Bitcoin’s value as money will naturally be determined by how easy it is to use it to buy things. Luckily, Bitcoin has what is called a “difficulty adjustment” which is known to vary based on the proportion of Bitcoin transactions that start with zero.

This is because if it is too difficult for somebody to transfer Bitcoin, but they have already committed to a transaction by proving the transaction works, they tend to just transfer zero and use PayPal instead.

This is a key way Bitcoin scales because PayPal can do lots of transactions.

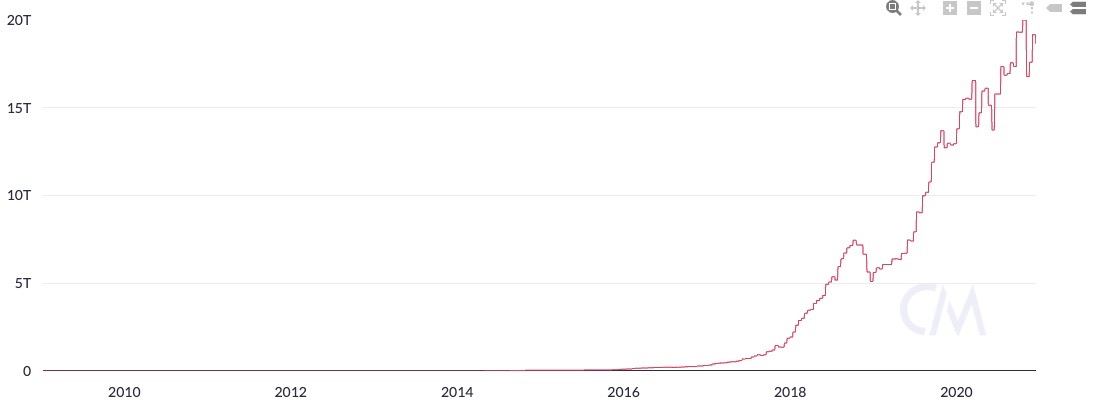

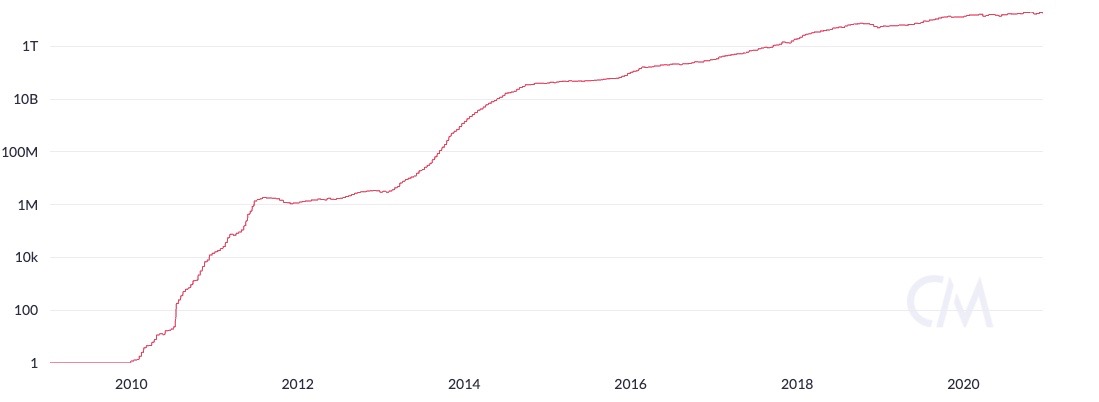

Data show the difficulty adjustment has been rising for some time, as has PayPal’s total payment volume (TPV).

But, obviously, only some PayPal transactions are related to Bitcoin (a lot more recently as PayPal announced they would run a full node). https://dazeinfo.com/2019/06/04/paypal-total-payment-volume-by-year-graphfarm/

But, obviously, only some PayPal transactions are related to Bitcoin (a lot more recently as PayPal announced they would run a full node). https://dazeinfo.com/2019/06/04/paypal-total-payment-volume-by-year-graphfarm/

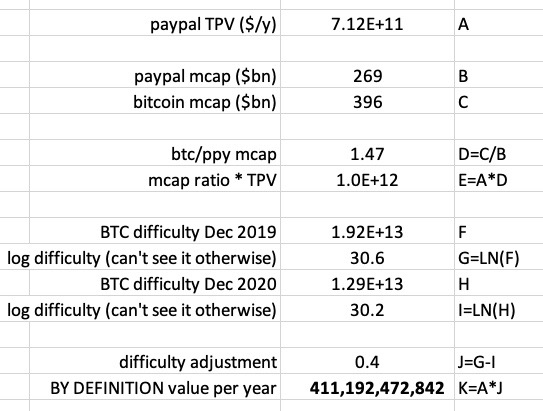

Hence, if we compare Bitcoin’s market cap to PayPal’s and apply that ratio to the PayPal TPV, we get an idea of the Bitcoin "layer 2" component of PayPal.

We can then normalize this number by adjusting for the change in the difficulty. Note we have to use the logarithm of difficulty because otherwise you can’t see most of it.

(h/t @coinmetrics)

(h/t @coinmetrics)

This gives $411bn. Working shown below.

This is *by definition* the value per year for our DCF.

If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.

This is *by definition* the value per year for our DCF.

If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.

The main *risk* of Bitcoin is that the difficulty gets so hard (likely due to UI/UX) that people stop using it altogether, meaning it stops functioning as a medium of exchange and probably also a store of value.

As for “unit of account”, I honestly don’t know what that means and I’m not entirely convinced anybody does.

Let’s make the simplifying assumption that every Bitcoin that has been mined represents one user in a Bitcoin network.

This suggests that Ethereum has many more users because much more has been mined.

This suggests that Ethereum has many more users because much more has been mined.

Although this is difficult to say precisely because nobody actually knows the Ether supply, but we can guestimate by using coinmarketcap: https://coinmarketcap.com/currencies/ethereum/

This is important because the effects of networks – or “network effects” – suggest that the bigger network will win out in the long run.

However, this doesn’t account for network quality. Adjusting for the impact of DAUs, for example, casts Ethereum in a poor light.

However, this doesn’t account for network quality. Adjusting for the impact of DAUs, for example, casts Ethereum in a poor light.

A better way to determine risk is the error in the S2F model.

If it were *perfectly* accurate, there would arguably be no risk whatsoever. But as it is only a *scientific* truth, and not a *mathematical* one, we note the R^2 is around 0.95.

If it were *perfectly* accurate, there would arguably be no risk whatsoever. But as it is only a *scientific* truth, and not a *mathematical* one, we note the R^2 is around 0.95.

This suggests that there is a 5% chance that the model actually shows nothing – maybe because one of the variables isn’t a variable at all and the coefficients – the only meaningful numbers in the model – have neither a derivation nor a physical explanation?

This is the real risk and therefore is our risk premium. The risk-free rate is probably like minus 2 or 3 percent by now, so let’s call the discount rate a tasty 2.5%

Finally, we know that blockchain technology means Bitcoin finishes in 2140, so $0 then makes sense as a terminal value.

Putting this all together we get a DCF of $15,598,046,490,550.40 – or ~$15tn market cap, $861k per coin.

Putting this all together we get a DCF of $15,598,046,490,550.40 – or ~$15tn market cap, $861k per coin.

But not so fast.

As well as being money, Bitcoin is also the internet.

This complicates things.

As well as being money, Bitcoin is also the internet.

This complicates things.

The internet is not a network but is actually a *network of networks* (few understand this) meaning we need to square our previous answer (hence @sqcrypto) giving a fair value per coin of 7 quintillion dollars and a market cap of 134 septillion dollars.

Of course, this has not been probability adjusted, so if we quickly say this is probably only 1.35% likely and also I am only 10% sure this squaring method holds up, this comes out as 874 trillion dollars per coin and a 184 sextillion dollar market cap.

Therefore, #Bitcoin  is very probably 99.99999999976% undervalued.

is very probably 99.99999999976% undervalued.

You’re welcome, @barronsonline. https://www.barrons.com/articles/why-bitcoin-is-overpriced-by-more-than-50-51608120001?mod=bol-social-tw

is very probably 99.99999999976% undervalued.

is very probably 99.99999999976% undervalued. You’re welcome, @barronsonline. https://www.barrons.com/articles/why-bitcoin-is-overpriced-by-more-than-50-51608120001?mod=bol-social-tw

Read on Twitter

Read on Twitter