As Congress continues to stumble around whether to direct $$$ to state and local governments, I think it might be worthwhile to check in on America’s 5th largest city, Phoenix, AZ.

When the pandemic started, there was widespread agreement that local governments relying on the sales tax were in for a rough ride.

Phoenix gets like ~60% of its revenue from the sales tax (some via the state). So…yeah. People – including me! – were very concerned.

Phoenix gets like ~60% of its revenue from the sales tax (some via the state). So…yeah. People – including me! – were very concerned.

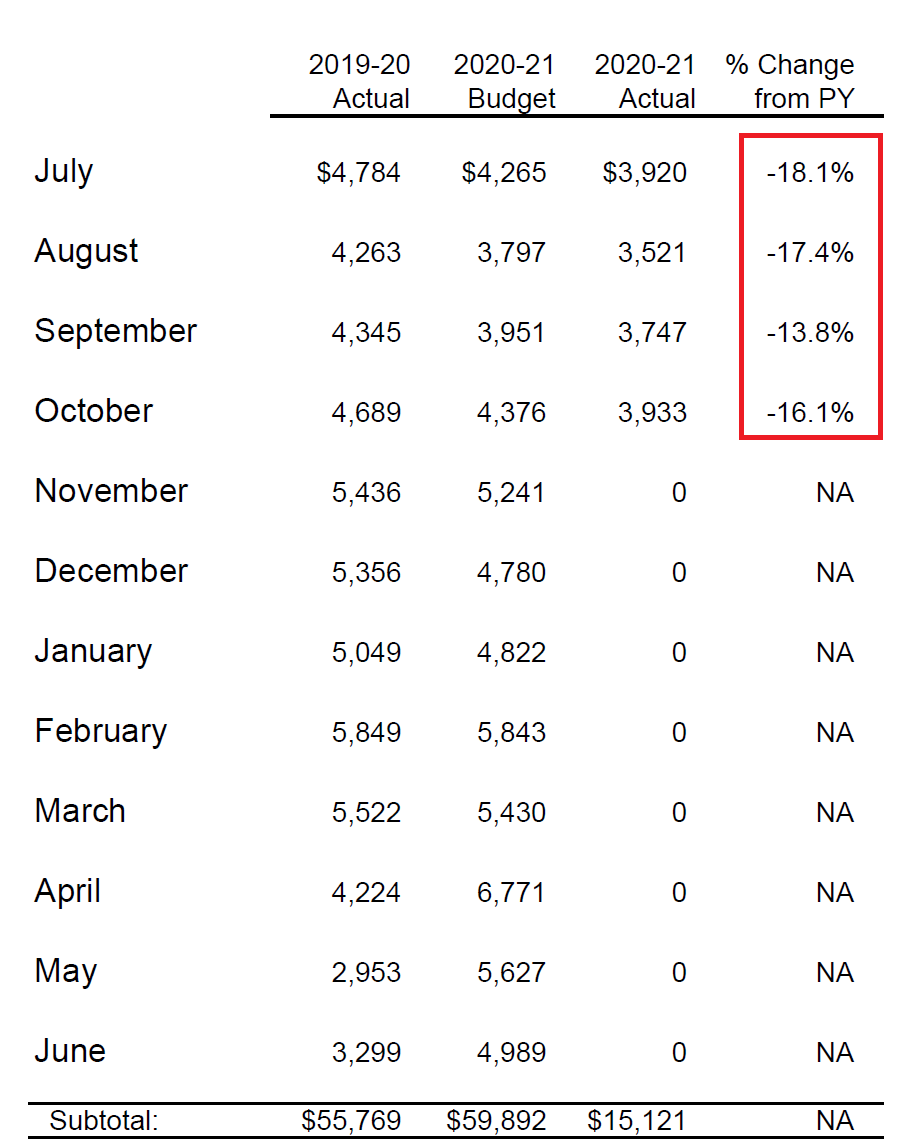

Turns out that general fund sales tax revenues in the first 4 months of 2020 are up 6.7%.

Yes, you read that right. Phoenix has generated more sales tax revenue in the first 4 months of FY 20-21 than it did over the same period last year.

Yes, you read that right. Phoenix has generated more sales tax revenue in the first 4 months of FY 20-21 than it did over the same period last year.

How? Consumption at retail shops & online sales seems to be offsetting the losses from restaurants, bars, hotels, and car rentals.

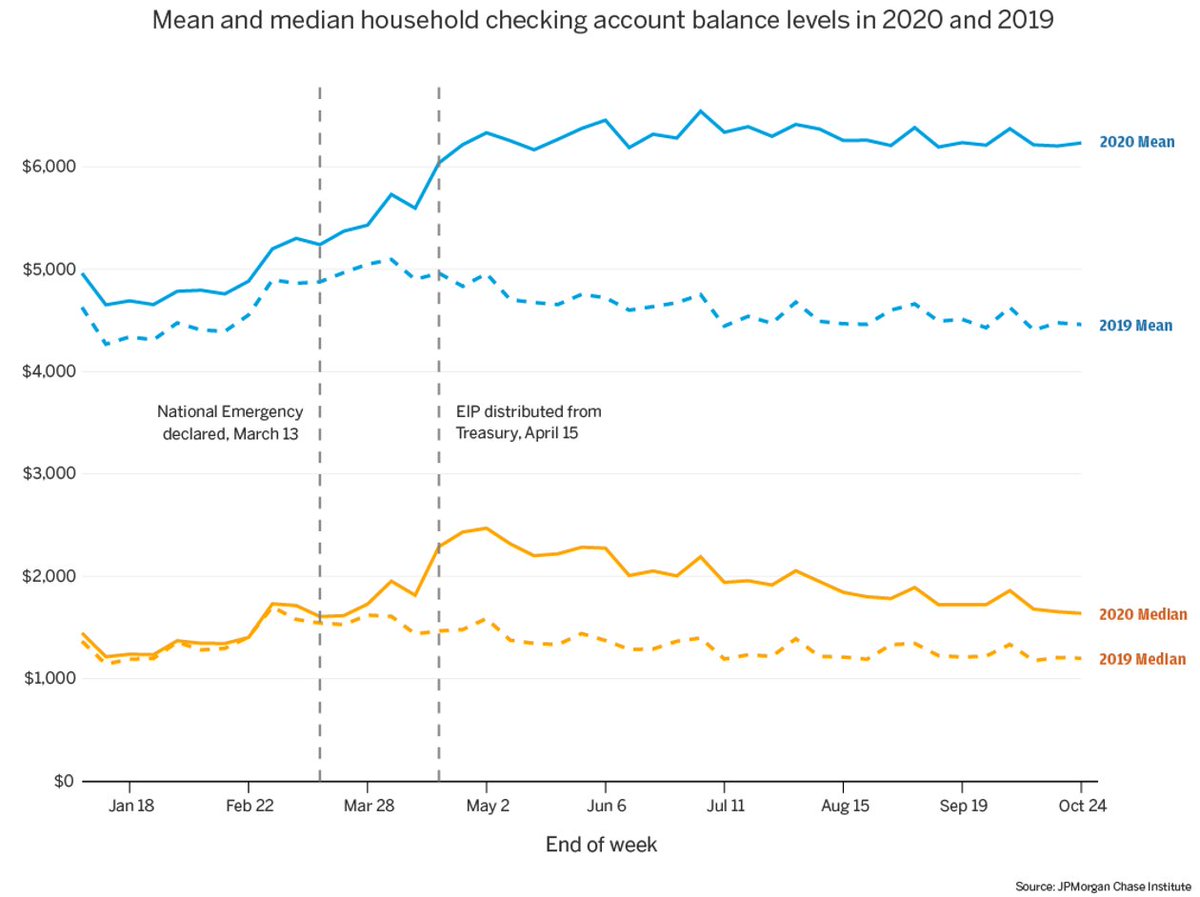

This doesn’t seem to be just a Phoenix (or AZ) thing either. The CARES Act did wonders for consumer balance sheets. This is a great thing!

The bad news? Most of the CARES Act stimulus stopped in July and the well will be completely dry in about a few weeks. Recent reports on retail in November showed a year-over-year decline in spending. https://www.cnbc.com/2020/12/16/us-retail-sales-november-2020.html

So, what does this all mean? Phoenix’s general operations are probably fine for now. There’s been a surplus in revenue over the budget for the first months of the year. Even if revenues fall quite a bit, the city probably won’t have to make general fund cuts this fiscal year.

If this is the case, then why fight over state & local aid? Two reasons:

1) the general fund is not the whole government

2) the current FY was balanced based on the CARES Act

1) the general fund is not the whole government

2) the current FY was balanced based on the CARES Act

On point 1: local governments do a lot, and not all of it is funded from the general fund. In Phoenix’s case, its Convention Center and airport are huge parts of the city’s financial portfolio but aren’t in the general fund.

How are they doing? Well, both rely on revenue generated from in-person commerce. So, not great.

Here's the Convention Center's main revenue source.

Here's the Convention Center's main revenue source.

The airport, Sky Harbor, is in bad shape too. The CARES Act provided $ directly to airports, which helped a lot. But that money is gone now. https://kjzz.org/content/1619318/when-will-turbulence-end-phoenix-sky-harbor-airport

On point 2: The CARES Act is what saved Phoenix from having to make cuts for the current year. Absent new federal aid, the city has basically no margin for error. Any decline in revenue means service cuts (think library hour reductions, furloughs, layoffs) b/c all slack is gone.

In sum: in fiscal terms, the past few months have been better than I expected for Phoenix. But things can still go off the rails. More federal $$$ would go a long way toward preventing that.

Read on Twitter

Read on Twitter