR below

Full blog in my bio on Substack.

https://shelleyolivia.substack.com/p/affirms-going-public-honest-financing

(All info discussed is publicly available. Most can be found in its 300 page S-1)

1/  Traditional credit needs reform.

Traditional credit needs reform.

The average American owes $6.2k in credit card debt. At an average 17% APR, this means $1k+ in interest alone. Total, Americans owe $1T in cc debt and $121B in interest, $11B in overdraft fees, & $3B in late fees. We need better options.

Traditional credit needs reform.

Traditional credit needs reform. The average American owes $6.2k in credit card debt. At an average 17% APR, this means $1k+ in interest alone. Total, Americans owe $1T in cc debt and $121B in interest, $11B in overdraft fees, & $3B in late fees. We need better options.

2/  What is honest & transparent credit?

What is honest & transparent credit?

Honest credit should profit from adding value to a customer instead of profiting from a customer’s mistakes or inability to pay exactly at the 30-day mark. Interest rates keep increasing & fine-print sections get more complex.

What is honest & transparent credit?

What is honest & transparent credit? Honest credit should profit from adding value to a customer instead of profiting from a customer’s mistakes or inability to pay exactly at the 30-day mark. Interest rates keep increasing & fine-print sections get more complex.

3/  What is Affirm?

What is Affirm?

Affirm creates honest financial products. 3 are credit products & 1 product is a high-yield savings account. It is a market leader in the US:

- $4.6B in transaction volume

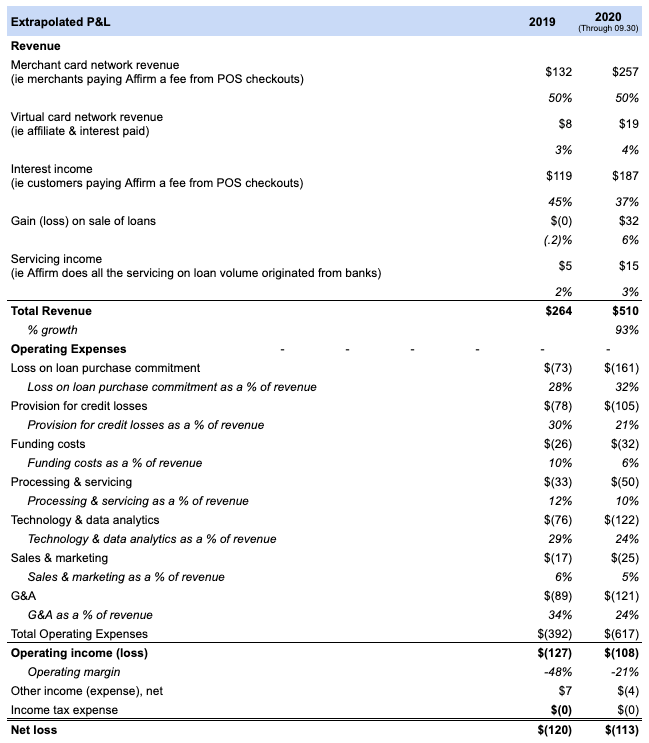

- $500M in revenue (93% growth since last year)

- 6.2M customers

- 6.5k merchants

What is Affirm?

What is Affirm? Affirm creates honest financial products. 3 are credit products & 1 product is a high-yield savings account. It is a market leader in the US:

- $4.6B in transaction volume

- $500M in revenue (93% growth since last year)

- 6.2M customers

- 6.5k merchants

4/  Affirm’s strengths || part 1

Affirm’s strengths || part 1

(a) Strong delinquency & approval rates - delinquency is 1% vs the 5% of credit cards. It approves 20% more customers

(b) Affirm is run in a cash efficient way - Affirm doesn’t need a lot of its own cash b/c it partners w/ origination banks.

Affirm’s strengths || part 1

Affirm’s strengths || part 1 (a) Strong delinquency & approval rates - delinquency is 1% vs the 5% of credit cards. It approves 20% more customers

(b) Affirm is run in a cash efficient way - Affirm doesn’t need a lot of its own cash b/c it partners w/ origination banks.

5/  Affirm strengths || part 2

Affirm strengths || part 2

(c) Merchants - Affirm acquire customers w/o discounting or hurting brand equity.

(d) Customers - 46% of loans are 0% interest. The UX is well-designed & mobile-optimized.

(e) Network effects - more merchants = more customers & vice versa.

Affirm strengths || part 2

Affirm strengths || part 2(c) Merchants - Affirm acquire customers w/o discounting or hurting brand equity.

(d) Customers - 46% of loans are 0% interest. The UX is well-designed & mobile-optimized.

(e) Network effects - more merchants = more customers & vice versa.

6/  Affirm strengths || part 3

Affirm strengths || part 3

(f) Talent - pretty much everyone I worked w/ was amazing. Top colleges & past job experiences.

(g) Key partnerships - It just acquired 1 of Canada’s biggest “buy now, pay later” companies. Also, Shopify is an investor with a 3 yr contract.

Affirm strengths || part 3

Affirm strengths || part 3 (f) Talent - pretty much everyone I worked w/ was amazing. Top colleges & past job experiences.

(g) Key partnerships - It just acquired 1 of Canada’s biggest “buy now, pay later” companies. Also, Shopify is an investor with a 3 yr contract.

7/  Affirm strengths || part 4

Affirm strengths || part 4

(h) P&L strength - many revenue streams keep it diversified. Also, it decreased its net income as it doubled sales.

(i) Unit economics - merchants are charged about ~11% of the transaction value. Customers are charged 0% to 30%.

Affirm strengths || part 4

Affirm strengths || part 4(h) P&L strength - many revenue streams keep it diversified. Also, it decreased its net income as it doubled sales.

(i) Unit economics - merchants are charged about ~11% of the transaction value. Customers are charged 0% to 30%.

8/ Affirm’s risks || part 1

Affirm’s risks || part 1

(a) Peloton - 30% of sales are from Peloton. They do have a 3 year contract though, ending in Sep 2023.

(b) Bank dependence - Cross River Bank funds most of the loans. They also have a 3 year contract so the chance of disruption is low.

Affirm’s risks || part 1

Affirm’s risks || part 1 (a) Peloton - 30% of sales are from Peloton. They do have a 3 year contract though, ending in Sep 2023.

(b) Bank dependence - Cross River Bank funds most of the loans. They also have a 3 year contract so the chance of disruption is low.

9/ Affirm’s risks || part 2

Affirm’s risks || part 2

(c) Regulation - when it comes to lending, there are so many federal & local laws as well as political dynamics and data privacy regulations.

(d) Competition - it’s a crowded space. But only a few companies will survive.

Affirm’s risks || part 2

Affirm’s risks || part 2 (c) Regulation - when it comes to lending, there are so many federal & local laws as well as political dynamics and data privacy regulations.

(d) Competition - it’s a crowded space. But only a few companies will survive.

10/ Affirm’s risks || part 3

Affirm’s risks || part 3

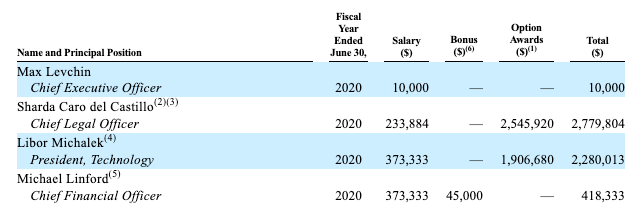

(e) Star CEO - Max Levchin is part of the “PayPal Mafia” group that created PayPal. If he weren’t CEO, this would be a blow to Affirm’s perception.

(f) Dual-class structure - execs w/ Class B shares have 15:1 voting rights. Hard to remove.

Affirm’s risks || part 3

Affirm’s risks || part 3(e) Star CEO - Max Levchin is part of the “PayPal Mafia” group that created PayPal. If he weren’t CEO, this would be a blow to Affirm’s perception.

(f) Dual-class structure - execs w/ Class B shares have 15:1 voting rights. Hard to remove.

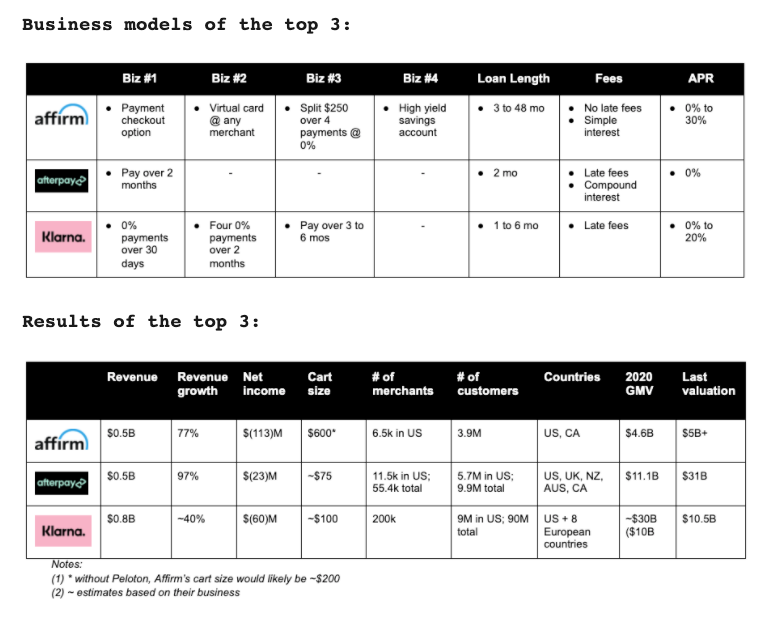

11/  Competition in this space is heating up. Not all “buy now, pay later” companies are equally transparent & honest.

Competition in this space is heating up. Not all “buy now, pay later” companies are equally transparent & honest.

Affirm, Afterpay, & Klarna are the top 3. Affirm is just starting to expand outside the US. I could see someone betting on all three.

Competition in this space is heating up. Not all “buy now, pay later” companies are equally transparent & honest.

Competition in this space is heating up. Not all “buy now, pay later” companies are equally transparent & honest. Affirm, Afterpay, & Klarna are the top 3. Affirm is just starting to expand outside the US. I could see someone betting on all three.

12/  Fortunately, this market has lots of room to grow.

Fortunately, this market has lots of room to grow.

By 2023, online sales will be 22% of the ~$6T US retail market. 3% of sales will be paid via “buy now, pay later” ⇒ This is ~9x larger than Affirm’s $4.6B in transactions today. Worldwide, the opportunity gets bigger.

Fortunately, this market has lots of room to grow.

Fortunately, this market has lots of room to grow. By 2023, online sales will be 22% of the ~$6T US retail market. 3% of sales will be paid via “buy now, pay later” ⇒ This is ~9x larger than Affirm’s $4.6B in transactions today. Worldwide, the opportunity gets bigger.

13/  I’d categorize this stock as a buy. But am cautious of the price around IPO.

I’d categorize this stock as a buy. But am cautious of the price around IPO.

A good company & an overvalued valuation aren’t mutually exclusive. I’m impressed w/ its growth & the opportunity ahead though.

(Opinions are my own.)

I’d categorize this stock as a buy. But am cautious of the price around IPO.

I’d categorize this stock as a buy. But am cautious of the price around IPO. A good company & an overvalued valuation aren’t mutually exclusive. I’m impressed w/ its growth & the opportunity ahead though.

(Opinions are my own.)

14/  IPO valuation & timing

IPO valuation & timing

- IPO Valuation: $10B to $12B

- Price / share: $50 / share

- Timing: early 2021

(These are my estimates. Read my rationale in my blog)

IPO valuation & timing

IPO valuation & timing - IPO Valuation: $10B to $12B

- Price / share: $50 / share

- Timing: early 2021

(These are my estimates. Read my rationale in my blog)

15/  Fun facts

Fun facts

- Offices: in the ~2 years I was there, we moved offices 3x. What 600% growth looks like!

- Meeting rooms: in each office, we had thematic names for meeting rooms. One office had coffee drink names, another had plant & tree names.

- Exec compensation:

Fun facts

Fun facts- Offices: in the ~2 years I was there, we moved offices 3x. What 600% growth looks like!

- Meeting rooms: in each office, we had thematic names for meeting rooms. One office had coffee drink names, another had plant & tree names.

- Exec compensation:

16/  All feedback welcome.

All feedback welcome.

Follow me for more posts and subscribe to my substack. Thank you for reading & for your support!

All feedback welcome.

All feedback welcome. Follow me for more posts and subscribe to my substack. Thank you for reading & for your support!

Read on Twitter

Read on Twitter